Welcome to this week's state and local tax roundup. Think of Eide Bailly for your state tax needs, whether you are dealing with income taxes, sales taxes, or business incentives and credits.

Pa. Justices OK J&J Unit's $2.1M Tax Refund In Sourcing Fight - Paul Williams, Law360 Tax Authority ($):

Pennsylvania's Supreme Court awarded Johnson & Johnson unit Synthes a $2.1 million tax refund Wednesday in a dispute that pitted the company and the state's tax agency against the state attorney general's office over how receipts for services should be sourced.In a split opinion, the state's top court upheld a Commonwealth Court's finding that Synthes, in West Chester, was permitted to source its receipts for services based on where its customers were located. The justices agreed with the state Department of Revenue and Synthes, who sided together before the Commonwealth Court after the agency initially denied the refund, that the state's sourcing law applied a market-based sourcing approach instead of a cost-of-performance method, which would source receipts to where services were performed.

Many states have moved to such "market based" sourcing of revenues in recent years. As most states now apportion income based on revenues alone, rather than on a combination of revenue, property, and payroll, this makes a big difference in where state income taxes are paid.

Corporate Tax Breaks Surge in Push for Chip and Electric-Vehicle Factories - Konrad Putzier, Wall Street Journal:

States and cities, flush with pandemic-stimulus cash, are ramping up their pursuit of new jobs by showering companies with big tax breaks.

States and local governments, including in Georgia, Michigan and West Virginia, agreed to give out at least $1 billion in subsidies eight times in 2022, according to an analysis from Good Jobs First, a nonprofit research group that is often critical of subsidies. These tax breaks, cash grants and other incentives went to companies in return for opening a factory.

Local Income Taxes: A Primer - Jared Walczak, Janelle Fritts, and Maxwell James, Tax Policy Blog. "Most states avoid municipal income taxes for good reason. They add substantial complexity for governments and taxpayers alike, particularly since taxpayers are far more likely to live and work across town lines than state lines. They are more volatile and less economically competitive than other forms of taxation available to local governments. And particularly in an era of enhanced mobility, they have the potential to drive outmigration or accelerate remote work."

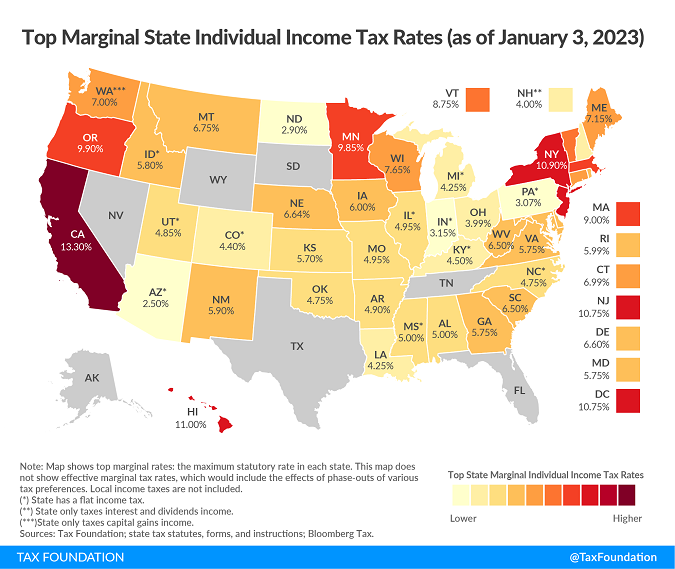

State Individual Income Tax Rates and Brackets for 2023 - Timothy Vermeer, Tax Policy Blog. "Of those states taxing wages, eleven have single-rate tax structures, with one rate applying to all taxable income. Conversely, 30 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state. Kansas, for example, is one of several states imposing a three-bracket income tax system. At the other end of the spectrum, Hawaii has 12 brackets. Top marginal rates range from Arizona’s 2.5 percent to California’s 13.3 percent."

State-by-state Update

Arkansas

Arkansas Bill Prohibiting Local Income Taxes Sent to Governor - Matthew Pertz, Tax Notes ($). H.B. 1026, sponsored by Rep. David Ray (R), was approved in the Senate on a 27–6 vote along party lines February 9 after passing the House 79 to 10 January 31. As of February 22 the bill was awaiting action by Gov. Sarah Huckabee Sanders (R), who has made phasing out the state income tax a priority.

Arizona

Ariz. Lawmakers OK Conformity With Federal Tax Code - Zak Kostro, Law360 Tax Authority ($). "SB1171 which passed the state House of Representatives by a 56-0 vote Monday after having cleared the Senate Thursday, would conform state tax statutes with the Internal Revenue Code to reflect changes made in 2022, according to a fact sheet accompanying the legislation."

Arizona Digital Sales Tax Bill Likely Dead For Year - Paul Jones, Tax Notes ($):

An Arizona bill to clarify sales taxation of digital goods and services appears to be dead for this session.

H.B. 2585 was introduced February 6, and missed the deadline for bills to be heard in committee in their chamber of origin. The office of the bill’s sponsor, Rep. Neal Carter (R), chair of the state’s Ways and Means Committee — to which the bill had been assigned — confirmed to Tax Notes in a February 17 email that a recent court decision in the case ADP LLC v. Department of Revenue had put the kibosh on the legislation for now.

Ariz. Gov. Vetoes Bill Prohibiting Local Residential Rent Taxes - Michael Nunes, Law360 Tax Authority ($). "In a statement, the Democratic governor said she vetoed S.B. 1184, which prohibits localities from imposing a tax or fee on the business of renting residential dwellings, as it lacks any enforceable mechanism to ensure relief will be provided to renters. She added that implementing the bill would require an appropriation of an estimated $270 million over the next year and a half, which would be outside a comprehensive budget agreement that is in place."

California

CA updates PTET FAQ - Melissa Menter, Eide Bailly. "The California Franchise Tax Board issued additional guidance on its pass-through entity elective tax, including how to make the election, how to make payments, and how to calculate and claim the credit."

Colorado

Colo. Senate Panel OKs Small Biz Delivery Fee Exemption - Sanjay Talwani, Law360 Tax Authority ($). "The Senate Finance Committee unanimously referred S.B. 143 to the Senate Appropriations Committee. If enacted, the bill would exempt businesses with less than $500,000 in retail sales from the state's 27-cent fee on retail deliveries by motor vehicle. The bill, sponsored by Senate President Steve Fenberg, D-Boulder, and Sen. Kevin Van Winkle, R-Highlands Ranch, would also allow retailers to pay the fee on behalf of a purchaser instead of passing it along as an itemized charge."

Georgia

Ga. Storm Victims Get Extension For State Taxes - Jared Serre, Law360 Tax Authority ($). "Following guidance issued by the Internal Revenue Service last month, taxpayers in nine counties now have a May 15 deadline for an assortment of filings and payments, the state said in a news release."

Illinois

Answers to Important Illinois Tax Questions - I Tax School (video)..

Indiana

Ind. To Allow Pass-Through Entity-Level Tax, Owners' Credit – Zak Kostro, Law360 Tax Authority ($). "Indiana will authorize qualifying pass-through entities to elect to pay tax at the entity level and provide refundable income tax credits to electing entities' owners under a bill signed by the governor."

Iowa

Iowa OKs Rules For Pass-Throughs' Composite Tax Returns -Zak Kostro, Law360 Tax Authority ($). "The regulations carry out a law signed in 2021 requiring pass-through entities to file composite returns to report the state income of nonresident members, according to a notice published Wednesday in the state administrative bulletin. The law also established a credit for those members in the amount of the tax paid on their behalf by the entity."

More information: Iowa Composite Returns for Tax Year 2022 and Later.

Iowa House Bill Seeks Pass-Through Election Options, Credit - Jaqueline McCool, Law360 Tax Authority ($). "H.F. 352, which was introduced Monday by the House Ways and Means Committee, would allow partnerships, excluding publicly traded partnerships and S corporations, to elect to be taxed at the partnership or S corporation level. Partners or shareholders would then be able to claim an individual income tax credit equal "to the ratio of the partner's or shareholder's share of taxable income over the total taxable income multiplied by the state tax liability of the electing taxpayer," according to the bill."

Kansas

Kansas Bill Would Provide Tax Credit for Pet Care Expenses - Emily Hollingsworth, Tax Notes ($):

H.B. 2419, introduced February 15 by the House Committee on Taxation, would provide a nonrefundable income tax credit for taxpayers equal to their pet care expenses for their cats or dogs, up to $500 each.

The bill added that an individual taxpayer could claim up to three Fidos or Snowballs for the credit.

Sadly for pet owners, a key member of the Kansas House Taxation Committee has no plans to hold hearings on the bill.

Kentucky

Kentucky Governor Signs Income Tax Reduction Bill - Matthew Pertz, Tax Notes ($). "H.B. 1, which will cut the state’s individual income tax rate to 4 percent, was signed into law February 17. The bill accelerates a rate reduction that started with H.B. 8 in 2022. For 2023 the individual rate will be 4.5 percent, and for 2024 and after it will be 4 percent."

North Dakota

ND House Approves Flat Income Tax - Jared Serre, Law360 Tax Authority ($):

A North Dakota bill that would replace the state's progressive income tax system with a 1.5% flat tax is one step closer to becoming law after passing the state House of Representatives.

H.B. 1158, introduced last month, passed the state House on Tuesday by a 79-14 vote. It now moves to the state Senate.

South Carolina

South Carolina weighs 'Yankee tax' on newcomer driving fees - James Pollard, AP via Washington Post. "Droves of newcomers have made South Carolina one of the nation’s fastest-growing states. As legislators respond to climbing population totals, a bill dubbed the “Yankee tax” could require freshly minted Palmetto State locals to pay $500 total in one-time fees for new driver’s licenses and vehicle registration."

The article does not clarify whether this will apply to newborns.

Utah

Utah House OKs Elimination Of Food, Grocery Tax - Jared Serre, Law360 Tax Authority ($). "If the bill is ultimately signed by Republican Gov. Spencer Cox, it will take effect only if a joint resolution that modifies intangible property tax revenue spending advances through the Legislature and is approved by voters. The target date for the potential grocery tax cut to take effect is Jan. 1, 2025."

West Virginia

West Virginia Senate Approves SALT Cap Workaround - Benjamin Valdez, Tax Notes ($). "The bill, a committee substitute for S.B. 151, would allow passthrough owners to elect to pay income tax at the entity level, for which the owners could claim a tax credit equal to their share of the tax paid, effectively skirting the federal $10,000 SALT cap enacted under the Tax Cuts and Jobs Act. The bill was approved 33 to 0 in the Senate February 17 and was sent to the House for consideration."

Wisconsin

Wisconsin High Court Upholds ‘Dark Stores’ Exclusion in Lowe's Valuation - Andrea Muse, Tax Notes ($). "The court concluded February 16 in Lowe’s Home Centers LLC v. City of Delavan that Lowe’s had not overcome the presumption of correctness afforded to the city’s property tax assessments and had failed to demonstrate that the assessments were excessive, giving deference to the trial court’s determination that the city’s appraisal was more credible than the appraisal by Lowe’s expert, which used dark and distressed properties as comparable sales."

Other news

Pa. Justices Nix BJ's Customer's 38-Cent Tax Refund Claim - Jaqueline McCool, Law360 Tax Authority:

A BJ's Wholesale Club customer isn't entitled to a 38-cent sales tax refund on purchases made with store coupons, because the coupons weren't described on the receipts, the Pennsylvania Supreme Court ruled Wednesday.

This is the best part, to me: The taxpayer "is represented by George Alexander Bochetto and John O'Connell of Bochetto & Lentz PC and William Wolk of Eaton & Wolk PL."

This is a lot of legal firepower for pennies, which makes me think that maybe, somehow, more than 38 cents was at stake.

Make a habit of sustained success.