Key Takeaways

- Finance Committee Republicans untroubled by Billy Long's links to dubious tax credits.

- Timing of final Senate vote unclear on IRS Commissioner nominee.

- Senate budget bill negotiations heat up.

- "The difficulties don’t mean the bill is close to collapse."

- Musk: budget bill "disgusting abomination."

- CBO projects $2.4B deficit.

- Steel tariffs double.

- National Hug Your Cat Day.

Ex-GOP lawmaker’s IRS nomination advances in Senate - Caitlin Reilly, Roll Call:

...

Sen. Charles E. Grassley, R-Iowa, who voted for Long, said ahead of the vote that he found the nominee’s involvement in promoting the tribal tax credits concerning, but couldn’t find other Republicans who agreed.

“I looked into it and checked with a lot of my colleagues to see how much concern there was among my colleagues, and I expressed my concern,” Grassley said Monday evening. “I didn’t find any support for my concern.”

Senate Panel Advances IRS Nominee; Final-Vote Timeline Unclear - Cady Stanton and Benjamin Valdez, Tax Notes ($):

...

During his hearing, Long said one of his day 1 priorities would be to use 90 minutes every day to allow any employees to visit him in his office and suggest improvements to the agency, which he said supports a broader effort to change the culture at the IRS

Long, who worked in real estate and was an auctioneer before joining Congress, likened himself to former Commissioner Charles Rossotti, who didn’t have prior tax experience but was confirmed unanimously by the Senate.

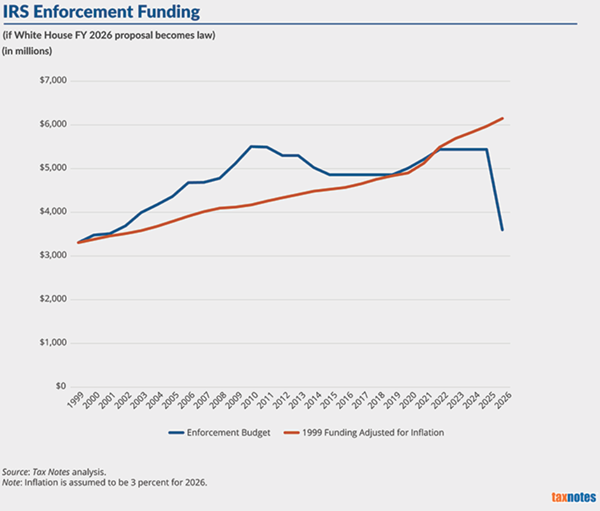

Trump Proposal Would Eclipse Scandal-era Cuts to IRS Enforcement - Doug Sword, Tax Notes ($):

The proposed cut would eclipse the combined 12 percent in enforcement funding reductions the IRS suffered in fiscal years 2012 to 2015 in the wake of wasteful spending and not-for-profit targeting scandals.

The Senate Works on the Tax Bill

Megabill tax negotiations heating up - Katherine Tully-McManus, Meredith Lee Hill and Jordain Carney, Politico. "Chair Mike Crapo (R-Idaho) and Republican members of the panel will head to the White House Wednesday to meet with President Donald Trump on the tax component of the party-line domestic policy package, Senate Majority Leader John Thune said in an interview Tuesday."

‘A ton of tradeoffs’: Thune acts fast to cut deals and move Trump’s megabill - Jordain Carney, Politico:

Senate committees will fully release revised text of the bill by the end of next week, Thune said. Panel markups where that text might be debated and potentially amended will be highly optional. And he is already in close consultation with Trump about targeting key senators who will need to be persuaded to back the sprawling legislation.

“He’s been very engaged,” the South Dakota Republican said. “I think he would do that whether we asked [or not], but we tried to give him some direction, yeah.”

GOP Senators’ Demands Push Megabill Price Tag Up - Richard Rubin, Wall Street Journal:

Locking down the votes of those senators and others with similar requests will cost money one way or another, and could further inflame intraparty tension with fiscal hawks. To balance things out, senators could find more offsetting spending cuts, dial back their tax relief or accept larger budget deficits. Each of those options comes with risks, both in finding a majority for the bill in the 53-47 Senate and in avoiding problems in the House, which passed its version 215-214 last month and must approve any changes.

...

The difficulties don’t mean the bill is close to collapse. GOP senators share a sense of purpose and they are committed to passing legislation that would avert an outcome they can’t countenance: The scheduled expiration of many of Trump’s 2017 tax cuts, which are slated to lapse Dec. 31.

Whither SALT Cap, Tip Tax Break

House SALT Deal Will Have to Change, Senate Leader Says - Steven Dennis and John Harney, Bloomberg via MSN:

“It would be very, very hard to get the Senate to vote for what the House did,” Thune told Politico. “We’ve just got some people that feel really strongly on this.”

Tillis wants major changes to Trump’s tax cut on tips - Brian Faler, Politico:

Tillis, a tax writer, said he wants a different approach that would treat people with similar earnings more equally.

He also raised the possibility of dropping the $40 billion tip proposal from the legislation altogether, noting the idea has bipartisan support and expressing doubt that Democrats would stop Republicans from passing it separately later.

An Illustrated Guide to Who Really Benefits From ‘No Tax on Tips’ - Alicia Parlapiano and Andrew Duehren, New York Times. "This Las Vegas blackjack dealer would save a lot based on his significant tips."

Tax Bill Discontents

Elon Musk Calls Trump Megabill a ‘Disgusting Abomination’ - Siobhan Hughes and Jasmine Li, Wall Street Journal:

Trump’s ‘Revenge’ Tax Could See Dollar Dive 5%, Allianz CIO Says - Alice Gledhill and Anna Edwards, Bloomberg via MSN:

The item, introduced in legislation that passed the US House in May as Section 899, is “exactly what people don’t spend enough time on,” Subran said in an interview on Bloomberg TV on Tuesday. The provision would increase tax rates for individuals and companies from countries whose tax policies the US deems “discriminatory.”

Related: Tax News & Views International Weekly: Retaliation on Auto-Pilot

Working the Refs

GOP beats down key budget office over tax plan projections - Aris Folley and Tobias Burns, The Hill:

“The Democrat inspired and ‘controlled’ Congressional Budget Office (CBO) purposefully gave us an EXTREMELY LOW level of Growth, 1.8 percent over 10 years — how ridiculous and unpatriotic is that!” he wrote on social media.

House GOP gets megabill’s official price tag: $2.4T - Jennifer Scholtes, Katherine Tully-McManus and Ben Leonard, Politico. "Congress’ nonpartisan scorekeeper released its full score Wednesday of the tax and spending package House Republicans passed along party lines last month, predicting that the measure would grow the federal deficit by $2.4 trillion."

Tariffs of Steel

Trump Signs Order Doubling US Steel, Aluminum Tariffs to 50% - Josh Wingrove, Bloomberg via MSN. "President Donald Trump has raised steel and aluminum tariffs to 50% from 25%, following through on a pledge to boost US import taxes to help domestic manufacturers."

Businesses brace for steel and aluminum tariffs, which double today - Abha Bhattarai, Washington Post:

Now, with import taxes rising to 50 percent, CEO Rick Huether says he’ll have to pass on even more of those expenses.

...

Economists also caution that the fallout of higher tariffs could drag down other parts of the economy. Researchers found that Trump’s 2018 round of 25 percent steel and aluminum tariffs helped add about 1,000 steel-production jobs but also contributed to the loss of 75,000 jobs in U.S. manufacturing.

Blogs and Bits

IRS watchdog says AI could make for more productive tax audits - Kay Bell, Don't Mess With Taxes:

Such results mean that agency resources are wasted on unproductive examinations, noted the independent IRS watchdog. From the taxpayer point of view, compliant filers also are unnecessarily burdened.

Facebook Fails to Persuade Tax Court to Invalidate Transfer Pricing Regulations - Parker Tax Pro Library. "The Tax Court held, in a dispute between Facebook, Inc. and the IRS regarding a cost sharing arrangement between Facebook and its Irish subsidiary, that the income method in Reg. Sec. 1.482-7T(g)(4) could apply to the transaction because only Facebook made a nonroutine platform contribution. However, the court also found that the IRS implemented the income method unreasonably, by selecting the wrong inputs, and therefore abused its discretion under Code Sec. 482 by reallocating income to Facebook to the extent of the wrong inputs."

Can I Use My Financial Statement Valuation for Transfer Pricing? - Chad Martin, Eide Bailly. "The purpose and scope of financial statement valuations and transfer pricing valuations are not the same."

What day is it?

It's National Hug Your Cat Day! More fun if you don't have cat allergies.

Make a habit of sustained success.