Key Takeaways

- IRS puts bad social media advice on "Dirty Dozen" list.

- Judge refuses to bar tax on Arizona 2023 rebates.

- Radiation compensation as a lever to move tax bill?

- Taiwan deal at risk in tax bill holdup.

- Don't be a bozo if you mail your return.

- Texan faces criminal employment tax problems.

- A $24 million gift from a business associate?

- National Unicorn Day.

Bad tax advice is multiplying on TikTok - Jacob Bogage and Julie Zauzmer Weil, Washington Post:

The tips that pop up on TikTok and on Instagram and Facebook, both owned by Meta, make splashy claims that promise big returns. One influencer... says to buy short-term rental properties that lose money on paper, and use that to offset income from your full-time job. Another... tells followers to hire their children as employees and deduct some of their housing costs as a business expense — and if their accountant warns that could cause an audit, their accountant is wrong. Still others tell hundreds of thousands of followers to buy 6,000-pound vehicles, then write off the sticker price, maintenance and fuel.

...

In reality, taxpayers can’t deduct salaries they pay their children unless the children truly are gainfully employed, and they can’t deduct the full cost of a fancy new vehicle unless the car is used to run a business, not for personal use. Deducting business trips from your taxes can be legal — but it’s more complicated than just scheduling a meeting during your vacation, and experts suggest keeping business transactions and personal transactions separate to avoid red flags for audits.

Influencer names omitted.

Social media can routinely circulate inaccurate or misleading tax information, where people on TikTok and other social media platforms share wildly inaccurate tax advice. Some involve urging people to misuse common tax documents like Form W-2, or more obscure ones like Form 8944 involving a technical e-file form not commonly used by taxpayers. Both schemes encourage people to submit false, inaccurate information in hopes of getting a refund.

...

The IRS warns taxpayers to be wary of trusting internet advice, whether it's a fraudulent tactic promoted by scammers or it's a patently false tax-related scheme trending across popular social media platforms. While some producers of misleading content are driven by criminal profit motive, others are simply trying to gain attention and clicks. They will post anything, no matter how wrong or outlandish, if it garners more attention.

If the person who does taxes for a living tells you one thing, and some stranger on TikTok who gets attention for a living disagrees, bet on the tax person.

Sorry, Arizona.

Federal Court Won’t Bar IRS From Taxing Arizona Rebate - Andrea Muse, Tax Notes ($):

A federal district court has refused to prohibit the IRS from imposing income tax on Arizona’s 2023 rebate for families with dependents.

In an April 5 order in Arizona v. IRS, the U.S. District Court for the District of Arizona concluded it is unlikely that it has jurisdiction to hear Arizona’s challenge to an IRS determination that the rebate is subject to federal income tax, denying the state’s motion for a preliminary injunction.

What's (not) happening in D.C.

Senate Stuck on Tax Deal as End of Filing Season Nears - Cady Stanton and Doug Sword, Tax Notes ($):

Two weeks of recess appeared to bring senators no closer to advancing the House-passed tax package.

Senate Majority Leader Charles E. Schumer, D-N.Y., shouldn’t test Republicans’ resolve on their support of Senate Finance Committee ranking member Mike Crapo, R-Idaho, and his efforts to make changes to the $79 billion Tax Relief for American Families and Workers Act of 2024 (H.R. 7024), Finance Committee member Thom Tillis, R-N.C., said.

A new wrinkle for the tax bill - Andrew Desiderio and Laura Weiss, Punchbowl News.

Here’s a new wrinkle: Sen. Josh Hawley (R-Mo.), who has said he’s “favorably disposed” toward the tax package, is now floating the idea of attaching it to his big-ticket bill reauthorizing a compensation program for radiation victims. RECA, as it’s known, got 69 votes in the Senate last month.

Hawley told us Monday night that he would vote for the tax bill with RECA attached. The Missouri Republican believes this could be the difference-maker for some of his GOP colleagues.

...

Another reason why this is an interesting move by Hawley? Crapo is a big supporter of RECA, and his state stands to benefit significantly from the program.

The path forward for the house passed bill is murky, as our Jay Heflin reminded us yesterday. The bill would restore full deductions for domestic research costs, resume 100% bonus depreciation, and loosen restrictions on deductions of business interests. But Jay has also noted that tax bills often appear dead right up until they are approved.

Trains, Planes and TikTok: Congress Has a Lot to Do and Not Much Time - Steven Dennis, Bloomberg via MSN. "Senate Republicans are poised to sink a bipartisan $78 billion tax cut pairing breaks for US companies with large research or capital equipment costs together with an expanded child tax credit mostly benefiting lower-income families. Some oppose the child tax credit expansion as damaging work incentives, don’t want to give Biden an election-year victory or think they can get a better deal after the election. Momentum could slow further after the April 15 tax-filing deadline, though the IRS has said it would retroactively send checks to eligible recipients."

Taiwan Deal Risks Getting Lost in Tax Bill Row - Chris Cioffi, Bloomberg ($):

As lawmakers in the Senate jostle over whether to advance House-passed tax legislation, provisions in the bill like a double taxation fix for those doing business between the US and Taiwan may get lost in the shuffle.

...

Uncertainty around whether the $78 billion package will even get a vote in the Senate is spurring worries among those seeking closer business ties between Taiwan and the US. And the road ahead if the tax package withers isn’t clear.

“When they suggest some other path, there’s not really any discussion about what that looks like,” said Rupert Hammond-Chambers, president of the US-Taiwan Business Council. “Cold water is just thrown over the entire suggestion of breaking Taiwan out.”

In a separate article, Mr. Cioffi explains how Tax Package Delay Puts Taiwan’s US Chip Investment in Question (Bloomberg, $).

AICPA Tells FinCEN to Pause Enforcement of Ownership Reporting - Andrew Velarde, Tax Notes ($). "Enforcement of the beneficial ownership reporting requirements should be suspended until one year after the conclusion of court cases challenging the constitutionality of the regime, according to the American Institute of CPAs."

Link: AICPA letter.

Blogs and bits

Don't miss these 10 too-often overlooked tax breaks - Kay Bell, Don't Mess With Taxes. "6. Retirement savings credit: If you do put some money into an IRA, traditional or Roth version, or a workplace or self-employment retirement plan, you also might be able to get a bonus tax break. The Saver's Credit is available to lower- and middle-income earners who contribute to retirement savings. It's worth up to $1,000. And because it's a tax credit, that $1,000 can erase that much of any tax you owe."

Bozo Tax Tip #4: The $0.68 Solution - Russ Fox, Taxable Talk:

So assume you have a lengthy, difficult return. You’ve paid a professional good money to get it done. You go to the Post Office, put proper postage on it, dump it in the slot (on or before April 15th), and you’ve just committed a Bozo act.

If you use the Postal Service to mail your tax returns, spend the extra money for certified mail. For $4.40 you can purchase certified mail. Yes, you will have to stand in a line (or you can use the automated machines in many post offices), but you now have a receipt that verifies that you have mailed your return.

So true. In my second tax season, back before e-filing was a thing, I was instructed to deliver a return to perhaps our largest individual tax client, collect his signatures and a six-figure balance due check, and deliver his return to the post office, all on April 15. I saved the certified mail postmark in the client file, which saved my job when the IRS mailed him a late filing notice with penalties, as the postmark proved that the return was timely.

Former IRS Crime Chief Finds New Home At Fintech Firm Chainalysis - Kelly Phillips Erb, Forbes. "Chainalysis—a blockchain forensics firm headquartered in New York—uses on-chain data to trace crypto transactions and identify scams, hacks, fraud, and illicit activity involving digital assets."

Tax Court Allows Only 2.5% Of Claimed Easement Charitable Deduction - Peter Reilly, Forbes. "Judge Joseph Goeke of the United States Tax Court has finally made it clear that the syndicated conservation easement industry is an industry based on nonsense. You can't routinely buy property and have the fair market value of an easement on the property be a multiple of the price you just paid. That is the big takeaway from his opinion in Savanah Shoals LLC- TC Memo 2024-35."

Tax Policy Corner

Who’s Left to Tax? Grappling With a Dwindling Shareholder Tax Base - Steven Rosenthal and Livia Mucciolo, TaxVox.

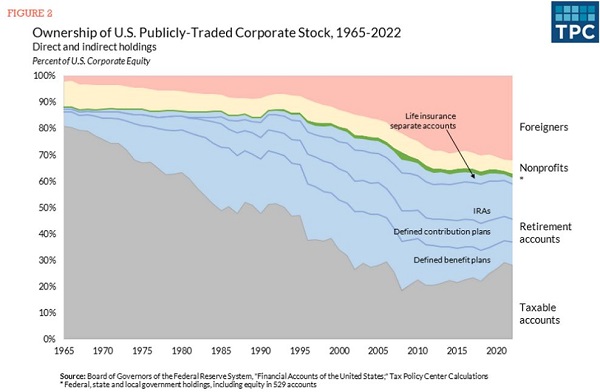

Our main findings: From 1965 to 2022, the share of outstanding US stock that was held in taxable brokerage and mutual fund accounts declined from 79 percent to 27 percent (see Figure 1). The share of publicly traded stock that was held in taxable accounts similarly declined from 81 percent to 28 percent (see Figure 2).

...

The big shift in stock ownership complicates attempts to tax corporations and their shareholders. Compared to 60 years ago, corporations now pay substantially fewer taxes on their profits, largely as a result of profit shifting to foreign entities as well as lower corporate tax rates. And policymakers who seek, for example, to increase shareholder taxes must grapple with a relatively small and dwindling number of taxable accounts. Widening the base of corporate earnings that are taxed and/or increasing tax rates on those profits, at either the corporate or shareholder level, is the most sensible path forward.

A corporate income tax combined with a deduction for taxable dividends paid - and a withholding/excise regime for foreign or non-taxable owners - might ensure that all corporate earnings get taxed, but only once.

Learning tax the hard way

Kingsville business owner charged with failing to pay employment taxes - IRS (Defendant name omitted):

Corpus Christi, TX — A Bishop resident has been indicted on 16-counts for failure to pay employment taxes to the IRS, announced U.S. Attorney Alamdar S. Hamdani.

...

According to the indictment, Defendant owned and operated... a residential remodeling and fence installation business in Kingsville and Bishop. Defendant was allegedly responsible for determining which expenses to pay and exercised control over all aspects of the business.

As owner and operator, Defendant was allegedly held liable for collecting and withholding employment taxes from his employees’ paychecks. Such employment taxes include federal income tax, Social Security and Medicare taxes. It is alleged Defendant withheld these taxes from employees but failed to pay them over to the United States.

The indictment further alleges Defendant diverted corporate funds to cover his personal salary and expenses. Defendant still owes more than $400,000 in employment taxes on behalf of his company’s employees, as alleged in the indictment.

A sobering illustration of the unwisdom of not staying current with withholding. The IRS notices these things, especially when employees want refunds based on the unremitted employment taxes. The owner still has to come up with the cash, which has (allegedly) gone to personal "expenses." And it became a criminal problem, as it often does.

Tax Court Balks at 'Bad Advice' Argument - Mary Katherine Browne, Tax Notes ($). "The Tax Court held that it was unreasonable to believe that a taxpayer acted in good faith on a lawyer’s 'remarkably bad' advice when treating $24 million in transfers from a business partner as nontaxable."

The article points out that it's not clear whether the lawyer was given the facts on which the "remarkably bad tax advice" - that the $24 million was non-taxable gifts, rather than income - was based. From Judge Marvel's opinion (taxpayer names omitted):

At a minimum, Mr. Taxpayer has failed to show that he provided Mr. Attorney with necessary and accurate information to determine the tax consequences of the transfers. There is no evidence that Mr. Taxpayer ever disclosed many of the considerations that we found decisive... to Mr. Attorney, including (1) the noncompete agreement that prevented him from investing in Peachtree, (2) Peachtree's upcoming liquidity events, (3) Mr. Taxpayer's and Mr. Business Associate's history of participating in nominee arrangements with each other, or (4) the exact details of their business and personal relationship. There is also no documentary evidence of the nature of the advice that Mr. Attorney gave to Mr. Taxpayer or the factual and legal assumptions on which it was based.

The article notes that the attorney prepared Form 3520 for the taxpayer. The tax law requires recipients of gifts of $100,000 or more from overseas to report them on Form 3520, to help identify instances where income from offshore sources might be misclassified as gifts. The penalties for not filing the form are severe. The penalties for not reporting $24 million in income, which are upheld in this opinion, are also nothing to sneeze at.

What day is it?

It's National Unicorn Day! Sorry, I don't have any good recipes.

Make a habit of sustained success.