Key Takeaways

- IRS: Hey, why don't we start monitoring those preparer numbers we issue?

- Nebraska legislature moves stripped-down property tax bill.

- IRS says you should register early for "direct-pay" credits.

- Whither the 20% pass-through deduction?

- Will "no tax on tips" bill move this year?

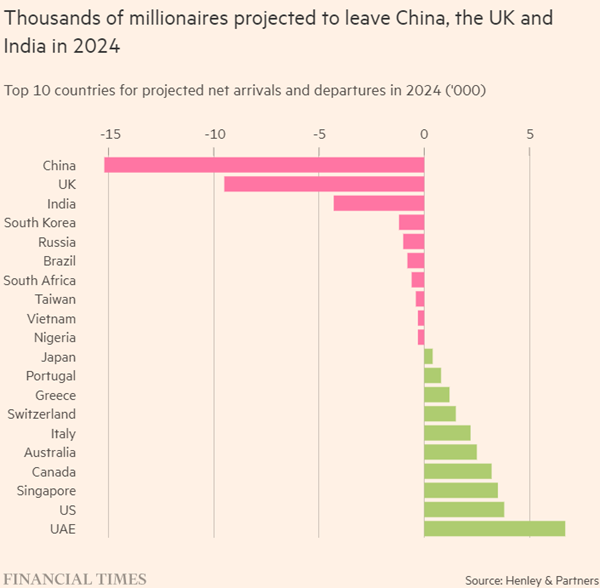

- Where the wealthy go.

- Oh, that $100 million in income.

- National Lemon Meringue Pie Day.

- Chant at the Moon Day.

Programming Note: I will be hosting a free Eide Bailly webinar next Tuesday, August 20, on Tax Planning Tips: Key Business & Individual Considerations. Register here.

IRS to Ramp Up Scrutiny of Preparer Tax Identification Numbers - Benjamin Valdez, Tax Notes ($, my emphasis):

“They’re able to do that because we were not verifying their PTIN,” Rogers said during an August 14 session of the IRS Nationwide Tax Forum in Baltimore. But that will soon change, and the IRS plans to start taking a closer look at PTINs, she said.

Everyone who signs a tax return is required to have a PTIN, which we have to renew and pay for annually. And now they tell us that they haven't even been using them for anything. They want to license preparers, but they aren't even using the tools they already have.

Meanwhile in Lincoln

Nebraska Lawmakers Advance Stripped-Down Property Tax Reform - Michael Bologna, Bloomberg ($):

...

The bill now excludes various revenue raisers Pillen previously sought. For weeks, the Republican governor worked with lawmakers on a plan to expand the sales tax base through the repeal of exemptions on about 70 products and services. The bill also sought to raise funds for property tax cuts through higher excise tax increases on cigarettes, vaping, consumable hemp products, and liquor, as well as a new 50-cent fee on all retail deliveries.

Register now for your energy credit $$$

"Elective Pay" allows entities that don't pay taxes, either because they have no taxable income or are tax-exempt, to claim energy-related tax credits as cash payments from the government.

...

The IRS recommends that taxpayers submit the pre-filing registration at least 120 days prior to when the organization or entity plans to file its tax return on which it will make its election. This should allow time for IRS review, and for the taxpayer to respond if the IRS requires additional information before issuing the registration numbers.

Whither 199A?

Partnerships Prep for Possible Changes to Key Expiring Tax Break - Erin Schilling, Bloomberg ($):

...

For decades, more business owners have chosen to be a partnership or S corp because there’s only one level of tax levied at the individual income rate. Meanwhile, corporations are taxed both at the entity level and on their dividends, leading this structure to fall in popularity.

But a corporate structure may make sense for some businesses if the tax rate stays low.

Campaign Corner

‘No Tax on Tips’ Bills: Movement This Year or 2025 Placeholder? - Cady Stanton, Tax Notes ($):

Legislation on exempting tips from tax has prompted renewed interest, but prospects for movement by year-end are unclear. The bills were proposed after former President Trump pitched the idea at a June 9 campaign rally. Vice President Kamala Harris, the Democratic presidential nominee, endorsed eliminating taxes on tips for service and hospitality workers and raising the minimum wage at an August 10 event.

...

It’s unclear whether committees in either chamber will advance the bills in an election year with limited session days and a long list of other priorities, and none of the members introducing the legislation serve on taxwriting committees.

If they pass a tip tax exemption while killing the house-passed bill allowing immediate expensing of research expenses and the expanded child tax credit, it will be a remarkable display of how little sound tax policy matters to politicians.

Hot tip: Both parties should stop bribing voters with tax cuts) - Washington Post. "Why should a waiter or blackjack dealer who gets most of their income from tips be exempted from taxes, when an employee at a nearby Walmart or a bus driver earning the same income — or perhaps much less — must pay taxes on all their hard-earned wages?"

TCJA: should it stay or should it go? - Kay Bell, Don't Mess With Taxes. "Regardless of who wins the U.S. presidency this November, the next occupant's first year in (or return to) the Oval Office will be during a potentially tumultuous year for taxes. That’s because 2025 is when the Tax Cuts and Jobs Act’s (TCJA) individual provisions expire."

International Terminal

The low-tax countries wooing the world’s wealthy - Emma Agyemang, Financial Times (free registration required): "Last month, UBS published a report forecasting the UK and Netherlands would lose the most millionaires by 2028 — falling by 17 per cent and 4 per cent respectively. The two countries bucked a worldwide trend in which the number of millionaires is set to rise in 52 out of 56 countries that the bank monitors. Its data includes those who have become millionaires through wealth creation as well as émigrés."

Related: Eide Bailly Global Mobility Services

The Supreme Court, Executive Deference, and International Taxes - Alex Parker, Things of Caesar:

As with all areas of law it’s complicated, but treaties that are ratified by the Senate are generally seen as having the force of legislation. So in that sense, the arm’s-length standard is part of the U.S. legal code.

D.C. Circuit reverses Tax Court on assessment of foreign entity ownership reporting penalties - Thomas Godwin and John McKinley, Journal of Accountancy. "The D.C. Circuit, reversing the Tax Court, upheld the IRS’s authority to assess penalties for failure to furnish information specified under Sec. 6038 regarding U.S. persons’ ownership of certain foreign corporations and partnerships."

After 70 Years, It’s Time to Rethink the Foreign Withholding Tax - John Harrington, Dentons via Bloomberg. "So, why are FDAP withholding tax rates the same as they were in 1954, despite all the changes in US tax rates and rules over the last 70 years? The various justifications given for such high rates don’t withstand scrutiny."

The Premier League, transfers, wages and tax: How does it all work? - Peter Rutzler, The Athletic:

For football clubs, VAT is added to the whole transfer immediately, even if it is agreed to be paid in instalments. So if a player is signed for £100million, the overall cost with VAT is £120m. Transfer fee add-ons and performance-based bonuses only incur VAT when the criteria are met.

Related: VAT Rates in Europe, 2024

Tax Crime at the Bar

Disbarred Atty Admits To Tax Evasion Over Mass Tort Fees - Gina Kim, Law360 Tax Authority ($):

From the Department of Justice press release (Defendant name omitted):

It might be hard to convince the IRS that people will loan you nine figures when your tax returns show no income.

What Day is it?

Why, it's National Lemon Meringue Pie Day! Or, if you are following political campaigns too closely, it's also Chant at the Moon Day.

Make a habit of sustained success.