Key Takeaways

- Child credit clashes hold up research cost relief.

- ERC deadline March 22.

- IRA energy credit transfers popular.

- IRS Commissioner hunts high-income tax cheats.

- If you win your bracket, remember the IRS.

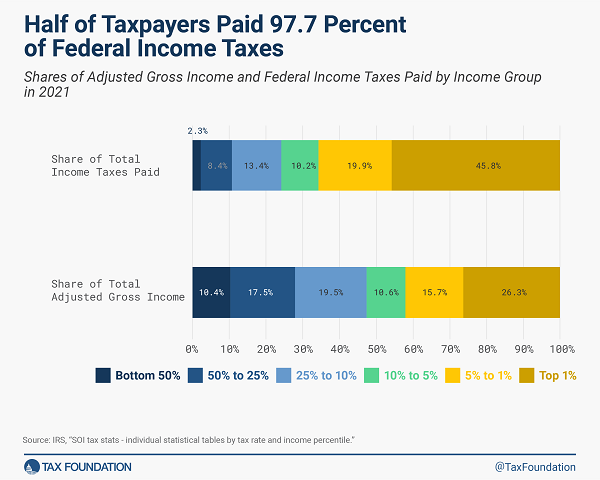

- Who pays federal income tax.

- Robbing all the ATMs

- Celebrating frogs, sparrows, and ravioli.

Crapo’s Tax Deal Offers Were Non-starters for Dems, Wyden Say - Cady Stanton, Tax Notes ($):

Proposed tweaks to the tax bill offered by the top Senate Republican taxwriter in recent negotiations would have been “poison pills” for Democrats, according to Senate Finance Committee Chair Ron Wyden, D-Ore.

Changes proposed by Senate Finance Committee ranking member Mike Crapo, R-Idaho, are provisions “Democrats couldn’t have voted for,” Wyden told reporters March 19. The two negotiators traded offers for tweaks to the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) the week of March 11 but didn’t make progress on finding a middle ground.

H.R. 7024 is the House-passed bill that would restore full deductions for domestic research costs, expand business interest deductions, and renew 100% bonus depreciation. The bill has stalled out in the Senate over opposition to child tax credit changes included in the deal to get needed Democrat votes for passage.

ERC Voluntary Disclosure Program Barrels Toward Uncertain End - Nathan Richman and Lauren Loricchio, Tax Notes ($). "The ERC voluntary disclosure program, which lets employers who submitted improper claims repay 80 percent of the amount received while also avoiding penalties and interest, is set to end March 22. Some tax professionals are getting more inquiries about the program with the deadline approaching, while others say they haven’t seen much interest in it."

Related: IRS Releases New ERC Voluntary Disclosure Program Details.

Treasury Stats Show Zeal for Clean Energy Investment Tax Credits - Alexander Rifaat, Tax Notes ($):

In data released March 19, Treasury said that as of March 8, about 500 entities have registered to obtain the subsidies for over 45,000 facilities or projects.

According to Treasury, more than 98 percent of the entities chose the transferability option, which confirms earlier assessments by some industry observers that transferring the credits is proving to be more appealing than receiving a direct payment from the IRS.

The direct-pay option for clean energy credits, known as elective pay, was expanded under the IRA to entice government and other tax-exempt entities to access the subsidies, which can only be claimed after the project is complete — a limitation that is proving to be an obstacle for entities without sufficient financing options.

Related: How Exempt Organizations Can Benefit from Clean Energy Incentives.

IRS chief zeroes in on wealthy tax cheats in AP interview - Fatima Hussein, AP via ABC News:

Werfel, who will hit the one-year mark at the helm of the IRS in April, said in a wide-ranging interview with The Associated Press that the agency will expand its pursuit of high-wealth tax dodgers with new initiatives in the coming months and is using tools like artificial intelligence to ferret out abuses and taking the fight to sophisticated scammers.

...

“It's having an impact,” Werfel said. Large corporate filers and others are “taking notice that the IRS is ramping up our scrutiny, and I think that will inevitably result in more compliance" — and revenue.

GAO Calls on IRS to Update Plans for Modernization Spending - Wesley Elmore, Tax Notes ($):

The IRS’s modernization efforts risk failure if the agency doesn’t update its plans to reflect how it expects to use the additional funding it received from the Inflation Reduction Act, according to a government watchdog agency.

In a report released March 19, the Government Accountability Office reviewed the technology objective in the IRS’s strategic operating plan, released in April 2023. It found that the IRS hadn’t updated its plans for its modernization programs to account for the infusion of funds from the Inflation Reduction Act.

Fun with Filing Season

Treasury Touts Direct-File Milestone - Alexander Rifaat, Tax Notes ($):

More than 50,000 taxpayers have either started or already filed their tax returns using the IRS’s direct-file pilot program.

Treasury Deputy Secretary Wally Adeyemo announced the milestone in a post on X, formerly known as Twitter, March 19.

Election result

Voters in the primary election handed a defeat to Democratic Mayor Brandon Johnson by 54% to 46%, with 98% of precincts reported. Johnson had pushed for the measure, called Bring Chicago Home, as a way to increase funding for tackling homelessness and affordable housing issues in the city. Transfer taxes are typically paid by buyers of a property.

Had the new regime been approved by voters, Chicago would have shifted from a flat rate of 0.75% to one that varies depending on the price of the property sold. The rate would have been reduced to 0.6% on sales under $1 million. But it would have been 2% rate on properties sold between $1 million and $1.5 million and 3% rate on sales of higher amounts. The restructuring of the tax was projected to generate at least $100 million. annually.

Additional coverage: Bring Chicago Home real estate transfer tax referendum appears headed to defeat - Todd Feurer, CBS News.

Blogs and Bits

Some closer looks at Biden's fiscal year 2025 budget - Kay Bell, Don't Mess With Taxes. "On the individual side, the highest marginal ordinary tax rate would go from the TCJA level of 37 percent back to pre-tax-reform's 39.6 percent."

Multiple Free Filing Options Available for Taxpayers in 2024 - Erin Collins, NTA Blog. "You may qualify to obtain free tax return preparation services through one of the IRS partners participating in the VITA or TCE programs. VITA sites offer free tax preparation services to individual taxpayers who make $64,000 or less, persons with disabilities, and taxpayers with limited English proficiency. TCE sites offer free federal and state tax preparation assistance to taxpayers who are 60 years of age and older and often specialize in tax issues unique to seniors, such as pension and retirement-related issues. These sites provide services in different ways including in-person, virtual, or drop-off. However, some sites offering in-person service require an appointment. The sites will tell you what you need to bring and how to get ready for your appointment. You can find out more about these volunteer programs, determine your eligibility, and even find a VITA or TCE site here."

Tribute to Judge Colvin - Keith Fogg, Procedurally Taxing via Tax Notes. "Many of the things we take for granted today in Tax Court practice were the result of actions taken by Judge Colvin in his effort to assist the many unrepresented petitioners who entered the Tax Court."

Understanding the Specificity Requirement for Claiming R&D Tax Credits - Heidi Reardon, Eide Bailly alerts 2024/3. "Taxpayers now face stricter criteria for claiming R&D credits on amended tax returns, known as the 'specificity requirement.'"

Tax Policy Corner

Does Taxing Capital Encourage Capital Formation? - Scott Sumner, Econlog:

Corporations have several different ways of rewarding investors. One method is dividends. Another approach is to use a stock buyback, which leads to capital gains. Many investors prefer to receive capital gains, which are generally treated more favorably than dividends in the federal tax code (partly because the gains are not taxed until the stock is sold.) By taxing stock buybacks, the government would be raising the effective tax rate on capital formation.

These taxes do not encourage investment—just the opposite.

Crime and punishment

Former employee convicted of defrauding his employer sentenced to five years in federal prison - IRS (emphasis added, defendant name omitted):

Information from the plea hearing and sentencing hearing showed that Defendant was employed by Mobile Money, Inc. for over 20 years. Part of Mobile Money, Inc.’s business operations were servicing ATMs across eastern Iowa. Starting in January 2016, Defendant defrauded and stole from Mobile Money, Inc. by stealing cash that was meant for ATMs or cash that was supposed to be deposited into a Mobile Money, Inc. bank account.

In January 2021, Defendant told his superiors, which included someone Defendant had been friends with for over 30 years, that there was approximately $1.1 million in cash locked in a vault in Waterloo that he could not access because the vault lock was broken. It was later discovered that Defendant had intentionally tampered with the vault in order to prevent anyone else from accessing it. In February 2021, other employees got into the vault and discovered there was less than $100,000 in cash in it.

The old "the vault is broken" trick.

Also in January 2021, Mobile Money, Inc. executives discovered Defendant had failed to deposit approximately $2.5 million in cash into bank accounts. On February 1, 2021, Defendant sent ten bank deposit tickets to Mobile Money, Inc., purporting to show he had deposited that money. However, the bank deposit tickets were fraudulent and he had not deposited any such money.

Once Mobile Money, Inc. discovered Defendant had been stealing from the company, the company determined his fraud had resulted in the company losing $3,407,000. Even though this money was obtained illegally, Defendant was required to report it as income to the Internal Revenue Service. He failed to do so and filed false tax returns for multiple years.

How was he supposed to know that it was taxable? Nobody sent a 1099! I guess that means all income is taxable, 1099 or no 1099.

The Moral? It seems like there was a breakdown in accounting controls somewhere along the way. Eide Bailly can help fix that.

What day is it?

Make a habit of sustained success.