When it comes to tariffs and transfer pricing, uncertainty dominates the planning world for multinational enterprises (MNEs). Today’s planning is tomorrow’s controversy – and I anticipate a flood of tax authority audits and inquiries in the years to come.

Enforcers of tariffs and enforcers of transfer pricing rules have different goals. Customs audits focus on ensuring full and proper declared value, while transfer pricing audits focus on proper allocation of taxable income. These objectives can be in direct conflict – for example, when a US distributor continues to purchase at a given value from a related foreign manufacturer when tariffs are increased, reducing U.S. taxable income. And how will US and foreign customs and tax authorities decide whether and how tariff costs should be allocated between a Principal entity and a “Limited Risk” affiliate?

These issues will be treated differently both within and between countries. The outcomes for taxpayers will include complex and burdensome audits, tax uncertainty, and even double taxation.

The most important steps MNEs can take right now include:

- Review and understanding of tax, transfer pricing, and customs rules.

- Thorough review of internal/external value chains, industry norms, etc.

- Deliberate and consistent planning of policies, and thorough documentation of those policies for compliance and audit defense.

- Update of intercompany contracts and legal agreements to memorialize policies pertaining to allocation of functions, risks, and costs.

- Prospective identification of potential audit challenges and drafting of defense memoranda to address them.

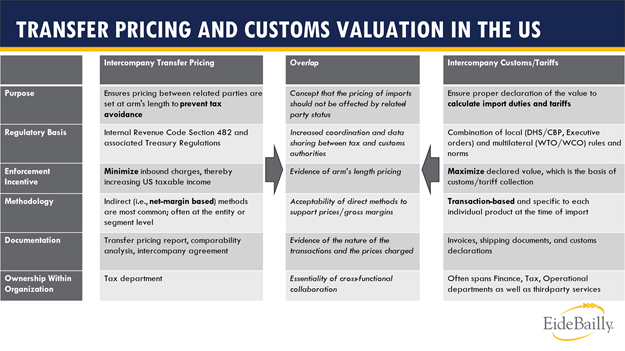

Although no silver bullets exist to bridge every gap between tax and customs controversy risk, knowledge is power. Included below is a cheat-sheet summarizing some of the key differences and overlaps between transfer pricing and customs processes. Reach out today for a no-cost consultation with Eide Bailly’s experts!

Click for a larger image.

Chad Martin directs Eide Bailly's Transfer Pricing Services practice.

Make a habit of sustained success.