Key Takeaways

- Tax bill clears committee this morning after marathon session.

- SALT deal today?

- More on the bill's contents.

- IRS Commissioner-designate's ties to dubious tax credits.

- Tariffs in court.

- IRS secret shopper shops for tax prep services.

- Chihuahua appreciation.

Ways and Means Advances GOP Tax Bill After 17-Hour-Plus Markup - Doug Sword and Cady Stanton, Tax Notes ($):

The markup of the 389-page bill, which began May 13, stretched late into the night with no changes made to the bill as Republicans swatted down nearly three dozen amendments from Democrats. The larger bill, including the tax title, will now be combined in the House Budget Committee before facing the Rules Committee and a vote on the House floor.

House panel advances tax portion of Trump agenda bill after marathon meeting - Mychael Schnell and Tobias Burns, The Hill:

The tax legislation, which spans 389 pages, makes the 2017 income tax rates permanent — a top priority for Trump and congressional Republicans — implements some of the president’s campaign promises including no tax on tips or overtime through 2028, and temporarily increases the child tax credit, among several other provisions.

SALT shakers

Republicans Could Reach SALT Compromise Wednesday, Johnson Says - Erik Wasson and Billy House, Bloomberg via MSN:

The House Ways and Means Committee is debating a proposal Tuesday evening that calls for increasing the SALT cap from $10,000 to $30,000, phasing out for individuals who earn at least $200,000. But several lawmakers have already rejected that plan, saying it doesn’t do enough to reduce the tax burden for constituents living in their high-tax districts.

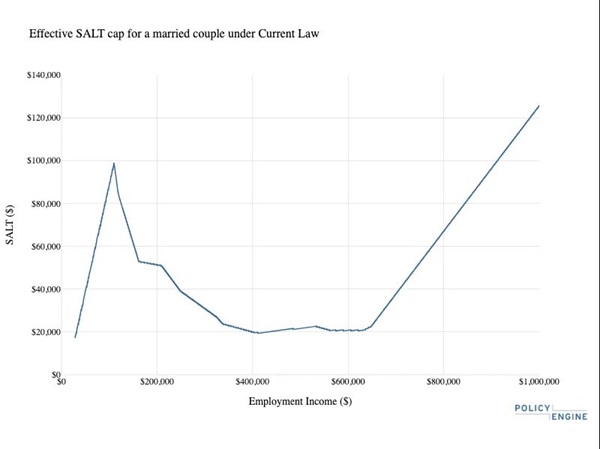

Anna Tyger of Arnold Ventures notes on x/twitter that the $30,000 number is actually a larger SALT deduction than was generally available before 2018, except at the highest income levels:

What's next?

Mike Johnson Contends With Republican Mistrust in Dash to Pass Tax Bill - Olivia Beavers, Wall Street Journal:

Senate Republicans Balk at House Plan to Gut Energy Tax Cuts - Ari Natter, Bloomberg via MSN:

...

Emerging Republican pushback means the House plan is likely a “ceiling for changes to the credits,” research firm Capstone LLC wrote in a note to clients. It said additional changes weakening the energy tax cuts could be made by moderate House Republicans before the bill is sent to the Senate.

More on the tax bill contents

What’s in Trump and Republicans’ giant tax and immigration bill? - Jacob Bogage, Washington Post. "Trump campaigned heavily on ending taxes on tips, and now that policy is in the bill. The legislation would allow a tax deduction for the total amount of tipped income received. It contains some guardrails to prevent “highly compensated employees” from claiming their earnings as tips and specifically identifies food service, hair care, nail care, aesthetics, and body and spa treatments as applicable professions to receive eligibility for the deduction."

More Lawyers, Accountants, Lobbyists to Get Break in GOP Bill - Erin Schilling, Bloomberg ($):

...

Those working in specified service trades or businesses—which include law, accounting, and consulting firms—don’t receive the 199A benefit under current law unless their taxable income is below a certain threshold.

A Guide To The Tax Cuts In (And Out) Of Trump’s ‘Big, Beautiful Bill’ - Kelly Phillips Erb, Forbes. "Under the draft bill, miscellaneous itemized deductions would be permanently eliminated."

MIT, Yale Face Endowment Tax Hike While Notre Dame Scores Break - Amanda Albright and Janet Lorin, Bloomberg via MSN. "Private colleges and universities with at least 500 students and endowments exceeding $2 million per student would pay a rate of 21% on net investment income under a bill released Monday as part of the House’s plan to extend the 2017 tax cuts. That’s up from the current tax of 1.4%."

Taxing Tuesday: Commentary Round-Up on the One Big Beautiful Bill - Mary Pat Campbell, Stump - Meep. "Only five (using only full-time equivalent enrollment) institutions would be affected: Princeton, Yale, Stanford, Harvard, and MIT."

Related: Eide Bailly Exempt Organization Tax Services.

IRS Commissioner Flaky Tax Credit Controversy

Senate Dems Probe IRS Nominee’s Ties to Tribal Credit Scheme - Benjamin Valdez, Tax Notes ($):

Senate Finance Committee ranking member Ron Wyden, D-Ore., and committee member Catherine Cortez Masto, D-Nev., in a May 13 letter asked White River Energy Corp. CFO Jay Puchir to detail the company’s work to sell so-called tribal tax credits to investors despite a lack of acknowledgment of the credits’ validity from Treasury or the IRS.

The senators are also seeking information on Long’s work for White River after a government ethics filing revealed that he received over $65,000 in referral fees related to tribal tax credits and over $5,000 directly from White River.

Energy Co. Schemed On Tribal Tax Credits, Dem Senators Say - Anna Scott Farrell, Law360 Tax Authority ($):

The December call "contains evidence of a corrupt lobbying scheme between White River and incoming Trump administration officials to authorize millions in … 'tribal tax credits' the IRS claims do not exist," Sen. Ron Wyden, D-Ore., the panel's ranking member, and Sen. Catherine Cortez Masto, D-Nev., said in the letter.

Tariffs in the dock

Trade Court Panel Looks Askance At Trump Tariff Justification - Natalie Olivo, Law360 Tax Authority ($):

His response prompted Judge Jane Restani to question if this reasoning meant that the president could declare an extraordinary emergency in response to a national peanut butter shortage.

A peanut butter shortage would be an emergency, but I'm not sure tariffs would help.

Underpayment Rates

IRS announces underpayment, overpayment rates for 2025 Third Quarter - Bailey Finney, Eide Bailly. "The rates remain the same as second quarter 2025."

Blogs and Bits

2nd W&M tax proposal includes popular, controversial, and costly provisions - Kay Bell, Don't Mess With Taxes. "Today’s measure includes many of the Trump administration’s populist policy priorities. That includes campaign promises to exempt gratuities and overtime pay from taxation."

Persistent Losses on Arabian Horse Venture Precludes Loss Deductions - Parker Tax Pro Library. "The Tax Court held that persistent losses incurred in a couple's Arabian horse enterprise indicated that their venture was operating more as a hobby than as a business and thus the losses incurred were not deductible under the hobby loss rule in Code Sec. 183(a)."

IRS offers guidance theft loss deductions for investment scam victims - NATP Blog. "The IRS Chief Counsel Advice memorandum (CCA 202511015) addressed questions raised by five individual taxpayers who suffered theft losses when they transferred funds from investment accounts to accounts maintained by scammers. Because the memorandum addresses five types of common scams, it provides valuable insights into how the IRS will treat resulting losses."

The Profit Split Method: A Transfer Pricing Method for Today - Chad Martin, Eide Bailly. "There are a host of reasons that this historically neglected method is becoming increasingly relevant to multinational enterprises (MNEs) in a wide array of industries, transaction categories, and sizes."

Does Pope Leo XIV Have to File an FBAR? U.S. Citizenship and God’s Bank - Virginia La Torre Jeker, US Tax Talk. "It’s a wild intersection of tax law and theology, and in this blog post I explore whether Pope Leo’s role as sovereign of the Holy See triggers U.S. tax reporting."

IRS Secret Shopper visits a tax preparer

Athens tax preparer sentenced to prison for filing $3.5+ million in false returns - IRS (Defendant name omitted, emphasis added):

Defendant, of Athens, Georgia, was sentenced to serve 96 months in prison to be followed by five years of supervised release by U.S. District Judge Tilman E. “Tripp” Self, III on May 8. Defendant previously pleaded guilty to one count of wire fraud and one count of aiding and assisting in preparing and presenting false income tax returns on Nov. 22, 2024. There is no parole in the federal system.

...

According to court documents and statements made in court, FBI agents investigating a multi-state unemployment benefit scheme conducted during the COVID-19 pandemic discovered text messages between individuals involved in the scheme and Defendant, a tax preparer with Defendant Tax Services in Athens. Defendant filed for Pandemic Unemployment Assistance (PUA) benefits on behalf of those individuals who had created fake businesses or submitted false information to fraudulently obtain benefits. In return, Defendant received a percentage of the ill-gotten gains.

Internal Revenue Service-Criminal Investigations (IRS-CI) agents executed an undercover operation at Defendant’s business in April 2022 as part of the continuing investigation. The undercover agent (UA) met Defendant to have taxes prepared, and Defendant asked if the UA did anything on the side. At first, the UA responded no, but Defendant said that expenses could be deducted if he did, and the UA said he mowed an aunt’s lawn sometimes, which Defendant said was good enough. The UA did not provide any income or expense amounts. Still, Defendant created a Schedule C business for landscaping on the UA's federal income tax return based solely on that interaction. Defendant prepared a Form 1040 and filed electronically, including a fictitious Schedule C loss of $19,373, and claimed an Earned Income Tax Credit (EITC), a Child Tax Credit (CTC), and a Qualified Business Income (QBI) deduction, which were affected by the fraudulent Schedule C loss. As a result, the UA’s return claimed a fraudulent federal income tax refund of $12,359.

Beware of an amazing refund. Don't sign a return that shows a business you don't own.

There is a lesson for all businesses here. The IRS will visit businesses that are up for sale posing as potential buyers. They will casually ask to see tax returns. If the seller says that the returns don't reflect "real" income, the seller has a problem.

What day is it?

It's International Chihuahua Appreciation Day. Not for everyone, but more festive than the contemporaneous Root Canal Appreciation Day.

Make a habit of sustained success.