Key Takeaways

- Social Security taxation.

- State tax impacts from OBBBA.

- More tax proposals on Capitol Hill.

- Trump announces 50% tariff on Brazilian products.

- Split-Dollar Life Insurance Taxation.

- National Kitten Day!

One Big Beautiful Bill Act

Correcting the Social Security Administration About The Big Budget Bill - Howard Gleckman, Tax Policy Center:

The biggest beneficiaries are seniors making between about $80,000 and $130,000 (the 60th to 80th percentile of income). Their average tax cut would be about $1,100 or roughly one percent of their after-tax income.

Despite the SSA claims, most would see their income taxes on Social Security benefits reduced, not eliminated.

Tax News & Views International Weekly: The Tax Bill's Global Tax Review - Alex Parker, Eide Bailly:

Related: What the New Law Means For You.

State Impacts of Tax Bill

Trump Tax Bill Brings State Funding Dilemmas, Conformity Choices - Paul Jones, Tax Notes ($):

...

In addition to the fiscal implications of the federal funding cuts, the OBBBA's changes to federal tax rules will also affect many states’ tax regimes.

One major change is the increase in the federal cap on the state and local tax deduction from $10,000 to $40,000 for tax years 2025 through 2029, with annual adjustments and a phaseout for taxpayers with more than $500,000 in income. The cap returns to $10,000 in 2030.

California has an idea to counter Trump’s megabill: Roll back environmental laws - Alex Nieves, Politico:

...

The discussion about where California goes next after the megabill isn’t all conflict. There’s a general agreement that the state should invest more in EV incentives after Republicans eliminated a $7,500 federal tax credit for car buyers. Newsom floated that idea in November, saying that he wanted revenues from the state’s cap-and-trade auctions to be spent on new EV incentives if the federal tax credit went away.

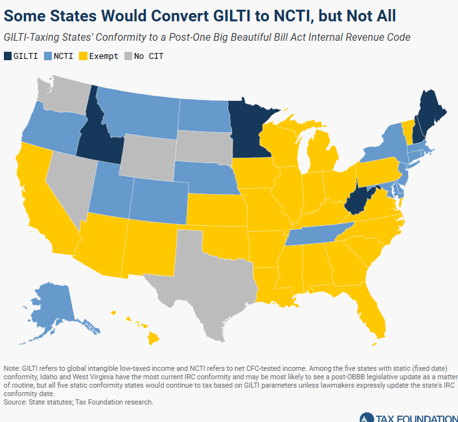

State Implications of the GILTI to NCTI Conversion - Jared Walczak, Tax Foundation:

Whereas the conversion of the global intangible low-taxed income (GILTI) regime to the new net CFC-tested income (NCTI) regime contains both revenue raisers and tax savings that represent a net tax cut at the federal level, these provisions are haphazardly incorporated into the tax codes of states that have heretofore included GILTI.

Related: Eide Bailly International Tax Services

More on Capitol Hill

Conservatives are asking Trump for another big tax cut - Jeff Stien, Washington Post:

...

In an interview, Norquist said he directly recommended to Trump in a recent phone call that he should implement the change by executive order after passage of the tax bill, reminding the president that he had explored this option during his first term. Norquist, who argues that the new policy will help open up the housing market, said he has also talked to Bessent about the proposal.

New Bill Would Reverse GOP Tax Law’s Reduced Gambling Deduction - Katie Lobosco, Tax Notes ($):

Introduced by Rep. Dina Titus, D-Nev., the bill would restore the 100 percent deduction for gambling losses, which was lowered to 90 percent in the Republicans’ reconciliation package.

Tariffs

Trump Slaps Brazil With 50% Tariff, Cites Bolsonaro Trial - Raw Ann Varona, Law 360 Tax Authority ($):

IRS

IRS Expands Filing Exceptions For Certain Pass-Throughs - Natalie Olivo, Law 360 Tax Authority ($):

Blogs and Bits

How Well Do You Know the New Tax Law? Take our quiz: - Ashlea Ebiling, The Wall Street Journal:

Take the quiz.

It's no joke: Being nice is among this attorney's top ways to deal with the IRS - Martha Waggoner, The Tax Adviser:

And the third one? “It’s going to sound like a joke, but it’s not,” Wiley, a partner at Kostelanetz LLP, said at an AICPA & CIMA ENGAGE 25 session on dealing with the IRS. “Be nice. Be really nice. Imagine the job that is, you sitting on the other end of a phone line in Ogden or Philadelphia or Cincinnati, and you’re working for the IRS. It is a hard job. People are not nice to those people.”

In the Courts

An Examination of McGowan v. United States: Unpacking Split-Dollar Life Insurance Taxation - Ed Zollars, Current Federal Tax Developments:

What day is it?

It's National Kitten Day!

Make a habit of sustained success.