Key Takeaways

- Tax bill's fate could be dimming.

- Tax education needed.

- Energy rebates not income.

- Tax payment deadline reminder.

- IRS spending IRA cash.

- Students, unions, taxes.

- Court action.

- Global minimum tax grabs ink.

- Student debt and taxes.

- Empanadas ah plenty.

The tax bill’s window is closing - Laura Weiss, Punchbowl News ($):

Heading into this brief April work period, the Senate GOP is mostly dug in against the Smith-Wyden bill. Only a handful of Republican senators have said publicly they’d vote for it.

GOP senators are largely lining up behind objections from Senate Finance Committee top Republican Sen. Mike Crapo of Idaho. Crapo and Senate Republican leadership have urged colleagues to stick together and to vote against cloture.

Lay of the land: Both chambers will be in session for two weeks before the next vacation. Yes, you read that correctly. Lawmakers return to work on April 8 in the Senate and April 9 in the House, then everyone goes on recess the week of April 22.

Between then and now, the Senate has more pressing legislative priorities than voting on the tax bill, which include:

- Impeachment proceedings (Homeland Security Secretary Alejandro Mayorkas)

- Reauthorizing FISA

- Authorization for FAA funding

- Confirming presidential nominees

The collapse of the Key Bridge in Baltimore will also be a priority discussion.

The tax bill that has already passed the House but has been sitting in the Senate for roughly six weeks. Normally, the longer legislation languishes in a chamber of Congress the less chance there is that it will be the subject of a vote.

The current tax bill includes R&D expensing for domestic costs, ups bonus depreciation to 100% and expands the business interest deduction and the Child Tax Credit, to name a few of its provisions.

Most D.C. observers think if the Senate does not vote on the tax bill by Tax Day (April 15) – a week from today – it won’t happen. But never say never. Lawmakers generally do not care about deadlines. If there is a political win for voting on the tax bill, then they will do it – no matter what the calendar says.

To wit, the guessing game continues:

GOP opposition to child tax credit bill could be softening in Senate – Jacob Bogage, Washington Post:

Bipartisan legislation to cut taxes for working families and extend certain corporate tax breaks has stalled in the Senate over Republican opposition. But the bill’s prospects could be growing rosier as lawmakers prepare to return to Washington next week from a long recess.

Privately, some GOP lawmakers have said they’re increasingly willing to support the bill with small changes that the measure’s Democratic sponsor has already offered, according to four people involved in the conversations who spoke on the condition of anonymity to discuss private talks.

An onslaught of business lobbying for tax breaks is bouncing off GOP senators – Brian Faler, Politico Pro ($):

The CEOs are calling.

Sen. Thom Tillis (N.C.) has heard from nearly a half dozen of them, some, he says, from companies whose names you’d recognize.

They’re urging him to back a nearly $80 billion tax package, half of which would benefit businesses, which was overwhelmingly approved by the House but is now on the brink of failure in the Senate.

Tillis’s response: Sorry.

Sometimes "nos" become "yeses." It happens frequently on Capitol Hill.

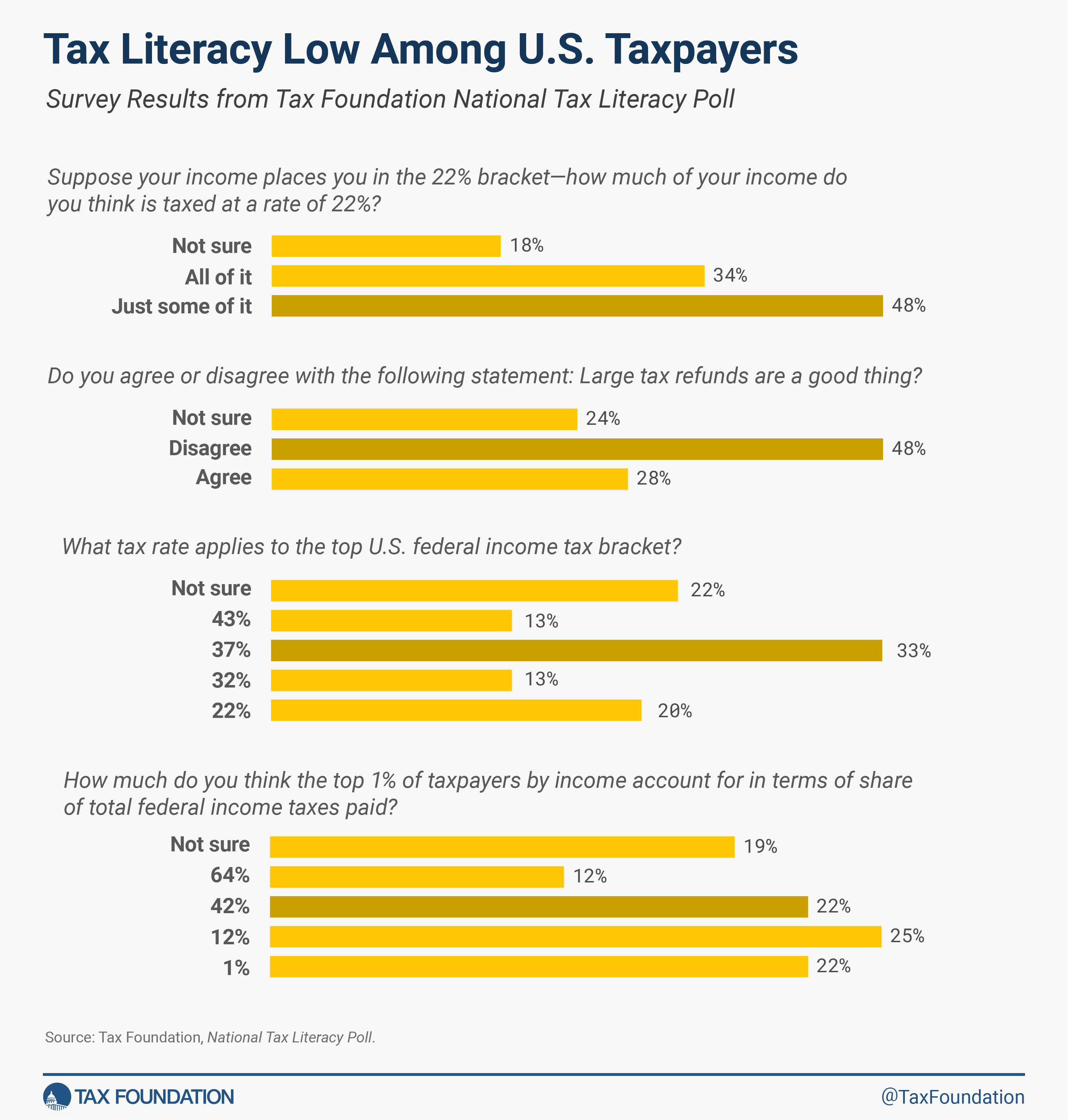

The tax bill could be higher priority in Congress if more people understood what taxes are.

New National Tax Literacy Poll Highlights Need for Better Tax Education – Zoe Callaway, Tax Foundation:

Taxes impact every American in one way or another. The IRS reported more than 162 million individual income tax returns filed in 2023, and research from the Joint Committee on Taxation (JCT) estimates around 90 percent of the U.S. population is represented annually on these returns. And when you include the other federal taxes (like corporate, payroll, excise, and estate taxes), no one is left untouched...

Meanwhile:

Most U.S. Taxpayers Do Not Understand the Federal Tax Code

IRS Updates

The Department of Treasury and the Internal Revenue Service today issued Announcement 2024-19 that addresses the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements.

Generally, taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns. They will, however, need to reduce the basis of the property when they sell it by the amount of the rebate.

The announcement is here.

IRS reminder: 2024 first quarter estimated tax payment deadline is April 15 – IRS:

The Internal Revenue Service today advised taxpayers, including self-employed individuals, retirees, investors, businesses and corporations about the April 15 deadline for first quarter estimated tax payments for tax year 2024.

Since income taxes are a pay-as-you go process, the law requires individuals who do not have taxes withheld to pay taxes as income is received or earned throughout the year. Most people meet their tax obligations by having their taxes deducted from their paychecks, pension payments, Social Security benefits or certain other government payments including unemployment compensation.

IRS Spent $4.4B Of Climate Law's Funds, TIGTA Says – Jared Serre, Law360 Tax Authority ($):

Through 2023, the Internal Revenue Service spent $4.4 billion of the funds earmarked in the tax, climate and healthcare law, the Treasury Inspector General for Tax Administration said in a report published Friday.

Of the $58 billion earmarked for the agency through 2031, the IRS has expended $1.8 billion on operations support, $1.1 billion on taxpayer services, $997.4 million on business systems and $425.7 million on enforcement, TIGTA said in the report, dated Wednesday. In addition, approximately $863 million of the expended funds were spent during the first quarter of fiscal year 2024, the report said.

Exempting Exempts

IRS Rejects Student-Athlete Booster Group’s Tax-Exempt Status - Caleb Harshberger, Bloomberg ($):

A group paying student athletes to promote charitable organizations isn’t eligible for tax-exempt status, the IRS found in a private letter ruling released Thursday.

The unnamed group formed to pay student athletes to lend their name, image, and likeness—or NIL—to promote area charitable organizations. The organization claimed on its website to be a 501(c)(3) tax-exempt NIL collective and that donations to the organizations were tax-deductible.

Somewhat related:

College Athlete Unions Raise Specter of Scholarship Tax Hit - Diego Areas Munhoz and Samantha Handler, Bloomberg ($):

Dartmouth College’s basketball team made waves across the college sports world when they voted to form a union, a move with potential tax consequences for student-athletes on scholarships seeking to follow in their footsteps…

The decision caught many legal observers and universities by surprise, and they now question what will happen when players with athletic scholarships to play sports organize. Under current federal tax law, scholarships aren’t taxed as long as they’re not considered compensation, but that could change if the NLRB [National Labor Relations Board] continues to rule that student athletes are employees and deems scholarships compensation.

Organizations Lose Charitable Donee Status – Tax Notes ($). “The IRS has listed (Announcement 2024-15, 2024-15 IRB 876) organizations that no longer qualify as charitable donees under sections 501(c)(3) and 170(c)(2).”

The document is here.

Need an expert in this area?

Maintaining tax-exempt status can be complex, but you shouldn’t let that hinder your mission – Eide Bailly:

Unfortunately, tax-exempt status does not mean exempt from complex tax rules, regulations, and processes. Exempt organizations have unique tax needs that demand specific knowledge, attention to detail, and solid advice. An experienced team can offer guidance to help you confidently make decisions, protect your exempt status, and avoid costly issues with the IRS.

Our dedicated professionals have helped many nonprofits and foundations navigate confusing tax regulations to find solutions that fit their needs. With extensive experience in the nonprofit industry and a National Tax Office that offers deep expertise and insights, our team can help ease your tax burden.

Court Side

Tax Pros Get Technical on Court’s Partnership Ruling – Kristen Parillo, Tax Notes ($):

A recent Tax Court opinion rejecting the IRS’s interpretation of the partnership technical termination rules drew mixed reaction from tax professionals, with some calling it flawed and others saying the court made the right call.

In its March 26 memorandum opinion in Savannah Shoals LLC v. Commissioner (T.C. Memo. 2024-35), the Tax Court agreed with the petitioner that “nothing in the Code or the regulations precludes a partnership that is deemed to form immediately after a technical termination from using the date of the technical termination as the start date of its taxable year.”

Internal Revenue Service Employee Arrested for Filing False Tax Returns – U.S. Treasury Inspector General for Tax Administration (TIGTA) (Defendant name omitted):

On March 20, 2024, in the District of Massachusetts, Internal Revenue Service (IRS) employee, the Defendant, was arrested for filing false tax returns.

According to the complaint, the Defendant has been employed by the IRS since 2006. The Defendant has extensive and specialized knowledge and training in accounting techniques, practices, and investigative audit techniques. She is also responsible for examining and resolving various tax issues of individuals and business organizations that may include extensive national and/or international subsidiaries.

The complaint alleges the Defendant fraudulently claimed thousands of dollars in false business expenses for at least tax years 2017, 2018, and 2019. Specifically, the Defendant is alleged to have filed a Schedule C claiming a net loss from a business. The net loss was carried over to her IRS Form 1040s and used to reduce the Defendant’s adjusted gross income and ultimate tax liability. According to the complaint, the Defendant reported the income and expenses of her alleged business resulted in net losses of $42,805 in 2017, $20,324 in 2018, and $27,063 in 2019.

Criminal Return Preparer Liable for Taxes; Liens Encumber Property – Tax Notes ($):

A U.S. district court granted the government judgment for the unpaid taxes of a former return preparer who was convicted of tax fraud, finding that the tax assessments are valid and timely because her returns were fraudulent, and the government has valid enforceable tax liens against her that attached to property she transferred to her son and daughter.

CEO Gets 30 Months for Failing to Pay $10 Million Payroll Taxes – Bloomberg ($) (Defendant name omitted):

A New Jersey man who previously pleaded guilty has been sentenced to 30 months in prison for failing to pay more than $10 million in payroll taxes, according to the Justice Department Friday.

The Defendant served as CEO of a business that provided administrative services to nursing home operators and health care facilities, including 20 companies co-owned by the Defendant, said the DOJ. In 2017 and 2018, the Defendant failed to pay the IRS over $10 million in payroll taxes owed by his companies, the government said.

International Zone

Monopolies Will Raise Prices Under Minimum Tax, Expert Says – Kevin Pinner, Law360 Tax Authority ($):

The 15% global minimum tax will worsen the problems that monopolistic companies impose on economies because raising taxes on a company that lacks competition will lead it to raise prices, an academic expert on tax havens said Friday during a conference.

James Hines, a professor of law and economics at the University of Michigan, made the comments during a live broadcast panel on how the global minimum tax will affect competition at an event organized by the International Tax Policy Forum and held at Georgetown University. The minimum tax, officially called Pillar Two, is being implemented in the European Union, Japan, South Korea and elsewhere this year after governments from more than 130 jurisdictions endorsed the plan at the Organization for Economic Cooperation and Development in 2021.

Top Treasury Official Argues for US to Adopt Global Minimum Tax - Lauren Vella, Bloomberg ($):

Acting Deputy Assistant Secretary for International Affairs at the Treasury Scott Levine said Friday the US should adopt an income inclusion rule or reform its current global intangible low-taxed income rule, known as GILTI, so that it is compliant with the global minimum tax rules.

The income inclusion rule is one of the three main provisions that make up the 15% global minimum tax rules published by the OECD.

Over 100 Large Companies Report Possible Adverse Pillar 2 Effects – Martin Sullivan, Tax Notes ($). “About half the companies in the S&P 500 use their annual Form 10-K reports to describe the new 15 percent, OECD-guided pillar 2 corporate minimum tax. They emphasize their uncertainty about how the tax operates under OECD guidance and legislation in various jurisdictions, yet more than 100 of them are telling shareholders that the new minimum tax could negatively affect their after-tax earnings.”

From the “Call Your Accountant” file

Today, Biden-Harris Administration leaders will fan out across the country as President Biden announces his Administration’s new plans to cancel student debt for tens of millions of Americans. The plans, if implemented, would provide debt relief to over 30 million Americans when combined with actions the Biden-Harris Administration has already taken to cancel student debt over the past three years.

Key words: “if implemented.” And if it is implemented you might need help figuring out how this will affect your taxes.

Let us help you relieve your tax headache – Eide Bailly

Federal, state, local, and international tax burdens and responsibilities consume time and cash flow. Whether you’re an individual, a business, a nonprofit, or handling a trust or estate, proper planning and guidance from a well-versed professional can make managing taxes less painful.

Eide Bailly has the depth of tax resources to help you gain peace of mind. Plus, our professionals are supported by the National Tax Office, allowing clients to dig into specialized tax situations.

Don’t trust the Internet:

Dirty Dozen: Taking tax advice on social media can be bad news for taxpayers; inaccurate or misleading tax information circulating – IRS. “[T]he Internal Revenue Service today warned about bad tax information on social media that can lure honest taxpayers with bad advice, potentially leading to identity theft and tax problems."

What Day Is It?

Lord have mercy! It’s National Empanada Day! Hold my calls!

Make a habit of sustained success.