Tax Bill

Democrats expect to be making their case into the week of June 23 that the Senate parliamentarian should rule against several features of the Senate Finance Committee’s tax package released June 16. Among their goals are to win rulings requiring that Republicans use a stricter method to score the cost of the tax package.

Democrats are also preparing for an all-night “vote-a-rama” on the bill, perhaps the week of June 23, by drafting amendments aimed at winning Republican support to make changes to the legislation or to force Republicans to cast uncomfortable votes to keep the bill as is.

“Big, Beautiful Bill” Senate GOP Tax Plan: Preliminary Details and Analysis - Garrett Watson, Huaqun Li, Erica York, Alex Muresianu, Alan Cole, Peter Van Ness, and Alex Durante, Tax Foundation:

Our preliminary analysis of the major tax provisions included in the Senate Finance bill finds it would increase long-run GDP by 1.1 percent. The major tax provisions would reduce federal tax revenue by $4.8 trillion between 2025 and 2034, on a conventional basis. On a dynamic basis, incorporating the projected increase in long-run GDP of 1.1 percent, the dynamic score of the tax provisions falls to $3.9 trillion, meaning economic growth pays for 19 percent of the major tax cuts.

Megabill debt warnings fall on deaf ears inside the GOP - Benjamin Guggenheim, Politico:

The problem highlighted by CBO and other economists is this: While the GOP’s tax cuts may provide some economic growth, they will likely not juice the economy as much as when Republicans first enacted Trump’s tax cuts in 2017. On the flip side, with federal debt closing in on $37 trillion, the rising costs of servicing more expensive interest payments will far outweigh any additional revenue that is generated from increased economic growth.

Tax Bill - Public Perception

KFF Health Tracking Poll: Views of the One Big Beautiful Bill - Ashley Kirzinger, Lunna Lopes, Marley Presiado, Julian Montalvo III, and Mollyann Brodie, KFF:

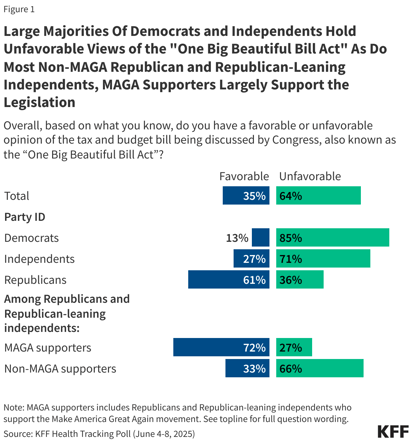

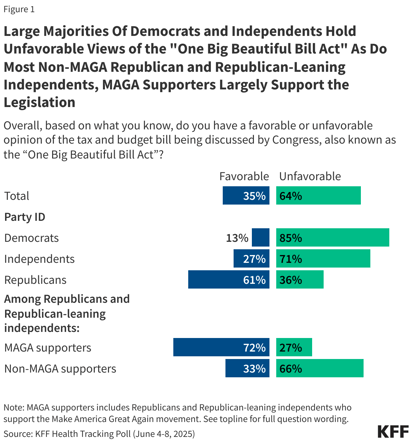

The “One Big Beautiful Bill Act” that was passed by House Republicans and is currently being discussed by the U.S. Senate is viewed unfavorably by a majority of adults (64%), including large majorities of independents and Democrats. Six in ten Republicans have a favorable opinion of the bill, but this support is largely driven by supporters of the Make America Great Again (MAGA) movement, while two-thirds of non-MAGA Republicans view the bill unfavorably.

This is an extraordinarily complex legislative package that will impact virtually every American if it becomes law. There could still be weeks of GOP infighting left, ending with no one totally in love with the final outcome.

The larger question for Trump and Hill Republicans is this: Is the One Big Beautiful Bill a replay of what Obamacare or Build Back Better was for Democrats? Is it a bill that’s so large, complex and all encompassing that it’s impossible to sell?

Tax Bill - SALT Cap

Senate Softens Blow for Pass-Throughs Using Current SALT Workarounds - Jared Walczak, Tax Foundation:

The Senate retains the existing $10,000 cap but strikes a new balance on the use of PTET workarounds.

Under the Senate plan, income that states tax at the entity level is, for each owner, deductible as follows:

1. Any portion of the $10,000 SALT cap left over for the owner after their personal deductions for other income and property taxes may be deducted for PTE taxes.

2. Above that, the greater of $40,000 or 50 percent of the PTE taxes are deductible.

Reaching an agreement over a SALT cap has proved a key sticking point as Senate and House Republicans negotiate over the proposed reconciliation bill.

While the House’s version of the bill (H.R. 1) increased the cap to $40,000, mostly to placate the concerns of GOP members from traditionally Democratic-leaning states, the Senate’s version keeps the cap at its current level of $10,000 and uses the provision as a significant pay-for.

Blogs and Bits

IRS improves Pre-Filing Agreement tax certainty program for large business and international taxpayers - IRS:

These improvements mark a renewed commitment by the IRS to expand access to cooperative tax compliance strategies that prevent disputes before they arise. The PFA program allows taxpayers under the Large Business and International Division jurisdiction to resolve potential tax issues before filing their return, offering certainty, reducing audit risk, and encouraging voluntary compliance.

Related: Eide Bailly International Tax Services

As Congress continues to haggle over how best to prevent falling off a tax cliff when myriad Internal Revenue Code provisions expire at the end of 2025, two other critical deadlines involving popular U.S. social safety net programs were announced.

The news is not good for those who currently rely on or one day hope to collect Social Security and Medicare benefits.

The report by the trustees of the Social Security and Medicare trust funds, which annually assesses the state of and future outlook for these federal retirement and medical benefits, says both programs will face fiscal shortfall sooner than ever.

IRS

A New IRS Commissioner And The Promise Of More Efficient Tax Audits - Nathan Goldman, Forbes:

Given the mission Long depicted for a new modern IRS, this study provides several important takeaways that can be considered to achieve this modernization without sacrificing the taxing authority’s grip on funding the federal government. For instance, if the financial statement audits are already adequately reviewing the tax financial statement disclosures, then perhaps the IRS can utilize that information already available to deter tax noncompliance.

In the Courts

Notice of Deficiency Validity: Insights from Cano v. Commissioner - Ed Zollars, Current Federal Tax Developments:

The outcome in Cano v. Commissioner underscores the meticulous standards the Tax Court applies to jurisdictional prerequisites. While the IRS did indicate its intention to resolve the underlying income issue administratively, the case serves as a powerful reminder to tax practitioners that a Notice of Deficiency, even if eventually received, may still be invalid if not properly mailed to the last known address, particularly when the mailing error is substantial enough to prevent a presumption of proper mailing or timely actual receipt.

Related: Eide Bailly IRS Disputes & Collections

What day is it?

It's National Fishing Day & International Sushi Day!