Publication note: Eide Bailly offices are closed tomorrow and Monday for the Memorial Day Holiday. This week's DC recap appeared yesterday and the state tax roundup will appear today. We will be back on schedule on Tuesday. Enjoy the long weekend!

SALT Cap Tweak, Child Tax Credit in the Mix for GOP Tax Package - Samantha Handler, Bloomberg ($):

The committee will roll out an economic package in early June, after the debt limit crisis has been resolved, lawmakers said. A research and development tax break, full bonus depreciation, and the interest expense deductions under tax code Section 163(j)—all of which expired at the end of last year—are expected to be included, said Rep. Kevin Hern (R-Okla.), a member of the committee.

Members are still jostling to ensure their priorities make the cut while the committee shapes the package. Some of those tax measures, such as lifting the $10,000 state-and-local tax deduction gap and changes to the Child Tax Credit, may give the package more votes—from both parties—but also dredge up some intraparty disputes.

Capitol Hill Recap: Debt Ceiling Contradictions - Jay Heflin, Eide Bailly:

House Republicans plan to introduce an “economic package” that would allow for R&D expensing, expand the 163(j) interest deduction (from EBIT to EBITDA), and up Bonus Depreciation to 100%, among other measures. These tax provisions have bipartisan, bicameral support.

The bill might also include an extension of the Child Tax Credit that was included in the 2017 tax reform bill. Certain lawmakers will only support modifications to the aforementioned business tax breaks if the legislation also extends the Child Tax Credit. (An extension of the 2017 provision is not what they want. They support extending the provision in the American Rescue Plan – or something close to it).

Mont. To Provide Optional Pass-Through Entity Tax, Credit - Zak Kostro, Law360 Tax Authority ($):

Montana will institute an optional pass-through entity tax and a refundable credit, allowing some stakeholders a workaround for the $10,000 federal cap on state and local tax deductions, under a bill signed by the governor.

S.B. 554, which Republican Gov. Greg Gianforte signed Friday, will allow pass-through entities to pay state income tax at the entity level, with owners allowed a refundable tax credit for their share of taxes paid, according to the bill text.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround.

House GOP Taxwriters to Step Up OECD Global Minimum Tax Beef - Stephanie Soong and Cady Stanton, Tax Notes ($):

More information: Why There Won't Be a Global Min Tax TreatyRepublican lawmakers have confirmed plans to introduce legislation pushing back against pillar 2 of the OECD global tax reform deal as they prepare to take their complaints to officials in Paris and Berlin.

...

Pillar 2 of the plan, which follows up on action 1 of the BEPS project, sets up a system of top-up taxation, under which multinational enterprises with annual group revenues exceeding €750 million pay an effective tax rate of 15 percent in every jurisdiction in which they operate. Pillar 2 relies on the global anti-base-erosion (GLOBE) rules, comprising the income inclusion rule and the UTPR. The latter was originally known as the undertaxed payments rule.

Belgium To Stop Sharing Data On US Residents With IRS - Kevin Pinner, Law360 Tax Authority ($):

The Belgian government won't transfer data about Americans living in the country to the IRS under the Foreign Account Tax Compliance Act after concluding the practice is unlawful under European Union law, its data protection authority said Wednesday.

The Belgian Data Protection Authority found that FATCA, a U.S. law that requires foreign countries to share American citizens' bank account information with the Internal Revenue Service through bilateral intergovernmental agreements, doesn't comply with the EU's General Data Protection Regulation, according to a news release.

FATCA, billed as a tool to crack down on cross-border tax evasion, has in practice cracked down on ordinary Americans abroad attempting to commit personal finance. It will be interesting to see if this helps trigger long-overdue reforms on the worldwide taxation of U.S. persons.

GOP attack on IRS funding runs counter to deficit reduction effort - Tobias Burns, The Hill. We knew that, but this at the bottom of the article is interesting:

Different parts of the economy are compliant with tax laws to different degrees. Workers and employees are the most law-abiding segment, reporting their wages and salaries with 99 percent accuracy, while business owners are far less tax law-abiding.

Among the least compliant sectors are farmers, whose income is subject to “little or no information reporting,” according to the IRS. Sixty-four percent of all farm income is misreported to the IRS, while business owners in sectors other than agriculture report their income with only 43 percent accuracy.

Tax is hard.

Federal income tax is now the most hated tax - Kay Bell, Don't Mess With Taxes. "One thing that also contributed to the increased disdain for the Internal Revenue Code is the finding that 60 percent of those surveyed said the amount of federal income tax they pay is too high."

It's funny how many people hate the income tax, but not for other people.

Tax Potpourri – Hobby Losses; Employer-Provided Housing; Tax Computation for Fuel Blenders; and Conservation Easement Deeds - Roger McEowen, Agricultural Law and Taxation Blog. "Recently, the U.S. Tax Court has issued opinions involving several areas that also can involve farmers and ranchers. With today’s post I highlight some of those recent cases and provide some context for how the issues might apply to agricultural producers and/or agribusinesses."

Lesson From The Tax Court: On Time Is Late - Bryan Camp, TaxProf Blog. "Judge Buch holds that their Petition was filed late, because 11:05 p.m. in Alabama was five minutes after midnight in Washington D.C."

No Deduction Allowed in 2012 for Lawsuit Settlement Check Delivered in 2013 - Parker Tax Pro Library. "The Tax Court held that taxpayers who tentatively settled a lawsuit in 2012 with United States Department of Housing and Urban Development (HUD) and delivered a cashier's check to their attorney to pay the settlement amount were not entitled to a deduction for the payment in 2012 because their attorney did not deliver the check to the government until 2013."

IRS Updates its Audit “Campaign” Targets – Who’s on the List? - Virginia La Torre Jeker, US Tax Talk. "The IRS just updated its audit campaign targets on April 28. Unsurprisingly, many of the campaign areas involve international taxation matters. For example, LB&I active campaigns are now ongoing for: expatriations (many individuals are not filing and paying taxes owed including “exit tax”); those claiming the foreign earned income exclusion / housing exclusion or deduction (many do not meet the necessary requirements in order to qualify for these beneficial exclusions); FATCA filing accuracy; tax noncompliance related to offshore banking; foreign corporations with US business activity; nonresident alien taxation matters; individual foreign tax credits claims and the list goes on."

Related: Eide Bailly International Taxation Services.

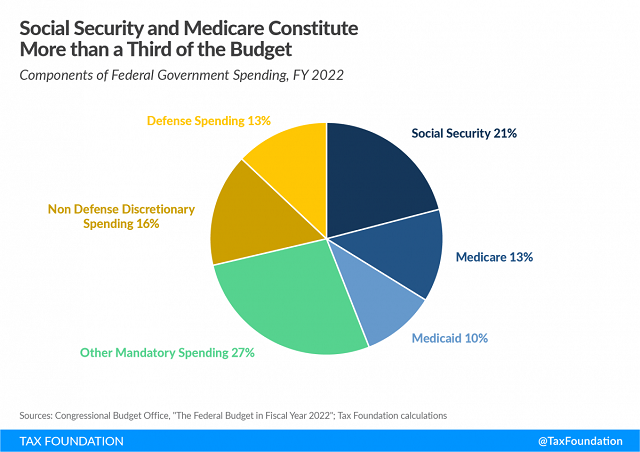

Tackling America’s Debt and Deficit Crisis Requires Social Security and Medicare Reform - Alex Durante, Tax Policy Blog. "While current debt ceiling negotiations largely concern ways to restrain the discretionary parts of the budget, any serious proposal to tackle the emerging debt and deficit crisis must also address our largest mandatory spending programs: Social Security and Medicare. Together, these two programs will be responsible for nearly 80 percent of the deficit’s rise between 2023 and 2032, according to Congressional Budget Office (CBO) projections."

Owner of two California construction firms sentenced to prison for employment tax crimes - IRS (defendant name omitted:

A California man was sentenced yesterday to 12 months in prison for willfully failing to account for and pay over employment taxes.

According to court documents and statements made in court, Defendant, of Berkeley, California, operated two construction businesses... These companies served as general contractors or subcontractors, including on some government projects. For both companies, Defendant was responsible for filing quarterly employment tax returns and collecting and paying over to the IRS payroll taxes withheld from employees' wages. Defendant, however, did not timely file employment tax returns or pay over withholdings to the IRS for 2014 and the last three quarters of 2015 for [one business] and for all four quarters of 2016 for [the other business]. In total, Defendant caused a tax loss to the IRS exceeding $250,000.

Not sending withheld taxes to the government is a terrible idea. I've seen taxpayers say they were just "borrowing" the funds to cover more pressing business needs. The IRS doesn't see it that way at all.

Chippewa Tribe Member’s Law Practice Income Not Exempt From Tax - Tax Notes ($). "The Tax Court held that an enrolled member of the Chippewa tribe is liable for self-employment tax on income from his law practice, finding that his income is not exempt from taxation under a treaty that gave the Chippewa the right to 'hunt, fish, and gather the wild rice' on their lands and that there is no exemption from tax in the Indian Citizenship Act."

Interesting argument. Tax Court Judge Holmes summarizes the taxpayer's position (I omit the taxpayer's name):

Taxpayer is an enrolled member of the Chippewa tribe who lives and practices law on the Leech Lake Reservation in Minnesota. In a treaty with the United States, the Chippewa kept the right to “hunt, fish, and gather the wild rice” on their traditional lands. Taxpayer says this is really the right to “food, clothing and shelter and travel, whereby the new canoe is the automobile.” He argues that this means that income from his law practice is tax exempt.

The taxpayer argued that another case pointed to a tax exemption. From the opinion (my emphasis):

Taxpayer points us to United States v. Brown, 777 F.3d 1025, 1031 (8th Cir. 2015), an Eighth Circuit case where that court held that the 1837 Treaty “indicate[s] that the Indians believed they were reserving unrestricted rights to hunt, fish, and gather throughout a large territory.” In deciding whether the right to fish included the right to sell fish, the court looked to history and concluded that the “Chippewa Indians' exercise of their usufructuary rights included selling what they hunted, fished, or gathered in order to make a modest living.” Id. (emphasis added). Taxpayer says that his law practice is analogous to hunting, fishing, and gathering wild rice in that it also enables him to make a “modest living.” He asserts that the right to make a “modest living” is what the 1837 Treaty means by its preservation of the Indians' rights to “hunting, fishing, and gathering the wild rice.” Continuing the analogy, Taxpayer argues that the right to “hunt, fish, and gather the wild rice” really means the right to “food, clothing and shelter and travel, whereby the new canoe is the automobile.”

"The new canoe is the automobile." But they won't let me drive a car in the Boundary Waters Canoe Area, so maybe not. Judge Holmes considers the argument, and:

We are not persuaded.

The right to hunt, fish, and gather may be the means to a “modest living,” but the Treaty does not clearly express an intent that it means a modest, tax-free living. Brown made no holding about whether Chippewa would owe tax on the sale of the fish they caught, much less a broad holding that includes an exemption from tax of any Chippewa earning a “modest income” from any other source. It held only that the Chippewa were not criminally liable for violating federal law because of their right to fish retained under the 1837 Treaty.

Win for IRS, but I admire the effort.

Together, they can lead to embarrassing karaoke incidents. Today is both National Wine Day and National Sing Out Day!

Make a habit of sustained success.