Key Takeaways

- Glimmer of hope for house tax bill?

- First procedural step for Senate floor vote taken.

- Last day for ERC disclosure program.

- IRS funding flat in shutdown agreement.

- International Tax Corner.

- IRS agent arrested for tax crimes.

- Bavarian Crepes Day.

Cloture Vote on Tax Package Looking More Likely - Doug Sword, Tax Notes ($):

The top Senate taxwriter’s indication that more than 60 senators support action on the $79 billion tax package has his GOP counterpart thinking that Democrats have the votes to overcome a filibuster.

But Senate Finance Committee ranking member Mike Crapo, R-Idaho, declined to predict the outcome of such a vote, which he said could be coming after a procedural action taken by the chamber’s Democrats March 20 along with comments from committee Chair Ron Wyden, D-Ore., on the matter.

It might because they have the votes, or it might be because it'd time to cash in some chips: "However, even a loss might be a win for Democrats, who could claim that it was Senate Republicans who killed the popular assortment of tax breaks for businesses and families."

Senate Leaders Take Step Toward Tax Bill Vote - Samantha Handler, Bloomberg. "Sen. Chris Van Hollen (D-Md.), acting on behalf of leadership, began the process of adding the legislation to the calendar under Rule 14, which allows the Senate to bypass committee approval. While directly placing the package on the calendar may make it easier to bring a floor vote on the measure, placement on the calendar doesn’t guarantee a Senate vote, according to the Congressional Research Service."

Crapo says he still wants a tax deal - Brian Faler, Politico Pro ($):

Sen. Mike Crapo (R-Idaho) said he still wants an agreement and that he continues to talk with Finance Committee Chair Ron Wyden (D-Ore.) despite the deadlock.

...

A Wyden spokesperson disputed Crapo's characterization, saying that, in fact, negotiations between the two sides have ceased.

As Jay Heflin says, tax bills are often dead right until they pass.

Last day for ERC regrets program

Businesses Face Tricky Choice on IRS Program for Covid Credit - Erin Slowey, Bloomberg ($):

Businesses that incorrectly claimed a pandemic-era tax credit have until Friday to make a tough decision: participate in an IRS settlement program or risk getting audited.

The IRS wants to give businesses a second chance if they received an employee retention credit refund they think they weren’t eligible for. These employers can apply for the voluntary disclosure program, meaning they will need to pay back most of the credit and turn over information on the third parties that helped file their claim, or pass on the program and take a chance that they won’t pop up on the IRS’s radar later.

That's today.

More Congress

Big Corporate Mergers Get Fresh Tax Scrutiny in Washington - Richard Rubin, Wall Street Journal:

Sens. Sheldon Whitehouse (D., R.I.) and J.D. Vance (R., Ohio) want to eliminate companies’ ability to do tax-free mergers like the pending Capital One-Discover deal. Under their bill, shareholders who receive stock through such deals would owe capital-gains taxes immediately, instead of deferring those taxes until they sell their shares. The senators introduced the legislation on Thursday; it has exceptions for companies with annual revenue below $500 million.

The Whitehouse-Vance legislation stands little chance of becoming law soon, given that Congress is struggling to pass a tax bill that a majority of lawmakers support. But the bill is a sign of political sentiment against corporate power that unites some Republicans and Democrats who are otherwise far apart on tax policy. And it is a rare attempt to address competition policy through the tax code.

Flat IRS Spending Measure Set for Vote to Avoid Shutdown - Cady Stanton, Tax Notes ($): "The legislation favors a $12.3 billion bipartisan Senate plan for the agency’s funding, including $2.78 billion for taxpayer services, $5.44 billion for enforcement and $4.1 billion for operations support. But the package also includes a pre-negotiated $20.2 billion clawback of funding for the IRS from the Inflation Reduction Act: $10.2 billion rescinded in the Financial Services spending bill and $10 billion rescinded in the Labor, Health and Human Services, and Education bill, all in enforcement funding."

Treasury Inspector General on revolving doors and backlogs

Treasury Watchdog Finds Little ‘Revolving Door’ Risk - Alexander Rifaat, Tax Notes ($):

The Treasury Office of Inspector General report, obtained by Tax Notes March 21, was initiated in April 2022 as a response to an inquiry by three Democratic lawmakers led by Senate Finance Committee member Elizabeth Warren, D-Mass., over a possible “revolving door” issue involving tax professionals and the IRS.

In its analysis the inspector general concluded that, given the number of steps and different offices within Treasury and the IRS involved in the process, it is unlikely that any one employee could sway policy at a meaningful level.

So much for taking a government job to make a difference.

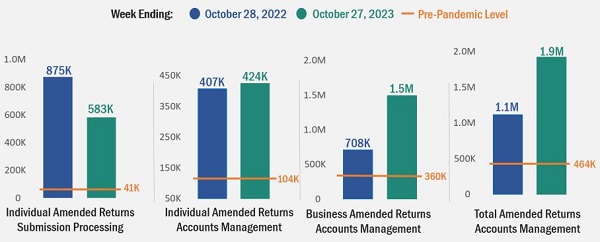

The IRS Continues to Reduce Backlog Inventories in the Tax Processing Centers - Treasury Inspector General.

As TIGTA previously reported, the IRS implemented a Get Healthy Plan in CY 2022 intended to return the IRS to pre-Pandemic, i.e., CY 2019, inventory levels by the end of CY 2022. Although the implementation of these initiatives resulted in a significant reduction of the backlogged inventories in the Tax Processing Centers, concerns remain with the inventories of suspended returns, i.e., tax returns in the Rejects, Unpostables, and Files functions.

In addition, concerns remain with the inventories of amended tax returns remaining to be worked, which are significantly above the pre-Pandemic levels.

Blogs and bits

Property donation valuation guidelines for charitable spring cleaners - Kay Bell, Don't Mess With Taxes. "For many, a yard sale is a good way to get rid of unwanted but workable items. But those who don't want to spend a Saturday haggling with strangers over the price of used items often opt to donate the goods."

Filing Season Statistics Indicate That Half Of All Taxpayers Have Filed Their Returns - Kelly Phillips Erb, Forbes ($). "A significant majority of the returns received to date—just under 98%—were e-filed. That number is the roughly same as the last few weeks and isn’t expected to drop. The IRS encourages taxpayers to file electronically, noting that taxpayers who e-file and use direct deposit typically see a refund within 21 days."

Secretive Husband Who Failed to Share Financial Info Is Solely Liable for Deficiency - Parker Tax Pro Library. "The Tax Court held that a husband who concealed all aspects of his finances from his wife was solely liable for the tax deficiencies and penalties relating to a joint return filed by the couple for 2017. The court concluded that because the couple maintained separate bank accounts and because the wife was not aware of her husband's employment or business activities, she could not have known of the origin of the deductions her husband claimed on their joint return and was thus eligible for innocent spouse relief under Code Sec. 6015."

Best Practices for Form 1040 Extensions. - Thomas Gorczynski, Tom Talks Taxes. "Completing all electronic filing of extensions several days in advance permits the timely mailing of an extension if the electronically filed extension is rejected. Remember to retain proof of timely mailing with a method approved under §7502."

Free File provides quick, easy way to file an extension - IRS. "Although an extension grants extra time to file, it does not extend the obligation to pay taxes due on April 15, 2024. To avoid penalties and late fees, taxpayers who owe should pay either their full tax bill or at least what they can afford to pay by the April 15 deadline. Taxpayers in Maine and Massachusetts have until April 17 to file and pay taxes due this year. This is because these states observe the Patriots’ Day holiday on April 15 this year and April 16 is the Emancipation Day holiday in the District of Columbia."

International Tax Corner

Section 911 Housing Cost Amounts Updated for 2024 - International Tax Blog. "Code §911(a) allows a qualified individual to elect to exclude from gross income an 'Exclusion Amount' related to foreign earned income and a 'Housing Cost Amount.' The Exclusion Amount for 2024 is $126,500."

The OECD’s Pillar One Global Tax Cannot Be Salvaged - Adam Michel, Liberty Taxed:

Pillar One consists of two parts, Amount A and Amount B. Amount A is a multilateral convention to redistribute about $200 billion of large multinational corporate profits to countries based on customer location, regardless of a company’s physical location. An accompanying Joint Committee on Taxation report estimates that US multinationals account for 70 percent of Amount A’s redistributed profits, resulting in annual US revenue losses between $100 million and $4.4 billion (using 2021 data). The multilateral convention is designed so that it will not take effect without US Senate ratification (requiring a two‐thirds vote).

Amount B of Pillar One is a new formulaic system for apportioning income between countries for routine marketing and wholesale distribution arrangements. The more simplified system is intended to limit aggressive and expensive transfer pricing audits by countries seeking to expand their tax base.

The Global Min Tax Administrative Challenge - Alex Parker, Things of Caesar. "With different industries or companies receiving benefits not available to taxpayers at large, low-taxed income can exist in countries with high statutory tax rates–even countries where the average effective tax rate is high. This is especially true in the developing world, where jurisdictions compete for investment through favorable tax treatment."

Yellen Hopeful About Global Minimum Tax Treatment of R&D Credit - Michael Rapoport and Samantha Handler, Bloomberg ($). "Treasury Secretary Janet Yellen said she was optimistic that the US would be able to maintain the value of its research and development tax credit for companies, in the face of concerns that the new global minimum tax could jeopardize it."

Related: Eide Bailly International Business Structuring

Tips For Mailing Your Tax Return From Abroad - Olivier Wagner, 1040 Abroad. "While the convenience of electronic filing (e-filing) offers an efficient way to submit your federal tax return, certain conditions may require you to submit a paper tax return by mail. Understanding when and how to accurately mail your personal income tax return is crucial to ensure compliance with the IRS and avoid unnecessary processing delays."

To Amend or Not to Amend – That is the Question - Virginia La Torre Jeker, US Tax Talk. "Taxpayers living and working overseas who receive certain amounts or in-kind benefits from their employers often do not realize that these must be included in income. Examples include when the employer provides airline tickets home for the taxpayer and his/her family; or pays tuition directly to the school where the taxpayer’s child studies abroad."

Related: Eide Bailly Global Mobility Services

Tax crime watch

IRS revenue agent arrested for filing false tax returns - IRS (defendant name omitted, emphasis added):

A revenue agent for the United States Internal Revenue Service (IRS) was arrested today for allegedly filing false personal tax returns for three years.

...

According to the charging documents, Defendant has been employed by the IRS for over 17 years. In her current position as a Revenue Agent assigned to the Large Business and International Division of the IRS, Defendant conducts independent field examinations and related investigations of complex income tax returns filed by large businesses, corporations and organizations. Defendant has extensive and specialized knowledge of and training in accounting techniques, practices and investigative audit techniques. She is also responsible for examining and resolving various tax issues of individuals and business organizations that may include extensive national and/or international subsidiaries. In addition to her IRS position, Defendant worked as a visiting instructor at Salem State University, teaching college-level classes that included instruction on the verification of records; valuation and analysis of accounts; the importance of financial accounting and financial statements; professional standards; and ethics, professional responsibilities and legal liabilities issues facing auditors.

It is alleged that Defendant filed false personal tax returns for tax years 2017, 2018 and 2019. It is further alleged that, for each year, Defendant filed a false Schedule C claiming a business loss from a purported “import and export” business she claimed to have. As a result, the claimed net loss was carried over to her personal IRS Form 1040s and used to reduce Defendant’s adjusted gross income and ultimate tax liability. Specifically, Defendant allegedly underreported her total income by approximately $42,805 in 2017, $20,324 in 2018 and $27,063 in 2019.

If actual IRS agents do this, it becomes harder to credit claims that IRS preparer licensing will improve compliance. It will just give shady preparers an implied IRS seal of approval.

What day is it?

Make a habit of sustained success.