Publication note: Next week Jenny McGarry will be running the daily roundups to cover for vacations and meetings. What passes for normal here resumes the following week.

Second Quarter Estimated Tax Payments Are Due Today! Information on how to pay here.

Big Companies on Verge of New Market for Clean-Energy Tax Credits - Richard Rubin, Wall Street Journal:

Many companies that generate clean energy don’t make enough profit to use all of the tax credits they could claim. So under the new rules, which are part of last year’s Inflation Reduction Act, a utility-scale solar installation could sell its tax credits to a tech company that had no involvement in the project but was looking for a lower tax bill. A school district, meanwhile, could get a direct cash payment for buying electric vehicles, equal to the tax credit a for-profit entity could get.

...

Credits can be transferred only once, and generally, the recipient bears the legal risk of audits. Lawyers and deal makers expect tax credits to sell at a discount, with prices varying based on the record of the project developer and other factors. Many expect prices to exceed 90 cents on the dollar, so that a large company might pay more than $90 million for $100 million of tax credits.

IRS Releases Info on Direct Pay and Transfer of Energy Credits - Mary Katherine Browne, Tax Notes ($):

Temporary regulations (T.D. 9975) set forth mandatory information and registration requirements for qualified taxpayers planning to take advantage of elective payment election and transferability election options established by the IRA and the CHIPS Act.

The IRS and Treasury also issued proposed regs addressing the section 6417 elective payment of applicable credits (REG-101607-23), the section 6418 transfer of specific credits (REG-101610-23), and the elective payment of the advanced manufacturing investment credit (REG-105595-23). Written comments for all proposed regs are due August 14.

The IRS also released a list of frequently asked questions regarding direct pay and transferability.

From the FAQ:

Q1. What is an Elective Payment (also known as an "elective pay" and informally as "direct pay")? (added June 14, 2023)

A. Elective pay allows applicable entities (as defined), including tax-exempt and governmental entities that would otherwise be unable to claim these credits because they do not owe federal income tax, to benefit from some clean energy tax credits by treating the amount of the credit as a payment of tax and refunding any resulting overpayment.

...

Q2. What is Credit Transfer (also known as "transferability") and who can use it? (added June 14, 2023)

A. Transferability allows a taxpayer who generates certain clean energy tax credits to elect to transfer (i.e., sell) all or a portion of a tax credit to an unrelated third-party transferee (i.e., buyer) in exchange for cash. In such transactions, the buyer and seller negotiate and agree to the terms and pricing. The transferor is sometimes referred to as the "seller" and the transferee is sometimes referred to as the "buyer". Applicable entities cannot use transferability; they can only use elective pay.

Crypto Reg Delay Ruffles Lawmakers - Lauren Loricchio, Tax Notes ($):

Treasury is taking more time than usual to issue proposed regulations for cryptocurrency, puzzling observers and troubling some members of Congress who are eager for the industry to comply with tax reporting requirements.

The Office of Management and Budget’s Office of Information and Regulatory Affairs finished reviewing proposed regulations on cryptocurrency broker reporting requirements on February 23 — six weeks after receiving them from Treasury. At press time the proposed regs hadn’t been released.

Crypto Tax Collections Creep Up Even as Many Investors Don’t Pay - James Munson, Bloomberg. "The US has raised $109.6 million revenue in recent years from taxpayers buying and selling cryptocurrencies, according to court filings. India collected 1.6 billion rupees (US$19 million) in the taxation year that ended March 20, 2023, its Finance Ministry said. Taxpayers in France in 2021 declared 400 million euros ($428 million) in gains from cryptocurrencies, a tax agency spokeswoman said. Neither the UK tax authority nor the European Commission have crypto tax compliance data, they said."

Senate Taxwriters Try to Work It Out on Child Tax Credit - Cady Stanton, Tax Notes ($). "Senate Finance Committee members agreed on the need for interplay between employment and financial support for American families living in poverty at a June 14 hearing but butted heads over the merits of implementing stronger work requirements for families using the CTC."

Expanded Child Credit Didn't Suppress Jobs, Lawmakers Hear - Stephen Cooper, Law360 Tax Authority. "Expanding tax credits for children and working families as part of coronavirus pandemic relief efforts didn't dampen the rate of labor force participation, but it did raise millions of children out of poverty, a tax expert told the Senate Finance Committee on Wednesday."

The child credit debate is key to a tax package advancing this year. Unless an agreement on child credits is reached, the Senate may be unwilling to advance key business tax provisions, such as a restoration of the current deduction for research expenses.

Senate Tax Writers Broach Subject Central to Advancing House Tax Bill - Jay Heflin, Eide Bailly:

Senate Democrats are the majority party and have 51 members. For the House tax bill to pass the Senate, it will likely require 60 votes. This means that passage of the bill will require the support from at least nine Senate Republicans – most of whom oppose expanding the Child Tax Credit.

Several Senate Republicans have argued that the Child Tax Credit from the American Rescue Plan provided so much relief that it created a disincentive for recipients to find work. They think a work requirement should be included if there is an expansion of the Child Tax Credit.

College Athlete Collectives on Alert After Tax Exemption Warning - Erin Slowey, Bloomberg ($):

The IRS disrupted the name, image, and likeness industry by releasing a memo saying many organizations that fund college athletes no longer will be considered charitable.

...

The status and structure of NIL collectives aren’t universal. For example, The Foundation—a collective partnered with The Ohio State University—is registered as a charitable organization within the state. The 1890 Initiative, a collective for University of Nebraska athletes, said on its website that providing donations to NIL activities isn’t deductible for charitable contributions but could be tax-deductible as business marketing expenses.

Be careful in leaning on the "marketing expense" argument. If a business pays an athlete fees to appear at a store or make an endorsement, that's likely a deduction. If the business puts cash in a "collective" and doesn't get a specific benefit, or maybe just a name on a list of donors, it's harder to support a business deduction.

Colorado Creates Credit for Employer Contributions to Homebuyer Accounts - Emily Hollingsworth, Tax Notes ($):

H.B. 23-1189, signed into law June 7, establishes a credit equal to 5 percent of the employer’s contributions, up to $5,000 per employee. The maximum annual credit allowance is $500,000 per employer but credit amounts exceeding that total can be carried forward for up to five years. The credit will be available for tax years beginning on or after January 1, 2024, but before January 1, 2027.

The employer's contributions must be used for down payments and/or closing costs related to the purchase of a principal residence. If an employee terminates their employment or uses the contributions for ineligible expenses, the employer's credit will be subject to recapture, according to the bill.

Widely Promoted CRAT Tax Elimination Scheme Fails to Deliver - Richard Fox, Bloomberg. "This too-good-to-be-true 'tax strategy' has now been rejected by the Tax Court and shut down by the US Justice Department, and the names of the taxpayers who used the strategy have been disclosed to the IRS."

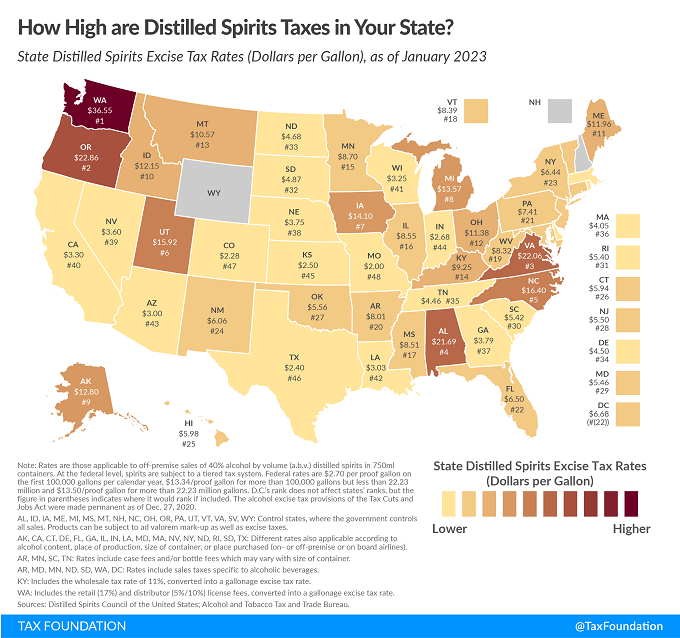

How Hard Do Distilled Spirits Taxes Bite in Your State? - Adam Hoffer, Tax Foundation. "Across states, Washington levies the greatest excise tax rate on distilled spirits, at $36.55 per gallon. The Evergreen State is followed by Oregon ($22.86), Virginia ($22.06), Alabama ($21.69), and Utah ($15.92). Distilled spirits are taxed the least in Wyoming and New Hampshire. These two control states gain revenue directly from alcohol sales through government-run stores and have set prices low enough that they are comparable to buying spirits without taxes. Missouri taxes are the next lightest at $2.00 a gallon, followed by Colorado ($2.28), Texas ($2.40), and Kansas ($2.50)."

Pay your taxes if you're planning a trip abroad - Kay Bell, Don't Mess With Taxes. "The U.S. Department of State can pull your passport or prevent its issuance or renewal if you have a substantial unpaid federal tax bill."

IRS Encourages Taxpayers To File Late Returns By June 14 To Avoid A Bigger Penalty - Kelly Phillips Erb, Forbes. "Haven't yet filed your 2022 taxes? Now is your chance. If you missed the April 18 tax deadline to file your 2022 federal income tax return and pay any tax, you should take action by June 14, 2023, to avoid a larger late-filing penalty."

Expanding Child Tax Credits Provides More Effective Inflation Relief Than A Higher Standard Deduction - Elaine Maag, TaxVox. "To better target benefits to low- and middle-income families with children, at reduced cost, Congress could instead modestly expand the child tax credit (CTC) in a variety of ways – that might garner bipartisan support. Even better would be to eliminate the phase-in of the CTC so that low-income families could receive the full benefit, often referred to as full refundability."

Tax Court Moves Toward Greater Transparency With Expanded Online Access But Could Do More - Erin Collins, NTA Blog.

The Tax Court provides several resources, including general information about filing a petition and answers to frequently asked questions. However, if a petitioner wants to research the pleadings in cases with similar issues, DAWSON does not provide remote access. Nonparties are only able to access non-sealed evidence, briefs, pleadings, and transcripts of proceedings by visiting the Tax Court building in Washington, D.C., during normal business hours or by calling the Tax Court records department and requesting items on a particular docket by telephone. However, the nonparty would need to provide information about the specific document, date, and docket number for the request. Without first seeing the docket, the nonparty may be unable to provide the necessary information to request the correct records by phone.

...

Although I welcome this change and thank the Court for increased access and transparency, I renew the recommendation in my 2022 Annual Report to Congress, in which I encouraged the Tax Court to use DAWSON to provide full access to case dockets on par with what the PACER system provides for dockets in other U.S. courts. With Administrative Order 2023-02, the Tax Court is improving public access by making posttrial and amicus briefs available electronically through DAWSON; however, the Tax Court should provide similar electronic access to the pleadings in non-sealed cases. Taxpayers deserve access and transparency in our court system and tax administration regardless of where they are located.

"DAWSON" is the Tax Court's electronic filing and case management system.

Pipeline Co. CFO Pleads Guilty In $6M Payroll Tax Case - Anna Scott Farrell, Law360 Tax Authority ($). "The chief financial officer of a company that builds and maintains pipelines pled guilty to failing to report and remit payroll taxes to the Internal Revenue Service, causing a tax loss of more than $6 million, the U.S. Department of Justice said."

Failing to remit payroll taxes is a terrible idea. Not only are those responsible potentially saddled with personal liability for the unpaid amounts, but it can easily become a criminal matter.

Link: Department of Justice Press Release.

Gold Broker’s Income Subject to Tax, Penalties, Tax Court Says - Chandra Wallace, Tax Notes ($). "A self-employed broker and consultant on gold and silver exchange markets owes nearly $3 million in taxes and penalties for the 2010 through 2016 tax years, the Tax Court held."

The taxpayer, whose name we will omit, made some bold arguments (from the Tax Court Opinion).

Petitioner argues that the payments he received from LMC are not taxable because he is not an “individual” subject to tax. Specifically, petitioner contends that he is a “citizen,” not an “individual.” Petitioner relies on section 7701(a)(1), defining “person” as an “individual.” Petitioner then argues that because “citizen” and “person” are listed together in various Code sections, the two are mutually exclusive and thus so are “citizen” and “individual.”

That's not how Tax Court Judge Greaves sees it:

Petitioner's theory that citizens do not need to pay federal income tax has been consistently rejected as frivolous by this Court...Petitioner was born in the United States and is subject to its jurisdiction, which makes him a citizen under the regulations. As a citizen, he is an individual as defined by section 1. Therefore, section 1 imposes a tax on his income, including the compensation he received from LMC. Consequently, we uphold respondent's determination that petitioner received unreported income of $3,492,526 in the years at issue.

Decision for IRS, with imposition of the 75% civil fraud penalty.

The moral? No matter how much research you have done to come up with your conclusion that your income isn't taxable, it helps not at all when the IRS, all the judges, and all the nice people in the federal marshals office have concluded otherwise.

Live it up. It's National Prune Day!

Make a habit of sustained success.