Impact of New IRS Funds Won’t Immediately Be Felt in Audits – Naomi Jagoda, Bloomberg ($):

The IRS has been able to spend some of the funds for taxpayer services quickly, leading to a smoother tax-filing season this year. However, it will take longer for the IRS to hire and train new enforcement personnel and boost the number of audits on wealthy households and complex businesses…

The IRS said that it has been able to hire and train new employees to audit partnerships, but the timing of the hiring and start date for training means that the impact of Inflation Reduction Act funding won’t been seen until at least fiscal 2025.

IRS has ten years to spend the $80 billion. Of that amount, $45.6 billion goes to enforcement.

So far, things seem to be improving at the IRS:

As taxpayer service improves, IRS staffers say they’re happier at work – Jacob Bogage, Washington Post:

It’s hired more than 5,000 workers and posted jobs for 5,300 more. It’s reopened walk-in tax clinics that shuttered as staffers quit over the years. Workers rejoiced in Cincinnati when the agency replaced almost two-dozen copy machines that had been down for almost three years. No longer must agents queue up in front of the machines to print and scan taxpayer notices.

For the first time in years, employees say, it’s not so bad to work for the tax man.

Employee Retention Tax Credit - Chris Cioffi, Bloomberg ($). "Ways and Means Committee Republicans want a status update from newly confirmed IRS Commissioner Danny Werfel on the processing of employee retention tax credit claims."

'We have received numerous inquiries and constituent complaints about the lengthy delays in processing the ERTC, and the lack of information being provided to those waiting on resolution of their claims,' according to the letter, led by Oversight Subcommittee Chairman David Schweikert (R-Ariz) and signed by 14 other lawmakers.

Fraud will likely be a subject raised at the hearing. From the letter ($):

We are also aware that the IRS warned about the rise of ERTC 'mills' last fall and we are concerned about the numerous reports of fraudulent claims being filed.

So far, neither tax-writing committee (House Ways and Means and Senate Finance) have announced a hearing on how the IRS is handling things. Both chambers are out of session until April 17th. It seems likely that an IRS hearing will wait until after tax season ends.

Biden EV-Sourcing Rules Leave Few Autos Eligible for Credits – Ari Natter, Gabrielle Coppola and Keith Laing, Bloomberg ($):

The guidance released Friday clarifying provisions of the Inflation Reduction Act — President Joe Biden’s landmark climate bill — will leave few EVs eligible for up to $7,500 credits as of April 18, administration officials said. The reason: most don’t meet new requirements that battery components or critical minerals are sourced from North America or US free trade partners.

Treasury Balancing Act on EV Tax Credits Leaves Open Questions – Alexander Rifaat and Mary Katherine Browne, Tax Notes ($). “Dozens of vehicles sold or leased in the United States currently qualify for subsidies, but a senior Treasury official told reporters that that number is expected to drop in the short term when the new rules go into effect.”

New EV Rules Mean Fewer Models Eligible for Tax Credit – Yuka Hayashi and Richard Rubin, Wall Street Journal ($):

The criteria will take effect on April 18, when a list of models that qualify for the tax credit will be issued. Until then, consumers can claim the full tax credit when they buy vehicles that are currently eligible, before some are expected to drop off the list.

Treasury’s needle thread on EV credits – Benjamin Guggenheim, Politico. “The guidance issued Friday looked like a compromise that addressed several stakeholders’ concerns but made no one terribly happy.”

More coverage is here.

Metaverse Economy Poses Daunting Challenges to State Tax Agencies - Michael Bologna and Donna Borak, Bloomberg ($). “State tax administrators are taking a closer look at the metaverse, concerned they may be missing tax revenue from platforms brokering sales of virtual products and services.”

SALT developments:

Republican members of Congress from high-tax states such as New York andCalifornia are hashing out ways to compromise on the state and local tax deduction cap—the SALT cap—in the run-up to a deal they’re looking to make before the 2024 election.

More on the SALT cap debate can be found in Eide Bailly’s Capitol Hill Recap, which is here.

Texas Tax Break Replacement Champions Chips, Excludes Renewables - Angélica Serrano-Román and Lauren Vella, Bloomberg ($):

The roughly two-decade-old economic development program, known as Chapter 313 for its position in the Texas tax code, was aimed at promoting manufacturing and renewable energy businesses until it ended on Dec. 31. A proposed replacement (HB 5) features a significant change—it would leave out the renewable energy companies that previously accounted for almost two-thirds of the active deals. Instead, top Texas officials want to prioritize manufacturing, supply chain, and critical infrastructure companies, such as those making semiconductor chips.

Kentucky Legalizes Sports Betting, Creates New Excise Taxes - Angélica Serrano-Román, Bloomberg ($). “The measure, HB 551, establishes a new 9.75% excise tax on the adjusted gross revenues on wagers made at a licensed facility and a 14.25% tax on wagers placed online or on a smartphone.”

Teleworkers Denied Extra Relief In St. Louis Earnings Tax Suit – Maria Koklanaris, Law360 Tax Authority ($). “A group of remote workers who won earnings tax refunds from St. Louis for days worked outside the city after the start of the COVID-19 pandemic won't get further relief, including attorney fees, a Missouri judge ruled.”

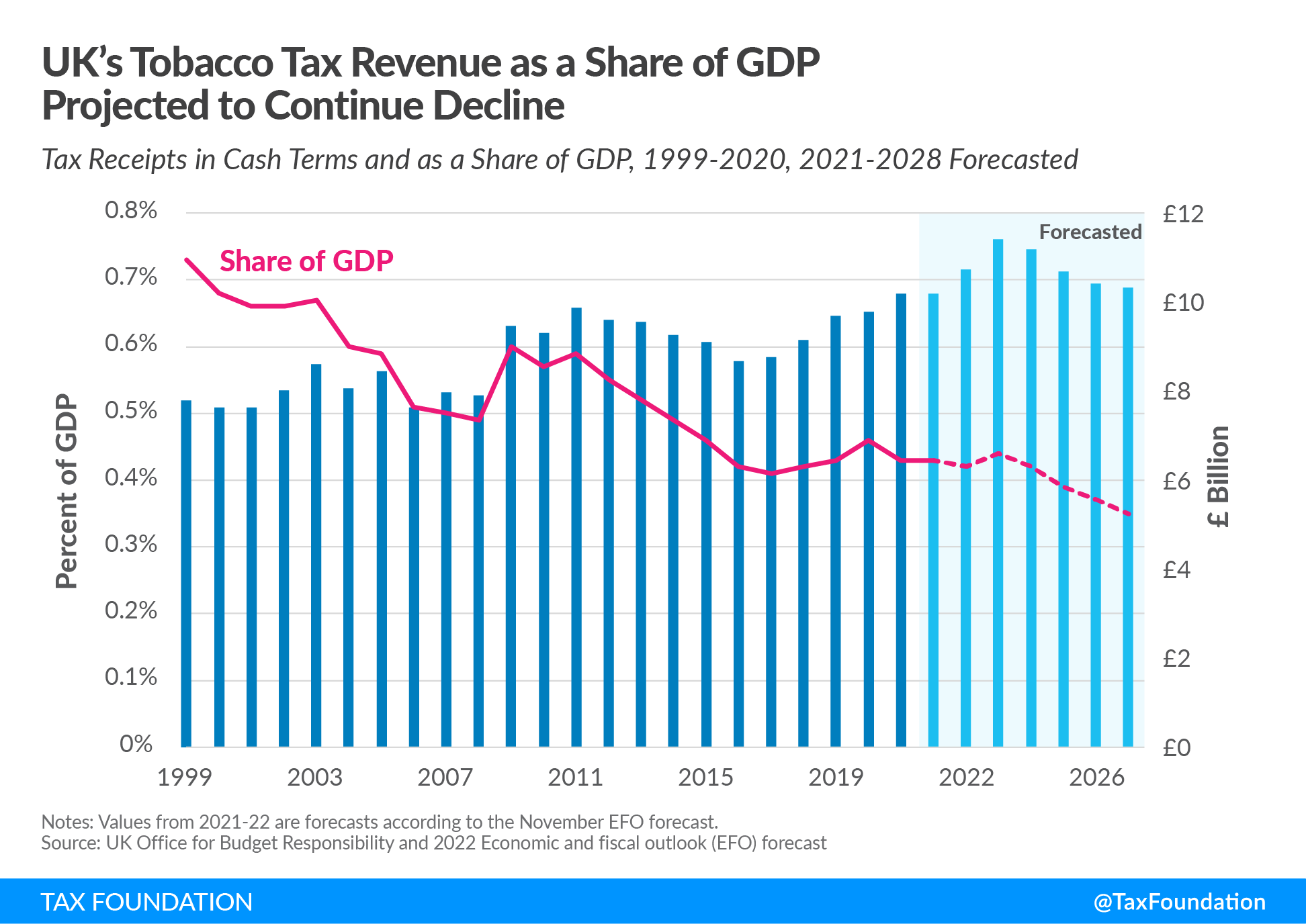

Shrinking Revenue from Sin Taxes: A Small Price to Pay for Healthier Behaviour – Adam Hoffer, Sean Bray and Cecilia Perez Weigel, Tax Foundation

Younger and healthier Brits have created a $17.1 billion budget hole by smoking and drinking less. That’s great news.

Excise taxes are generally levied on consumer products with negative public effects. Policymakers use these taxes to incentivize market participants to produce and purchase less of these ‘sinful’ products. Common excise taxes include those on tobacco products, alcohol, fuels, and carbon. The more successful the tax is at deterring consumption and production, the less government revenue is created.

New Corporate Minimum Tax Could Ensnare Some Firms Over One-Time Moves – Jennifer Williams-Alvarez, Wall Street Journal ($):

A new corporate minimum tax is stoking concern among some companies that one-time activities, such as the sale of a business unit, will push them over the threshold for the levy even though the companies wouldn’t otherwise qualify.

The 15% corporate minimum tax that went into effect at the beginning of this year applies to U.S.-based companies that report income to shareholders averaging at least $1 billion over three years. What’s more, once a company is subject to the levy, it remains that way even if profits decline unless certain conditions are met, such as a determination from the government that a company shouldn’t be subject to the minimum tax.

Corp. AMT May Require Cos. To Revisit Past Accounting – Stephen Cooper, Law360 Tax Authority ($). “The new 15% corporate alternative minimum tax has a three-year look-back period for companies to determine their liability, but in some cases they may have to review their accounting practices for earlier years or even look to the distant past.”

Can Congress Fix Treasury’s GLOBE Mistakes? – Mindy Hersfeld, Tax Notes ($). “The inevitability of global adoption of pillar 2 has helped motivate taxpayers to sharpen their focus and study how the rules will affect their individual businesses. Taxpayers are also working to educate their elected representatives about how these rules will harm U.S. taxpayers and the collection of U.S. corporate tax revenues.”

From the “Remember Me?” file:

LIFO - Chris Cioffi, Bloomberg ($):

The AICPA expressed its support for bills in both chambers—both of which have bipartisan support—that would allow auto dealers to delay the recognition of income triggered by the Last-In First-Out (LIFO) recapture, saying the failure to do so would hamper the ability of these companies to financially recover from global supply-chain issues.

The congressional focus on LIFO decreased as attention switched to R&D expensing. However, addressing the LIFO and R&D issues have a common bond: Neither one of them is large enough to pass Congress as a stand-alone bill. This means that both need a larger bill that they can hitch a ride on, and both could hitch a ride on the same bill. The only problem: Finding the right bill.

Today has everything. If you have a sweet tooth, it’s National Chocolate Mousse Day. If you’re looking for adventure, its National Find a Rainbow Day! And if you’re looking to par-tay, its World Party Day!

Lastly, for those in Minneapolis wondering why traffic is so bad:

The White House:

[T]he President will travel from Wilmington, Delaware to the Minneapolis, Minnesota area as part of his Administration’s Investing in America tour.

Make a habit of sustained success.