Fax to the Future: IRS Unveils Modern-ish Tool for Penalty Relief – Jonathan Curry, Tax Notes ($):

The IRS has announced that, under the right circumstances, international taxpayers will be able to use a new, fully electronic tool to submit penalty relief requests for a few late-filed forms: a fax.

Faxing the requests gives taxpayers another option instead of mailing them, and in a release, the IRS touted the move as being part of its broader effort to modernize, leaving behind its time-consuming and costly paper-based processes in favor of a fully digital tax administration.

The Internal Revenue Service announced today the availability of a new option that provides an easier, more efficient way for taxpayers or their tax professionals to submit electronic requests for relief for certain late-filed international documents to improve taxpayer service.

As part of a step toward full digitalization being taken across the IRS, the new option will apply to the following filings:

1. Gain Recognition Agreements

2. Late filed Dual Consolidated Losses, and

3. Partnership Gain Deferral Contributions

Here is the fax number that is helping the agency achieve "full digitalization."

How the process will work

Requests can be submitted via fax at 855-582-4842.

More fun fax:

Partnership Urges Supreme Court to Review Faxed Return Case – Kristen Parillo, Tax Notes ($). “A Ninth Circuit opinion holding, that a partnership’s faxing of a delinquent tax return to the IRS agent who requested it didn’t trigger the statute of limitations, will produce ‘Kafkaesque madness’ if the Supreme Court doesn’t intervene, the partnership says."

‘By rewarding the IRS’s bait and switch, the decision below lets the IRS perennially mislead taxpayers about whether they have filed returns and extract penalties after sitting on received returns for decades,’ the partnership asserts in its August 7 petition for certiorari in Seaview Trading LLC v. Commissioner.

The future of tax administration – Benjamin Guggenheim, Politico:

That battle is happening now, with Democrats and several civil society groups asserting that yes, in fact, the IRS has already made remarkable strides since Democrats enacted their climate, health and tax bill last August… But Republicans and conservative groups are underscoring other developments to argue that the agency is as untrustworthy as ever.

Take what the conservative Americans for Tax Reform said in response to a watchdog report published last week that revealed that the IRS lost track of millions of sensitive tax records: ‘This is the same agency that wants to spend large amounts of taxpayer dollars to get into the tax software business. Yes, the same agency that wants you to trust them with safeguarding your most sensitive personal data cannot even do a basic inventory.’

Moving Because of Taxes? Group’s New Study Calls It Unlikely - Michael Bologna, Bloomberg ($):

A new study concludes state taxes play a minimal role in decisions by households and businesses to move between states.

Further down the article:

Is there a mad rush on U-Haul rental offices in California and New York each time Mississippi Gov. Tate Reeves (R) vows to fully repeal his state’s income tax 'once and for all?'

The Center on Budget and Policy Priorities disputed that theory this week in a 73-page report concluding that state taxes play a minimal role in decisions involving interstate moves…

Bloomberg basically reported the opposite last week: SALT Deduction Cap Has Lasting Economic Effect in High-Tax States. The article was included in Friday’s Roundup and is here (scroll down).

States Gain Tax Revenue After Limiting Sportsbooks’ ‘Free Bets’ - Angélica Serrano-Román, Bloomberg ($):

Curtailing tax breaks for sports betting companies’ ‘free bets’ is paying off for two states that took the step last year to limit how many of these promotional offers sportsbooks can deduct from their gross income.

Betting platforms like FanDuel, DraftKings, Caesars, and BetMGM frequently offer ‘free bets’ or credits, often referred to as ‘free play,’ to attract new gamblers. While these promotional bets can be a substantial portion of their gross gaming revenue, they may not be subject to taxation in every state.

Further down the article:

But after setting limits last year on the deductions sportsbooks can take on these ‘free bets,’ Colorado and Virginia now say they’re generating more gaming-related tax revenues―not only thanks to the new tax rules, but also from an overall increase in betting. According to the American Gaming Association, sports wagers topped $31 billion in the first quarter of 2023.

Perhaps the Big Apple should follow Colorado’s and Virginia’s lead:

NYC Tax Haul Shows Signs of Weakening, Fiscal Board Reports - Danielle Muoio Dunn, Bloomberg ($). “New York City political leaders should brace for an economic slowdown later this year, with signs that tax revenue collections are weakening after a period of sustained growth, the state Financial Control Board said in its most recent assessment of the city’s adopted budget.”

Seattle too:

Ideas for taxes to fill Seattle's $200M budget hole – Melissa Santos, Axios:

Seattle officials are projecting an annual budget hole of more than $200 million in 2025 — but several ideas for new taxes could help close that gap.

Driving the news: A report released last week by a city workgroup outlines nine potential taxes that could help shore up the city's $1.6 billion general fund budget, which is projected to spend more than it's bringing in.

The report is here. Its ideas include:

City-level Capital Gains Tax

- The City would not need voter approval for a Capital Gains Tax, and it may be able to do so without any further State authorization.

Wisconsin Bill Moves to Restore Tax Reciprocity with Minnesota - Angélica Serrano-Román, Bloomberg ($):

A bill in Wisconsin aims to study the effects of restarting an income tax reciprocity agreement it had with Minnesota that ended more than a decade ago due to delayed payments on one side.

The proposed legislation ( SB 374 / AB 375 ) mandates that Wisconsin’s revenue department, along with Minnesota’s revenue agency, assess the potential impacts of reinstating income tax reciprocity, which the two states shared beginning in 1968. The agreement ended in 2010 over late payments from the Wisconsin side. Wisconsin lawmakers have been trying to make amends by restarting a pact for years.

If this happens it will take a while:

Minnesota’s revenue agency said it looks forward ‘to discussing this issue further with the Wisconsin Department of Revenue.’ The Minnesota legislature will not consider any potential reciprocity bills until it reconvenes in February 2024.

Minnesota DOR Announces Deadline for Claiming 2021 Property Tax Refunds – Bloomberg ($). "The Minnesota Department of Revenue (DOR) Aug. 10 announced that the deadline for homeowners and renters to file for their 2021 property tax refund is Aug. 15. Claims for 2022 refunds can be filed until Aug. 15, 2024."

Governor Healey and Lieutenant Governor Driscoll Sign $56 Billion Fiscal Year 2024 Budget – Mass.Gov:

Gov. Maura Healey today signed a $55.98 billion state budget for Fiscal Year 2024 (FY24), making historic investments in schools, child care, workforce development, public transit, housing, climate resiliency and other key areas that will help make Massachusetts more affordable, competitive and equitable.

Further down the press release:

The plan also sets aside $580 million for the first year of a tax relief plan the Healey-Driscoll Administration filed in March that is pending final resolution with the Legislature, where each branch has approved their own versions of the bill.

Property Owners Want a Tax Cut as Prices Sink in San Francisco - John Gittelsohn, Eari Nakano, and Eliyahu Kamisher, Bloomberg ($):

Owners of San Francisco’s office towers, shopping centers, hotels and homes are flooding the county with appeals to slash their property assessments — and tax payments — as real estate prices sink in the beleaguered city.

Some of the world’s biggest landlords, including Brookfield Corp. and Blackstone Inc., have filed for assessment cuts. The volume of such appeals have doubled in the three years since the pandemic. Assessments for this fiscal year went out in early July, and new appeals are expected to surge before a Sept. 15 deadline to request reductions.

San Francisco has its own set of problems with commercial real estate. On the national level, many in Washington are waiting for Congress to deal with the fallout commercial real estate is experiencing as remote work keeps workers away from town centers. If lawmakers propose something that looks or smells like a bailout, there will likely be political consequences for them.

Fax homonym alert: From the “Tax Facts" file:

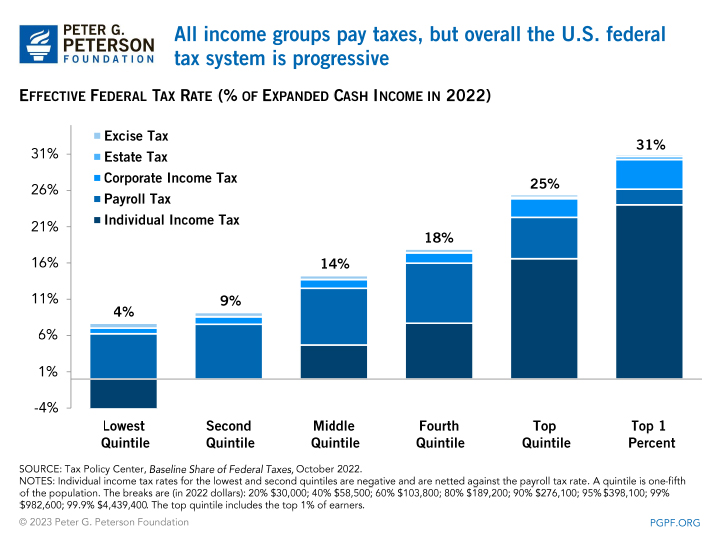

Who Pays Taxes? – Peter G. Peterson Foundation:

As a whole, the U.S. tax code remains progressive — with higher-income taxpayers paying a greater share of their income in taxes. That is true despite the fact that high-income Americans benefit disproportionately from tax breaks, otherwise known as tax expenditures.

Major tax expenditures — such as lower rates on capital gains and dividends, deductions for charitable contributions, and deductions for state and local taxes — tend to benefit higher-income taxpayers more than lower-income groups. CBO estimates that the top quintile of taxpayers receive 44 percent of the value of major tax expenditures, while only 11 percent goes to the bottom two quintiles. However, even with substantial tax expenditures, the top one percent of American taxpayers still pay an effective tax rate of 31 percent, on average, while the bottom 20 percent of the population pay an average of 4 percent.

I love blasting the rich for being tax cheats as much as the next fella. But the Peterson Foundation is highlighting a fact that has been repeated several times, and apparently falls on deaf ears in the media.

It’s National Navajo Code Talkers Day. How to celebrate it, according to National Day Calendar:

Celebrate the Navajo language. Recognize the incredible efforts of the Navajo Code Talkers by attending online and public events.

Or see the movie about it, which is titled Windtalkers.

Make a habit of sustained success.