Key Takeaways

- IRA looks to get ahead of scammers.

- IRS operating plan doesn't target sole proprietorship piece of the tax gap.

- East Palatine payments qualify for disaster exclusion.

- IRS representation roadblock in Navajo country.

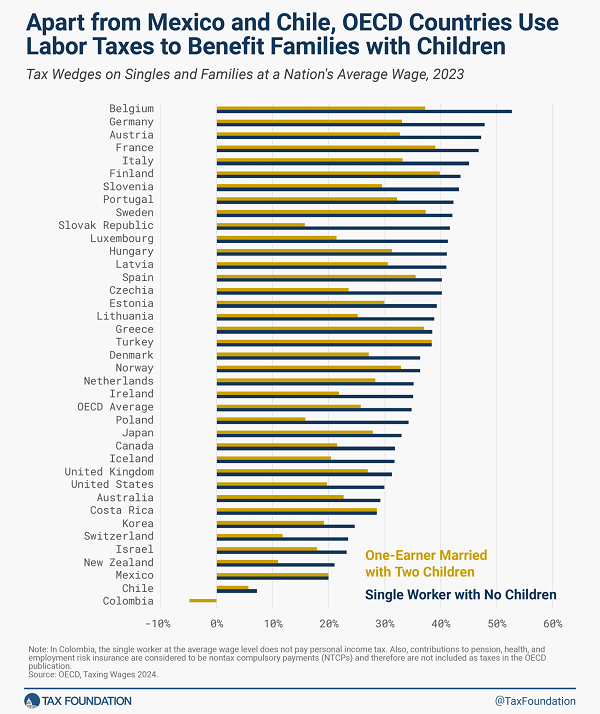

- Tax burden on labor in OECD countries (Belgium is highest).

- OECD as tax regulator.

- Utah movie producer bombs in trial.

- D-Day anniversary.

IRS Seeks Outside Help to Thwart Scams and Schemes - Lauren Loricchio, Tax Notes ($):

Williams said the agency is often responding to the latest scam or scheme to try to help taxpayers but would prefer to be proactive. That is why getting ahead of scam and schemes requires partnership with other federal agencies and state and local governments, he said.

Capitol Hill Recap: IRS Funding Fight - Jay Heflin, Eide Bailly. "The chambers fighting over IRS funding is a perennial event on Capitol Hill. It blossoms every spring."

Document Upload Tool reaches key milestone; 1 million submissions received - IRS. "Initially launched in 2021 in a limited format and greatly expanded in 2023 with funding from the Inflation Reduction Act (IRA), the tool offers taxpayers and tax professionals the option to respond digitally to eligible IRS notices by securely uploading required documents online through IRS.gov. For anyone with a smart phone or computer, this means that replying to IRS notices is now often as easy as scanning required documents and uploading them to the tax agency."

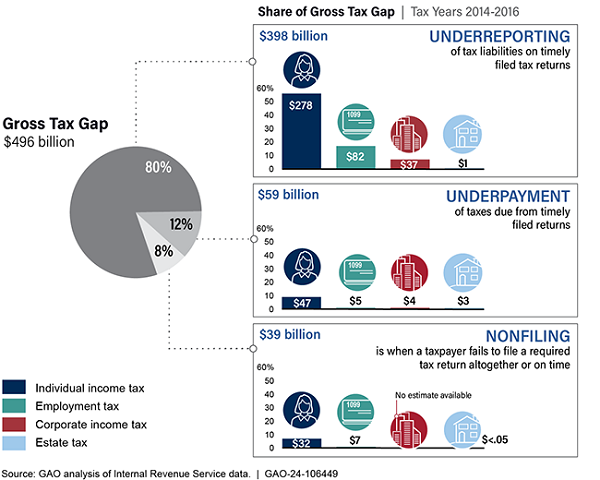

AI Use in IRS Tax Gap Audits Lacks Transparency, Watchdog Says - Owen Racer, Bloomberg ($):

The GAO report released Wednesday includes six recommendations that the IRS agreed to, including multiple forms of documentation around its use of AI in its efforts to increase confidence in the agency’s ability to detect taxpayer noncompliance.

From the GAO report:

The strange omission of sole proprietor compliance from the IRS operating plan may well stem from the Biden administration pledge to not increase audit rates for taxpayers earning less than $400,000. This may inadvertently send a message that tax cheating is fine until you make more than $400,000.

Train Disaster; Tribal Tax Help Train Wreck

Many payments to individuals affected by East Palestine train disaster are tax-free; new guidance could help those in Ohio, Pennsylvania, West Virginia - IRS. "In Notice 2024-46, posted today on IRS.gov, the IRS determined that the Feb. 3, 2023, derailment qualifies as an event of a catastrophic nature.' As a result, various payments made to affected individuals by the common carrier that operated the derailed train are 'qualified disaster relief payments,' which, by law, are excluded from gross income. Individual taxpayers qualify for the exclusion only if the expenses covered by the qualified disaster relief payments made by the common carrier are not otherwise paid for by insurance or other reimbursement."

Inside the IRS Representation Roadblock Facing Navajo Nation - Caitlin Mullaney, Tax Notes:

This restriction for a community already facing minimal access to tax information and preparation resources compounds a tedious process that can affect the timely manner of a tax case, according to Emery McCabe, a member of the Navajo Nation Bar Association.

Much social welfare spending, including the Earned Income Tax Credit, is run through the tax code. The tax law isn't easy to navigate without help, and the poor by definition aren't hiring tax lawyers. And in Navajo country, even free lawyers have a problem:

Blogs and bits

House GOP Tax Teams seek public input on expiring tax reform provisions - Kay Bell, Don't Mess With Taxes. "The House tax-writing committee has created a special email address to accept input from the public. These comments, say GOP leaders, will be used in their formulation of future tax measures."

Tax And Financial Literacy Matters - Kelly Phillips Erb, Forbes. "Specifically, TaxEDU found that more than two-thirds of respondents did not know the top federal income tax rate and over half did not know how tax brackets work. And, the majority of respondents also answered incorrectly when asked whether tax credits were more valuable than tax deductions (the answer is yes)."

Court Denies Taxpayer's Request to Dismiss Willful FBAR Penalties Case - Parker Tax Pro Library. "The court found that the government alleged myriad deliberate actions over the course of a decade by Gyetvay that established plausible allegations of willfulness. In the court's view, Gyetvay is a sophisticated international businessman with an extensive background as a CPA, audit partner, CFO, and consultant, who retained a Swiss wealth advisory firm to help him hide his ownership and control of certain foreign accounts, transferring such accounts between different banks."

IRS “Direct File” Will Become a Permanent Option – But Not for Americans Overseas - Virginia La Torre Jeker, US Tax Talk. "While the IRS has stated it will be expanding Direct File to cover more tax situations and studying how to make Direct File available to more taxpayers, if you are an American abroad – I think it is safe to say, forget about using the Direct File program. Given the complexity of US tax returns for the American living and working overseas, use of the Direct File program will not be possible."

International Tax Corner

Remember Eide Bailly for your International Tax Services.

Tax Burden on Labor in Europe, 2024 - Cristina Enache, Tax Foundation:

...

Belgium has the highest tax burden on labor at 52.7 percent (also the highest of all OECD countries), followed by Germany and Austria at 47.9 percent and 47.2 percent, respectively. Meanwhile, Switzerland had the lowest tax burden at 23.5 percent.

FBAR First Time Abate ("FTA") Relief for First Year Delinquent FBAR Filings - Jack Townsend, Federal Tax Procedure. "I have just focused on the IRS’s adoption in the IRM of First Time Abate (“FTA”) opportunity for failure to file an FBAR. First Time Abate has long been available even without a showing of reasonable cause for a first-time failure to file, failure to pay, and/or failure to deposit penalties. The FBAR FTA, however, is more limited."

The "FBAR" is the report required for taxpayers with foreign financial accounts. Heavy penalties can apply for failure to report such accounts, even if no tax is owed on them.

Related: Penalty Help

The OECD's New Role in Global Taxes - Alex Parker, Things of Caesar. "As PwC Ireland Tax Policy Leader Peter Reilly explained in a recent PwC podcast, it’s not that the new OECD guidance automatically becomes the Ireland law. But it’s pretty close to that, allowing the department to issue an order “at any point in time to bring in guidance,” he said. Given that Ireland strongly wants to be seen as in compliance, the OECD’s new guidance can become the country’s de facto law almost instantly."

With bonus Atomic Rabbit.

EU Corp. Tax Proposal Delayed By Uncertainty On OECD Plan - Bengt Ljung, Law360 Tax Authority ($):

That would make it premature for the EU to move forward with its proposal to introduce a common system for calculating the tax base of company groups across the bloc, known as Business in Europe: Framework for Income Taxation, Thomas told Law360.

US Businesses Slam Canada Plan for 5% Streaming Service Tax - Michael Rapoport, Bloomberg ($). "Canada’s plan calls for streaming services that generate at least C$25 million ($18.3 million) in Canadian revenue to pay 5% of that revenue to support the Canadian broadcasting system beginning with the 2024-25 broadcast year, the Canadian Radio-Television and Telecommunications Commission (CRTC) said Tuesday."

What’s the Problem That Prompted Pillar 2 and Is There a Better Solution? - Leonard Wagenaar, Leonard's Tax Posts. "This paper argues that there’s a better solution for tax competition and tax avoidance than P2 (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4823124). Instead, countries should just adopt worldwide taxation, remove all exceptions to CFC rules and just impose CIT on all profits of subs (with FTCs). They argue that it would stop tax competition a lot better."

This production flopped.

Former Utah Movie Producer Found Guilty of Tax Crimes - US Department of Justice (Defendant name omitted, emphasis added):

According to court documents and evidence presented at trial, Defendant owned a home in Cedar Hills, Utah, and operated Blue Moon Productions LLC, a freelance film and media production company. From 1999 through 2005, Defendant did not file any federal income tax returns or pay any tax. In 2007, the IRS conducted an audit and assessed him with $703,266.96 in taxes, interest and penalties. After Defendant failed to make any payments towards his outstanding debt, the government filed a civil suit in federal court to foreclose on his home to satisfy his outstanding tax debt.

After several court proceedings in which Defendant participated, a federal judge ordered that his home be sold at auction and the proceeds used to pay off some of the taxes he owed. Defendant then attempted to stop the sale by filing bogus documents on the property’s title and with the IRS, intimidating potential purchasers or investors for the home and harassing IRS personnel by filing frivolous lawsuits against them personally.

Shortly before the court-ordered sale closed, Defendant forcibly broke into the home and attempted to reclaim it. With the help of others, he occupied the home unlawfully for five months, fortifying it with weapons, sandbags and wooden boards tactically placed throughout the house.

Sometimes it's better to just pay the taxes. I'm pretty sure he can't write off the weapons and sandbags as a tax prep cost either.

What day is it?

Today is the 80th Anniversary of D-Day, the Normandy invasion. That sort of overshadows National Yo-Yo Day.

Make a habit of sustained success.