Key Takeaways

- IRS issues warning

- ERC tightrope

- Tax bill needs work

- To file or not to file

- SALT didn’t happen

- Missing $1 million refund

- 5-Hour Energy cap gain

- Interest gets Interesting

- Mangia!

IRS warns tax professionals to be aware of EFIN scam email; special webinars offered next week – IRS:

The Internal Revenue Service and Security Summit partners today alerted tax professionals of a scam email impersonating various software companies in an attempt to steal Electronic Filing Identification Numbers (EFINs).

The IRS warned that scammers are posing as tax software providers and requesting EFIN documents from tax professionals under the guise of a required verification to transmit tax returns. These thieves attempt to steal client data and tax preparers' identities, creating the potential for them to file fraudulent tax returns for refunds.

To help protect tax professionals against this emerging scam, the IRS is hosting a special series of educational webinars aimed at the tax community. The sessions will begin Feb. 12 and run each day next week.

IRS warns tax pros about new EFIN scam – Michael Cohn, Accounting Today:

The IRS said it's already gotten dozens of reports about the scam targeting tax pros. The scam email includes a U.S.-based area code for faxing EFIN documents and also has instructions on obtaining EFIN documentation from the IRS e-Services site if the number is unavailable. Scam variations being seen use different fax numbers for software vendors. Other warning signs of a scam include inconsistencies in the email wording and a German footer in the email.

The IRS said tax professionals who receive the emails shouldn't respond to them, nor proceed with any of the steps displayed in the email.

IRS Confirms ERC Voluntary Disclosure Isn't for Willful Conduct – Nathan Richman, Tax Notes ($):

The IRS’s voluntary disclosure program for employee retention credit claims differs from the agency’s general voluntary disclosure practice because it doesn’t forgive willfully fraudulent conduct, according to IRS officials.

“If somebody willfully filed a fraudulent employee retention credit claim, or if they assisted or conspired in such type of conduct, applying to the employee retention credit voluntary disclosure program will not exempt them from potential criminal investigation or prosecution,” Erik W. Anderson of the IRS Small Business/Self-Employed Division said February 8 on an IRS webcast.

Anderson, who heads up the ERC voluntary disclosure program, emphasized that the program isn’t a replacement for the IRS Criminal Investigation division’s voluntary disclosure program.

Taxpayers Filed Securely With Free E-File Program, IRS Says - Erin Slowey, Bloomberg ($):

More than a dozen taxpayers filed their returns using the IRS’s new agency-run free filing tool after it went live at the start of filing season, the agency said Thursday.

“The ‘First Filers’ have successfully and securely filed their returns for free through Direct File, and the IRS is continuing to progress through internal testing,” Bridget Roberts, Direct File pilot lead, said in a statement.

“More than dozen”? There are roughly 170 million taxpayers in the U.S. The crowing seems a bit premature.

Taking the Hill

Chief tax writers working to broaden appeal of tentative accord – Caitlin Reilly, Roll Call:

A bipartisan, bicameral $70 billion tax agreement taking shape on the Hill is drawing mixed reviews, pointing to potential challenges ahead for Senate Finance Chair Ron Wyden and Ways and Means Chairman Jason Smith.

For those new to the game, the bill includes the following provisions:

- R&D expensing (domestic)

- Expands the 163(j)-interest deduction from EBIT to EBITDA

- Ups Bonus Depreciation to 100%

- Increases section 179 expensing

- Enlarges the Child Tax Credit

- Modifies Employee Retention Credit

The House approved the bill and now it's in the Senate, where some lawmakers seek to change it.

Some Senate Finance Republicans said they were eager to reach a deal. Others took issue with the plan to end the pandemic-era employee retention tax credit early as a means to cover its costs, as well as the scope of the tentative child tax credit expansion…

On the other side of the issue, some Democrats want a package that would do more to expand the child tax credit, specifically make the full credit available as a refund to families with little or no taxable income, as was the case under the 2021 pandemic relief law.

Lots of folks are monitoring this bill because of its business tax provisions. But the fate of this bill will likely depend on whether a majority of lawmakers agree on changes to the Child Tax Credit.

This tax bill did not follow regular order. In fact, it appeared outta nowhere.

Quiet rebellion threatens House GOP chair over surprise tax deal – Juliegrace Brufke, Axios:

Multiple GOP lawmakers fumed about how negotiations on the bipartisan tax deal were handled.

- GOP critics said key members weren't consulted on negotiations. Some members learned of the deal on social media, a senior committee source told Axios.

- "I don't know who the f*** he's dealing with," one lawmaker told Axios. "How does Jason Smith announce the deal before the speaker knows about it?"

- "Jason negotiated with the Senate and the Dems. For some reason Republicans weren't included in his negotiation," the lawmaker said.

Potential changes to the bill are now fodder for news stories instead of subjects tackled by committees:

Crapo’s sphinx-like approach to the tax bill - Laura Weiss, Punchbowl News ($):

Tax deal drama is boiling over in the Senate. Tensions are escalating over Senate Finance Committee ranking member Mike Crapo’s(R-Idaho) continued opposition to the bipartisan $80 billion package passed by the House, even as interest bubbles up from his GOP colleagues.

Crapo’s opposition could signal that other Senate Republicans will also oppose the bill. Passage will require at least some support from members in this party, and amending the bill to get those votes could prove costly:

Yet any changes made now would likely sink the package. And no one seems to know exactly what Crapo needs to get to yes. Some believe Crapo wants to wait to strike his own deal next year when Senate Republicans could be in the majority.

In conversations with tax staffers, they said it was unlikely the bill would pass the Senate as is. Amendments would be needed, which might meet resistance in the House.

Partnership Filing Headaches Mount as Tax Bill Stalls in Senate - Erin Schilling, Bloomberg ($):

The uncertainty of the bipartisan tax bill that passed in the House and is stalled in the Senate is causing a domino effect of delays for tax returns for partnerships and their owners.

The bill would renew three business tax breaks retroactively, which would impact tax preparation for this year’s filing season.

Tax professionals are torn between filing business tax returns now—and possibly submitting an amended return later—or filing for an extension. Often-complicated partnership tax returns are due March 15. Individuals involved in partnerships need those returns to file their personal taxes by the April 15 deadline.

FWIW: Lawmakers don’t factor in deadlines when passing legislation. They say they do, but they don’t.

Exhibit A: The multiple times Congress passed tax legislation that extended tax breaks that expired the year prior.

Legislation upping the SALT-cap could be stalled in the House:

Capitol Hill Recap: Hold The SALT – Jay Heflin, Eide Bailly:

The original plan was for the full House to vote on the measure Tuesday. The vote was expected to be on the “rule” for the bill, which instructs how the chamber will debate and possibly amend the bill. That vote did not occur and there has yet to be an announcement for when ballots will be cast.

Normally, when a chamber vote on legislation is pulled from the floor schedule it means that the measure lacks sufficient support to pass. Given the amount of grousing about this bill by lawmakers from both political parties, support for it could be lacking.

The current prediction is that the House will vote on the “rule” next week, but there is no official announcement about this.

I wouldn’t hold my breath waiting for this bill to be enacted, according to staffers I have spoken to. There are apparently more lawmakers against upping the cap than there are who support it. However:

[L]lawmakers sometimes talk smack about legislation then wind up supporting it. In other words, the terminal diagnosis for upping the SALT-cap bill could be premature. Stay tuned.

Court Action

Claim for $1 Million Tax Refund Filed Too Late, Court Says - Mike Vilensky, Bloomberg ($):

A company alleging it overpaid the IRS by more than $1 million filed its amended tax return too late to recover the funds, a federal judge ruled, clarifying the standard for when a filer can submit an amended return.

American Guardian Holdings Inc. in 2019 noticed an error in the 2015 tax return that it had filed in 2016: it had only owed $148,243 in taxes that year, not the $1,327,806 it had reported and paid, the company said in a complaint filed in the US District Court for the Northern District of Illinois. AGH worked on three amended tax returns in an effort to claim a refund, it said: the first it failed to send, the second it filed in 2019, and the third, allegedly correcting errors in the second, was filed in 2020.

Ouch! Dudes needed a professional:

Strategic tax planning can create fewer headaches and generate more savings – Eide Bailly:

Eide Bailly’s goal is to help you minimize your tax liability and manage your tax risk. With dedicated professionals who spend every day solving tax issues in a variety of industries, Eide Bailly brings a wealth of knowledge and resources to any tax situation or question. Our people are active in the development and review of tax legislation and work with you through industry and professional groups to advocate for your needs.

DC Circ. Skeptical Of 5-Hour Energy Partner's Tax Challenge – Anna Scott Farrell, Law360 Tax Authority ($):

D.C. Circuit judges seemed skeptical of a Canadian citizen's argument that $6.5 million in gains she received from selling a share of a U.S. partnership that sold 5-Hour Energy drinks shouldn't be federally taxed, grappling to understand her reasoning during oral arguments Thursday.

Chief Judge Sri Srinivasan told an attorney for Indu Rawat that it was unclear why the U.S. Tax Court, in ruling against giving Rawat a refund last year, was necessarily wrong to adopt the IRS' reading of Internal Revenue Code Section 751 governing the inventory items and gains and losses at issue in the case.

Divorced Woman Not Liable After Ex Omitted W-2 From Joint Filing - Shweta Watwe, Bloomberg ($):

A woman isn’t liable for a tax deficiency that resulted when her ex-husband failed to disclose a W-2 for the couple’s jointly filed 2019 return before their divorce was finalized, the US Tax Court said on Thursday.

Alexandra Faretra met the requirements for “innocent spouse relief” under the tax code, because she didn’t know about the omitted W-2 and her finances resulting from the divorce would make it inequitable to hold her liable for the deficiency.

International Tax Corner

Inclusive Framework Members continue countering harmful tax practices – OECD:

Jurisdictions continue to make progress in addressing harmful tax practices through the implementation of the international standard under BEPS Action 5. This progress is evident in the release of new results on preferential tax regimes and substantial activities in no or only nominal tax jurisdictions.

Need help? We’re here!

Global expansion is full of complex decisions. Take the guesswork out of international tax planning with the help of Eide Bailly – Eide Bailly:

Doing business internationally can be complicated, and setting your business up for success includes being mindful of creating a tax efficient model at the outset. Whether you are just starting or have an established multinational business, an experienced advisor can help you make confident decisions in these areas. Specific expertise, including language fluency, in the countries where you operate and/or have sales can help ease the burden and the headaches of determining the right course of action.

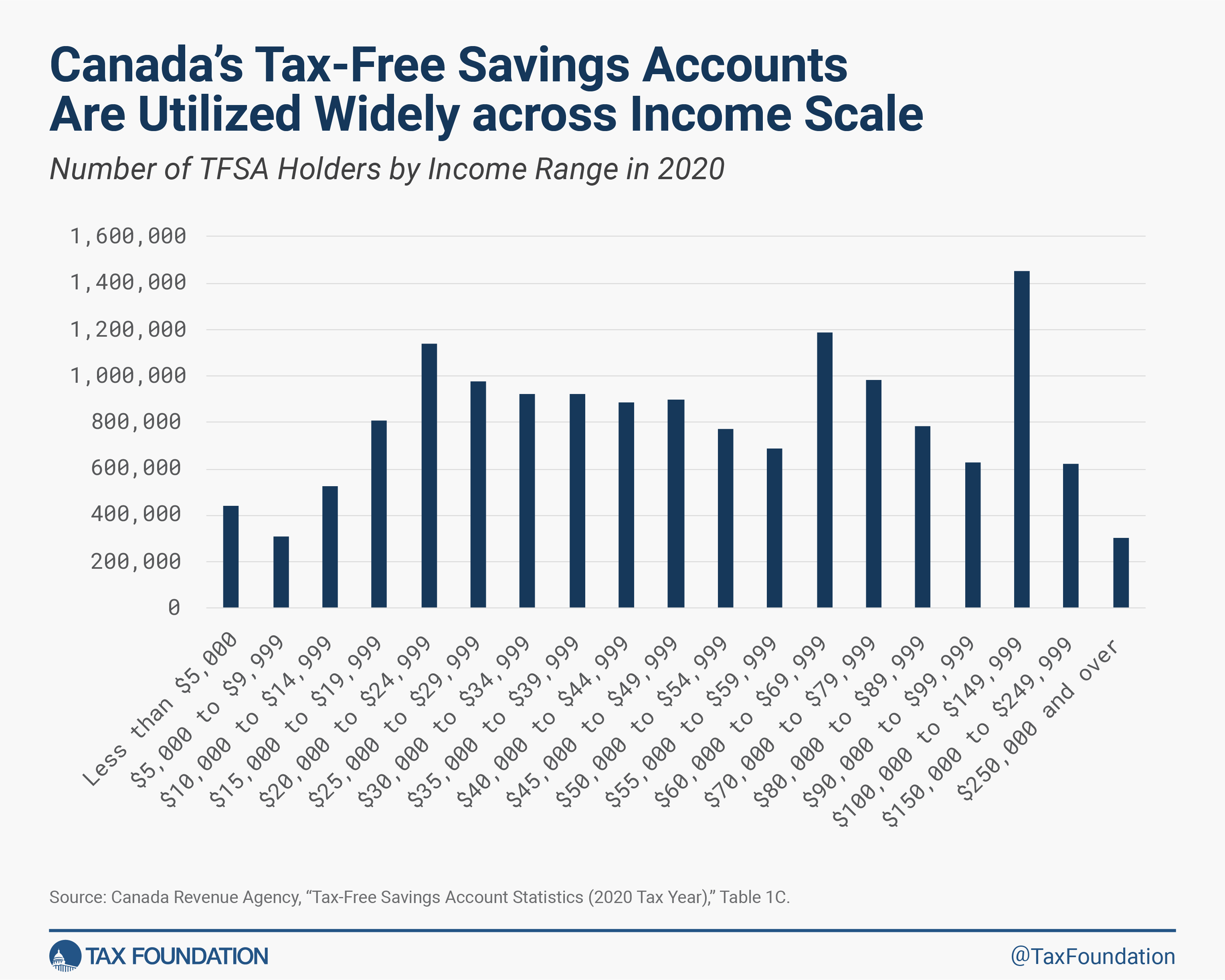

Canada’s Tax-Free Savings Accounts Are a Huge Success. U.S. Lawmakers Should Take Note – William McBride, Tax Foundation:

For most Americans, saving is a taxing experience. The most readily available option is to put money away in a savings or brokerage account and then face taxes on any interest, dividends, or capital gains received. Another option is to navigate a convoluted system of tax-advantaged accounts narrowly specified for limited uses, such as 401(k)s and IRAs for retirement, health savings accounts (HSAs) for qualified medical expenses, 529s for qualified education expenses, and the new Secure 2.0 provisions allowing employers to offer pension-linked emergency savings accounts under certain conditions.

Our neighbors to the north have found a better solution—and U.S. lawmakers should take note. Since they began in 2009, Canada’s tax-free savings accounts (TFSAs) have provided Canadians a simple option to save tax-free without strings attached. TFSAs are a type of universal savings account (USA), in which individuals 18 or older can make contributions on an after-tax basis (i.e., non-deductible), earnings grow tax-free, and withdrawals can be made for any reason without triggering additional taxes or penalties.

US Grantor Trusts Need Int'l Reporting Clarity, Treasury Told – Natalie Olivo, Law360 Tax Authority ($):

The U.S. Treasury Department should clarify that domestic grantor trusts aren't required to file international information returns, the American Institute of Certified Public Accountants said in a letter made public Thursday, claiming that current uncertainty has led to redundant reporting.

Treasury should issue a notice or revenue procedure to resolve uncertainty regarding the obligation for the grantor, or creator, of domestic trusts to file international information returns, the AICPA said Monday in a letter. According to the AICPA, this category includes Form 5471, which involves U.S. stock ownership in offshore corporations, and Form 8858, an information return regarding foreign disregarded entities and foreign branches.

Blocked Brazilian Income Can’t Be Taxed in U.S., 3M Brief Argues – Alexander Peter, Tax Notes ($):

In the opening brief of its Eighth Circuit appeal, 3M claims that regulations allocating payments that the company’s Brazilian subsidiary could not lawfully remit as U.S. income are substantively and procedurally invalid.

3M’s opening brief, filed February 8 at the Eighth Circuit, follows the appeal that 3M on December 29, 2023, lodged against the Tax Court’s September 28, 2023, decision in favor of the government, confirming a $3.6 million income tax deficiency for 3M's 2006 tax year. In its February 9, 2023, opinion in 3M Co. v. Commissioner, 160 T.C. 3 (2023), the Tax Court held that the so-called blocked income regulations are neither substantively invalid under Chevron U.S.A. Inc. v. Natural Resources Defense Council Inc., 467 U.S. 837 (1984), nor procedurally defective under the Administrative Procedure Act to the extent that they require a different result.

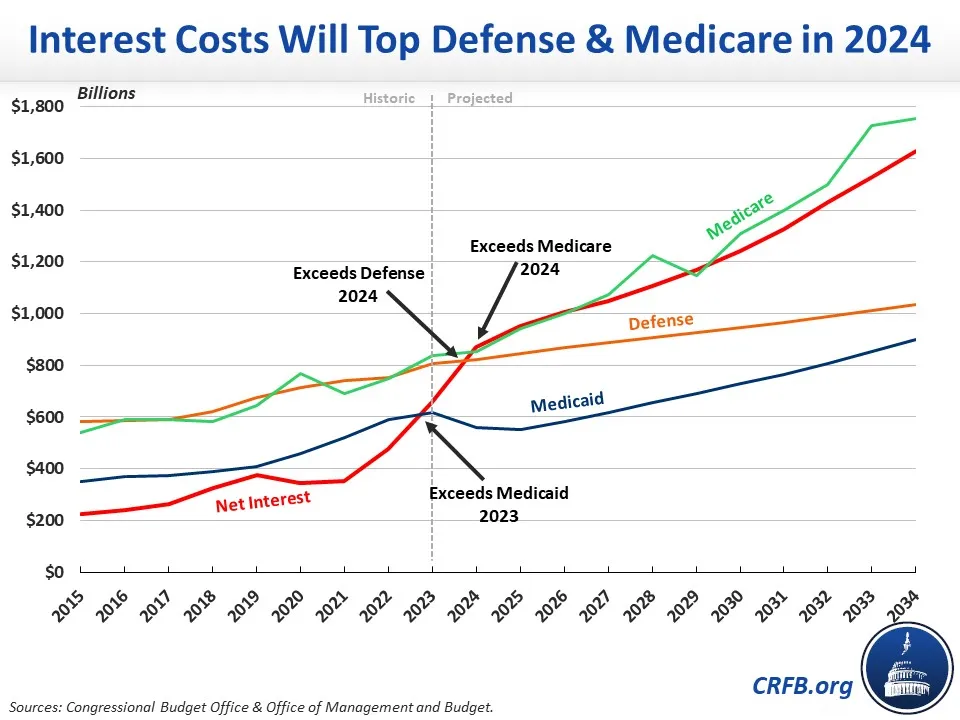

From the “Interest Becomes Interesting” file:

Interest Costs Will Leapfrog Medicare and Defense This Year – Committee for a Responsible Federal Budget:

Interest on the debt is the fastest growing part of the budget. Net interest payments will exceed both defense and Medicare spending this year, in Fiscal Year (FY) 2024, according to new projections from the Congressional Budget Office (CBO). That will make interest the second largest government expenditure.

Net interest has been exploding over the past few years, with payments rising from $223 billion in 2015 to $352 billion in 2021 before nearly doubling to $659 billion in 2023. In 2024, CBO projects net interest will total $870 billion, a near-record 3.1 percent of Gross Domestic Product (GDP).

What does interest have to do with taxes? Everything. Taxes are the main revenue source for the federal government to pay for stuff, like interest. And if costs go up there will likely be a discussion on whether taxes should go up.

What Day is it?

Happy National Pizza Day! Mangia! Mangia!

Make a habit of sustained success.