Some Republicans crack open door to child tax credit compromise – Laura Weiss, Roll Call:

Some House Republicans defending vulnerable seats in the 2024 elections are working on an expansion of the child tax credit and view it as a priority in discussions about broader tax legislation this fall.

The GOP interest in playing a more active role to boost the benefit for families with children this year is bubbling up from at-risk freshmen and centrist groups in the party, who view the child credit as an important policy tool that has across-the-aisle support.

This could be big. If Republicans can seal a deal on the Child Tax Credit with Democrats, then the odds of passing a tax bill this year improve greatly. The bill would include R&D expensing, 100% Bonus Depreciation, and expanding the 163(j) interest deduction.

Taiwan Tax Bill Would Have No Revenue Impact, CBO Says – Tax Notes ($):

S. 1457, the Taiwan Tax Agreement Act of 2023, which would authorize an income tax agreement with Taiwan, would have no impact on spending or revenue, the Congressional Budget Office said in an August 10 estimate.

Eide Bailly has learned that lawmakers might add to this bill the tax legislation that passed the House Ways and Means Committee in June. That being said, doing so might be a pipedream if issues with the Child Tax Credit can't get resolved.

SECURE 2.0 Retirement Disclosures Draw Call for Public Input - Austin Ramsey, Bloomberg ($):

The US Labor Department is seeking public comments on reporting and disclosure provisions it must enact under the sweeping retirement access law Congress passed late last year.

Regulators issued a SECURE 2.0 Act (Pub. L. No. 117-328) request for information (RIN 1210-AC23) Thursday that elicits input from stakeholders and the public on a range of provisions eliminating, consolidating, enhancing, or otherwise improving certain employer-sponsored retirement plan reporting and disclosure regimes under the Employee Retirement Income Security Act of 1974 (Pub. L. No. 93-406).

The document is here.

A New Green Tax-Credit Market Is for Corporations. Some People Want In. – Richard Rubin, Wall Street Journal ($):

President Biden’s signature climate law gives corporations a new and lucrative opportunity: Spend $910,000 to buy clean-energy tax credits and shave $1 million off your tax bill.

Individual Americans should get the same deal, some tax advisers say.

IRS Lays Out Energy Credit Rules for Projects in Low-Income Areas – Mary Katherine Browne, Tax Notes ($):

Renewable energy investors are getting additional information about how to claim a bonus tax credit for projects that are based in low-income communities.

The IRS's final rules (T.D. 9979), released August 10, arrive in time for the fall opening of the program for the energy investment credit under section 48. The guidance provides definitions and requirements for the program and describe the four project categories under which facilities can apply for an allocation and the credit increase of either 10 percent or 20 percent.

Eide Bailly's coverage of this topic in yesterday's Roundup is here (scroll down).

Related:

The Clean Hydrogen Rules Will Be Delayed Until at Least October – Emily Pontecorvo and Robinson Meyer, Heat Map:

The Biden administration is planning to publish rules governing one of the most generous subsidies in its new climate law — a tax credit for clean hydrogen — no earlier than October, missing a key deadline inscribed in the law, according to a source familiar with the process.

The rules revolve around one of the most contentious questions that has emerged after the law’s passage: How do you know that your electricity is clean? The debate has divided climate activists, hydrogen companies, renewable developers, and nuclear-power plant owners.

Tax Levy On Family Trust Held at Santander Bank Can Proceed - Jeffery Leon, Bloomberg ($). “The federal government can enforce a levy on a family trust held at Santander Bank N.A. to reclaim tax liabilities from a construction business officer who pleaded guilty to tax evasion.”

Tax Court: Debt Canceled at Property Sale Is Gain – Chandra Wallace, Tax Notes ($):

More than $2.7 million of nonrecourse debt canceled as part of a real property sale was gain realized on the sale and not excludable cancellation of debt (COD) income, the Tax Court held.

In an August 10 memorandum opinion in Parker v. Commissioner, Judge Joseph W. Nega ruled that the passthrough entity that sold the property couldn’t exclude from its gross income the amount of nonrecourse debt that was canceled concurrently with the sale.

Bank of America Faces Second Worker Suit on PPP Loan Overtime - Jennifer Bennett, Bloomberg ($):

Bank of America NA workers who processed Paycheck Protection Program loans hit the bank with allegations of violating California wage statutes, echoing earlier claims in a similar suit under New York law.

The bank offered loan officers who processed the PPP loans multiple types of nondiscretionary incentive pay, but it didn’t always include those amounts when calculating the workers’ proper overtime pay rates, according to the complaint filed in the US District Court for the Northern District of California.

N.Y. Cannabis Growers Can Take Advantage of Manufacturer Credit - Rachel Wright, Abraham Finberg and Simon Menkes, Bloomberg ($):

New York cannabis cultivators and manufacturers face more challenges than most businesses in the Empire State. At the federal level, the IRS imposes an onerous tax burden on cannabis businesses due to Section 280E of the tax code.

The illegal cannabis market also is booming, and legitimate cannabis companies are forced to compete against clandestine operations that don’t pay tax. In this difficult environment, licensed cannabis businesses must find ways to shave their tax obligations to the bone.

Texas Offers New Tax Benefit to Attract Bitcoin Miners - Michael Bologna, Bloomberg ($):

Texas will open its doors next month to a new incentive aimed at cutting greenhouse gas emissions from flared and vented gas, offering a severance tax exemption to energy producers using the fugitive emissions to power Bitcoin mining rigs.

Under a law enacted earlier this year, HB 591, Texas will waive taxes on gas consumed at the well site that would otherwise be lawfully vented or flared—often referred to as “stranded gas.” The program could help Texas cut releases of stranded gas, a major source of CO2 emissions, methane, and pollutants resulting from burning gas. In addition, the oil and gas industry could move closer to meeting the World Bank’s Zero Routine Flaring by 2030 Initiative.

Global Rulemaker Plans Changes to Small Firm Tax Accounting - Michael Kapoor, Bloomberg ($):

The International Accounting Standards Board wants to change its small company accounting standard next month, allowing small firms to skip some tax reporting requirements for a period because of the uncertainty created by OECD global minimum tax rules.

The IASB is holding a special meeting to approve the changes August 23 and published the schedule in a staff paper Thursday. Companies will be allowed a temporary exemption from reporting money owed in deferred taxes after an OECD-led global agreement for countries to impose a minimum tax rate on multinationals. Uncertainty over when some countries will introduce the minimum rates makes it impossible for companies to predict future tax liabilities.

Dual Resident Claims Mexico-U.S. Treaty Precludes FBAR Filing – William Hoke, Tax Notes ($). “A Mexican citizen with a U.S. green card told a U.S. court he does not have to file a foreign bank account report because tax treaty tiebreaking rules provide an ‘escape hatch’ from the requirement.”

From the “Got It Wrong” file:

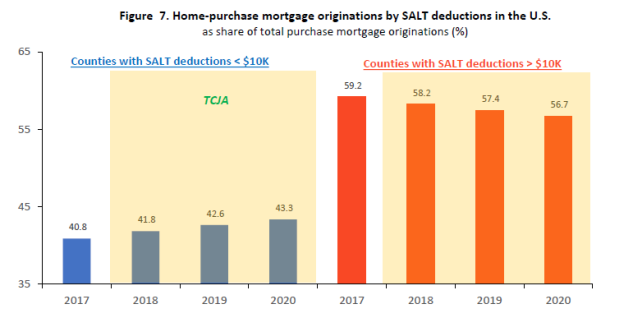

SALT Deduction Cap Has Lasting Economic Effect in High-Tax States - Andrew Silverman, Bloomberg ($) (scroll down):

- Restaurants and retailers with sizable operations in high-tax states may have to wait until the $10,000 cap on SALT deductions is lifted for help seeing their revenue growth return to pre-2018 levels.

- The SALT cap may have dampened annual home price growth as well as mortgage originations in counties with historically high SALT deduction use.

- Just as New York and California are losing businesses, residents, and income, Florida and Texas are gaining. Florida has added 706,597 residents since 2020 and Texas 884,144.

Having been a part of the lobbying effort for the 2017 tax reform bill, which the SALT cap was included, the last bullet point takes me by surprise.

I attended a meeting where a lawmaker said that the main reason for including the SALT cap in the tax reform bill was to prompt taxpayers in high tax states (aka blue states) to move to low tax states (aka red states). Shortly after the meeting ended, a few of us who were part of it laughed because we thought tax law would never force taxpayers to upend their lives and move to a different state. It looks like we were wrong.

Happy National Presidential Joke Day! I’m not sure this qualifies as a joke.

National Day Calendar:

George H. W. Bush pledged in 1988, ‘Read my lips: no new taxes.’ Two years later, Bush raised taxes.

Here's a real joke:

Young person: Did you get a haircut?

Old man: I got them all cut.

Make a habit of sustained success.