Key Takeaways

- Inspector General report: last filing season went well, but this coming one is iffy.

- Report notes 25% IRS staff reduction.

- Tariff rebates face skeptical Congress.

- "Math doesn't add up."

- FBAR fine ruled not "excessive."

- Trump pardons man for $38M payroll tax and ERISA crimes.

- Trusted employee shouldn't have been.

- National Peanut Butter Fudge Day.

Wealth Transition Update! Tune in next Tuesday for a free webinar featuring Devin Hecht, director of the Eide Bailly Wealth Transition Services team. Topics will include the increased opportunities for income tax planning under OBBBA, the use of non-grantor trusts, trust flexibility, and portability planning. No charge, 1 hour CPE available. November 25, 1:00 p.m. Central Time. Register here.

TIGTA Report to Congress Reiterates IRS Staffing Concerns - Tyrah Burris, Tax Notes ($):

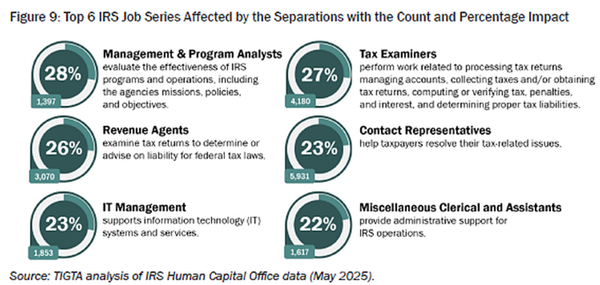

In its semiannual report to Congress, released November 19, TIGTA noted that as of May, the IRS had a 25 percent reduction in employees, from about 103,000 in January to 77,000.

Most of the departures were a result of the deferred resignation program, which allowed employees to resign immediately with continued pay through September 30. In April the IRS also began offering employees the chance to retire or leave federal service early, according to the report.

From the TIGTA report:

However, we are concerned about how this will impact the 2026 Filing Season. Key IRS functions responsible for managing the filing season have lost 17 to 19 percent of their workforce. The IRS began a Zero Paper Initiative to expand scanning and digital processing of paper-filed tax returns, which was expected to mitigate the impact of some of the staffing losses on the upcoming filing season. However, the initiative is already delayed.

Tariffs: Trade Slips, Rebates Face Math

GOP Lawmakers Appear Skeptical of Trump’s $2,000 Tariff Rebate Checks - Richard Rubin, Gavin Bade and Natalie Andrews, Wall Street Journal.

GOP lawmakers are lukewarm at best about approving any $2,000 checks, calling into question whether Trump can secure the congressional approval needed to get the cash to Americans as he has promised. With publicly held debt nearing record levels, Republican members of Congress say they would rather use tariff revenue to reduce budget deficits. They also are considering funding for health-policy ideas designed to address the Dec. 31 expiration of enhanced Affordable Care Act subsidies.

...

Trump’s tariff increases are expected to generate $158 billion in 2025 and $2.3 trillion over 10 years, according to the conservative Tax Foundation. A round of $2,000 payments targeted at middle-income households could cost $280 billion to $607 billion, depending how it is structured, the group estimates. That gap between costs and revenue could get bigger if the Supreme Court rules that most of Trump’s tariffs exceeded his legal authority.

Math Doesn’t Add Up on Trump's Tariff Dividends, Economists Say - Jonathan Curry, Tax Notes ($):

Tariff revenues surged this year thanks to the sprawling new tariff regimes enacted by the Trump administration, but even under restrictive parameters, those revenues fall far short of what is needed to fund a widely distributed $2,000 dividend, experts say.

Hassett Says Tariff Rebate Check Proposal Should Be on the Table - Enda Curran, Bloomberg ($):

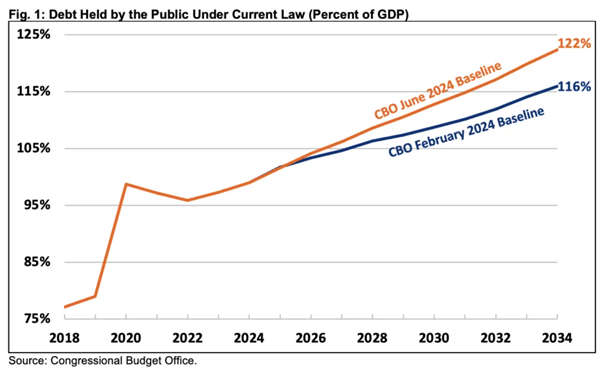

“We’re making so much progress on reducing the national debt that I think it’s fair to think about what other policies we might pursue” in a so-called reconciliation bill in 2026, Hassett, director of the White House National Economic Council, said Wednesday in a discussion hosted by Bloomberg Economics .

The progress:

Chart by CRFB.org

Trump’s Global Tariffs Curtailed Trade, Data Shows - Ana Swanson, New York Times:

U.S. goods exports also fell in August, shrinking by $500 million to $179 billion as the rest of the world bought fewer American consumer goods, cars and car parts, and gold. That was offset by an increase in exports of U.S. services, including travel.

The White House has tried to draw a red line on tariffs. It’s getting blurry. - Daniel Desrochers, Politico:

The response from the White House: Don’t count on it.

Congress Not Near ACA Tax Credit Deal

Senate struggles toward a health care deal - Burgess Everett, Semafor:

There are no official negotiations going on yet — just informal talks with Republicans — and Democrats are deliberating between engaging with the GOP or forcing Republicans to vote down a subsidy extension and letting them deal with the political fallout.

...

Republicans say a straight extension of the subsidies will fail and GOP Whip John Barrasso stressed that Republicans need “major modifications, major revisions” to the ACA to consider a Democratic proposal.

That leaves Democrats’ skeptical that the Senate can get 60 votes for anything.

In the Courts: FBAR Fine Not Excessive; Economic Substance Test Limits

U.S. Court Says FBAR Fine Isn't Unconstitutionally Excessive - Amanda Athanasiou, Tax Notes ($):

In a November 18 order in United States v. Saydam, the U.S. District Court for the Northern District of California declined to reduce a $437,564 penalty for willful FBAR failures. It found that the FBAR penalty has at least a partial deterrent or punitive role, and that Tuncay Saydam’s assessment “is not grossly out of proportion to the activity the Government is seeking to deter.”

In so holding, the district court sided with the Eleventh Circuit in that court’s split from the First Circuit on the issue of whether FBAR penalties are fines subject to the Eighth Amendment’s prohibition on excessive fines. The Ninth Circuit, which would be the appropriate appellate court in Saydam’s case, hasn’t ruled explicitly on that issue, the district court noted.

FBAR fines are assessed for failing to report interests in foreign financial accounts in any year in which the taxpayer's balance of such accounts exceeds $10,000. It applies not only to owners, but to those with signature authority as well. More here.

The Rise And Proliferation Of Excessive FBAR Penalties - Andrew Leahey, Forbes:

Over time, Congress expanded the civil penalty provisions. Today, if the IRS concludes that a violation is willful—a term that now includes reckless or even “willful blindness”—the penalty can reach up to 50% of the highest balance. Per year. Per account.

Related: Eide Bailly IRS Dispute Resolution and Collections Services.

Tax Court Substance Ruling Offers Silver Lining For Taxpayers - Kat Lucero, Law360 Tax Authority ($):

...

"It makes clear that the IRS cannot indiscriminately apply the economic substance doctrine to every transaction," Robert Kovacev of Miller & Chevalier Chtd. said. "From now on, the IRS will have to think twice before using the economic substance doctrine against taxpayers engaging in activities Congress intended to incentivize under the tax code."

Beg Your Pardon

Trump Pardons Man for $38 Million Nursing Home Tax Crime - Nathan Richman, Tax Notes ($):

Trump issued three pardons on November 14, one of which relieved Joseph Schwartz of most of the three-year sentence he received in April after pleading guilty to one count of employment tax fraud under section 7202 and one count of failure to file a Department of Labor form for a section 401(k) plan he sponsored.

According to the government, Schwartz’s business, Skyline Management Group LLC, withheld but failed to pay over more than $38 million in employment taxes from October 2017 to May 2018.

Blogs and Bits

Social Security Benefits Increase 2.8 Percent for 2026; Wage Base Grows by 4.77 Percent - Parker Tax Pro Library. "The Social Security Administration announced that social security and supplemental security income (SSI) benefits for approximately 75 million Americans will increase 2.8 percent in 2026. The amount of earnings subject to social security tax will increase from $176,100 to $184,500."

AICPA warns that merger of IRS offices would ‘confuse’ taxpayers - Martha Waggoner, The Tax Adviser. "Merging the IRS office that regulates credentialed tax practitioners with another office that deals with uncredentialed return preparers would confuse the public and could harm the tax system, the AICPA said in a letter to the leaders of those offices."

The New Senior Deduction: What OB3 Really Changed for Retirees - Matt Gaylor, Matt's Tax Firm Insights. "Campaign promises of “no tax on Social Security” didn’t survive the legislative process — but Congress did create a meaningful deduction for seniors. Here’s what it is, who qualifies, and how it works."

Unregistered U.S. Citizenship: Hidden Risks For American Born Abroad - Virginia La Torre Jeker, US Tax Talk. "Many expatriate parents choose not to register their child’s birth with the U.S. Embassy or Consulate. They reason that if they simply don’t document the citizenship, their child can grow up outside the U.S. tax and compliance system."

Related: Eide Bailly Expatriate Tax Services.

When the Trust Funds Run Dry: The Price Level May Do the Adjusting If Congress Doesn't - Veronique de Rugy, The Unseen and The Unsaid:

...

Politicians weighing whether to kick the can down the road on entitlement reform when the trust funds run dry may take comfort in CBO projections showing debt climbing for decades with no apparent crisis or inflationary spiral. That complacency would be dangerously misplaced, as CBO reports themselves acknowledge. Financial markets will not wait for the debt to reach those distant levels; they will respond the moment it becomes clear that Congress intends to finance Social Security and Medicare shortfalls entirely with borrowed money and no chance of reform or eventual repayment. Once investors conclude that fiscal discipline has been abandoned, they will reprice U.S. debt quickly, and the adjustment will follow through falling bond values, higher prices, and rising inflation.

Misplaced Trust

Former assistant office manager of Bellingham business sentenced to two years in prison for $1.4 million embezzlement scheme - IRS (Defendant name omitted, emphasis added):

According to records filed in the case, for nearly ten years Defendant was a trusted employee, being trained to take over as the office manager. However, Defendant betrayed that trust by using a variety of methods to steal company funds: Defendant issued fraudulent company checks to herself and to organizations whose financial accounts she controlled; she initiated unauthorized electronic payments to herself and on her behalf; she made unauthorized personal purchases on company credit cards; and she misappropriated the company’s petty cash. In order to accomplish the theft Defendant forged signatures or inveigled those with signing authority to sign blank checks for a seemingly legitimate purpose. She altered the company books to make it appear that payments were to legitimate vendors or for tax purposes to hide the theft via electronic payments. Instead of cancelling credit cards as requested by company executives, Defendant used the cards to make unauthorized purchases for her personal benefit, including more than 1,800 unauthorized transactions on her personal Amazon account. Defendant concealed the credit card statements from the company by having the statements sent electronically only to her work email address.

Defendant used the embezzled funds to pay her mortgage, purchase vehicles, fund her travel and leisure, pay her childcare and healthcare, and purchase securities. While Defendant lived above her means with stolen funds, her coworkers lost out on bonuses and profit sharing... When her fraud was finally discovered, Defendant instead placed blame on innocent coworkers, further degrading the trust the company had placed in her.

And she didn't put the income on her 1040, it seems.

It does appear the Defendant had more control over disbursements and the accounting system than was good for her. Even trusted employees shouldn't face temptation. There is no substitute for good internal accounting controls.

Related: Eide Bailly Fraud Prevention and Detection Services.

What Day is It?

It's National Peanut Butter Fudge Day! It's also Beaujolais Nouveau Day. I'm not sure what the suggested pairing might be.

Make a habit of sustained success.