Key Takeaways

- $400M in withdrawn employee retention credit claims.

- Werfel on IRS and cannabis descheduling.

- IRS win on foreign reporting penalties.

- IRS nearly ready to retire 60 year-old software.

- Minnesota tax change and disclosure bill advances

- Options for the 2025 expiration of TCJA provisions.

- Hidden high marginal rates on low incomes.

- Why employers should log into EFTPS regularly

- Cream Pie Day

- Root Canal Appreciation Day.

IRS’s Werfel Talks ERC Claims and Direct File - Samantha Handler, Bloomberg ($):

On the fraud-ridden ERC, Werfel said taxpayers have withdrawn $400 million of unpaid claims since the agency paused processing new claims. The credit has also drawn ire from lawmakers, who’ve proposed a crackdown on fraud in the bipartisan tax package that passed the House in January.

$400 million is real money, but it in the context of the overall ERC program, and the suspected large proportion of shaky or fraudulent claims, it isn't much. It's less than 2/10 of 1 percent of the amount paid out of the program to date, and the IRS continues to receive claims by the thousands.

The tax bill passed by the House of Representatives earlier this year would end the credit for claims filed after January 31, but prospects for Senate passage have faded.

Weed tax, Foreign assessment, old IRS tech.

IRS Preparing for Tax Implications of Marijuana Rescheduling - Wesley Elmore, Tax Notes ($):

“What will their status be with respect to financial institutions? Will they remain mostly a cash-based industry, or will they move into something other than cash?” Werfel asked. “All of these things are important moving pieces for the IRS to determine how this emerging and changing industry is assessed at the right level and paying what they owe.”

Descheduling is important for cannabis businesses because as long as marijuana is on Schedule I, it is subject to Sec. 280E, which disallows expense deductions for sellers of Schedule I items other than cost of goods sold. Deductions for rents, salaries, equipment, and other ordinary expenses are disallowed, meaning cannabis businesses pay tax on gross income, rather than net income.

The Commissioner's comments of banking are important. Regulators frown on banks doing business with Schedule I businesses, forcing them to use cash, leaving them with obvious security and control risks. Many taxes are required to be paid electronically, and that's hard to do without a bank account.

IRS Win on Foreign Holdings Penalties Seen as Blow to Taxpayers - James Munson, Bloomberg ($):

...

The dispute pit the IRS against Alon Farhy, who challenged agency penalties for failing to report interests in two Belizean corporations between 2003 and 2010 through a Form 5471. The IRS used Section 6038(b) of the tax code to assess nearly $500,000 in penalties for the violation in 2018, according to the circuit ruling.

Prior coverage: Tax Court Decision may hamper IRS penalty collection for controlled corporations and partnerships

IRS Budget Request Would Push Its Fiscal Cliff Back Two Years - Doug Sword and Benjamin Valdez, Tax Notes ($):

If you ever suspect that IRS computer systems may not be entirely up to date, the article will confirm your suspicions:

A modern version of the agency’s individual master file, which is the hub of all transactions for individual taxpayers, has been running concurrently with the legacy system this year and will be fully adopted next filing season if all goes well. The commissioner said to expect an update on the progress later this spring.

Fortunately, there is no historic preservation movement for software code, or there would be lawsuits demanding the IRS preserve its historic COBOL IT systems.

Other news

Minnesota House Passes Omnibus Bill With Corporate Tax Changes - Emily Hollingsworth, Tax Notes ($):

H.F. 5247 was amended and narrowly approved in the House in a 68 to 60 vote on May 3 and was sent to the Senate. The franchise tax disclosure provision was retained, as was a provision requiring a study on corporate tax base erosion, despite criticisms of both proposals by the Council On State Taxation and the Minnesota Center for Fiscal Excellence. Motions to eliminate the contentious provisions failed ahead of the vote.

Eide Bailly Set for Growth East of the Mississippi as Apple Growth Partners Joins the Firm - Eide Bailly:

...

The union will bring 24 partners and 125 staff into Eide Bailly and expand the firm’s footprint in the Great Lakes region with offices in Akron, Cleveland, and Canton, Ohio, and Schaumburg, Illinois.

Blogs and bits

10 tips to help you deal with an IRS tax notice - Kay Bell, Don't Mess With Taxes. "6. Speak up if you disagree. If, however, you don't agree with the notice, it's important for you to respond. Write a letter to the IRS explaining why you think the agency is wrong. Include any information and documents you want the IRS to consider. Mail your reply with the bottom tear-off portion of the notice to the address shown in the upper left-hand corner of the notice. Allow at least 30 days for a response."

Related: IRS Dispute Resolution & Collections

Tax Court Invalidates Notice of Deficiency Due to IRS Address Change Irregularities - Parker Tax Pro Library. "The Tax Court held that a notice of deficiency was invalid because it was not sent to the taxpayer's last known address and therefore dismissed the case for lack of jurisdiction. "

Backdoor Roth IRAs Are Promising—and Perilous - Laura Saunders, Wall Street Journal. "Look before you leap into a backdoor Roth, however. While it can be a great move, there are potential pitfalls. Some savers opting in face unexpected tax bills right away plus record-keeping headaches that last for years—or even decades. "

Tax Policy Corner

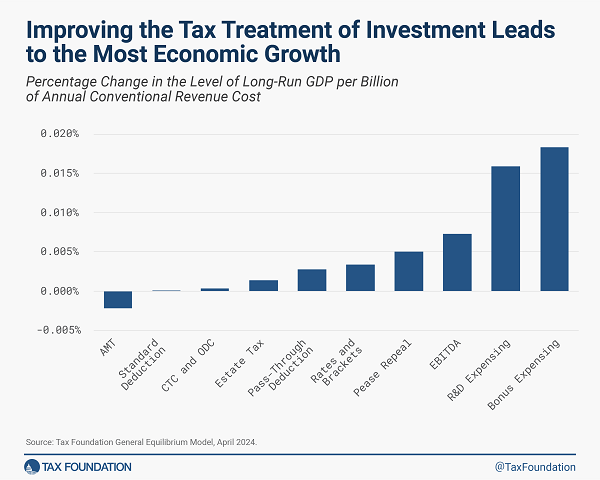

Options for Navigating the 2025 Tax Cuts and Jobs Act Expirations - Erica York, Alex Durante, Huaqun Li, Garrett Watson, and William McBride, Tax Foundation. "Not every dollar of the $7.4 trillion in lower taxes has the same effect on economic growth or tax compliance and administration costs. The most pro-growth provision by far is permanence for 100 percent bonus depreciation, illustrating how improving investment incentives creates the most economic return for each dollar of tax revenue forgone. Indeed, recent studies have determined that the TCJA’s corporate tax reforms, including lowering the corporate tax rate and providing 100 percent bonus depreciation, significantly boosted investment in the United States.

Expiring Tax Breaks, Charitable Giving, and What’s At Stake for Philanthropy - Jack Salmon, The Chronicle of Philanthropy. "A total of 23 tax provisions are set to expire at the end of 2025, many of which helped fuel charitable giving trends in recent years."

New audit points to fraud potential in tax credit program for biofuels - Ed Tibbetts, Iowa Capital Dispatch. "Fraud is in nobody’s interests. Obviously, it’s not good for taxpayers, nor the people and businesses who have a legal right to claim these biofuel subsidies. It’s also not a good thing politically. If the right safeguards aren’t put in place, support for these tax credit programs will suffer."

Intersecting Disincentives - John Cochrane, The Grumpy Economist:

Roughly speaking, and including in-kind transfers (health insurance, housing), the average American earning from $0 to $60,000 faces a 100% marginal tax rate. Equivalently, we have a $60,000 universal basic income, with a 100% tax of actual income on top of that.

...

Income phaseouts apply to market income, not program income. If you earn an extra legal dollar, you lose x% of your benefits. If you join another program (low income bus pass) the extra income does not count against your other benefits, so there is zero marginal tax rate. Getting a subsidized bigger apartment is just free. Getting a better paying job and paying for that apartment pays taxes and reduces other benefits.

Tax Crime Corner

Former Wise County man sentenced for income tax-related fraud - IRS (Defendant name removed, emphasis added):

According to information presented in court, Defendant was the president and owner of Employer Tools and Solutions (ETS), a payroll service provider that operated in Denton County, Texas. ETS filed Forms 940 and 941 on its clients’ behalf and made payroll and payroll tax payments using funds provided by its clients. Part of ETS’s function in processing its clients’ payroll was holding and remitting employment tax to the Internal Revenue Service for its clients. Employment tax consists of trust fund taxes, which are items withheld from employees’ paychecks, and the employer portion of taxes.

From 2017 to 2019, Defendant embezzled hundreds of thousands of dollars from his small-business clients. He took funds provided by various clients for employment taxes and failed to pay the money over to the IRS. Instead, he kept this money and used it to pay bills—including payments on his home—and to fund his lifestyle—including a European vacation. Defendant also failed to report the client funds he embezzled as income on his U.S. Individual Income Tax return.

Sadly, the IRS will likely go after the employers whose funds were stolen to recover payroll taxes that the defendant cannot cover.

Many taxpayers outsource their payroll for good business reasons. Cases like this show why it's a good idea to regularly log in to EFTPS, the Electronic Federal Tax Payment System, to make sure that payroll taxes are being properly credited to your employer account.

What day is it?

Hopefully, this isn't cause and effect day; it's National Coconut Cream Pie Day and Root Canal Appreciation Day.

Make a habit of sustained success.