Key Takeaways

- Market-based sourcing disrupts state tax world.

- Baking gambling taxes into gambling fees.

- Paying for roads without gas taxes.

- California sued over "retroactive" tax plan.

- Colorado calls special tax session.

- "Market research" makes company taxable in Minnesota.

- Nebraska special session on taxes looks to fall short of Governor's goals.

- North Dakota to vote on ending property taxes.

- Minnesota tax policy in campaign spotlight.

- Oh, that swimming pool.

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning needs!

Rocky Transition to Market-Based Sourcing Evident at MTC Forum - Amy Hamilton, Tax Notes ($):

“Market-based sourcing is huge in the litigation realm across the country,” said Leah Robinson, leader of Mayer Brown’s state and local tax group, during the panel that kicked off the meeting. “This is the biggest issue on my firm’s state tax litigation slate right now on the income tax side.”

DraftKings Announces Surcharge Plan on States With High Betting Taxes - Emily Hollingsworth, Tax Notes ($):

The online sports betting giant announced the gaming tax surcharge plan in its August 2 letter to shareholders. It said that the goal of the surcharge is “to ensure an operational effective tax rate of approximately 20 percent.”

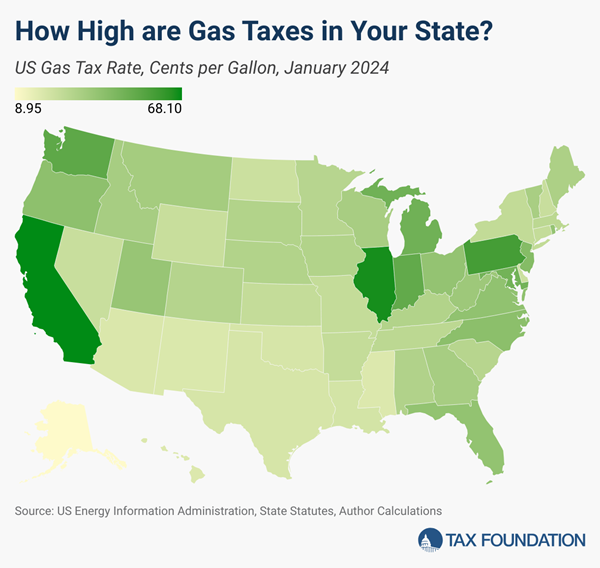

States scramble to replace gas tax cash - Adam Aton, Politico:

States’ most common approach, though, has been to levy more costs on EV owners. Thirty-nine states now charge some kind of annual fee for hybrid or electric vehicles. That includes states that plan to require all new car sales to be zero-emission vehicles by 2035, such as California and Washington, as well as the states with the fewest EVs, like West Virginia and Mississippi.

Gas Tax Rates by State, 2024 - Adam Hoffer and Jacob Macumber-Rosin, Tax Foundation. "California pumps up its gas tax the most at 68.1 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (58.7 cpg). The lowest gas tax rates are levied in Alaska at 8.95 cpg, followed by Mississippi (18.4 cpg) and Hawaii (18.5 cpg). These rates don’t include the effects of cap-and-trade carbon policies or low carbon fuel standards, which drive prices even higher in California, Washington, and select northeastern states."

State-By-State Roundup

California

Group Challenges Calif. Law Targeting Microsoft's Tax Win - Maria Koklanaris, Law360 Tax Authority ($):

...

In addition, the group said, the section of the law, which deals with apportionment, also violates the due process clause by having an unlimited period of retroactivity. The complaint was filed Wednesday in the Superior Court of California, County of Sacramento.

California Measure to Block New Vote Thresholds Delayed to 2026 - Paul Jones, Tax Notes ($). "California voters will have to wait until 2026 to weigh in on a ballot measure designed to make it harder for antitax groups to establish supermajority voter approval thresholds for taxes."

California OTA: Investor Owes Additional Tax for Ed McMahon's House - Christopher Jardine, Tax Notes ($). "In Matter of Schryer, the California OTA determined that Daniel Schryer wasn't eligible to claim rental losses from the period he owned the home because he did not attempt to make a profit and that the Franchise Tax Board was not barred from challenging his claimed net operating losses carryover."

Colorado

Colo. Gov. Calls Special Session On Property Tax Relief - Michael Nunes, Law360 Tax Authority ($). "Polis said in a statement that the special session will start Aug. 26 and focus on legislation meant to provide property tax relief next year. The call was made after two ballot questions were submitted to the secretary of state that proposed capping property tax growth and reducing assessing rates.

Minnesota

Minnesota High Court: Company’s Reports Constitute Taxable Market Research - Cameron Browne, Tax Notes ($):

In an August 7 decision in Uline Inc. v. Commissioner of Revenue, the state supreme court affirmed that the company’s practice of having its sales representatives obtain information about its competitors’ products and business practices constitutes market research and is not protected under P.L. 86-272 as mere solicitation of orders.

Nebraska

Nebraska Lawmakers Advance Stripped-Down Property Tax Reform - Michael Bologna, Bloomberg ($):

The bill now excludes various revenue raisers Pillen previously sought. For weeks, the Republican governor worked with lawmakers on a plan to expand the sales tax base through the repeal of exemptions on about 70 products and services. The bill also sought to raise funds for property tax cuts through higher excise tax increases on cigarettes, vaping, consumable hemp products, and liquor, as well as a new 50-cent fee on all retail deliveries.

You can follow the Nebraska special session action on LB34 here. You can watch the action on the legislature livestream here.

Property tax debate to pick up Friday as Nebraska lawmakers continue to seek broader relief - Zach Wendling, Nebraska Examiner:

“If we’re going to get one shot to move this in the right way, let’s take one shot, the right way,” State Sen. Justin Wayne of Omaha said during debate.

State Sen. Danielle Conrad of Lincoln saw it differently. She led opposition to LB 34 and its 122-page committee amendment Tuesday, one of various plans backed by Gov. Jim Pillen that she panned as a “reverse Robin Hood scheme” to raise taxes on low-income Nebraskans while cutting taxes for large landowners, including the governor.

Education Government & Politics Labor & Growth Nebraska lawmakers advance ‘absolute minimum’ property tax package after months of buildup - Zach Wendling, Nebraska Examiner. "That was a striking contrast from plans Gov. Jim Pillen, the Revenue Committee and others championed this summer. That included the results of a statewide tour that Pillen led to 26 communities, along with organizing a “task force” of select lawmakers."

North Dakota

North Dakota Ballot Initiative Seeks To End Property Tax - Jaqueline McCool, Law360 Tax Authority ($). "Initiative measure four, which qualified Friday for the ballot in North Dakota, would ban the imposition of property tax if passed. Only political subdivisions that have a bonded indebtedness that was incurred before or within 30 days of the measure's approval by voters would be able to levy property tax to pay off the debt, the ballot measure text said."

Utah

Utah Justices Refuse Tax Break For Sports Lab - Sanjay Talwani, Law360 Tax Authority ($). "The justices said they were not persuaded by Sports Medicine's argument that it needed to perform tests for performance-enhancing drugs for professional sports organizations at the market rate in order to sustain its philanthropic mission of testing for government agencies and charitable organizations for free or at significant discounts.

Washington

Washington High Court Rules Against Backers, Opponents of Ballot Measures - Paul Jones, Tax Notes ($):

...

In Walsh v. Hobbs, backers of the measures — led by Rep. Jim Walsh (R), chair of the state’s Republican Party — argued that public investment impact disclosures should be removed from the ballot materials for I-2109, a measure to repeal the state’s 7 percent capital gains tax on long-term gains over $250,000; for I-2117, which would repeal the state’s cap-and-trade law; and for I-2124, which would let workers opt out of the state’s employment-tax-funded long-term care program.

West Virginia

State officials certify 4% income tax reduction in West Virginia - Matthew Schaffer, WCHSTV.com. "State Revenue Secretary Larry Pack and State Auditor JB McCuskey signed off on the reduction before filing it with the State Tax Division, according to an announcement from West Virginia Gov. Jim Justice's office."

Wisconsin

Catholic Charities Seeks SCOTUS Review of Wisconsin Exemption Case - Christopher Jardine, Tax Notes ($). "The Catholic Charities Bureau (CCB) is urging the U.S. Supreme Court to review a Wisconsin high court's decision that the charity is not operated primarily for religious purposes and is therefore subject to unemployment insurance taxes."

State Taxes on the Campaign Trail

The Tax Policy Record of Minnesota Gov. Tim Walz - Richard Auxier, TaxVox:

While the legislation Walz signed in 2023 was a net tax cut, it included some offsetting tax increases. Specifically, the bill limited the amount of standard or itemized deductions that filers earning more than $220,000 could claim (with tighter restrictions on those earning more than $1 million), reduced a deduction for dividend income, and created a surtax on capital gain income. The law also conformed state tax law with federal rules on the global intangible low-taxed income tax (GILTI)—a minimum tax intended to prevent multinational corporations from shifting profits overseas—that amounted to a tax hike on corporations operating in Minnesota.

Gov. Tim Walz Raised Taxes as Most Governors Cut Them - Jared Walczak, Tax Policy Blog:

Under Walz, Minnesota became the only state to impose a surtax on the long-term capital gain income and other net investment income of high earners (all other states tax long-term capital gains at ordinary income tax rates or even preferential rates). Walz also signed legislation partially phasing out the benefit of standard and itemized deductions for high earners, and later had to sign legislation fixing a drafting error that accidentally reduced the standard deduction for all taxpayers in what would have been an unintended $350 million tax increase.

Walz also signed legislation expanding the scope of the corporate income tax to capture more international business income through global intangible low-taxed income (GILTI) taxation, something most states have eschewed, and which New Jersey largely eliminated from its tax base recently. New Jersey, which raised its corporate tax rate, is one of only three other states besides Minnesota (with California and New York) to raise the rate of a major tax since 2021. A further effort to tax international income, which would have seen Minnesota become the only state with worldwide combined reporting, failed in the legislature by a single vote.

Tax Policy Corner

A Good Outcome in South Carolina - David Brunori, Law360 Tax Authority ($):

...

Here is what you should know. The South Carolina Legislature passed this law because it wanted to benefit in-state sellers of these products ― and not help their out-of-state competitors. Decades of court decisions explain why such discrimination is unconstitutional. Yet state legislatures still pass discriminatory laws.

Summer Tax History

It's about the hottest time of the year, and it's natural to think of refreshing swimming pools. Tax administrators in Europe are way ahead of you. Tax returns in Greece require you to disclose whether you have a swimming pool - a potential indicator of unreported high income. Compliance was not good:

So tax investigators studied satellite photos of the area — a sprawling collection of expensive villas tucked behind tall gates — and came back with a decidedly different number: 16,974 pools.

Stay cool, dear readers.

Make a habit of sustained success.