Key Takeaways

- IRS has to fight TikTok Tax without being on TikTok.

- 1099-K $20K threshold clears committee, but passage this year is unlikely.

- Early look at 2025 inflation adjustments. Get ready for $30K standard deduction.

- 600 pages of minimum tax proposed regulations issued.

- EU hits Apple with $14B of taxes. "...a bit selective."

- Prison time for defrauding an athlete, skipping the taxes.

- National Chocolate Milkshake Day.

IRS Seeks to Bypass TikTok Ban to Fight Tax Scams, Fallacies - Erin Slowey, Bloomberg ($):

Congress enacted a ban on the social media platform in the fiscal 2023 spending bill over concerns on security risks associated with its Chinese ownership. The IRS has accounts on Facebook, Instagram, X, YouTube, and LinkedIn.

Unintended consequences to hasty legislation? Imagine2 that. But TikTok tax influencers flaunting their tax-free lives shouldn't be too smug:

On the Hill

House Taxwriters Advance 1099-K, Hostage Filing Penalties Bills - Cady Stanton, IRS:

A measure that would alleviate tax penalties for Americans held hostage abroad garnered broad bipartisan support during a September 11 markup. A majority of the panel’s Democrats opposed bills related to the taxation of nonlethal weapons, a return to the $20,000 threshold for Form 1099-K reporting, and tax credits for donations to organizations providing scholarships and nonprofits that offer workforce training.

The bills without bipartisan support aren't going anywhere anytime soon.

Taxes on the Campaign Trail

Trump, Harris, and All the Wrong Ways to Do Tax Reform - Adam Michel, Liberty Taxed. "In addition to addressing existing policy expirations, both presidential candidates have proposed trillions of dollars of new and expanded special interest tax breaks that undermine the simplifications made in 2017 and make the 2025 fiscal cliff even more daunting."

Where Trump Stands on Tariffs, Taxes and Immigration - Andrew Restuccia, Wall Street Journal. "Trump has proposed a 60% tariff on imports from China and a 10%--or higher– across-the-board tariff on all imports into the U.S."

Where Kamala Harris Stands on Taxes, Housing, the Economy - Andrew Restuccia, Wall Street Journal. "Harris supports a less drastic increase in the top capital-gains tax rate than President Biden has proposed. Under Harris’s plan, the all-in top rate would be 33%, which would include a new 28% capital rate, as well as Biden’s previous proposal to raise a 3.8% investment income tax to 5%."

An early peek at 2025 inflation adjustments

Your First Look At 2025 Tax Rates: Projected Brackets, Standard Deductions And More - Kelly Phillips Erb, Forbes:

How does that translate to dollars? Here's a look at the projected numbers for the tax year 2025, beginning January 1, 2025. These are not the tax rates and other numbers for 2024 (you'll find the official 2024 tax rates here).

A few highlights:

- The top 37% rate will kick in for taxable income of single filers starting at $626,351 and for joint filers at $751,601.

- The zero tax rate on capital gains will be on taxable income up to $48,350 for single filers and $96,700 for joint filers.

- The standard deduction will be $15,000 for single filers and $30,000 for joint filers.

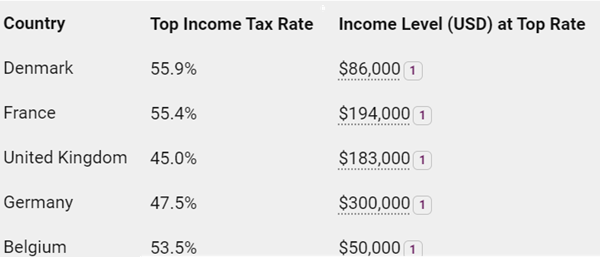

While 2025 rates in Europe aren't out yet, they are often much higher and kick in at much lower rates. A few examples:

(Chart via Bing Copilot; thresholds in dollars are approximate and rounded)

International Terminal

Eide Bailly and its affiliates in HLB Global stand ready to help meet your worldwide tax compliance and consulting needs.

Biden’s 15% Minimum Tax on Big Companies Gets 603-Page Rulebook - Richard Rubin and Jennifer Williams, Wall Street Journal:

The Treasury Department on Thursday released 603 pages of proposed rules for the corporate alternative minimum tax, or CAMT, reaching a milestone in this exceptionally complex endeavor for regulators and corporate tax executives. The proposal comes more than two years after Congress passed the law creating the tax and more than 20 months after it took effect.

The proposed rules explain the definitions and calculations for a parallel corporate tax system based on companies’ financial reports, one that runs alongside the regular corporate tax system and makes affected companies pay whichever is greater. The rules mark an attempt to determine, in granular and sometimes impenetrable terms, what counts as a tax toward the 15% total and what counts as income.

Basing taxes on financial statement income is a terrible idea that has gained worldwide currency in the so-called Pillar Two international tax movement.

Link: proposed regulations.

Treasury Proposes Rules on Corporate Alternative Minimum Tax - Michael Rapoport, Bloomberg ($). "Treasury expects CAMT to apply to about 100 companies. Officials didn’t identify those companies, but most pay very little in taxes now, according to Treasury: Without CAMT, the 100 companies would have an average effective federal tax rate of 2.6%, and 25% of them would have an effective rate of zero."

Many more companies than 100 will have to run the numbers to determine whether or not they will have to pay, resulting in compliance costs for many taxpayers with no tax collected.

Apple must pay €13bn in back taxes, top EU court rules - Javier Espinoza, Jude Webber, and Emma Agyemang, Financial Times.

...

Apple chief executive Tim Cook has previously dismissed the commission’s position as “total political crap”. On Tuesday the company said the EU was “trying to retroactively change the rules and ignore that, as required by international tax law, our income was already subject to taxes in the US”.

ECJ verdict on Apple seems to reject holistic TP - Leonard Wagenaar, Leonard's Tax Posts:

...

Having EC and ECJ has tax enforcers of last resort feels uncomfortable, especially on highly technical topics (like TP) where they may lack the expertise of local authorities and courts. In addition, it all depends on which cases EC chooses to take. And that all feels … a bit selective.

IRS Staffs Up Transfer Pricing Enforcement Boost With New Hires - Caleb Harshberger, Bloomberg ($). "Brad Anwyll, the practice’s director of field operations, said the IRS is looking to end the year with around 70 new hires—including economists, tax specialists, and revenue agents. In addition to bringing on experienced transfer pricing professionals, he said the agency is gearing up to begin hiring less experienced candidates who will be trained in-house."

Javier Milei’s tax amnesty lures Argentines to declare hidden millions - Ciara Nugent, Financial Times. "Argentina’s long history of economic turmoil, marked by hyperinflation, currency controls and governments restricting access to savings, has pushed citizens to hold some $258bn in dollars outside its financial system, according to official estimates for early 2024. An unknown portion has not been declared to authorities."

11th Circuit Holds FBAR Penalties Are Subject to the Excessive Fines Clause: A Significant Taxpayer Weapon - Virginia La Torre Jeker, US Tax Talk. "The 11th Circuit’s decision could possibly serve as a precedent for curbing IRS imposition of disproportionate penalties in these contexts as well. Taxpayers should view this ruling as a potentially powerful weapon against IRS aggressive penalties—especially when they are disproportionate to the actual value of the unreported accounts or transactions."'

Blogs and bits

IRS collection from rich nonfilers exceeds $1.3 billion - Kay Bell, Don't Mess With Taxes. "Yellen also noted that the initiative was made possible by the additional funding the IRS received under the Inflation Reduction Act. Before then, said Yellen, the IRS had not had the resources to pursue these wealthy non-filers."

IRS Provides Guidance on Matching Contributions for Student Loan Payments - Parker Tax Pro Library. "For a qualified education loan to be treated as incurred by an employee, the employee who makes a payment on the qualified education loan must have a legal obligation to make the payment under the terms of the loan."

Unrealized gains taxes are a pointless hassle - Noah Smith, Noahpinion. "More fundamentally, it doesn’t make sense to go inventing completely new taxes — doing stuff that even Scandinavian social democracies have never done! — when we have multiple perfectly good taxes that we used just 30 years ago and that we already know are safe and effective."

Supernormal Returns: An Overlooked Foundation of Tax Policy Debates - Garrett Watson and Alex Muresianu, Tax Foundation. "Advocates of levying higher taxes on corporations argue that an increasing share of the corporate tax base contains a certain type of profit—supernormal returns—that may be taxed without much concern about economic impact."

‘Encyclopedia of Fraud’ Would Help Taxpayers Spot Scams Early - Andrew Leahey, Bloomberg ($). "The IRS should directly provide clearer and more accessible guidance that explains differences between legitimate planning and fraudulent avoidance. A comprehensive, user-friendly resource that describes these schemes and consequences of engaging in them could help taxpayers spot potential scams before falling victim to predatory tax preparers—or unwittingly committing fraud themselves."

Crime Time

Two men sentenced to years in prison for a conspiracy to defraud a professional athlete - IRS (Defendant names omitted, emphasis added):

Those must have been some rough dental problems.

Imagine that.

The moral? Professional athletes may want to stick with a good index fund.

What day is it?

It's National Chocolate Milkshake Day! Fries with that, please.

Make a habit of sustained success.