Key Takeaways

- Big bill returns to House with many changes.

- Will holdouts hold out?

- Representatives scramble to DC after mass flight disruptions.

- What made the cut.

- What it will cost.

- Built-in gain rules withdrawn.

- No superhero to rescue memorabilia seller.

- Disco Day.

Publication note: Eide Bailly offices will be closed July 3, 4, and 7 for the Independence Day holiday. Roundups will resume Tuesday, July 8.

Senate Returns Bill To House With SALT, Energy Tax Changes - Katie Lobosco, Tax Notes ($):

...

Like the House version passed May 22, the Senate-passed bill would make most of the expiring provisions of the Tax Cuts and Jobs Act permanent, including lower individual tax rates, an expanded standard deduction, a bigger child tax credit, and an increase to the estate tax exclusion.

But there are some key differences between the Senate and House bills.

Senate Passes GOP Budget Bill With Revised Tax Provisions - Kat Lucero, Law360 Tax Authority ($):

The revised bill stripped an excise tax that would have applied to green energy facilities that received certain assistance from foreign entities of concern, or FEOC, which are businesses or organizations with strong links to countries that the U.S. government has flagged as adversaries, such as the Chinese government. The bill would also ease some of the FEOC restrictions tied to some clean energy tax credits, which were first introduced in the House version of H.R. 1.

Link: H.R. 1 current text.

Hurdles in the House

House Republicans Threaten to Sink Trump’s Megabill - Olivia Beavers, Wall Street Journal:

...

Now, the fate of Trump’s bill looks rocky as the House GOP prepares to digest a series of changes that were made to a version of the bill that passed the lower chamber weeks earlier by one vote. Conservatives and centrists said they were disappointed with the latest iteration of the bill, despite some being told the Senate would improve it.

It is too early to write the bill’s obituary. Trump and Johnson have previously persuaded shaky Republicans to support the president’s agenda.

Republican megabill faces tallest hurdle yet - Eleanor Mueller and Shelby Talcott, Semafor. "With votes expected as soon as this afternoon, leaders are also watching closely to see if weather delays members’ flights. Trump has already begun working the phones, according to an administration official, as have others in the White House, like Office of Management and Budget Director Russ Vought."

Shut up and drive - Jack Blanchard and Dasha Burns, Politico:

Life is beautiful: The matter in hand is the imminent House vote on Trump’s flagship legislation — the tax-cutting, Medicaid-slashing, border-boosting megabill that squeaked through the Senate yesterday lunchtime. The bill is expected to hit the floor of the House for a final vote later tonight. (Don’t be surprised if we’re all up late once again.) If the House agrees to the bill with no further changes, it’s headed straight to Trump’s desk in time to hit the July 4 deadline.

Trump’s agenda faces a wary House GOP - Jake Sherman, Ally Mutnick and John Bresnahan, Punchbowl News:

Are wavering House Republicans really going to say no to Trump with his signature legislative bill on the House floor? Can Johnson set ‘em up so Trump can knock ‘em down? Here’s our Big Mad Index of the Republicans to watch on the bill.

There are two buckets of no votes that you should think about: the House Freedom Caucus, and then the rest of the GOP conference.

What the Senate Advanced

What’s in the Trump Tax Bill Passed by the Senate? Jasmine Li, Wall Street Journal:

...

Does the bill include no taxes on Social Security?

The legislation doesn’t eliminate taxes on Social Security, but it introduces a new deduction for seniors that would be in effect for the 2025 to 2028 tax years. Individuals over 65 years old would be able to deduct up to $6,000 from their taxable income.

The maximum deduction starts decreasing once income crosses $75,000 a person, or $150,000 for married couples. It then phases out completely once income surpasses $175,000 a person or $250,000 a couple. Taxpayers over 65 would still get the existing additional senior standard-deduction tax break.

What made the cut in Senate’s nearly 1,000-page policy megabill? - Aris Folley, Rachel Frazin, Nathaniel Weixel and Lexi Lonas Cochran, The Hill:

The final legislation does not allow a project to get the tax credit if it does not begin producing electricity by 2028. This is stricter than an earlier Senate version, which would have allowed projects that begin construction in the next few years to qualify for the credits.

...

The legislation omits a contentious change that floated over the weekend — an excise tax on new solar and wind projects if they contain Chinese components.

What’s in the Trump Tax Bill That Just Passed the Senate - Alicia Diaz, Bloomberg via MSN.

...

A deduction up to $10,000 would be established for interest payments on auto loans from 2025 through 2028. The tax break is only eligible for new vehicles whose final assembly is in the US.

Senate may have made it easier for undocumented immigrants to invest in ‘Trump Accounts’ - Brian Faler, Politico. "'Come to the US illegally and when your child is born here, they’ll get federally subsidized baby bonds,' George Callas, a former Republican tax aide, wrote on X."

Commentary on the bill

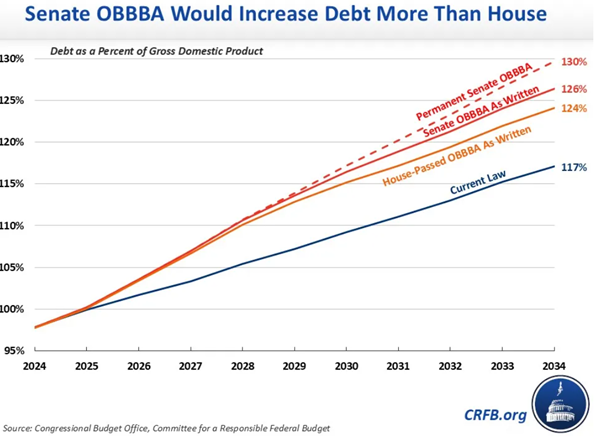

Debt Could Rise to 130 Percent of GDP - Committee for a Respnsible Federal Budget. "Under the Senate reconciliation bill, debt would rise from 100 percent of Gross Domestic Product (GDP) today to 126 percent by 2034 – compared to 117 percent under current law and 124 percent under the House bill. If the Senate bill is made permanent, debt would reach 130 percent of GDP."

The Senate’s Big Beautiful Blunder Could Increase the Debt by $6 Trillion - Dominik Lett, The Debt Dispatch. "Put bluntly, the Senate’s megabill is a fiscal disaster."

Senate Passes One Big Beautiful Bill Despite One Big Not-So-Beautiful Price Tag - Kelly Phillips Erb, Forbes. "An analysis of the just-passed Senate version of the One Big Beautiful Bill Act predicts the legislation will increase primary deficits by $3.1 trillion over 10 years. That didn’t worry the Senate—will it bother the House?"

Tax Administration

Built-In Gain and Loss Proposed Rules Withdrawn - Chandra Wallace, Tax Notes ($):

...

Section 382(h) limits the ability of a loss corporation after an ownership change to use tax attributes — like net operating losses — of the pre-change corporation. A loss corporation is one that has an NOL or available carryover NOLs in the tax year of the ownership change.

Related: Eide Bailly Transaction Advisory Services.

IRS, Security Summit launch summer series to help tax pros protect clients from identity theft as Nationwide Tax Forums begin - IRS. "Identity thieves are taking numerous approaches to steal sensitive information from tax professionals. Tax professionals need to be on the lookout to avoid falling prey to these attacks, which threaten not just their clients but their own businesses."

Blogs and Bits

Electric vehicle tax credit could end in just three months - Kay Bell, Don't Mess With Taxes. "So far, all versions of the OBBB have included cuts to the prior legislation’s environmentally friendly provisions."

District Court Upholds Validity of IRS Guidance on Employee Retention Credit - Parker Tax Pro Library. "A district court held that the IRS did not violate the Administrative Procedure Act (APA) when it issued Notice 2021-20, which provides guidance on the employee retention credit in question-and-answer format."

Update on IRS Form 11457 for Voluntary Disclosure in IRS VDP - Jack Townsend, Federal Tax Procedure. "I speculate that the IRS will try to limit submissions to those taxpayers with real prosecution risk, so may carefully word the Form to eliminate only the specific admission of willfulness; taxpayers and their counsel should consider carefully how the narrative discussions are presented..."

Related: Offshore Voluntary Disclosure

Needing a superhero

Corona man sentenced to one year and one day in federal prison for $1.2 million tax fraud involving the sale of Stan Lee memorabilia - IRS (Defendant name omitted, emphasis added):

...

Defendant pleaded guilty on March 11 to two counts of willfully subscribing to a false tax return.

From 2015 to 2018, Defendant had a personal relationship with Marvel Comics publisher Stan Lee and sold Marvel-related items bearing Lee’s autograph to various dealers, brokers and fans at comic conventions.

In exchange for selling these memorabilia, Defendant received payments from buyers, typically in the form of cash or checks. These payments were considered regular income by the IRS and should have been reported on Defendant’s income tax return each year that he received money.

For tax years 2015 through 2018, Defendant received reportable income from memorabilia sales of at least approximately $1,236,485 for the tax years 2015 through 2018, Defendant admitted that the tax due and owing on such income was approximately $482,833.

Stan Lee was a key creative figure in the creation of Spider-Man, The Hulk, and others. Super powers or no, income isn't tax-exempt just because you didn't get a 1099.

What day is it?

It's National Disco Day! Boogie down.

Make a habit of sustained success.