Key Takeaways

- Beware "new clients."

- Stock buyback rules eased for foreign owners.

- Can the tax bill find 60 Senate votes?

- Deadline tips.

- Audit flags.

- He saw a great ($5,000) light.

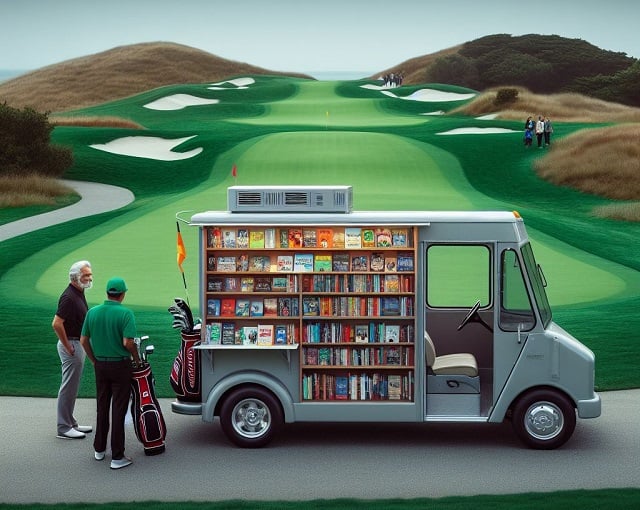

- National Bookmobile Day, Golfers Day.

Tax professionals and businesses present a tempting target for identity thieves given their extensive information, and scammers continue to look for creative ways to gain access into sensitive systems. In particular, the IRS and the Security Summit partners urge tax pros and businesses to watch out for a surge in a particular type of spearfishing known as “new client” scams, where identity thieves pose as potential clients using fake emails.

Through spearphishing emails, cybercriminals impersonate real taxpayers seeking help with their taxes, using fake emails to get sensitive data or gain access to a tax professional’s client information from their computer systems. While these can peak around tax season, they remain a year-round threat. Criminals accessing tax preparer credentials, or their client's tax-related information, can affect multiple victims.

The IRS offers useful online hygiene advice:

How to avoid being a victim of spearphishing:

-Never click suspicious links or download attachments from unknown senders, including potential clients.

-Call the potential client to confirm the email is from them.

-Send only password-protected and encrypted documents through email.

-Protect email accounts with strong passwords and two-factor authentication.

-Use security software products with anti-phishing tools.

-Be vigilant year-round, not just during tax filing season.

That's good advice for everyone, not just tax pros. Don't ever send anything with your social security number in an email without strong encryption. Better yet, use your tax pro's secure upload portal.

Stock Buyback Excise Rules

Treasury Proposes Long-Awaited Stock Buyback Tax Rules - Kat Lucero, Law360 Tax Authority ($):

The U.S. Treasury Department proposed a pair of long-awaited rules Tuesday that detail the calculation and reporting of a new excise tax assessed to publicly traded corporations that recently bought back their own shares of stock on the open market.

The levy — known as the stock buyback tax under Internal Revenue Code Section 4501 — is a rate of 1% of the fair market value of stocks repurchased that are valued over $1 million. The tax was enacted as part of the Inflation Reduction Act in August 2022 to limit corporations from pursuing such transactions to avoid paying taxes on dividends and, instead, opt for more long-term investments.

Stock Buyback Tax Changes Would Limit Scope of Funding Rule - Chandra Wallace, Tax Notes ($):

The proposed regs would eliminate a widely criticized “per se” rule regarding funding purchases of affiliated foreign corporation stock and replace it with a rebuttable presumption that would apply to only a targeted category of fundings.

...

The proposed regs would replace that strict rule with a rebuttable presumption that applies only for transactions defined as “downstream” fundings that occur within two years. The government said those transactions were most likely to raise the antiavoidance concerns underlying the funding rule.

The presumption would apply where qualifying affiliates of a foreign corporation directly or indirectly fund a “downstream relevant entity” within two years of a stock purchase by or on behalf of that entity.

Link: IRS news release.

Counting to 60

Schumer Waiting on Vote Count Before Bringing Tax Bill to Floor - Cady Stanton, Tax Notes:

Majority Leader Charles E. Schumer, D-N.Y., said he supports the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) negotiated between Senate Finance Committee Chair Ron Wyden, D-Ore., and House Ways and Means Committee Chair Jason Smith, R-Mo., but is waiting for assurance on a vote count before moving it forward.

“I’m all for the package. If there are enough votes to move it forward in the right way, yeah, we’ll try to get it on the floor. But right now we don’t think — they’re trying to get enough votes. The sponsors are trying to see if there are enough votes,” Schumer said April 9.

Tax season is nearly over. Many taxpayers are preparing returns or extensions to report business income based on having to capitalize and amortize, rather than deduct, research costs - causing them to pay tax on what amounts to phantom income.

Hey, there's a deadline coming up.

Tax Day 2024: What to know about deadlines, extensions, refunds and more - Julie Zauzmer Weil, Washington Post ($):

Yes. If you don’t pay on time, the IRS can charge you a fee for filing late and interest on what you owe. The amount will depend on how much money you owe and how long you wait to pay it. It’s better to formally request an extension than to simply let the deadline go by. To ask for an extension, you can either use tax software (including Free File) or mail a request to the IRS.

E-file if you can.

5 things to know about the tax filing deadline - Tobias Burns, The Hill:

Enforcement agencies are targeting automated scams that are throwing taxpayers for a loop, with one recent action by the Federal Communications Commission (FCC) going after a fake robocall campaign by Veriwave Telco known as the “National Tax Relief Program.”

“Approximately 15.8 million calls playing pre-recorded messages pertaining to a ‘National Tax Relief Program’ were placed. The Bureau found no evidence that this program actually exists,” the FCC said in a Friday release.

IRS Failed to Give Complete Cost of Direct File, GAO Says - Erin Slowey and Samantha Handler, Bloomberg ($):

The Government Accountability Office said in a report released Tuesday that the office and the Treasury Inspector General for Tax Administration found the Internal Revenue Service had no documentation to support its analysis of the cost of its Direct File tool and didn’t include start-up costs, which could be substantial.

“Without a comprehensive accounting of costs, IRS’s estimates could understate the full amount of resources required to develop and maintain a permanent Direct File program,” GAO said.

Top things to know about the IRS Direct File pilot as April filing deadline approaches - IRS. "IRS Direct File is available 24/7 — in English and Spanish — for eligible taxpayers in Arizona, California, Florida, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington and Wyoming until April 15. People in Massachusetts can use Direct File until April 17 to file, due to the Patriots’ Day and Emancipation Day holidays."

Blogs and bits

Don't wave these 10 audit red flags - Kay Bell, Don't Mess With Taxes "If you are legitimately losing money, then report that. But be ready to prove that you were trying to be successful financially. Keep complete, thorough records to prove your business intent and unfortunate losses to the IRS."

Bozo Tax Tip #3: Publicize Your Tax Crimes on Social Media! - Russ Fox, Taxable Talk. "A helpful hint to the Bozo tax community: Law enforcement does read social media. Indeed, the IRS will do a search of you on the Internet prior to a field examination (audit). So if you decide to go on the dark side of life, don’t brag about it online. A better course would be not to go on that dark side to begin with, but that rarely occurs to the Bozo community."

Taxpayer Can't Avoid Being a Responsible Person Due to CPA's Embezzlement Scheme - Parker Tax Pro Library. " The court rejected the taxpayer's argument that he was not a responsible person because of a learning disability with respect to mathematics and that the failure to pay employment taxes was due to embezzlement by the company's CPA; the court found that the focus was not on the taxpayer's abilities or whether he personally took responsibility for paying the employment taxes, but on his authority to control the company's employment tax obligations."

Tax Tips for College Students and Their Parents - Associated Press via U.S. News. "For dependent students filing taxes for the first time, it’s easy to overlook checking the 'dependent' box, and they cannot then be claimed on their parents’ tax forms without the long and arduous task of amending the return merely for failure to check a box."

This is a common cause for rejection of an e-filed return. If the student has already filed without checking the "dependent" box, IRS E-File will reject the parent return showing the student as a dependent.

Last-minute tax season reminders - National Association of Tax Professionals. "The IRS has been reminding U.S. taxpayers that they must report the sale or exchange of digital assets on their returns for several years, but a recent indictment of a taxpayer who filed to report profits from cryptocurrency transactions show that the agency is getting serious about enforcing the reporting requirements. The February indictment of a Texas man for allegedly underreporting his capital gains by $4 million is believed to be the first that has been filed against a taxpayer for failing to disclose a cryptocurrency transaction when no other crimes were involved. IRS officials have previously said it is ready to bring charges in hundreds of cryptocurrency cases."

May Deadline Approaches for Securing Stimulus Payments from 2020 - John Richmann, Tax School Blog. "Because the Recovery Rebate Credit was tied to taxpayers’ 2020 and 2021 tax returns, the three-year statute of limitations for filing a 2020 tax return expires on May 17, 2024. If the taxpayer did not file a 2020 tax return, they have until this date to file one, even if it’s just to claim the 2020 Recovery Rebate Credit."

Beware This Solar Panel Tax Scam - Thomas Gorczynski, Tom Talks Taxes. "Some unethical solar credit promoters are encouraging taxpayers to claim downright false Schedule C business losses with respect to their solar electric property for additional tax savings. A colleague sent me the tax package a solar credit promoter sent to one of her clients. It may be no surprise that it is full of questionable items (and that is a generous characterization)."

In the courts

Taxpayer Says He’s Seen the Light, Drops Ongoing Tax Challenge - Erin McManus, Tax Notes ($, taxpayer name omitted):

According to the judge, Taxpayer's April 2 motion noted how he “had time to reflect on his current thoughts and beliefs on the issue at hand” and that he has had “a radical change of mind and realizes his errors.”

...

Taxpayer received $88,083 from one employer in 2019. He maintained that he wasn’t a U.S. resident or citizen, and therefore no “equitable contract existed” between him and the IRS for a debt, which was the same argument made regarding his 2017 and 2018 tax liabilities.

From the Tax Court order:

2. . . . [P]etitioner has had time to reflect on his current thoughts and beliefs on the issue at hand.

3. Petitioner has since experienced a radical change of mind and realizes his errors.

4. Petitioner has no further interest in arguing his past beliefs before this court, nor will he continue to do so.

5. Petitioner hereby promises not to bring any further petitions before this court, and to cease any further frivolous arguments. . . .

8. Petitioner brings this motion in good faith and apologizes to all involved for bringing forth any frivolous claims and/or arguments before this court.

9. Petitioner hereby rescinds all frivolous arguments that he has made in the past.

The taxpayer had previously been hit with a $5,000 penalty for making silly arguments in another case. Sometimes that can be enough to improve ones understanding.

Atlanta’s former chief financial officer pleads guilty to theft of government funds and tax obstruction - IRS (defendant name omitted, emphasis added):

The City of Atlanta’s former chief financial officer (CFO)... pleaded guilty today to theft of government funds, which included the purchase and possession of two machine guns, and obstructing federal tax laws.

Two machine guns? That seems like a lot for one Lollapalooza. From the IRS press release:

In August 2015, Defendant used his city credit card to pay $1,278.72 for a hotel room at the J.W. Marriott Hotel in Chicago, Illinois for a three-night weekend stay. Defendant told the City that the hotel room was for a “Swap Advisory Engagement.” In reality Defendant was not in Chicago that weekend, but booked the hotel for his stepdaughter to attend the Lollapalooza music festival.

Of course there's a tax angle:

During his tenure as CFO, Defendant also submitted to the IRS a tax return for 2013, in which he claimed that he owned a consulting business which incurred more than $33,500 in alleged business losses in 2013, including $12,000 for travel expenses and $7,115 for deductible meals and entertainment expenses. In July 2015, the IRS advised Defendant that it was auditing that tax return and requested that Defendant provide documentation to support the purported expenses for his consulting business. In response, Defendant falsely provided:

1. receipts for airfare and hotels that Defendant paid for using his City of Atlanta credit card (which Defendant had previously told the City of Atlanta were for City business and his job as CFO);

2. expense reports for personal meals with his wife and personal companions; and

3. altered receipts that hid from the IRS the fact that the charges were incurred in connection with Defendant’s work for the City of Atlanta. In reality, none of those expenses were for a consulting business.

This resembles advice from social media influencers - "set up an LLC and you can deduct all the things." Maybe he can use reliance on TikTok as a mitigating factor in sentencing.

Related: Eide Bailly Fraud & Forensic Advisory Services.

What day is it?

Perhaps the bookmobile can meet you at the turn? It's both National Bookmobile Day and Golfer's Day!

Make a habit of sustained success.