Key Takeaways

- Senate makes big changes in House-passed tax bill.

- SALT deduction cap tightened, but open to negotiation.

- ERC clam disallowed after 1/31/24, but only for 2021 third and fourth quarters.

- 199A "pass-through" deduction set at 20%; House bill uses 23%.

- Research deductions made permanent; retroactive deduction for small taxpayers.

- Energy credits still cut back, but less drastically than in House bill.

- Justice Department budget would eliminate Tax Division.

- Eat Your Vegetables Day, Apple Strudel Day.

Senate overhauls Trump’s tax bill, setting up brawl with the House - Jacob Bogage, Washington Post:

The lower chamber passed Trump’s One Big Beautiful Bill in late May. The legislation aims to attach an extension of tax cuts from Trump’s first term with new campaign promises — including no taxes on tips or overtime wages — and hundreds of billions of dollars of new spending on immigration enforcement and national defense.

Senate GOP rethinks tax cuts, Medicaid overhaul in Trump’s megabill - Brian Faler, Politico:

The release comes after closed-door negotiations between Crapo and his colleagues over how far to go in revising the draft of the tax, immigration, energy and defense megabill approved late last month by the House.

And the changes could potentially delay the legislation lawmakers are now trying to rush to President Donald Trump’s desk by their July 4 recess. Absent a setback, Senate GOP leaders are hoping to pass the bill next weekend.

Harvard Wins Reprieve, SALT Stalls: Tax Bill Winners and Losers - Alicia Diaz, Bloomberg. "US businesses and wealthy universities scored major wins in the Senate Republicans’ version of President Donald Trump’s tax bill, while low-income Americans and clean energy providers are poised to be hit the hardest."

Winners listed in the articles include manufacturers, banks, wealthy colleges, chipmakers, tipped workers; losers include residents of high tax states, clean energy, low-income earners, and "deficit hawks."

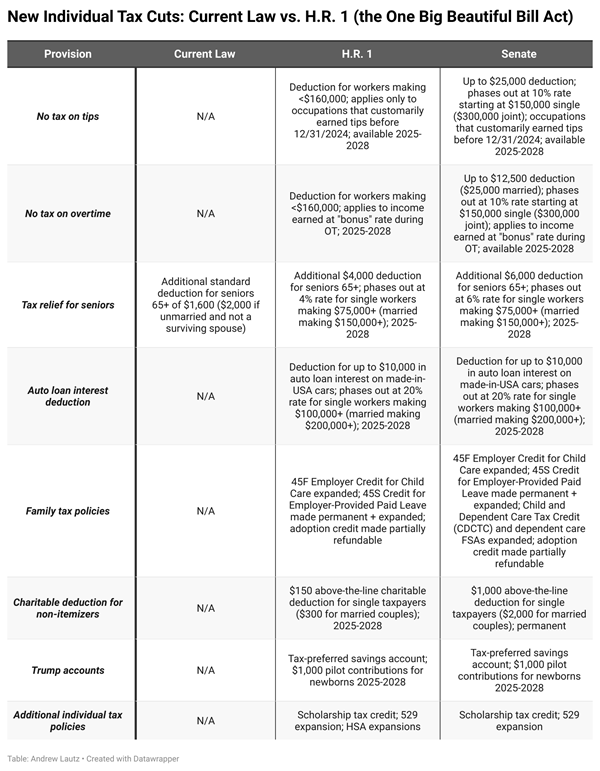

Andrew Lautz posted this chart on X/Twitter comparing current law, the Senate bill, and the House version:

Senate Finance Committee Links:

Other coverage

Here’s what’s in the Senate GOP’s version of Trump’s ‘big, beautiful bill’ - Tobias Burns, Rachel Frazin and Nathanie Weixel, The Hill.

Senate Tax Changes: More Growth, More Subsidies - Adam Michel, Liberty Taxed.

SALT in the Senate

Senate Tax Bill Lowballs SALT Proposal, Creating House Hurdles - Cady Stanton and Doug Sword, Tax Notes ($):

The proposal is significantly lower than that in the House-passed version, which would set a $40,000 SALT cap starting in 2025, with a phasedown for taxpayers making more than $500,000 a year. The income and deduction caps for SALT would increase by 1 percent each year over the next 10 years and remain at that level after the 10-year window under the House legislation.

The explanation for the provision in a section-by-section breakdown of the Senate bill makes clear that the number is not final.

Senate push to maintain ‘Salt’ cap imperils Trump’s tax bill - Lauren Fedor, Kate Duguid and Martha Muir, Financial Times. "The Senate bill also did not replicate a House measure that would have treated partners in law firms, accountancies and medical practices less favourably in Salt calculations than partners in other small businesses."

Other coverage

Senate GOP dials down SALT cap — for now - Jordain Carney, Politico.

Other Senate Bill Items: ERC, Research Costs, 199A, Energy Credits

Senate Tax Bill Narrows Employee Retention Credit Repeal - Benjamin Valdez, Tax Notes ($):

The provision is a pared-back version of the ERC repeal proposed in the House-passed tax bill (H.R. 1), which seeks to retroactively block all claims filed after January 31, 2024, including those filed for the second quarter of 2020 and the first two quarters of 2021.

Finance Committee members made the adjustment to avoid running afoul of the Senate’s Byrd rule, which prohibits changes affecting Social Security from being included in reconciliation bills.

Tax provisions of Senate Finance’s version of the budget bill - Alistair Nevius, The Tax Adviser:

...

The House bill would raise the QBI deduction rate from 20% to 23%. The Senate would keep the rate at 20%.

Also:

Small business taxpayers with average annual gross receipts of $31 million or less would generally be permitted to apply this change retroactively to tax years beginning after Dec. 31, 2021

Wind, Solar Credits Set to End Early in Senate GOP Tax Bill - Ari Natter, Bloomberg via MSN. "While the new version of the bill does not include language that would have required projects to be under construction within 60 days to be eligible for the credits, it still would end incentives for wind and solar in 2028. Tax breaks of other sources of power, such as nuclear, hydropower and geothermal, would be allowed to remain until being phased out in 2036, according to a summary of the legislation."

Senate Bill Would Slow Phaseout of Some Energy Tax Credits - Katie Lobosco, Tax Notes ($):

...

The Senate bill also makes some tweaks to the rules on foreign content used in clean energy projects. Like the House bill, the Senate bill proposes to exclude projects and facilities that receive material assistance from prohibited foreign entities. However, it expands on what material assistance means by introducing a cost ratio threshold. Notably, solar and wind projects, as well as qualifying battery components, under section 45X would have to meet higher threshold percentages.

The Senate bill would end several residential and electric vehicle tax credits early, although some would extend beyond the House bill’s December 31, 2025, expiration date. For example, the energy-efficient home credit and the energy-efficient commercial buildings deduction would terminate 12 months after the law’s enactment.

Reaction to the Senate Bill

Senate Republicans cool to Finance Committee’s tax plan - Jordain Carney, Lisa Kashinsky and Mia McCarthy, Politico:

Signs of discontent within the Republican Conference came as Senate Finance Chair Mike Crapo privately briefed his colleagues Monday night on his portion of the megabill central to enacting key elements of President Donald Trump’s domestic agenda. Crapo’s committee is responsible for some of the most politically consequential components of the party-line package, including changes to Medicaid, the fate of clean-energy energy tax credits and the state-and-local tax deduction that is important to high-tax state House Republicans.

Key GOP holdouts signal displeasure with Senate’s tax and Medicaid blueprint - Al Weaver, The Hill. "But Sens. Ron Johnson (R-Wis.) and Josh Hawley (R-Mo.), two preeminent critics of the bill, made clear they are dissatisfied by changes."

Tax Administration news

Justice Department to Eliminate Tax Unit as Workforce Shrinks - Erin Schilling, Bloomberg ($):

The plan is outlined in DOJ’s budget request to Congress for next fiscal year, which comes two weeks after the White House released its version. The proposal includes eliminating 5,093 positions across the department. About 4,500 employees at the DOJ have already accepted the Trump administration’s deferred resignation program.

...

DOJ had proposed reassigning tax division attorneys to US Attorneys’ offices across the country, but that plan received blacklash from dozens of former DOJ and IRS officials who said it would be a “grave disservice to tax administration.”

Taxpayer Advocate Service Found Often Late on Taxpayer Contacts - Tyrah Burris, Tax Notes ($):

TIGTA said in a report released June 16 that TAS case advocacy is facing three challenges: an increase in case receipts, an increase in the number of new case advocates, and the use of a legacy case management system that causes inefficiencies and delays, which affect the timeliness of case processing.

Blogs and Bits

Disaster developments: TX, OK & MO get tax relief, as Trump plans FEMA phaseout - Kay Bell, Don't Mess With Taxes. "For affected individual taxpayers in parts of the three states, the Nov. 3 deadline applies to their personal income tax returns and payments that were due on April 15."

Schwartz v. Commissioner: The Critical Role of Estimated Tax Compliance in Collection Due Process Determinations - Ed Zollars, Current Federal Tax Developments. "Crucially, the Court emphasized that the supplemental notice of determination provided three independent reasons for its conclusion, but the first reason—Dr. Schwartz’s lack of compliance with his estimated tax obligations—was sufficient on its own."

Related: Eide Bailly IRS Dispute Resolution and Collection Services.

Russian Scientist's Salary Was Not Exempt from U.S. Tax Under U.S. - Russia Treaty - Parker Tax Pro Library. "The Tax Court held that a taxpayer, a trained Ph.D. with high technical skills, who worked full time in laboratories at a university's medical institution and received a salary and benefits, in addition to further training in laboratory techniques, could not exclude her salary as a grant under the U.S. - Russia tax treaty."

Related: Eide Bailly Global Mobility Services.

It worked, until it didn't.

Commercial real estate broker pleads guilty to obstructing the IRS - IRS (Defendant name omitted, emphasis added):

Defendant, of Pasadena, pleaded guilty on Monday to one count of corruptly obstructing or impeding, or endeavoring to obstruct or impede, the due administration of the Internal Revenue Code. Defendant is free on $50,000 bond.

According to his plea agreement, Defendant is a commercial real estate broker who for years did not file timely federal individual income tax returns, specifically for the years 1998, 1999, and 2001 through 2005. He later owed tax liabilities for the years 2012 and 2013.

After the IRS assessed taxes against Defendant and attempted to collect them him via the sending of dozens of notices, Defendant took steps to conceal his income and assets from the IRS. For example, he made extensive use of cash and cashier’s checks; submitted a false form to the IRS that significantly understated his income; and used a nominee bank account to deposit income.

Thoughts:

- A successful real estate broker is going to get a lot of 1099s. Not filing returns reporting the 1099 income starts the IRS notice and collection machinery.

- When you don't file, the IRS has forever to assess your taxes.

- When you submit false forms and take steps to conceal income, it is more likely to become a criminal problem.

What day is it?

It's National Eat Your Vegetables Day. Or if you prefer, it's National Apple Strudel Day.

Make a habit of sustained success.