IRS Recognizes That Some Countries View Crypto as Tender - Mary Katherine Browne, Tax Notes ($).

The IRS has acknowledged that bitcoin is legal tender in some foreign jurisdictions while reaffirming that cryptocurrency still won’t generate foreign currency gain or loss for U.S. tax purposes.

...

While the notice acknowledges that some countries view cryptocurrency as legal tender, it contains no other modifications to the treatment of cryptocurrency. Instead, it states that the change doesn’t affect the answers to the FAQs in the 2014 notice. That includes Q&A-2, which concludes that convertible virtual currency isn’t treated as currency that could generate foreign currency gain or loss for federal tax purposes.

Link: Notice 2023-34

Related: New Tax Guidance Issued on Cryptocurrency Transactions.

IRS CCA: Guidance on Individual Holding a Cryptocurrency Native to a Blockchain Distributed Ledger that Undergoes a Protocol Upgrade - Bloomberg ($). "The IRS April 21 issued guidance on the tax consequences to an individual who holds a cryptocurrency native to a blockchain distributed ledger that undergoes a protocol upgrade. The guidance states: (1) an individual taxpayer, who holds 10 units of C, a cryptocurrency native to a distributed ledger that undergoes a protocol upgrade that changes the consensus mechanism by which transactions are validated, doesn’t realize gain or loss on those units under I.R.C. §1001 as a result of the protocol upgrade; and (2) an individual taxpayer doesn’t have an item of gross income under §61(a) as a result of the protocol upgrade. [CCA 202316008]"

Mont. Lawmakers OK Optional Tax On Pass-Through Entities - Sanjay Talwani, Law360 Tax Authority. "By a 96-2 vote Thursday, the House passed S.B. 554, sponsored by Sen. Greg Hertz, R-Polson. If enacted, The bill would allow pass-through entities to pay state income tax at the entity level, with owners allowed refundable tax credits for their shares of the taxes paid."

The proposal is set to take effect for 2023.

Kansas Gov. Vetoes Flat Tax Bill, Proposes Rebates - Jaqueline McCool, Law360 Tax Authority ($):

Democratic Gov. Laura Kelly issued her veto on the House of Representatives substitutefor S.B. 169 that would have replaced three income tax brackets for one that levies a 5.15% flat tax on income more than $6,150 for single filers and $12,300 for joint filers in 2024.

...

A representative for Speaker of the House Daniel Hawkins, R-Wichita, referred Law360 to Hawkins'statement on the veto. He said the Legislature intends to override Kelly's veto with a supermajority vote.

Kelly vetoes bill to cut Kansas taxes $1.4B over 3 years - John Hanna, AP via Washington Post. "The measure also would have reduced taxes on retirees’ Social Security incomes and accelerate phasing out of the state’s sales tax on groceries, so that it would end at the start of 2024 instead of 2025, both measures Kelly supported. It also would have reduced property taxes for most homeowners by $46 a year, a proposal pushed by Democrats."

Ford’s F-150 Leaves Tough Choices for Buyers Seeking Tax Credits - Kyle Stock, Bloomberg ($):

The tax credits also only apply to new EVs with a sticker price below $55,000, or trucks and SUVs priced under $80,000. And that’s where Americans’ truck lust is butting up against their taste for high-end trims. While the average gasoline-powered F-150 now sells for almost $63,000 — 25% more than five years ago — the electric version commands a premium of almost 30% over that, selling for $80,300 on average last month, according to Edmunds. That means roughly half of Ford’s electric pickups are too fancy for federal incentives.

“Honestly, I’m not even sure you can order the lower-end models at the moment,” said Zach Westrum, owner of Granger Motors, a Ford dealership near Des Moines, Iowa. “We’re about to find out very soon if these are just a second car for an affluent person or can become a primary car for a regular person.”

Small Towns Chase America’s $3 Trillion Climate Gold Rush - Phred Dvorak and Amrith Ramkumar, Wall Street Journal. "The federal laws, most notably the Inflation Reduction Act passed in August, offer huge subsidies aimed at shifting the nation to renewables and building new industries to compete with clean-energy powerhouse China. They sparked about $150 billion in investment announcements in renewables and battery storage in the eight months after the act passed, according to the American Clean Power Association, a clean-energy industry group."

Biden Threatens to Veto Bill to Lift Moratorium on Solar Tariffs - Ari Natter, Bloomberg ($). "President Joe Biden is threatening to veto legislation that would re-instate tariffs as high as 254% on solar panels imported from Southeast Asia, the White House said Monday."

Ruling In Foreign Penalty Case Could Blunt Other IRS Fines - Anna Scott Farrell, Law360 Tax Authority ($):

A recent U.S. Tax Court ruling overturned a long-standing IRS practice of automatically charging maximum penalties for failure to file information returns on foreign business interests, leaving vulnerable a host of penalties for failure to make related filings, including notice of large, foreign gifts.

...

The fallout could topple penalties for failing to file a variety of types of information returns required by the IRS for reporting international ownership in companies and certain kinds of foreign transactions. The penalties range from 10% of the fair market value of a property transferred to a foreign corporation for failing to file Form 926, to a compounding $10,000 charge per 30-day period for missing Form 8865 for foreign partnerships, disregarded entities or financial assets.

Related: Tax Court Decision may hamper IRS penalty collection for controlled corporations and partnerships.

Truckers and lawmakers pitch tax repeal to meet emission goals - Valerie Yurk, Roll Call. "Many in the trucking industry have long advocated repealing the 12 percent federal excise tax on the first sale of a heavy truck used on a highway, which can add up to $30,000 to the price of a high-end rig. And they're confident they will receive more interest from lawmakers as Democrats in Congress and President Joe Biden look to expand the nation's clean vehicle fleet equitably and affordably."

Many Tax-Exempt Orgs Face May 15 Filing Deadline - Kelly Phillips Erb, Forbes. "It's important to timely file. Organizations that fail to file required Forms 990, 990-EZ, or 990-N for three consecutive years will automatically lose their tax-exempt status. Revocation of the organization's tax-exempt status will happen on the filing due date of the third consecutively-missed year."

The great traditional IRA to Roth conversion debate - Kay Bell, Don't Mess With Taxes. "Pre-tax money goes into a traditional IRA, and in some cases the contribution is tax deductible. But when you get into your 70s, you must take required minimum distributions (RMDs) from the traditional retirement account. At RMD time, those taxes are collected at your then-ordinary income tax rate."

What’s the Difference Between a Traditional IRA and a Roth IRA? - Tanza Loudenback, Buy Side-WSJ. "Both traditional IRAs and Roth IRAs are tax-advantaged investment accounts you can use regardless of your employment status. But they are dissimilar in two ways: who is eligible to contribute and when, if ever, the money is taxed."

'It's been stressful': IRS garnishes tax return for Iowa couple caught in fraudulent unemployment scam - James Stratton, KCCI Des Moines. "KCCI Investigates first introduced you to Steven and Gloria Clark last summer. Then, the couple was on the hook for almost $3,800 for taxes on $30,900 of California unemployment money that was used in Steven's name. The state of California did recognize the scam and sent the Clarks a 10-99G tax form showing a zero-dollar balance. But, the IRS has not recognized the scam, nor has it wiped away the tax bill that the Clarks were told was just shy of $3,800."

Yes We CAMT - Alex Parker, Things of Caeser. "Is it possible that Republicans have found a tax they can live with?"

Monthly Payments Could Provide Low-Income Families With More Transparency Than Unpredictable Tax Refunds - Elaine Maag, TaxVox. "For families with incomes below the poverty level, tax credits average just over 20 percent of annual income in a typical year. Among families with incomes between the poverty level and up to double that amount, tax credits contribute an average of 14 percent of annual income."

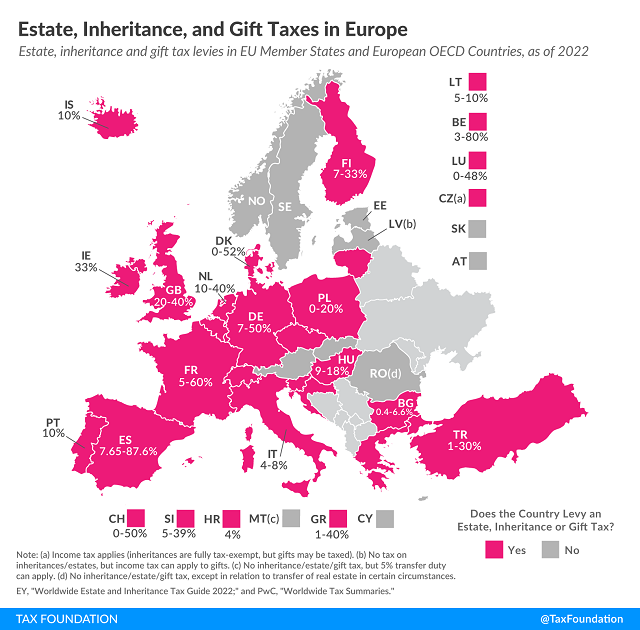

Estate, Inheritance, and Gift Taxes in Europe - Cristina Enache, Tax Policy Blog. "The majority of European countries covered in today’s map currently levy estate, inheritance, or gift taxes. These countries are Belgium, Bulgaria, Croatia, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Lithuania, Luxembourg, the Netherlands, Poland, Portugal, Slovenia, Spain, Switzerland, Turkey, and the United Kingdom."

IRS Completes Its 2023 'Dirty Dozen' Tax Avoidance and Fraud List - Carrie Brandon Elliot, Tax Notes Opinions. "The IRS warns that ERC promoters are not describing eligibility limits and are often collecting personal information."

Fox $787 Million Dominion Settlement Tax Write Off Is No Surprise - Robert Wood, Forbes. "Compensatory settlements by businesses are clearly deductible if they arise out of the business being conducted. Fox clearly meets that test. It doesn’t matter if the conduct producing the expense is later viewed as wrongful. The only exception is for certain confidential settlements in sexual harassment cases."

Court Finds Frivolous Return Penalty Applies To Trustee - Leslie Book, Procedurally Taxing. "The opinion reaches a sensible result, but in reading this and the recent Farhy case and other penalty cases for the treatise it strikes me that Congress may wish to take a fresh look at the scattered assortment of civil penalties, as well as the IRS’s process for determining whether a taxpayer has reasonable cause."

Former nonprofit leader pleads guilty to fraud in San Antonio - IRS (Defendant Names Omitted):

According to court documents, Defendant was one of two conspirators who operated the Latino Coalition Foundation, an entity organized as a charitable and tax-exempt organization, and Hispanic Business Roundtable Institute, formed as a domestic nonprofit corporation from October 2012 to September 2021. Defendant also controlled the two organizations' bank accounts.

Defendants solicited donations from at least two victims for the purpose of funding nonprofit programs. While some of the funding was used for its intended purpose, Defendant and Gutierrez also diverted between $250,000 and $550,000 of the charitable funds toward personal use credit card expenses. The payments to the co-conspirators were not reported and from 2017 to 2019, Defendant co-conspired to falsify the IRS Form 990s for the foundation.

Related: Seven Fraud Schemes You Need to Watch For Right Now.

Let it ring. It's both National Telephone Day and International Noise Awareness Day!

Make a habit of sustained success.