Key Takeaways

- International tax changes with OBBBA.

- OBBBA changes to charitable giving deductions.

- Guidance issued regarding CAMT for partnerships.

- Staffing changes at the IRS.

- IRS plans to overhaul old IT system.

- New tariffs announced.

- New bill for tariff rebates introduced, but unlikely.

- Sales tax holidays approaching.

- National Cheesecake Day!

Programming note: Eide Bailly is hosting a webinar on New Tax Legislation: What Leaders Need to Know About the Changes to the R&D Tax Credit and Capitalization of R&D Expenses under Section 174 on Friday, August 1st. The webinar is free, and 1 hour of CPE is offered. Register here.

Unpacking the OBBBA

U.S. Exporters Get Welcome Surprise in Trump Tax Law - Richard Rubin, Wall Street Journal:

...

Companies are digesting the new law’s complex details as they prepare and disclose rough estimates of its effects on tax payments and rates. The restructured deduction for Foreign-Derived Intangible Income comes as a welcome surprise to many executives. Companies poised to gain include those with research expenses and tangible U.S. assets like factories.

Trump Tax Megalaw Upends Charitable Giving - Richard Rubin & Juliet Chung, Wall Street Journal:

Trump’s ‘big, beautiful bill’ could spell trouble for gamblers: What to know - Aris Folley, The Hill:

“It will do irreparable harm to our nation’s gaming industry if it takes effect — especially in Nevada,” the Nevada Democrat said at the time, warning it would “disincentivize” gamblers.

The Senate Finance Committee said Chairman Mike Crapo (R-Idaho) is “open to receiving feedback from affected stakeholders and learning more about industry reporting and compliance.”

What’s In a Word? Tax Pros Puzzle Over FTC Allocations - Jonathan Curry, Tax Notes ($):

Related: Eide Bailly International Tax Services

Treasury Guidance on Partnerships

Treasury Revamps Guidance on Book-Income Tax, Partnerships - Michael Rapoport, Bloomberg ($):

IRS To Permit Corp. AMT Top-Down Election For Partnerships - Kat Lucero, Law 360 Tax Authority ($):

...

The notice also allows a corporate partner to opt for a taxable-income election, which would relieve the partnership from the requirement to report its modified financial statement income to the corporate partner.

Happening at the IRS

Losing The SOI Joint Statistical Research Program Would Harm Tax Administration - Barry Johnson, TaxVox:

...

Staff reductions, including layoffs of probationary employees, voluntary separation programs, and a hiring freeze, have shrunk SOI staffing to an historic low, impacting the JSRP in two ways. First, there aren’t enough employees left to oversee JSRP projects that have already been approved, much less review new applications. Second, external researchers, who are usually on loan to the IRS through an OMB program, have been prevented from working on JSRP projects due to a hiring freeze.

IRS Heads of Large Business Unit, Tax Pro Oversight Put on Leave - Erin Slowy & Caleb Harshberger, Bloomberg ($):

The decision comes weeks after former Missouri Republican Rep. Billy Long became commissioner, and during one of the most turbulent periods at the agency in decades. Over half of the IRS’s leadership has left this year and a quarter of the agency’s staff of 100,000 is gone after President Donald Trump’s initiatives to shrink the federal government.

IRS to overhaul decades-old tax IT system that’s under DOGE scrutiny - Jory Heckman, Federal News Network:

Internal documents show the IRS plans to merge several of its systems, including those that handle the processing of tax returns for individuals and businesses, “into one tax processing engine.”

Internal documents show a modernized IDRS will allow for “national real-time tax processing,” and that the agency will be able to “establish processes to intercept or claw back erroneous payments.”

Tariffs

Trump announces 25% tariff on India and unspecified penalties for buying Russian oil - Josh Boak & Rajesh Roy, AP News:

The Republican president added that India buys military equipment and oil from Russia, which he said has enabled the war in Ukraine. As a result, he intends to charge an additional “penalty” starting on Friday as part of the launch of his administration’s revised tariffs on multiple countries.

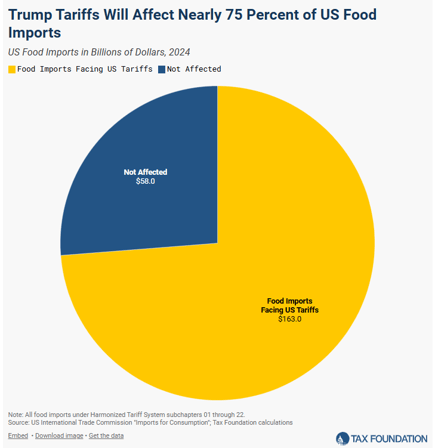

Trump Tariffs Will Raise the Cost of Food for Americans - Alex Durante & Rabecca Walker, Tax Foundation:

Trump Says He Won’t Extend Tariff Pause Past Aug. 1—Sets 25% Rate For India - Sara Dorn, Forbes:

Tariff Rebates?

New Bill Would Provide Rebate Checks Funded by Tariff Revenue - Tyrah Burris, Tax Notes ($):

Under the bill, the allowable rebate amount would be reduced by 5 percent of taxpayer adjusted gross income that exceeds $150,000 for joint filers, $112,500 for heads of household, and $75,000 for individual filers. The bill would also allow for a larger credit per person if tariff revenue exceeds current projections for 2025.

Don't believe the hype about tariff rebate checks just yet - Bryan Metzger, Business Insider:

"We're gonna basically borrow money to send it to the American people? There is no rebate if there's no money," Paul said. "I mean, it's the dumbest idea I've ever heard."

"Well, when we have a surplus, I'd be all for it," said Sen. Ron Johnson of Wisconsin said of the tariff rebate checks. "But we're $37 trillion in debt, running a deficit that's about $2 trillion as far as the eye can see. I would oppose it."

Sen. Cynthia Lummis of Wyoming told BI she'd also prefer to see any tariff revenue be used to pay down the debt — or to fund a strategic Bitcoin reserve.

Blogs and Bits

- Help tax professionals, especially smaller practices, develop a WISP.

- Guide users through starting a plan, including understanding security compliance requirements and professional responsibilities.

13 sales tax holidays are scheduled for August - Kay Bell, Don't Mess with Taxes:

As with tax filing, dates matter. While an event might be advertised as a weekend tax holiday, it could be in effect on just Saturday and Sunday, or Friday could make it a long weekend. Or Friday and Saturday if your state discourages shopping on what is the sabbath for many. Make sure you know when the holiday applies.

Streamlining Corporate Alternative Minimum Tax for Partnership Investments: An Examination of Notice 2025-28 - Ed Zollars, Current Federal Tax Developments:

AICPA Letter in Support of S. 2129, the Survivors Assistance for Fear-free and Easy Tax Filing Act of 2025 - AICPA. "The AICPA sent a letter to John Fetterman (D-PA) commending the introduction of S. 2129, the Survivors Assistance for Fear-free and Easy Tax Filing Act of 2025 (SAFE Act). The AICPA supports the SAFE Act would allow survivors of domestic abuse or spousal abandonment to file their taxes as if they were not married."

Tax Trouble

US, Japanese Businessman Settle $11.6M FBAR Dispute - Anna Scott Farrell, Law 360 Tax Authority (defendant name omitted) ($):

...

Defendant argued that the jury had taken its duty seriously and spent several days deliberating before returning a verdict, according to a March filing in the case. It heard evidence presented by both sides, allowing it every opportunity to weigh the plaintiff's credibility, Defendant said.

In the end, the jury chose to agree with Defendant's account of his understanding of American financial filing requirements, his reliance on accountants for tax preparation and the relevant Japanese language translations from his accountant's office, he said.

What day is it?

It's National Cheesecake Day!Make a habit of sustained success.