Key Takeaways

- Tax bill - what now?

- IRS hires private sector crypto experts.

- Dealing with the 2026 scheduled reduction in the estate tax exemption.

- IRS backtracks on Form 1042 e-filing requirement.

- San Diego filing deadlines moved to June 17.

- Pancake Day.

Push and Pull of Senate GOP Leaves Tax Deal’s Next Steps Unclear - Doug Sword and Cady Stanton, Tax Notes ($):

A congressional tax deal won overwhelming support in the House, but four weeks later, its advancement appears caught between Senate Republicans supporting it and GOP taxwriters urging changes.

...

Importantly, the desire for a rewrite is coming from Senate Finance Committee Republicans, who other Senate Republicans tend to defer to on tax matters. That deference holds true particularly for the top GOP taxwriter, Finance Committee ranking member Mike Crapo, R-Idaho, who dislikes a provision in the legislation that would ease income eligibility for refundable child tax credits.

The House bill would retroactively restore the full deduction for domestic research costs, restore bonus depreciation, and ease limits for business interest deductions, through 2025.

IRS Beefs up Crypto Policy Team

IRS adds two key experts to focus on cryptocurrency, other digital assets - IRS:

The Internal Revenue Service today announced the addition of two private-sector experts to help the agency’s efforts in the cryptocurrency and other digital assets arena.

Sulolit “Raj” Mukherjee, JD, and Seth Wilks, CPA, have been hired as executive advisors.

The pair, who have extensive experience in the tax and crypto industries, will help lead IRS efforts building service, reporting, compliance and enforcement programs focused on digital assets.

IRS Enlists Pair of Crypto Industry Vets to Help Steer Policy - Jonathan Curry, Tax Notes ($):

Douglas O’Donnell, IRS deputy commissioner for services and enforcement, added that the two new advisers will help the IRS better understand the digital asset sector and identify tools the agency can use to improve reporting of assets and transactions.

The IRS could use the help. The agency released proposed regulations in August 2023 on reporting requirements for digital asset brokers that wouldn’t take effect until January 1, 2026. Those proposed regs were alternately criticized by the cryptocurrency industry and some lawmakers for not giving brokers enough time to comply, and by other lawmakers for being too lenient by taking so long to take effect, in contrast to the statutory effective date of January 1, 2024.

In Other News...

Rich People Rush to Offload Wealth Before Estate Tax Break Drops - Erin Schilling, Bloomberg ($):

Wealthy taxpayers are hurrying to use the increased estate tax exemption amount before it potentially expires at the end of 2025.

Republicans’ 2017 tax-cut law doubled the estate tax exemption but built in a 2025 sunset. Those with over the exemption amount, which stands at about $13.6 million per person for 2024, in gifts or in their estate face a 40% transfer tax.

It’s unclear what the estate tax will look like after 2025, with the future of the exemption and many other 2017 law provisions hinging on the 2024 election. Republicans have long criticized the estate tax and have made multiple bids to repeal it entirely, while Democrats see the tax as a way to raise revenue from the ultra-wealthy.

IRS Nixes Digital Filing Of Form For Foreigners For 2 Years - Jared Serre, Law360 Tax Authority ($). "Certain withholding agents will not be required to electronically file a form relating to U.S.-based income of foreigners in 2024 and 2025, the Internal Revenue Service announced Tuesday."

Link: Notice 2024-26

Related: Eide Bailly International Tax Services.

Minnesota Enacts Fixes to Standard Deduction Amounts - Emily Hollingsworth, Tax Notes ($). "H.F. 2757, approved by Walz February 26, adjusts the standard deduction amounts for individual and joint filers to reflect inflation. Under the 2023 omnibus tax legislation, H.F. 1938, the standard deduction mistakenly didn’t account for inflation that had occurred since 2019. H.F. 2757 also corrects the deduction amounts for dependents and the additional deduction for elderly or blind taxpayers."

This is effective for 2023 returns.

Filing File

The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). Currently, this includes San Diego County. Individuals and households that reside or have a business in this locality qualify for tax relief.

...

The tax relief postpones various tax filing and payment deadlines that occurred from Jan. 21, 2024, through June 17, 2024 (postponement period). As a result, affected individuals and businesses will have until June 17, 2024, to file returns and pay any taxes that were originally due during this period.

This means, for example, that the June 17, 2024, deadline will now apply to:

- Individual income tax returns and payments normally due on April 15, 2024.

- 2023 contributions to IRAs and health savings accounts for eligible taxpayers.

- 2024 estimated tax payments normally due on April 15, 2024.

- Quarterly payroll and excise tax returns normally due on Jan. 31 and April 30, 2024.

- Calendar-year partnership and S corporation returns normally due on March 15, 2024.

- Calendar-year corporation and fiduciary returns and payments normally due on April 15, 2024.

- Calendar-year tax-exempt organization returns normally due on May 15, 2024.

Also, penalties for failing to make payroll and excise tax deposits due on or after Jan. 21, 2024, and before Feb. 5, 2024, will be abated as long as the deposits were made by Feb. 5, 2024.

TaxAct Filers Ink $23M Deal Over Meta, Google Info Sharing - Lauren Berg, Law360 Tax Authority ($). "TaxAct Inc. customers have asked a California federal judge to greenlight a settlement they say is worth more than $23 million and would resolve class claims accusing the tax preparation company of secretly sharing confidential taxpayer information with Meta Platforms Inc. and Google."

Direct file tax system opens to new users as IRS service levels improve - Tobias Burns, The Hill:

The direct file online tax return system from the IRS will open for a limited time to new users at 5 PM, the agency announced Tuesday.

The pilot program is available to taxpayers in 12 states where it is being given a test run by the IRS. They include New York, Texas, Florida and California. A full list can be accessed here.

Blue light special in Aisle 12.

Blogs and Bits

IRS watchdog report says taxpayer data security is lacking - Kay Bell, Don't Mess With Taxes. "'[F]or some sensitive systems, the IRS does not have adequate controls to detect or prevent the unauthorized removal of data by users," noted the IRS watchdog in the report, entitled Assessment of Processes to Grant Access to Sensitive Systems and to Safeguard Federal Tax Information.'"

New rules allowing for 529 plan rollovers include significant restrictions - National Association of Tax Professionals. "New rules are in effect for 2024 that allow beneficiaries of 529 plans to roll over unused funds to a Roth IRA. These changes are intended to ease concerns about the tax implications of withdrawing money that might remain in an education savings account when it is no longer needed to finance the beneficiary’s education. But limitations on the rollovers and the lack of IRS guidance on the issue mean the new rules may not be as helpful as they might first appear."

IRS Enhances Clean Vehicle Credit Information with Updated FAQs - Ashley Akin, Tax School Blog. "Despite part of the requirements for claiming the credit requiring a vehicle to meet mineral requirements, the IRS is clear in the FAQ that if an FEOC manufactures the battery, the vehicle will not qualify for even a partial credit. Accordingly, the new guidance will reduce the number of vehicles eligible for any portion of the credit."

Electing and Unwinding an S Corporation - Thomas Gorczynski, Tom Talks Taxes. "The conversion back to a disregarded entity is deemed liquidation of the corporation and is a taxable event to the shareholder under Treas. Reg. §301.7701-3(g)(1)(iii)."

Tax Policy Corner

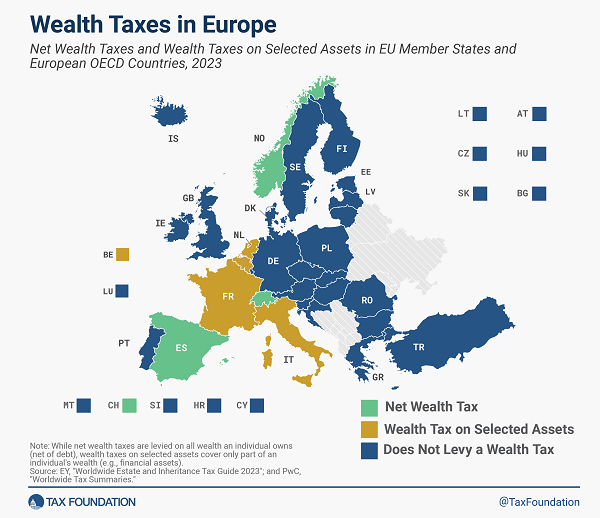

Wealth Taxes in Europe, 2024 - Cristina Enache, Tax Foundation. "of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three countries levy net wealth taxes in Europe—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se."

Tax on the Dock

Inmate Charged In Multimillion-Dollar Drug And Tax Schemes Conducted From Prison - Kelly Phillips Erb, Forbes ($):

According to court documents, Thomas led a multimillion-dollar tax refund fraud scheme from January 2022 through at least July 2023. As part of the scheme, the defendants worked to file payroll tax returns with the IRS that claimed Employee Retention Credits (ERC) for businesses that were not entitled to receive the credits so that they would receive large tax refunds.

...

Thomas allegedly provided his co-conspirators with instructions about how to file payroll tax returns, respond to IRS correspondence, deposit tax refund checks, and more.

ERC fraud? In prison? Hard to believe, I know.

Denver jury convicts former corporate CFO and wife of wire fraud - IRS (Defendant names omitted, emphasis added):

The U.S. Attorney’s Office for the District of Colorado announces that Defendants, of Denver, Colorado were found guilty for their roles in a wire fraud scheme that defrauded National Air Cargo, a logistics company and contractor for the Department of Defense. A federal jury in Denver returned guilty verdicts against the Defendants on Thursday, Feb. 15, 2024.

According to the facts established at trial, beginning in 2018, Defendants conspired to defraud National Air Cargo through the submission of dozens of false invoices for services and items that were never provided. Over the course of two years, with the help of a co-conspirator, the Defendants defrauded the business of five million dollars. Testimony at trial demonstrated the Defendants gambled away much of the money and spent $2.4 million buying Bitcoin at Bitcoin ATMs across the Denver area. Husband Defendant also failed to file federal income tax returns for tax years 2016 through 2019, on both his earned income and funds obtained from the fraud scheme.

Failing to file income tax returns is a common fact in tax crime reports. Filing a return might draw IRS attention, but not filing surely does.

What Day is It?

Keep 'em coming. It's National Pancake Day!

Make a habit of sustained success.