Key Takeaways

- Complex Nexus Relationships.

- SALT Scoreboard Q1 2025

- California Bill Proposes to Match Federal Tax Changes.

- Louisiana Broadens Marketplace Facilitator Definition.

- New York Violates Due Process With Retroactive Internet Rule.

- Texas Increases Business Property Tax Exemption.

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

Understanding the Complex Nexus Relationships Among Our Many Taxes- Robert L. Rojas and J. Michael Pulsey, Tax Notes ($):

Our goal is to make better decisions, and toward that goal, the tax adviser or tax director needs to better understand and explain the components that may be affected by a particular decision or set of circumstances.

The tax planner needs to contend not only with a multitude of taxes, and the relationships among those taxes, but also must read up on the “tax rules across thousands of jurisdictions.”

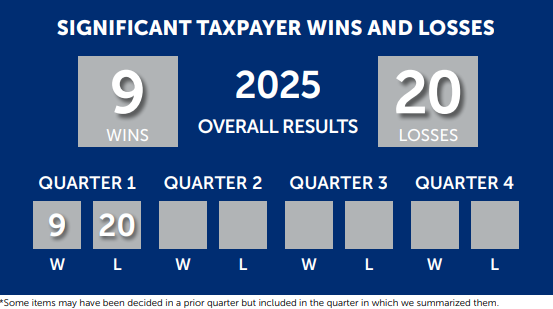

SALT Scoreboard Q1 2025 - Eversheds Sutherland:

In the first quarter of 2025, taxpayers prevailed in 31.0% (9 out of 29) of the significant cases.* In comparison, taxpayers won 37.0% (51 out of 138) of the significant cases for 2024.

State-By-State Roundup

California

Bill to Match California to Federal Tax Law Changes Advances - Laura Mahoney, Bloomberg Tax ($):

The bill (S.B. 711) moves next to the Assembly, where it must pass by Sept. 12 to reach Gov. Gavin Newsom (D). He hasn’t taken a position on the bill.

- The bill would conform the California Revenue and Taxation Code to some of the more than 1,000 changes made to the Internal Revenue Code between Jan. 1, 2015, and Jan. 1, 2025. California doesn’t automatically adopt most federal changes and must enact legislation to do so.

- California would remain out of conformity on federal treatment of depreciation, renewable energy credits, and health savings accounts; and decoupled from most changes made by the 2017 federal tax law such as business expense limitations for interest.

Georgia

Georgia DOR Adopts Sales, Use Tax Regulation on Digital Products, Goods, Codes - Bloomberg Tax ($):

Louisiana

La. Lawmakers OK Broader Marketplace Facilitator Definition - Paul Williams, Law360 ($):

H.B. 374 would specify that entities that facilitate the furnishing of an accommodation to transient guests, without owning, managing for operating the establishment, qualify as marketplace facilitators. The state House of Representatives gave the bill final approval Tuesday, voting 100-0 to concur with Senate amendments that would require accommodations intermediaries to remit local hotel and motel taxes to the state's Sales and Use Tax Commission for Remote Sellers starting Jan. 1, 2026.

The bill would take effect on July 1, if it is enacted. Rep. Jack McFarland, R-Bienville, introduced the bill in April.

Maryland

Md. Enacts Appeal Process For Digital Ad Tax - Michael Nunes, Law360 ($):

Democratic Gov. Wes Moore signed H.B. 546 and its Senate version, S.B. 605, on Tuesday. The legislation will create an appeal process for assessments levied under the digital ad tax, including a timeline for filing appeals, the right to a timely review and authority for the comptroller to amend assessments.

The comptroller or a comptroller designee will be able to correct an erroneous assessment of the tax, subject to specified conditions, according to a fiscal note. The legislation will take effect Jan. 1.

The Senate bill was sponsored by Sen. Craig Zucker, D-Montgomery. H.B. 546 was sponsored by Del. Jessica Feldmark, D-Howard.

Maryland Budget Passes with New Tax on Technology Services, Surtax on Capital Gains - Melissa Menter & Sandy Ng Jr, Eide Bailly:

The Maryland Budget Reconciliation and Financing Act of 2025 creates a new 3% tax on technology-related services, enacts a new 2% capital gains surtax on certain individuals, and makes other income tax changes.

Massachusetts

Founder's Equity Is Compensation for Sourcing, but Capital Gains for Taxation - William Hays Weissman, Tax Notes ($):

Michigan

Mich. Justices To Review Nationwide's Unitary Tax Filing Win - Paul Williams, Law360 ($):

The justices granted oral argument on the Michigan Department of Treasury's appeal application and ordered supplemental briefing on whether the state's tax laws allow a unitary group of insurance companies to file a combined return. The court also invited the State Bar of Michigan's Taxation Section to submit an amicus brief.

New York

New York Supreme Court Decides Retroactive Internet Activities Rule Violates Due Process - Bloomberg Tax ($):

The court held that the Internet Activities Rule does not conflict with and is not preempted by federal law, but the retroactive application of the rule to any period before its December 2023 publication violates due process.Oregon

Oregon Court Denies $21K Deduction For Church Donation - Michael Nunes, Law360 ($):

...

In its ruling, the tax court said the couple didn't provide the acknowledgment statement for their 2020 income tax return until 2024. Because the statement was filed past the filing deadline of May 17, 2021, it wasn't contemporaneous, the court said.

Texas

Texas Lawmakers OK Increase in Biz Property Tax Exemption - Zak Kostro, Law360 ($):

...

The bill would exempt $125,000 of the appraised value of income-producing tangible personal property from tax, replacing the current exemption for taxable value below $2,500, according to the bill text and a fiscal note.

Tax Bites: Tips, Tricks and Opportunities in SALT

Tom Marin, Director, Eide Bailly:

While technically not a tax, multistate unclaimed property obligations can catch businesses off guard much like an obscure state and local tax obligations. Did your business receive a notice from the Delaware Secretary of State (“DE SOS”) inviting the business to participate in the state’s Unclaimed Property Voluntary Disclosure program?

Make a habit of sustained success.