Key Takeaways

- 2025 tax debate will be a big one

- Senate likely to pause on tax action

- CTC is big deal for passing tax bill

- SALT clears panel, but will it clear House?

- Tax, err Audit, the Rich!

- The IRS comeback

- Gleaning retirement tax breaks

- Eide Bailly tax prep at your service

- Showering with friends???

Some TCJA Economics for the Great 2025 Tax Debate – Martin Sullivan, Tax Notes ($):

Experience tells us that the first year of a president’s term is often when major tax legislation is enacted. And at the end of 2025, a big part of the $1.5 trillion 2017 Tax Cuts and Jobs Act — the $1.1 trillion of individual tax cuts, which includes tax relief for passthrough business owners — is scheduled to expire. For a Congress in which both parties want at least portions of the TCJA to be extended, the scheduled expiration is an action-forcing event. So buckle up for a major legislative showdown on federal tax policy.

With budget deficits at unprecedented levels for non-recessionary, peacetime years and a host of factors that suggest ever-rising federal deficits — including rising interest rates, slower long-term growth, an aging society, pressing national security threats, and the cost of decarbonizing — the revenue cost of extending the TCJA will be in a bright spotlight. The Joint Committee on Taxation has estimated that if the individual income tax cuts under the TCJA are extended, the revenue loss in fiscal 2027 will be $346 billion, equal to about 1.1 percent of GDP. The Congressional Budget Office in May 2023 estimated that the budget deficit for 2027 (without any TCJA extension) will equal 5.5 percent of GDP.

The year 2025 is expected to be a huge tax year because lawmakers have no choice but to decide which TCJA provisions expire, and which are extended. The outcome of the 2024 elections will have an enormous influence on which tax provisions live or die in 2025.

Tax Grind Continues

House-passed child tax credit and business bill faces obstacles in Senate – Zachary Halaschak, Washington Examiner:

The bill, crafted between Ways and Means Committee Chairman Jason Smith (R-MO) and Senate Finance Committee Chairman Ron Wyden (D-OR), cleared the House with major bipartisan support in a 357-70 vote. It also has support from the White House.

Still, the measure, H.R. 7024, the Tax Relief for American Families and Workers Act, could hit several snags in the Senate.

Most notably, the legislation faces skepticism from Republican senators over its enlargement of the child tax credit, and specifically provisions that some conservatives have said would amount to an expansion of welfare and discourage work. Others have raised objections related to the legislation’s effects on the deficit.

5 fights to watch as tax deal goes to Senate – Tobias Burns and Aris Folley, The Hill:

Here are five points of contention to watch on the tax proposal as it gets considered in the upper chamber… How — if at all — is the cost of the bill covered? … GOP issues with the child tax credit… Democrats fear the bill is too business-friendly… State and local tax gripes could limit support… Election implications of passing a big tax bill…

Senate Has a Week to Keep Tax Package’s Momentum - Chris Cioffi, Bloomberg ($):

Several prominent Senate Republicans before the weekend said they want a chance to put their fingerprints on the tax bill by getting amendment votes on the legislation. But Senate Finance ranking member Mike Crapo (R-Idaho) or Minority WhipJohn Thune (R-S.D.) indicated an openness to finding agreement on an expedited process that would allow them to get amendment votes on the Senate floor, skipping a Finance Committee markup.

An agreement among senators on how to move the bill hasn’t been announced, and it’s expected that the border and aid bill will dominate this week’s calendar before the chamber breaks for a two-week recess set for Feb. 12 through Feb. 23.

The scuttlebutt for Senate action on the bill is that a vote will likely occur after Senators return from their recess, which begins next week and lasts until February 23rd. The original goal for enacting this legislation by the time tax season started is a distant memory.

Legislation to Sunset ERC Prompts Rush to File Claims – Lauren Loricchio and Nathan Richman, Tax Notes ($):

Tax legislation that would bring the employee retention credit program to an abrupt end has caught advisers off guard and has left some scrambling to get claims in before the cutoff.

Under the bipartisan tax agreement released January 16, claims for the ERC would have to be submitted the same day that the bill was passed by the House — January 31 — a change that the lawmakers said would save more than $70 billion to help pay for other parts of the bill.

“Tax professionals were surprised at how quickly that deadline was set, given that the bill was just proposed,” said Mary E. Wood of Meadows, Collier, Reed, Cousins, Crouch & Ungerman LLP. “It’s not a lot of time to give notice to the public for taxpayers who have legitimate ERC claims.”

R&D Questions Linger Even if Tax Bill Gets Senate Approval - Caleb Harshberger, Bloomberg ($):

The House passed the bill—which includes the return of the full deduction for R&D spending, plus other tax breaks for businesses, plus an expansion of the child tax credit—under an expedited process Jan. 31, sending it to a more wary Senate.

It wouldn’t be a clean fix, and companies and tax pros say the uncertainty around R&D tax policy means businesses may struggle planning ahead and making long-term investments in research and development.

“The uncertainty is really tough, especially when you’re trying to forecast liability for the coming year,” Kruze Consulting VP of Tax Dave Lowe said in an interview. “We’re working on extensions and estimations now, and we’re kind of in limbo. Is this going to pass? In what form is it going to pass? And how will the IRS handle the retroactive nature?”

Poorer Families, Foreign Investors Win in Tax Bill, Report Says – Doug Sword, Tax Notes ($):

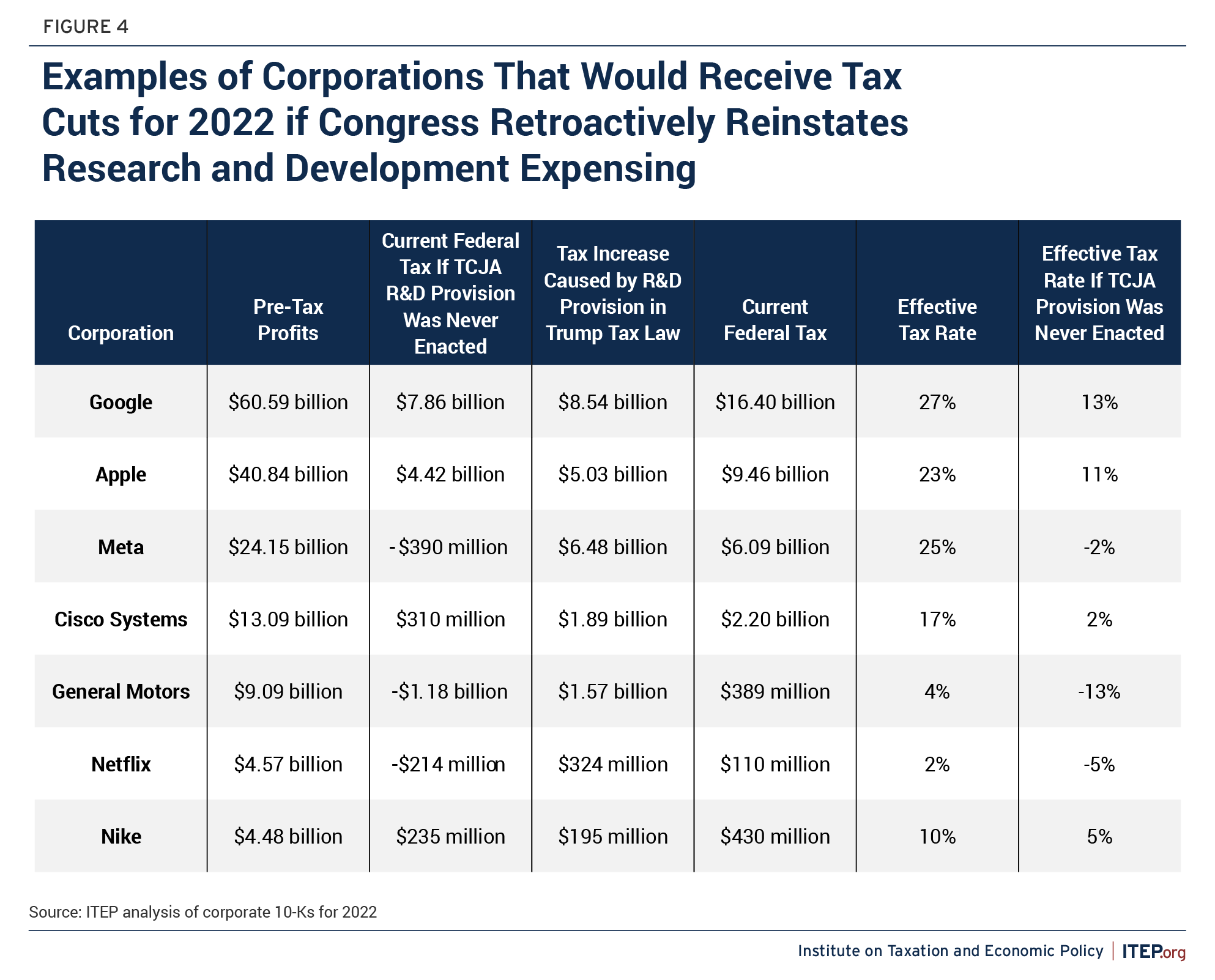

The biggest winners in tax legislation passed by the House would be low-income families with children and foreign investors in companies benefiting from a relaxation in business tax breaks, according to a new analysis from the Institute on Taxation and Economic Policy (ITEP).

In a January 31 vote, the House overwhelmingly passed the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024), a $79 billion collection of business tax cuts and enhancements to the child tax credit expected to soon be considered by the Senate.

From the report:

While the child tax credit may not be a priority for businesses, lawmakers’ support for it will be integral in getting business tax relief enacted into law. And the current child tax credit proposal pales in comparison to the pandemic family relief measure.

Proposed child credit boost would have a short reach – Brian Faler, Politico:

A small subset of families would see a sizable benefit from a Democratic bid to expand the Child Tax Credit — but millions of other parents may find themselves asking, That’s it?

The plan before lawmakers bears only a faint resemblance to the audacious expansion Democrats temporarily pushed through during the pandemic. It is far more modest, and suffers by comparison with the better-known version that briefly sent monthly checks to 40 million families.

This time around forecasters see just seven million households benefiting in some way from the plan, or less than 5 percent of tax filers.

And they’d get substantially less this time around.

Please Pass the SALT

House considers expanding state tax deduction for some families – Jacob Bogage, Washington Post:

The legislation, sponsored by Rep. Michael Lawler (R-N.Y.), would raise the cap for the state and local tax deduction, known as SALT, for married couples who file taxes jointly and make up to $500,000.

Congress had capped the deduction both for individuals and couples at $10,000 to help pay for President Donald Trump’s 2017 tax cuts. Lawler’s bill, which has support from a phalanx of other Republicans from Democratic-controlled states, would let married couples offset up to $20,000 of income on their federal returns with state and local taxes for the current tax year. The cap would drop back to $10,000 in 2024 until it expires in 2026.

Passage from the House is iffy, according to Punchbowl News:

Tuesday: The House is supposed to vote on a rule for the SALT bill. But many in leadership are skeptical the rule passes, dooming the bill’s already long prospects.

Latest SALT Deduction Cap Proposal Increases Budget Deficit, Creates New Tax Cliffs, and is Regressive – Garrett Watson, Tax Foundation:

While the bill represents a serious effort by policymakers to address the concerns of members in SALT-sensitive districts, its design creates several problems that violate the principles of sound tax policy.

First, we estimate the proposed change to SALT deduction cap would cost about $11.7 billion using Tax Foundation’s Taxes and Growth model. If the proposed change was extended to 2024 and 2025, it would cost another $25.5 billion over those two years. The bill contains no offsets, so the revenue loss would increase the budget deficit and would accrue additional interest costs.

Second, the proposed income limit of $500,000 creates a new and massive marginal tax rate cliff in the tax code. Joint filers earning $499,999 would be able to deduct up to $20,000 in SALT from their return. Joint filers earning one additional dollar would see up to $10,000 in SALT deductions immediately disallowed.

IRS Happenings

Wealthy Tax Evaders, New Tech Top IRS’s Agenda This Tax Season - Danny Werfel, IRS Commissioner, Bloomberg ($) (Comment):

In the area of service, we’re focused on helping taxpayers get it right the first time and avoid the need for back-and-forth engagement to fix errors when filing returns or claiming credits and deductions. We want taxpayers to interact with us seamlessly in whatever way works best for them—on the phone, in person, or online…

In the area of compliance, you’ll see us continuing to take swift and aggressive action to ensure high-income taxpayers with issues pay what they owe. We continue to place increased scrutiny in this area as we work to reverse the historically low audit rates for large corporations, complex partnerships, and high-wealth individuals.

A key area of focus is on millionaires and billionaires who evade taxes. These efforts are concentrated among taxpayers with more than $1 million in income and more than $250,000 in recognized tax debt. Over the past year, the total we’ve recovered through these new initiatives is $520 million, and that’s just the beginning.

‘Despair’ over IRS service turns to ‘cautious optimism,’ says advocate – Joe Davidson, Washington Post (Opinion):

Like a once terrible sports team battling to regain winning form, the Internal Revenue Service is rebuilding after years of dreadful customer service.

The improvement was evident last year. Now Danny Werfel, in his first year as the 50th IRS commissioner, sounds like an excited coach ready to impress with even better results this tax filing season, which began [last] Monday and runs through April 15. Instead of getting a superstar to turn things around, Werfel has about $60 billion to renew an agency that not long ago couldn’t master basic customer assistance.

The IRS has all our tax data. Why doesn’t its new website use it? – Julie Zauzmer Weil, Washington Post:

The new Direct File program is the Biden administration’s big gamble to shake up this practice by establishing a free competitor to behemoths like Intuit’s TurboTax and H&R Block.

But Direct File, which uses a question-and-answer format much like those paid websites, is a far cry from what some proponents of free tax software have sought. It doesn’t draw from the IRS’s vast trove of financial information on each taxpayer, including W-2 wage statements. Some had envisioned that a government platform would offer pre-filled returns to save users time and effort.

Retirement Relief

There’s Still a Way to Double Your Retirement Tax Breaks Before Filing – Laura Saunders, Wall Street Journal ($):

The window to use most tax breaks slams shut at year-end, so there aren’t many ways Americans can still cut their 2023 taxes.

But here’s an option many filers overlook: a spousal IRA contribution. It can benefit married couples when one partner earns less than the other—or even nothing.

Eligible couples can use it to double contributions to traditional individual retirement accounts (IRAs) and deduct $15,000 rather than $7,500 for 2023, as long as they do so by April 15 this year (April 17 in Maine and Massachusetts). Or they can contribute to Roth IRAs with no deduction.

Odds and Ends

Interest From Gov't Bonds Qualifies Corp. As A REIT – Anna Scott Farrell, Law360 Tax Authority ($):

A publicly traded corporation may use income and interest from government bonds to help it qualify as a real estate investment trust, the Internal Revenue Service said Friday in a private letter ruling.

Under PLR-105209-22 (PLR 202405001), dated Nov. 7, the corporation can treat any interest on the bonds that would qualify as interest for federal income tax purposes as interest qualifying it as a real estate investment trust under Internal Revenue Code Section 856(c) . That law defines a real estate investment trust as being required to receive a percentage of its income from certain sources, including interest.

Two Peas in a Pod: Partnership Tax Reform and the Antiabuse Rule - Monte Jackel, Tax Notes ($):

More IRS expertise is needed.

In IR-2024-9, the IRS provided an update on various audit and related activities that the agency has been engaged in recently, including those involving so-called complex partnerships, large corporations, and high-income, high-wealth individuals. The IRS information release says:

The IRS is working to ensure [that] large corporate, large partnership and high-income individual filers pay the taxes they owe. . . . The IRS is now taking swift and aggressive action to close [the tax] gap. . . . The IRS has identified ongoing discrepancies on balance sheets involving partnerships . . . which is an indicator of potential non-compliance. Taxpayers filing partnership returns are showing millions of dollars in discrepancies between end-of-year balances compared to the beginning balances the following year. The number of these discrepancies has been increasing. . . . The complex structures and tax issues present in large partnerships require a focused approach to best identify the highest risk issues and apply resources accordingly. . . . The IRS has been modernizing its hiring processes and holding more direct hiring events to better compete with the private sector and quickly bring top talent on board.

Google, H&R Block Ask Court To Toss Tax Data RICO Suit – Anna Scott Farrell, Law360 Tax Authority ($):

Google and H&R Block asked a California federal court to toss a suit accusing them of scheming to intercept the private data of a man who used H&R Block's tax preparation software, saying there was no evidence the companies conspired.

In separate motions to dismiss Thursday, Google LLC and H&R Block rejected Justin Hunt's claims that they, along with Meta Platforms Inc., conspired to track his online tax filing activity in violation of the Racketeer Influenced and Corrupt Organizations Act.

Easement Donation Deduction Survives Holding Period Challenge – Erin McManus, Tax Notes ($):

The IRS failed to convince the Tax Court that a conservation easement donor had held the subject property for only six months rather than the nine years claimed by the donor.

Tax Court Judge Cary Douglas Pugh denied summary judgment to the IRS January 22, holding that neither Rev. Rul. 99-5, 1999-1 C.B. 434, nor the substance-over-form doctrine apply to an easement donor’s holding period in Joint Star Properties LLC v. Commissioner.

Going to Jail for Failure to Pay – Keith Fogg, Tax Notes ($):

The IRS obtained a judgment against Mr. Kelly in May 2023 for almost $1 million related to his liability for foreign bank account reporting penalties. At the time of the judgment the government must have known that the assets he controlled that could pay this liability resided overseas. In October 2023 the IRS obtained an order to repatriate directing him to bring a sufficient amount of money back into the United States that would allow him to satisfy the judgment. The order specifically required him to bring money into a bank account in Michigan and to let the Justice Department attorney know the name and address of the bank by November 23, 2023. The court also issued an amended order tweaking the original.

Mr. Kelly did not bring his money back to a Michigan bank account by November 23, but sought a stay on the earlier order. The court denied the request for a stay and issued a second repatriation order alerting him that if he failed to repatriate the funds by December 1, 2023, sanctions would follow. Again, he did not comply, resulting in a motion filed by the government to hold him in contempt. In response to this motion, the court held him in contempt, issued an arrest warrant, and imposed a fine of $100,000 per day until he complied.

Couple Owe Reduced FBAR Penalty Of $400K, Court Says – David Hansen, Law360 Tax Authority ($):

An Oregon couple must pay almost $400,000 in fines, interest and penalties for failing to report their foreign bank accounts to the Internal Revenue Service, a federal court said.

But after the order byU.S. District JudgeKarin J. Immergut on Thursday, Ali Mahyari and Roza Malekzadeh will still pay less than the $650,000 that the IRS originally levied against them after a jury found that they had not intentionally failed to report one of the accounts.

From the “More Details Please” file:

Here’s who needs to file a tax return in 2024 – IRS:

Most U.S. citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the year.

The IRS has a variety of information available on IRS.gov to help taxpayers, including a special “free help” page.

Sometimes people get what they pay for when its free. Why not contact us?

Let us help you relieve your tax headache – Eide Bailly:

Federal, state, local, and international tax burdens and responsibilities consume time and cash flow. Whether you’re an individual, a business, a nonprofit, or handling a trust or estate, proper planning and guidance from a well-versed professional can make managing taxes less painful.

Eide Bailly has the depth of tax resources to help you gain peace of mind. Plus, our professionals are supported by the National Tax Office, allowing clients to dig into specialized tax situations.

Shower Power

It’s National Shower with a Friend Day. But it’s not what you think, according to National Day Calendar: The celebration “is a tongue-in-cheek way of educating people about the benefits of filtered, chlorine-free water.”

Make a habit of sustained success.