Key Takeaways

- Furlough second thoughts at IRS.

- Fraud staffers remain furloughed.

- Layoffs include 500 from exam and collections.

- The role of tax software firms in killing Direct File.

- Election results stall shutdown talks.

- Tariff uncertainty after Supreme Court arguments.

- Tax Obscura: foreign LLCs.

- Fountain Pen Day.

IRS Brought Back Some Employees During Shutdown- Benjamin Valdez, Tax Notes ($):

...

The subtle shift came as the government shutdown has lasted for over a month and now surpasses the previous longest shutdown on record.

The IRS Office of Chief Counsel will see 45 attorneys brought back from furlough — with all of them dedicated to implementing the One Big Beautiful Bill Act (P.L. 119-21), according to the plan. The boost to chief counsel was announced last month by acting IRS Chief Counsel Kenneth Kies.

IRS Recalled Handful of Workers From Shutdown Furloughs - Erin Slowey, Bloomberg ($):

The agency on Oct. 20 brought back 45 lawyers in the Office of Chief Counsel who work on drafting the Republicans’ tax-and-spending law, Kies said.

At the same time, the Trump administration is attempting to fire more than 1,000 additional IRS workers during the shutdown.

Fraud Furloughs

IRS Fraud Office Took Its Share of Staff Losses - Nathan Richman, Tax Notes ($):

...

OFE and the fraud counsel attorneys help the IRS take indications of tax fraud that appear during civil tax audits and vet those cases for potential referral to IRS Criminal Investigation division as possible criminal cases. That liaison function comes in part from the IRS’s concern regarding the proper distinction between civil and criminal investigations.

IRS Layoffs Include Over 500 Exam Employees, Docs Show - Anna Scott Farrell, Law360 Tax Authority ($):

...

In addition to the 527 people who worked for exam and collections, 489 people who worked for the agency's information services department that oversees the operation of security controls were laid off. Another 297 workers from the agency's shared services and support department, which deals with communications to taxpayer privacy, also were fired, according to the filing.

Farewell, Direct File: The Role of Tax Software Firms in its Demise

IRS ends Direct File, shifts focus to Free File upgrades and private sector - Martha Waggoner, The Tax Adviser:

The IRS website for Direct File says “Direct File is closed. More information will be available at a later date.”

...

Direct File allowed eligible taxpayers to file tax returns directly with the IRS for free. It began in 12 states, then expanded to 25 for tax year 2024, when it also covered more tax situations than the pilot program did. The IRS also operates Free File, which provides access to free software tools offered by IRS partners and is available to taxpayers with an adjusted gross income of $84,000 or less.

Treasury Wants to Reboot Low-Use Free File Offering - Doug Sword, Tax Notes ($):

Despite what a new Treasury report acknowledges are the “relatively low” participation rates of the decades-long efforts with Free File, a public-private partnership between the IRS and participating tax software companies, the partnership represents “an untapped opportunity” to expand free access, the report said.

IRS Moves to Boost Tax Software After Industry Lobbying Push - Zach Cohen and Erin Slowey, Bloomberg ($):

The American Coalition for Taxpayer Rights, which represents the tax prep companies and financial institutions that sell tax-time financial products, celebrated Direct File’s demise and pledged to work with the IRS and policymakers to promote their services.

...

Almost 300,000 taxpayers filed using Direct File through April 20, though over 32.2 million taxpayers were eligible. Direct File backers say the tool didn’t have a chance to reach its potential due to the lack of promotion by the Trump administration and claims that the program had been ended when it hadn’t yet.

Election Results Slow Down Shutdown Resolution

Shutdown drags on as Senate seeks path forward - Andrew Desiderio and John Bresnahan, Punchbowl News:

Shutdown pain notwithstanding, Democratic senators made the case that they’re in the strongest position they’ve been in since the stalemate began. (“Every day gets better for us,” one might say.) Democrats are convinced that they can get an even better deal if they hold out a bit longer.

...

- After Tuesday’s election victories, Democrats believe voters gave them a mandate to keep up the shutdown fight. Sens. Bernie Sanders (I-Vt.) and Chris Murphy (D-Conn.), among others, implored their colleagues to “keep fighting” during Thursday’s closed-door session.

US Shutdown Dealmaking Hits New Roadblocks as Tensions Flare - Steven Dennis and Erik Wasson, Bloomberg via Yahoo! Finance:

...

Centrist Democrats have explored agreeing to a temporary measure in exchange for a promise of a Senate vote on the Obamacare subsidies. The agreement would also attach Agriculture, Veterans Affairs and legislative branch full-year spending bills to the stopgap — a move that would end uncertainty about food stamp and child nutrition benefits.

On Thursday Republicans made a formal offer to Democrats on the three full-year appropriations bills. They are also discussing a possible provision to reverse dismissals of approximately 6,000 federal employees that the administration has attempted during the shutdown, according to a Republican aide.

Crypto Reporting Update for Digital Asset Brokers

New FAQ Clarifies Crypto Broker Reporting Requirements - Mary Katherine Browne, Tax Notes ($):

...

The new guidance confirms that only businesses that effect a sale transaction of digital assets, such as digital asset kiosks, have reporting requirements.

Tariffs - Waiting on the Supreme Court

Supreme Court’s Skepticism on Trump Tariffs Means Uncertainty Reigns - Shawn Donnan, Daniel Flatley, Laura Curtis and Mark Niquette, Bloomberg via MSN:

Businesses and countries suffering from the duties and looking for resolution, though, are set for months of uncertainty.

Whether or not the high court rules Trump wrongly imposed tariffs on dozens of nations by invoking the 1977 International Emergency Economic Powers Act, the reality is that the president loves tariffs. And trade lawyers and experts say there are plenty of other laws he can draw on to fill the gap if needed, even if none offers the immediacy Trump relishes.

The tariff case puts the Supreme Court’s conservatives in a bind - Josh Gerstein, Politico:

What a Rough Day in Court Means for Trump’s Tariffs - New York Times:

Chief Justice John Roberts Jr. likened the tariffs to “taxes on Americans,” which he said had “always been the core power of Congress.”

...

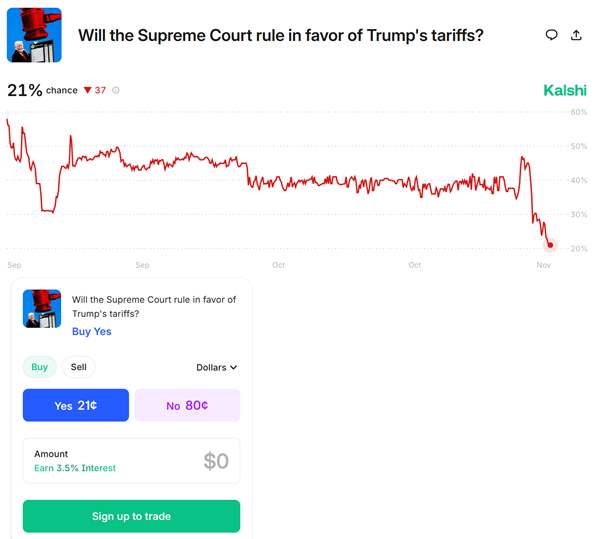

On the prediction market Kalshi, the odds of a favorable ruling on the IEEPA tariffs plunged to 28 percent, down from 58 percent in early September.

Here is the Kalshi tariff decision market as of this morning:

The Importance of IRA Beneficiaries

Leaving the Wrong Beneficiary on Your IRA Plan Can Be a Costly Mistake - Laura Saunders, Wall Street Journal:

...

“People pay attention to their wills when they sign them, but they fill out IRA and 401(k) beneficiary forms without thinking—and then forget about them,” says Bruce Steiner, an estate lawyer with Kleinberg, Kaplan, Wolff & Cohen in New York who specializes in retirement-benefits planning.

This is a mistake. Retirement accounts, unlike some financial accounts, typically don’t pass to heirs based on will provisions. Instead, they pass based on beneficiary forms filled out by the owner. While many problems with these forms can easily be solved while the account owner is alive, that’s not true after death.

Blogs and Bits

Direct File is officially dead - Kay Bell on Substack. "Individual taxpayers who used Direct File can no longer log on to the IRS website. Former Direct File users who need a transcript of their filings are instructed to access one through their IRS online accounts."

Second Circuit: Deed In Lieu of Foreclosure Resulted in COD Income - Parker Tax Pro Library. "The Second Circuit affirmed a district court and held that a married couple had cancellation of indebtedness (COD) income in 2015, when the property was in foreclosure and they executed an agreement to relinquish their right to possess the property and transferred the deed to the mortgagee."

Author Calls For Elimination Of Estate Tax And More Tax On The Wealthy - Peter Reilly, Forbes. "Much more significant is the analysis of who pays the bulk of the income tax."

Clessic - Lew Taishoff, Taishoff Law, commenting on a Tax Court case striking down a deduction for legal fees: "When a prospective client tells you that you are the fourth lawyer they’ve consulted, the previous three being incompetent, read this case. Then decline the representation."

Tax Obscura: Why Your Preparer Needs to Know About That Offshore LLC

A single-member LLC is typically "disregarded," or treated as if doesn't exist, for tax purposes. So no need to mention that I set one up offshore, right?

Wrong.

A taxpayer who sets up a foreign LLC or other "disregarded entity" is required to file Form 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs) with their US tax return. This form collects detailed information about the disregarded entity, including its structure, financial statements, and transactions with related parties.

The form is required even if you don't have income-producing property in the LLC. For example, if you buy a vacation home offshore through an LLC, you still have to file Form 8853.

It's not a no-harm, no-foul report. Even if the LLC has no income, you have to file. If you don't, the standard penalty is $10,000 for non-reporting.

Obscure? Yes, but obscurity isn't a good argument when you get that penalty notice.

Related: Eide Bailly International Tax Services.

What day is it?

It's Fountain Pen Day! Where we relive the glory days of ruining a nice shirt trying to change cartridges.

Make a habit of sustained success.