Key Takeaways

- Justices look at valuation of stock redemption insurance funding.

- Tax bill troubles.

- Alaskan landslide deadline extensions.

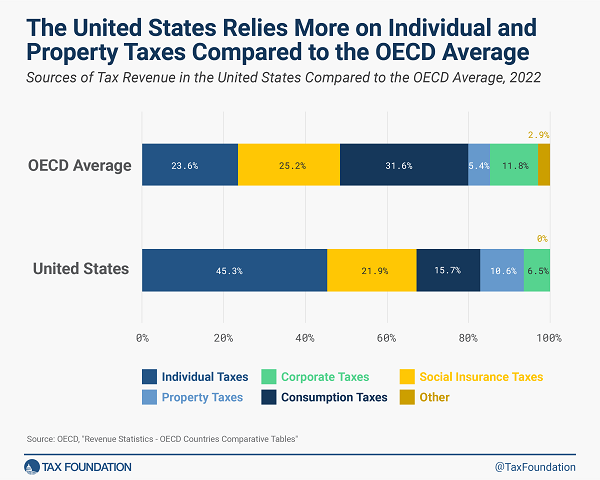

- U.S., OECD revenue by tax type.

- Romance scam guilty pleas.

- Manatee Appreciation Day, Joe Day.

Estate Planners Watch High Court for New Stock Redemption Risks - John Woolley, Bloomberg ($):

Brothers Michael and Thomas Connelly made such an agreement with their family business, Crown C Supply Co., in 2001. Their pact gave the surviving brother the option to purchase the other’s stock, or, alternatively, compelled Crown to redeem them using proceeds from an insurance policy on the dead brother’s life.

Academics Side With IRS on Treatment of Life Insurance Proceeds - Chandra Wallace, Tax Notes ($):

Petitioner Thomas Connelly, executor of his brother Michael Connelly’s estate, has argued that the corporation’s obligation to redeem Michael’s shares offsets its receipt of life insurance proceeds when valuing his interest in the corporation at his death. The U.S. Chamber of Commerce supported that position in its January 31 amicus brief, calling the use of life-insurance-funded redemption agreements a “time-tested, commonplace succession-management tool” for closely held companies that is threatened by the Eighth Circuit’s decision.

Devin Hecht, Leader of the Eide Bailly Wealth Transition Services team, comments: "Business owners should be aware of corporate ownership traps and potential tax burdens and risks of corporate owned life insurance policies. Taxpayers should consider the advantages of having shareholders purchasing life insurance themselves, rather than having the corporation purchase the insurance policy. Clients with corporate owned life insurance policies will want to pay attention to the Supreme Court’s ruling in Connelly and potential ramifications on estate tax burdens and business succession. Business owners should be holistically approaching life insurance planning considerations with their estate planning and succession planning."

Tax bill update

Whither the House-passed tax bill. Andrew Desiderio of Punchbowl News says the prospects for the bill, which would restore full deduction of domestic research costs and 100% bonus depreciation while loosening restrictions on business interest deductions, are grim:

...

There is modest GOP support in the Senate, especially with the expansion of the child tax credit. This is something that could also help in-cycle Democrats. But if the bill lacks the requisite 60 votes, it’s hard to see Schumer holding a show vote on this one.

Missed it by *this* much

Tax Court Hands Easement Partnership a Win and Loss - Kristen Parillo, Tax Notes ($).

The win? The IRS lost its argument that the partnership reported a conservation easement deduction in the wrong year under the now-repealed "technical termination" rules for partnerships. Nice win. But the loss?

...

After determining that the easement had a before value of $580,000, [Tax Court Judge] Goeke concluded that the easement’s FMV on the donation date was $480,000.

That works out to about a 98% chop in the charitable deduction.

Inflated $23 Million Easement Tax Deduction Incurs Penalties - John Woolley, Bloomberg ($): "Savannah Shoals LLC, the partnership behind the conservation easement, grossly misstated on its return the value of its 103-acre donation of undeveloped land in Hart County, Ga., by more than 200% of its fair market value, the court said. Tax code Section 6662(e) and (h) imposes a 40% penalty on its underpayment of tax attributable to misstatements, but the final amount that Shoals owes won’t be finalized by the court until later."

Conservation easements can be legitimate deductions. Taxpayers agree to not develop land and get a deduction for the amount the value of the land is reduced. In the past decade or so, a cottage industry grew up to market easement donation partnerships with, well, aggressive valuations - some of which have led to criminal convictions and long prison sentences.

The taxpayer in this case based the easement value on the assumption that the property subject to the easement donation could otherwise be a profitable quarry. Tax Court Judge Goeke was not convinced (footnotes omitted):

Blogs and bits

May 17, 2024, is the deadline to file for your part of $1 billion in unclaimed tax year 2020 refunds - Kay Bell, Don't Mess With Taxes. "Almost 940,000 people across the nation have unclaimed refunds for tax year 2020. They missed out on that money because they didn't file a Form 1040 back in May 2021."

IRS announces tax relief for taxpayers impacted by severe storms, landslides and mudslides in Alaska; various deadlines postponed to July 15 - IRS. "The Internal Revenue Service announced today tax relief for individuals and businesses in the Wrangell Cooperative Association of Alaska Tribal Nation that were affected by severe storms, landslides and mudslides that began on Nov. 20, 2023."

IRS Overstates Abuse in Charity-Geared Trusts, Tax Advisers Say - Erin Schilling, Bloomberg ($). "Tax avoidance schemes are uncommon in most charitable remainder annuity trust transactions, tax practitioners said, despite the addition of certain uses of these trusts to the IRS’s list of suspect transactions."

Producers Push IRS For Flexible Clean Hydrogen Credit Regs - Kat Lucero, Law360 Tax Authority ($). "Coal, nuclear power, hydropower, geothermal, biogas and renewable natural gas plants are already producing hydrogen that does not overwhelmingly pollute the air because the process captures and stores the polluting greenhouse gas emissions, speakers said during the second day of a three-day Internal Revenue Service hearing on the rules, held via teleconference."

GAO Finds $22 Billion Sent in Error for Earned Income Tax Credit - Alexander Rifaat, Tax Notes ($). "The GAO said improper payments represented nearly 34 percent of all EITC payments issued during the period, which is slightly higher than the approximately 32 percent of payments deemed improper in the prior fiscal year."

Link: GAO Report.

Tax Policy Corner

Sources of U.S. Tax Revenue by Tax Type, 2024 Update - Daniel Bunn and Cecilia Perez Weigel, Tax Foundation. "The United States relies much less on consumption taxes than other OECD countries. Taxes on goods and services accounted for only 15.7 percent of total U.S. tax revenue, compared to 31.6 percent in the OECD."

Democrats look for new ways to tax the super-rich - Julie Zauzmer Weil, Washington Post:

...

Many independent tax experts say such a levy would be almost impossible to enforce: The IRS would struggle to assess anyone’s total net worth, much less the complex fortunes of the ultrawealthy, they say.

Energy Tax Subsidies Could Top $1.8 Trillion - Adam Michel, Liberty Taxed:

As part of recent budget estimates, congressional scorekeepers updated the costs of some of the provisions of the IRA. Using these revised estimates, the Committee for a Responsible Federal Budget estimates that the ten‐year cost of the IRA credits increased by 170 percent, from $271 billion to $736 billion between 2022 and 2031.

Tax Crime Blotter

Three individuals admit tax evasion and other charges after defrauding more than 100 victims of over $4.5 million dollars in romance fraud scheme - IRS (Defendant names omitted, emphasis added):

...

“Romance scams frequently target elderly or vulnerable citizens and are particularly egregious crimes,” Postal Inspector in Charge, Christopher A. Nielsen, Philadelphia Division, said. “Let this investigation put fraudsters on notice that with our law enforcement partners, the Postal Inspection Service will investigate and pursue those individuals who scam, harass, and steal from the American people.”

According to the documents filed in this case and statements made in court:

From October 2016 to May 13, 2020, Defendants and their conspirators, several of whom reside in Nigeria, participated in an online romance scheme, defrauding more than 100 victims throughout the country. The conspirators made initial contact with victims through on-line dating and social media websites, corresponded with victims via email and phone, pretended to strike up a romantic relationship with victims, wooed them with words of love, and then requested the victims send money to them, or their associates, for fictitious emergency needs. In all instances, the individuals whom the victims believed they were speaking to did not exist, and instead they were speaking to the conspirators of this scheme.

Love is a dangerous game. Don't let your friends or loved ones get scammed.

What day is it?

It's National Joe Day and National Manatee Appreciation Day. If you know a manatee named Joe, give him my regards.

Make a habit of sustained success.