The Supreme Court turns up the tax pressure - Katherine Tully-McManus, Politico:

Arguments won’t be heard until the fall and a decision is probably a year off, but just the prospect of a big tax decision out of the court is already invigorating tax talk on Capitol Hill – yes, even during recess.

The challenge to a piece of the 2017 Trump-era tax law, if successful, could open the door for big corporations to get refunds for what they paid in one-time taxes on their overseas profits. But it could also welcome legal challenges to other parts of the established tax code. It may also drive the court to define “income,” which the justices have been loath to do.

California Package Includes Tax Breaks for Film, Manufacturing - Laura Mahoney, Bloomberg ($):

California lawmakers approved most of the state budget package Tuesday, including an extension of the film tax credit, after reaching agreement late Monday with Gov. Gavin Newsom on his push to include measures streamlining infrastructure projects.

Their agreement and approval of 20 bills signal the Democratic governor will sign the main budget measure lawmakers passed June 15 (S.B. 101) by his deadline of midnight Tuesday and in time for the July 1 start of the new fiscal year. The package outlines $226 billion in general fund spending, $38 billion in reserves, and a combination of deferrals, internal borrowing, and cuts to close a $32 billion deficit.

California's new budget covers $32 billion deficit while extending tax credits for film industry - Adam Beam, AP via Washington Post. "Despite the deficit, lawmakers agreed to extend tax credits for movie and television productions that film in the state. Those credits will reduce state revenues by up to $330 million per year. The big change is that those tax credits will be refundable. That means if a movie studio has credits that are worth more than what it owes in taxes, the state will pay the studio the difference in cash."

Trump launches FairTax attacks while supporters in House push for bill - Emily Brooks, The Hill:

A bill to implement a national sales tax in place of the federal income tax system has become an attack line for former President Trump as he aims to tear down Florida Gov. Ron DeSantis in the Republican presidential primary.

But the attack line based on the FairTax bill, which would overhaul the current system and implement a 23-percent sales tax nationwide, is having little effect on the policy in Congress, where many Trump supporters who co-sponsor the legislation still support the idea.

Distributor Exceeded P.L. 86-272 Protection, Minnesota Court Finds - Andrea Muse, Tax Notes ($):

In Uline Inc. v. Commissioner of Revenue, the Minnesota Tax Court determined that the distributor’s practice of having its sales representatives obtain information concerning its competitor’s products and business practices served a business purpose independent from the solicitation of orders and is not protected by P.L. 86-272. The opinion, dated June 23, was signed June 26.

Uline Inc. is an S corporation headquartered in Wisconsin that distributes industrial and packaging products. The company sold its Minnesota distribution center in September 2013 and had no physical office, distribution center, or place of business in the state in tax years 2014 and 2015. Uline’s Minnesota sales representatives submitted orders to its distribution facility in Wisconsin for acceptance, and the products were then shipped to Minnesota customers using common carriers.

Minn. Tax Court Says Biz Maintained Enough Contacts For Tax - Maria Koklanaris, Law360 Tax Authority ($):

Of the activities conducted by Uline employees in Minnesota — which included customer visits, documenting those visits in at least two ways, attending job fairs and occasionally personally picking up customer items to be returned — the tax court examined two that could have defeated the protections of P.L. 86-272.

Those two were the preparation of a document called "market news notes" and the occasional personal pickup of customers' items for return...

Preparing the market news notes, for which Uline maintained company guidelines, involved market research that included obtaining information about the company's competitors, Judge Wendy S. Tien wrote for the tax court.

P.L. 86-272 is a 1959 statute enacted to limit the reach of state income taxes. It prohibits states from taxing a business whose only activity is selling goods into the state from another state, and whose sales representatives have very limited duties in the selling state. This case illustrates how easy it is for businesses to overstep those limits and become subject to tax in a destination state.

Related: Eide Bailly State & Local Tax Services.

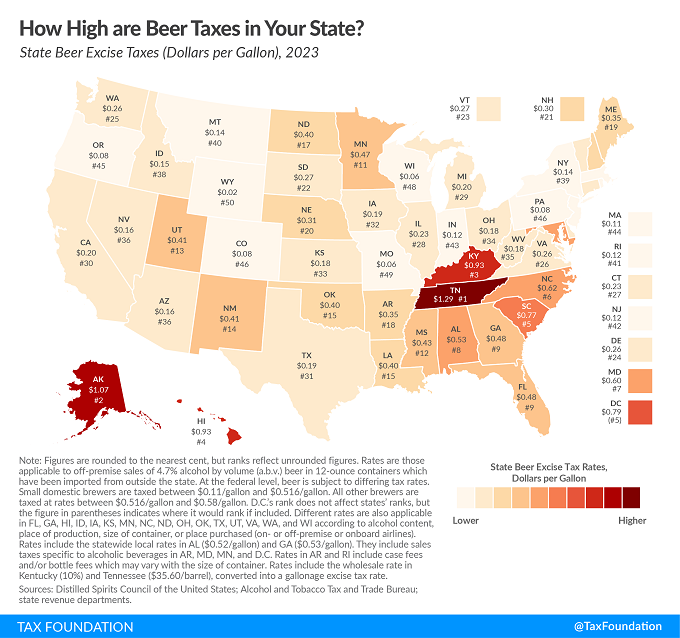

How High are Beer Taxes in Your State? - Benjamin Jaros and Adam Hoffer, Tax Policy Blog. "One might expect the price of beer to be driven primarily by the price of grain or hops. However, according to the Beer Institute, “Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.” A report in 2005 found that all the different layers of taxation on production and distribution make up about 40 percent of the retail price for beer."

How to avoid tax payment theft, like that allegedly committed by GA tax clerk - Kay Bell, Don't Mess With Taxes. "Don't pay with cash. No judging or victim blaming here. I don't know why the Georgia taxpayer chose to pay in cash. And I'm definitely glad that his actions led to further investigation."

Unless, of course, you are a state-legal cannabis dealer who is shut out of the banking system. Then you have to use cash.

Time is running out for millions to file 2019 tax returns and claim refunds - Wolters Kluwer Tax & Accounting. "Taxpayers usually have three years to file and claim their tax refunds, making the three-year deadline for filing 2019 returns to claim a refund in 2022. However, the IRS postponed the deadline to July 17, 2023, due to the COVID-19 pandemic."

Eighth Circuit: Value of Taxable Estate Includes Insurance Proceeds Used to Redeem Shares - Parker Tax Pro Library. "The court reasoned that in order for a willing buyer at the time of Michael's death to own Crown outright, the buyer would control the life insurance proceeds and therefore would pay up to $6.86 million for Crown, 'taking into account' the life insurance proceeds and then either extinguishing the agreement or redeeming the shares. On the flip side, a hypothetical willing seller of Crown would not accept $3.86 million knowing that the company was about to receive $3 million in life insurance proceeds."

The Bipartisan Road to a U.S. Carbon Border Tax - Nana Ama Sarfo, Tax Notes Opinions. "If the United States were to implement a carbon border tax, it would need to know which kinds of industrial goods release the highest emissions during production, and which countries are the worst carbon offenders. Sens. Christopher A. Coons, D-Del., and Kevin Cramer, R-N.D., want to start tracking that information."

The R&D Credit and the OECD Global Min Tax - Alex Parker, Things of Caesar. "Yet, the credit is coming under threat from outside, thanks to the Organization for Economic Cooperation and Development’s 15% global minimum tax. The 141-country agreement, which was heavily supported by President Biden, could encourage other countries to enact new taxing rules that target U.S. companies when they use incentives such as the R&D credit. This has become a rallying cry for Republicans critics of the agreement, who have threatened everything from retaliatory taxes to cuts in U.S. funding to the OECD in response to the plan."

FEIE vs. Foreign Tax Credit: Which One to Choose? - Kasia Strzelczyk, 1040Abroad. "When it comes to navigating the complexities of international taxation, understanding the distinctions between the Foreign Earned Income Exclusion (FEIE) and the foreign tax credit is crucial. These two mechanisms offer expatriates different options for minimizing their tax liabilities."

Institute for Policy Studies Settles False PPP Loan Allegations - Bloomberg ($):

The US Attorney’s Office has reached a $501,161 settlement with the Washington, D.C.-based Institute for Policy Studies involving Second Draw Paycheck Protection Program Loan allegations, according to a Monday news release.

...

The nonprofit admitted as part of the settlement that it falsely certified to the SBA that it wasn’t a think tank primarily engaged in political or lobbying activities despite publicly stating otherwise, which violated the Coronavirus Aid, Relief, and Economic Security Act, according to the office.

The institute's website says "IPS is a progressive organization dedicated to building a more equitable, ecologically sustainable, and peaceful society. In partnership with dynamic social movements, we turn transformative policy ideas into action."

Competing Accounts of Justice Dept.’s Handling of Hunter Biden Case - Glenn Thrush and Michael Schmidt, New York Times ($). "The plea deal last week was fraught for many reasons. It meant that the president’s son was admitting to criminal behavior by failing to file his taxes on time and would be subject to a diversion program on a felony charge of illegal gun possession, but would be spared time behind bars if a judge approves. Republicans immediately denounced it as a 'sweetheart deal' by the Biden team."

North Carolina CFO sentenced to 18 months in prison in multimillion tax fraud case - IRS (defendant name omitted, emphasis added):

Defendant, of Fayetteville, N.C., was sentenced today to 18 months in prison, followed by one year of supervised release to include home confinement, for tax fraud. On January 24, Defendant pled guilty willfully filing a false tax return with respect to nearly $25 million in unreported income he paid to himself from his company. In addition to his prison sentence, Defendant was ordered to pay more than $4.6 million in additional restitution.

"As noted by the judge at sentencing, this businessman used a sophisticated scheme over many years to knowingly divert corporate proceeds to support his lifestyle by claiming fancy jewelry, such as a Rolex watch, a Cartier diamond necklace and a Tiffany bracelet were business expenses," said U.S. Attorney Michael Easley. "We will not allow wealthy tax cheats to line their pockets at the expense of hardworking American taxpayers."

According to the criminal information and evidence summarized in Court, Defendant became the CFO and majority owner of an insurance and Human Resources benefits business, Ebenconcepts. Beginning at least as early as 2012, Defendant began to lavishly spend company funds for his own benefit, for example purchasing a watch for approximately $145,000 and spending approximately $300,000 of company funds for a swimming pool at his residence. As these expenditures came to light, Defendant filed for Chapter 11 bankruptcy. During the bankruptcy proceedings, an accounting firm retained by the Bankruptcy Trustee discovered almost $25 million in personal expenditures attributable to Defendant reported as business expenses between tax years 2012 and 2018. Defendant filed false personal returns over that period, which failed to report the income, leading to almost $6 million in uncollected federal income taxes.

Bankruptcy court can be a dangerous place when you have something to hide.

Pudding! It's National Tapioca Day!

Make a habit of sustained success.