Key Takeaways

- Trump Chief Counsel Nominee held position under George W. Bush.

- Trump v. Harvard.

- Delays in reconciliation tax markup.

- Energy credits in crosshairs.

- China hinting at tariff talks?

- Expanding protections for multistate filers in reconciliation.

- From Iowa to Illinois.

- National Tuba Day.

Trump Nominates Bush-Era Lawyer for Chief Counsel - Benjamin Valdez, Tax Notes ($):

Korb of Sullivan and Cromwell LLP was also nominated to be an assistant general counsel at Treasury, according to the Senate nomination filing dated April 29.

...

The chief counsel, one of two Senate-confirmed positions at the IRS — the other is commissioner — is responsible for crafting legal guidance for the tax code and oversees a team of more than 2,000 employees, although the agency has seen thousands of its workers accept the Trump administration’s deferred resignation offer in recent weeks.

Bush-Era Lawyer Picked by Trump to Serve as Top IRS Attorney - Erin Slowey, Bloomberg ($):

Korb, who is currently counsel at Sullivan and Cromwell LLP, served as the chief counsel during the administration of former President George W. Bush.

Trump Tax Administration

Harvard’s Tax-Exempt Status to Be Revoked, Trump Says - Gareth Vipers and Richard Rubin, Wall Street Journal:

“We are going to be taking away Harvard’s Tax Exempt Status. It’s what they deserve!,” Trump wrote in a post on Truth Social Friday.

...

It isn’t clear what argument the administration could make against Harvard. One possibility is that its admissions policies or approach to antisemitism violate fundamental public policy. That’s the standard that the Supreme Court set more than 40 years ago, when it upheld the IRS’s decision to revoke the tax-exempt status of Bob Jones University over the school’s racially discriminatory policies.

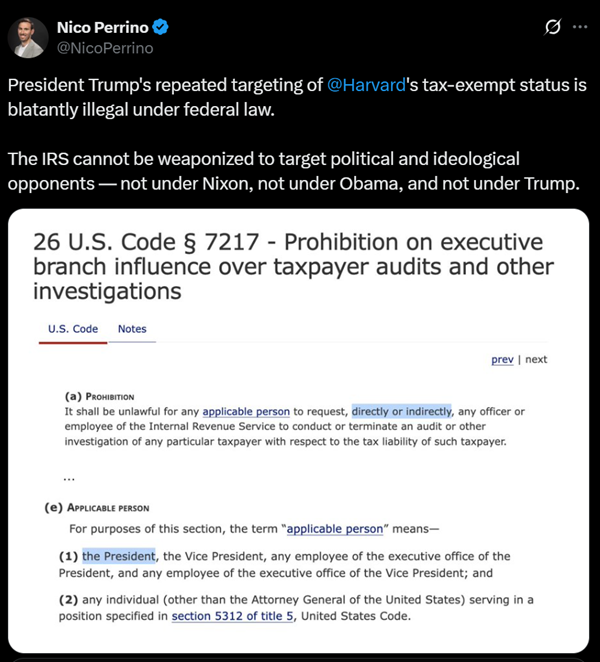

Nico Perrino, a lawyer for the civil liberties group FIRE, responds on X: "President Trump's repeated targeting of @Harvard 's tax-exempt status is blatantly illegal under federal law."

Related: Eide Bailly Exempt Organization Tax Services

Congress at Work

Byrd’s the word as House Republicans stumble - Jake Sherman, Samantha Handler, Laura Weiss and Brendan Pedersen, Punchbowl News:

After a White House meeting between Trump, Speaker Mike Johnson, House Majority Leader Steve Scalise and key committee chairs, the GOP leadership decided to delay markups next week in the House Energy and Commerce, Ways and Means and Agriculture panels, according to Republican lawmakers and aides.

...

Meanwhile, the Ways and Means Committee’s remit is the core of the Republican reconciliation process — an extension of the 2017 Trump tax cuts plus the president’s campaign priorities.

SALT Talks Stall as GOP Mulls Limiting Tax Break to Middle Class - Erik Wasson and Billy House, Bloomberg via MSN:

“I have made clear in no uncertain terms that I won’t support an income limit,” Representative Mike Lawler, who represents a suburban district just north of New York City, said in an interview Thursday, adding that he’s waiting to see a concrete SALT proposal from the Ways and Means Committee.

How to expand SALT — which was limited in President Donald Trump’s first-term tax bill — is among the most politically divisive issues facing Congress as lawmakers negotiate the contours of tax and spending legislation that they’re billing as their signature legislative priority for the year.

House Republicans look to sunset clean energy credits, hike endowment tax - Benjamin Guggenheim and Meredith Lee Hill, Politico:

The committee is also looking at taking away the ability for businesses to buy and sell those clean energy credits — an option known as transferability. There’s also likely to be a big hike to the endowment tax, though a proposed cap on the state and local tax deduction for businesses — known as C-SALT — is poised to fall out of the legislation, said the two people with direct knowledge of the latest negotiations.

GOP Seeks Appeal to Voters in Midterms by Averting Tax Hike - Chris Cioffi and Zach Cohen, Bloomberg ($):

...

Republicans insist parts of the bill will ultimately mean tax cuts for specific sectors, citing President Donald Trump’s promises to eliminate income tax on tipped and overtime wages, and on older Americans’ Social Security payments.

Those costly proposals, on top of the roughly $4 trillion extension of the 2017 law, have seen opposition from some GOP lawmakers.

Tariff Update

Trump’s Tariff Target: China - New York Times:

China has announced retaliatory measures of its own, raising tariffs on many American exports. The result has been an escalating trade war between the world’s two largest economies that risks damaging the global economy.

Trump Ends Chinese Tariff Loophole, Raising the Cost of Online Goods - Ana Swanson, New York Times:

A growing number of companies used the loophole in recent years to get their products into the United States without facing tariffs. After President Trump imposed duties on Chinese goods during his first term, companies started using the exemption to bypass those tariffs and continue to sell their products more cheaply to the United States. Use of the loophole ramped up in Mr. Trump’s second term as he hit Chinese goods with a minimum 145 percent tariff.

China signals, ever so obliquely, that it’s more open to trade talks - Katrina Northrop and Lyric Li, Washington Post. "After three months of bluster and tariffs so high they have all but curtailed trade between the world’s two biggest economies, both sides now appear to be softening their rhetoric ever so slightly. This comes amid new data showing that the trade war is already damaging both sides."

HSA limits; Non-filer Sweeps

IRS Issues Health Savings Account (HSA) limits for 2026 - Bailey Finney, Eide Bailly. "Health Savings Accounts are IRA-like accounts designed to accumulate funds for coverage of out-of-pocket health costs. Qualifying contributions generate an "above-the-line" deduction on 1040s, with no phaseouts for high-income filers."

IRS Nonfiler Compliance Sweeps Lacking in Some Areas, Audit Says - Tyrah Burris, Tax Notes ($):

The Treasury Inspector General for Tax Administration found that through revenue officer compliance sweeps of HINFs, officers referred 46 percent of delinquent returns to examination, while only 20 percent of HINF cases not involved in sweeps were sent to examination, according to a report released on May 1.

...

The sweeps were conducted throughout the United States and internationally, but TIGTA found that sweeps weren’t conducted in highest-risk rural and urban locations that have revenue officers present who may have other high-priority work. These locations include eastern New Mexico, West Texas, northwestern Nevada, and Wyoming, the report noted.

Reining in the states

House Judiciary Panel OKs Broadening PL 86-272 Protections - Paul Williams, Law360 Tax Authority. "The U.S. House Judiciary Committee advanced legislation on Wednesday that would impose more restrictions on state tax authorities to levy income taxes on out-of-state businesses, approving changes to P.L. 86-272 in the panel's portion of the federal budget reconciliation bill."

John Gupta, leader of the Eide Bailly State and Local Tax practice, comments:

One example is the taking and recording of general market notes by sales personnel during routine sales calls with customers. Many states have asserted that the taking of market notes is not ancillary to solicitation, voiding PL 86-272 protection. This position has been recently sustained by Maryland and Minnesota courts and is being pursued in audits by several other states. Combined with MTC guidance on internet activities, this position serves to render PL 86-272 nearly meaningless.

If the HR 427 text became law, these positions could no longer be sustained by the states.

PL 86-272 protects sellers of goods, but not service providers. It does not apply to sales taxes at all.

Blogs and Bits

May tax moves that could make for merrier savings - Kay Bell, Don't Mess With Taxes. "Regardless of whether you owed a lot of taxes or got a big refund this year, both circumstances are an indication you might want to revise your paycheck withholding amount. The goal generally is to come as close as possible to your eventual tax bill."

IRS Filing Deadline Fast Approaching For Many Tax-Exempt Organizations - Kelly Phillips Erb, Forbes. "The annual filing due date for the Form 990-series (Forms 990, 990-EZ and 990-PF, Form 990-N (the e-postcard), Form 990-T and Form 4720 are normally by the 15th day of the 5th month after the end of the accounting year. For an organization with a December 31 year-end, that's May 15."

Incomplete Forms 941 Are Not Valid Claims for Employee Retention Credit Refund - Parker Tax Pro Library. "The Chief Counsel's Office advised that an aggregate Form 941, Employer's Quarterly Federal Tax Return, submitted by a third-party payer (TPP) under the TPP's own employer identification number (EIN) to claim the employee retention credit on behalf of its common law employer clients is not a valid return for the clients if it fails to attach a Schedule R (Form 941), Allocation Schedule for Aggregate Form 941 Filers."

When Unpaid Taxes Can Cost You Your Passport: The Pfirrman Case - Ronald Marini, The Tax Times. "Did you know that owing the IRS can put your passport at risk?"

A personal note

I will be taking the coming week off from Tax News & Views to move from Iowa (a newly low-tax state) to Illinois (not so low), for family reasons. Taxes are definitely a thing, but they aren't everything.

My co-bloggers will continue to provide current tax goodness next week while I re-adapt to the Chicago area after a 40-year absence. What could possibly have changed?

I will be a Southsider this time, so that may be an adjustment.

I will miss Iowa. Des Moines is a great place to live, if not necessarily a world-class tourist destination. See you all from Illinois next time.

What day is it?

It's National Tuba Day! Rock on.

Make a habit of sustained success.