Key Takeaways

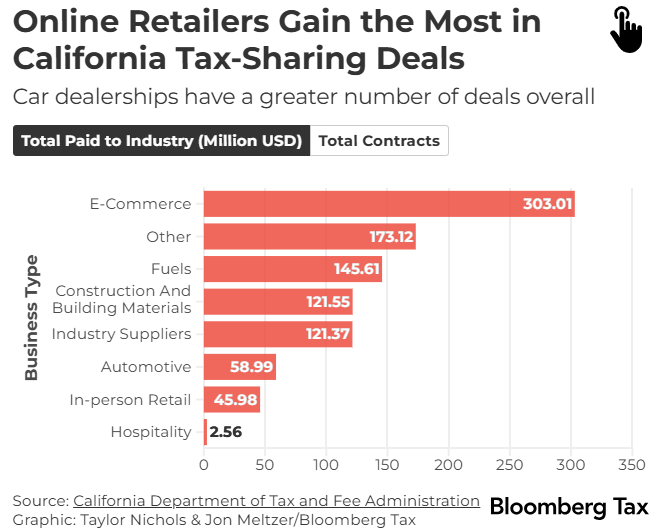

- Car Dealers Are Big Winners in CA Tax Sharing

- Minn. Tax Breaks for Data Centers

- New Mexico Issues Publication for Tax Credits

- More Than 58,000 Businesses Get TN Franchise Refunds

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs. Beginning this week, the State Tax News and Views will move to a biweekly schedule.

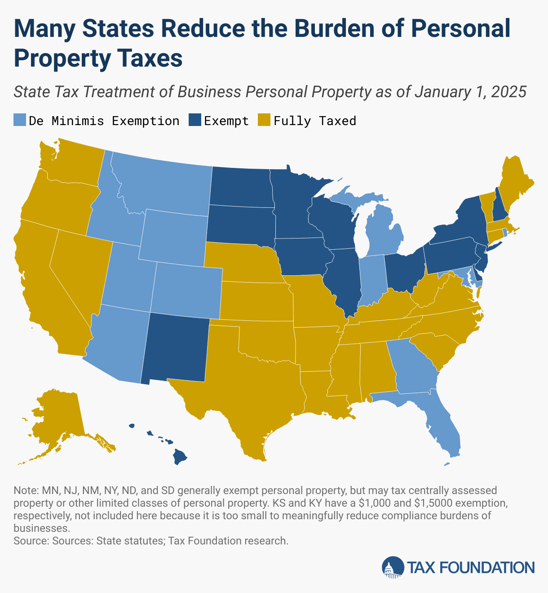

Tangible Personal Property De Minimus Exemptions by State, 2025 - Joseph Johns, Tax Foundation:

In most states, businesses not only pay taxes on their real property (land and structures), but also on their machinery, equipment, fixtures, and supplies, which are classified as tangible personal property (TPP). For many small businesses, the amount owed is negligible, but the compliance costs can be considerable. By allowing a de minimis exemption for businesses with only modest amounts of property, states can eliminate these compliance costs for a trivial loss of revenue.

Fourteen states broadly exempt tangible personal property from taxation, while another 12 impose taxes on TPP but offer de minimis exemptions to avoid unduly burdening businesses with only a small amount of potentially taxable property.

Car Dealers Outpace Retail Giants With California Tax Deals - Laura Mahoney, Bloomberg Tax ($):

Artificial Intelligence and the Future of Tax: Insights From Survey Results - Ryan Garbowski; Nicholas C. Hunt; Sonja E. Pippin; & Jeffrey A. Wong, Tax Notes ($):

State-By-State Roundup

Minnesota

Minn. Scales Down, Extends Tax Break For Data Centers - Sanjay Talwani, Law360 ($):

New Jersey

NJ Adopts Rules Following MTC Stance on Internet Activities - Paul Williams, Law360 ($):

The rules...consider certain internet activities, such as providing post-sale assistance through email or placing cookies on a customer's computer that gather market research for sale to third parties, to exceed the tax protections of the Interstate Income Act of 1959.

New Mexico

New Mexico Court Reverses GRT Assessment Against Out-of-State Medical Staffing Firm - Colette Sutton, Eide Bailly LLP:

The Court concluded that:

Vista’s Services Were Performed Outside New Mexico: Vista’s core business activities—recruiting, credentialing, onboarding, and billing—were performed electronically from outside New Mexico. While Vista staff occasionally visited New Mexico, these visits were not central to the services contracted for.

Medical Services Not Attributable to Vista: Although Vista’s revenue depended on the placement of medical professionals in New Mexico, those professionals were independent contractors, not Vista employees. The Court held that their services could not be imputed to Vista.

Overview of New Mexico Business-Related Tax Credits - Colette Sutton, Eide Bailly LLP:

New York

NY Says Biz's Marketplace Facilitator Collects Tax on Sales - Michael Nunes, Law360 ($):

"An out-of-state business that stores goods in New York doesn't need to register for sales tax if the marketplace facilitator it uses already collects the tax and it doesn't make other sales in the state..."

Ohio

Ohio High Court Denies Aramark's CAT Refund Challenge - Cameron Browne, Tax Notes ($):

In its June 18 decision in Aramark Corp. v. Harris, the state high court denied the food services company a refund of CAT taxes it paid related to its management fee contracts, upholding a 2023 Board of Tax Appeals (BTA) decision.

Tennessee

More Than 58,000 Businesses Snag Tennessee Franchise Tax Refunds - Michael J. Bologna, Bloomberg Tax ($):

The Tennessee Department of Revenue will continue to post an online rundown of its Franchise Tax Schedule G Refunds through June 30. The state last year created a six-month window for businesses to amend their returns and file refund claims for franchise taxes paid in the last five years. Providing the refunds and publishing the names of refund claimants were required by the state to mitigate unexpected legal risks over the constitutionality of the tax.

It's always nice to see our clients benefit from programs like this one. Under Tennessee's franchise tax refund program Eide Bailly was able to help clients obtain over $2.2 million in refunds.

Texas

Texas Expands Manufacturing Exemption to Include Excavation and Blasting Starting October 2025 - Jennifer Barajas, Eide Bailly LLP:

Starting October 1, 2025, the Texas Comptroller will begin applying the Westmoreland interpretation of the sales tax manufacturing exemption. This means certain activities like excavation and blasting will now qualify as “processing,” making related equipment potentially exempt from sales and use tax. The change stems from a court ruling that broadened the definition of processing to include these steps when they directly affect a product intended for sale. Industries likely to benefit include mining, construction materials, oil and gas, and aggregate production.

Texas Comptroller Rules RxDC Reporting Services Are Taxable Data Processing Services - Colette Sutton, Eide Bailly LLP:

The taxpayer assists employer-sponsored health plans in meeting federal RxDC reporting requirements under the Consolidated Appropriations Act of 2021, offering three tiers of service:

Level 1 – Reporting Entity Only: Submits employer-prepared data files to the federal portal, tests files, and converts formats if necessary.

Level 2 – Guided Service: Helps employers gather and format limited data (mainly premium and life-years).

Level 3 – White Glove Service: Reviews employer documents, extrapolates data, and prepares complete RxDC reports.

The Comptroller found that all three levels involve data entry, storage, manipulation, or compilation—activities that fall within the definition of taxable data processing under Texas Tax Code §§ 151.0035 and 151.0101 and Rule 3.330. As such, the taxpayer is required to collect and remit sales tax on 80% of the fees charged for these services, in accordance with the partial exemption allowed under § 151.351.

S.B. 2206, which the Republican governor signed Sunday, provides a franchise tax credit for eligible R&D expenses, effective Jan. 1, 2026, according to an analysis [by the Ways & Means Committee]. The bill also will repeal provisions of the preexisting law relating to a franchise tax credit for certain R&D activities that were set to expire Dec. 31, 2026, according to the analysis.

Virginia Tax Commissioner Finds Exemption Certificates Fail to Support Exempt Sales - Bloomberg Tax ($):

The Virginia Tax Commissioner determined in a letter ruling that the taxpayer's exceptions to a sales tax audit would not be removed...

The Commissioner determined that the taxpayer had received an exemption certificate from a customer that did not indicate the correct exemption and was, therefore, invalid.

Washington

Washington State Launches Tax Amnesty for Investment Income - Laura Mahoney, Bloomberg Tax ($):

The voluntary disclosure program is available from July 1, 2025 through April 30, 2026, and again from July 1, 2026 through April 30, 2027 to encourage registered or unregistered businesses with unreported investment income subject to the business and occupations tax to come forward and pay tax owed. Relief also applies to income reportable on combined excise tax returns.

Tax Bites: Tips, Tricks and Opportunities in SALT

Chris Martin, Director, Eide Bailly:

Make a habit of sustained success.