IRS Proposes New Service Industry Tip Reporting Program - David van den Berg, Law360 Tax Authority ($):

The program would replace three current tip reporting programs, the agency said. Similar to those programs, the proposed replacement would generally grant employers accepted into the program protection from liability under Internal Revenue Code Section 3121(q)— which governs tips included for employer and employee taxes — for their covered businesses that comply with the program, according to the agency.

IRS Proposes New Tip Compliance Program - Eide Bailly:

According to the IRS, the proposed new program "is designed to take advantage of advancements in point-of-sale, time and attendance systems, and electronic payment settlement methods to improve tip reporting compliance. The proposed program would also decrease taxpayer and IRS administrative burdens and provide more transparency and certainty to taxpayers."

...

The SITCA program would take effect when the proposed Revenue Procedure is published in final form, Comments are requested by May 7, 2023.

IRS Guidance Coming on Taxability of State Inflation Relief - Kristen Parillo, Tax Notes ($):

Taxpayers who received inflation relief payments or refunds in 2022 from states such as California, Illinois, and Georgia may finally get answers from the IRS this week about whether those payments are income for federal tax purposes.

“The IRS is aware of questions involving special tax refunds or payments made by states in 2022; we are working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers,” the agency said in a February 3 statement.

From the statement: "For taxpayers uncertain about the taxability of their state payments, the IRS recommends they wait until additional guidance is available or consult with a reputable tax professional. For taxpayers and tax preparers with questions, the best course of action is to wait for additional clarification on state payments rather than calling the IRS. We also do not recommend amending a previously filed 2022 return."

Biden to Outline Tax Vision in State of the Union Address - Alexander Rifaat, Tax Notes ($):

President Biden will use his State of the Union speech February 7 to call for a permanent expansion of the child tax credit, the introduction of a billionaire minimum income tax, and a quadrupling of the corporate stock buyback excise tax.

In a statement released February 6, the White House said Biden will tie the proposals to recently passed legislation to outline his vision of “reforming the tax code to reward work and not wealth.”

Punchbowl News dismisses the prospects for the proposals: "Every president proposes policies they know Congress can’t or won’t approve. But we’re curious to see the mix between the achievable and the impossible for Biden tonight. For example, we don’t think the House will vote to pass a “billionaire minimum tax” or make stock buybacks more expensive."

IRS Failing in Oversight of Tax Prep Software, Critics Say - Lauren Loricchio, Tax Notes ($):

One former IRS official said the agency hasn’t been proactive when it comes to oversight of section 7216, which prevents tax return preparers from recklessly disclosing taxpayer information.

The news website The Markup recently reported that H&R Block, TaxAct, and TaxSlayer have been sending sensitive financial information to Facebook through a piece of code called the Meta Pixel, which prompted congressional Democrats to call for the Treasury Inspector General for Tax Administration to investigate the data-sharing practices of those companies.

Perfect Storm for Some Companies: Fewer Interest Deductions, Rising Rates - Mark Maurer, Wall Street Journal:

For years, businesses generally could deduct all of their interest expenses from their U.S. pretax income. The tax law signed by President Trump that took effect in 2018 initially limited these deductions to 30% of earnings before interest, taxes, depreciation and amortization, or Ebitda.

Last year, the tax law further reduced the cap, cutting it to 30% of earnings before interest and taxes and prohibiting companies from factoring in depreciation and amortization. For some firms, the move shrank the amount of taxable income that can be offset by interest expenses.

Also: "Companies are also dealing with higher taxes stemming from a change in the treatment of research-and-development costs."

Japan Releases 15% Global Minimum Tax Bill - Kevin Pinner, Law360 Tax Authority. "Japan's tax reform bill for 2023 includes the income-inclusion rule, or IIR, from the international minimum tax package known as Pillar Two, according to the outline published Friday by the Ministry of Finance. The IIR is the centerpiece of the 15% minimum corporate income tax plan endorsed by more than 130 countries in October 2021 in a process orchestrated by the Organization for Economic Cooperation and Development."

IRS Looks to Crack Down on Kraken for Summons Noncompliance - Mary Katherine Browne, Tax Notes ($):

The IRS issued a John Doe summons against Kraken in May 2021, in which it asked Kraken to produce information about its users who directly or indirectly held or controlled accounts that engaged in cryptocurrency transactions equal to $20,000 or more in value from 2016 through 2020.

Cryptocurrency transactions are taxable. Betting on Kraken keeping the IRS from getting that information is shortsighted tax planning.

Small refunds make a big impact on families wallets this tax season - Avery Joseph, KEYC.com. "'I’m sure tax professionals, tax preparers working on these returns are going to have to field a lot of questions and a lot of times tax payers aren’t expecting it so when it’s a surprise it’s hard for people to understand,' said Mankato Eide Bailly Department Head Brooke Forstner."

Tax moves to make in February 2023 - Kay Bell, Don't Mess With Taxes. "By now you should have received all those tax statements you need to file your 2022 tax return. Based on my personal experience, though, some issuers are slow this year. We're past the Jan. 31 delivery date, and I'm still waiting for a half dozen of them. And yes, I have checked the issuers' websites where available; no 1099s to download yet."

What Looks Different And What You Need To Know About Your 2022 Tax Return - Kelly Phillips Erb, Forbes. "The child tax credit had been enhanced in 2021 but was rolled back in 2022 to $2,000 per qualifying child. Phaseouts, which are not indexed for inflation, begin with an AGI of more than $400,000 for married taxpayers filing jointly and more than $200,000 for all other taxpayers."

IRS requires all taxpayers to answer digital assets question on 2022 FY Form 1040s - Mark Friedlich, Wolters Kluwer Tax & Accounting. "The IRS makes clear that unlike in previous years, for tax year 2022, everyone who files Form 1040, Form 1040-SR, or Form 1040-NR must check one box, answering either "Yes" or "No" to the digital asset question. The question must be answered by all taxpayers, not just those who engaged in a transaction involving digital assets in 2022."

Tax Court Opinion - Charitable Deduction Case Involving Estate Planning Fraudster - Roger McEowen, Agricultural Law and Taxation Blog. "The rules surrounding charitable giving can be rather complicated when the gift is not of cash and is of a significant amount. Those detailed rules were at issue in a recent U.S. Tax Court case. What made the case even more interesting was that it also involved taxpayers that got themselves connected with an estate planning and charitable giving fraudster that the U.S. Department of Justice eventually shut down."

Engineering Firm Entitled to Section 179D Deduction Allocated from Federal Facility - Parker Tax Pro Library. "The Tax Court held that the shareholders of an S corporation that contracted with a government entity to supply and install components of a federal building's heating, ventilation, and air conditioning system were entitled to claim an energy efficient commercial building property (EECBP) deduction under Code Sec. 179D for the installation, but their deduction was limited to the amount billed for the work."

Related: Section 179D Tax Deduction for Energy Efficiency Made Permanent.

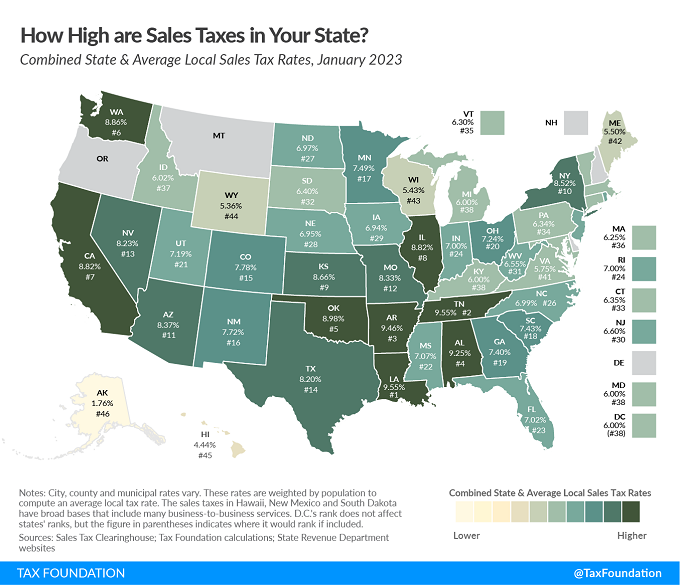

State and Local Sales Tax Rates, 2023 - Janelle Fritts, Tax Policy Blog. "The five states with the highest average combined state and local sales tax rates are Louisiana (9.550 percent), Tennessee (9.548 percent), Arkansas (9.46 percent), Alabama (9.25 percent), and Oklahoma (8.98 percent). The five states with the lowest average combined rates are Alaska (1.76 percent), Hawaii (4.44 percent), Wyoming (5.36 percent), Wisconsin (5.43 percent), and Maine (5.50 percent)."

Congress’s Medicare Financing Mess is Bigger Than You Think - Eugene Steuerle, TaxVox. "While Congress talks about the federal debt, it’s still hesitating to deal with one major source of rising deficits—Medicare—that it can’t avoid much longer. Medicare’s Hospital Insurance (HI) fund expenses increasingly exceed its revenues, and it is scheduled to run out of reserves to help pay for those expenses by 2028. If that happens, Medicare would only be able to pay about 90 cents on the dollar for hospital services. Absent some new means of finances, it would have to cut real benefits for retired and disabled individuals."

Fair Tax Act Of 2023 Has Rate That Varies - Peter Reilly, Forbes. "Discussions of the sales tax proposed in the Fair Tax Act of 2023 focus on the tax inclusive 23% rate. Using a tax inclusive rate makes it apples to apples with an income tax. If you make a hundred bucks and pay 23% you have $77 to spend. On the other hand every sales tax I know of is on the price without the tax. As an add on rate like other sales taxes the inclusive 23% rate is 29.87% and change."

The Potentially Insurmountable Hurdles to Wealth Taxation in America - Alex Parker, Things of Caesar:

Don’t get me wrong–implementing a wealth tax would still be a massive undertaking. Even if it were targeted at only the very wealthiest, it would require capacities that dwarf the current $80 billion enhancement at the IRS. The valuation challenges would be as difficult as enforcement of the current estate tax, but multiplied exponentially as they are undertaken on an annual basis.

But if Congress had the political will, it’s all theoretically possible. It would need to get over the constitutional hurdle first, however.

Former bank teller sentenced for federal fraud charges - IRS:

U.S. Attorney Duane A. Evans announced today that on February 1, 2023 United States District Judge Sarah S. Vance sentenced Defendant, of Marrero, Louisiana, to twenty-seven (27) months imprisonment followed by two (2) years of supervised release for violating Title 18, United States Code, Section 1344 (Bank Fraud), and Making and Subscribing False Tax Returns in violation of Title 26, United States Code, Section 7206(1).

...

From February 9, 2015, to October 28, 2016, Defendant used her position with the bank to embezzle approximately $349,556 from Client A's account by using 100 counter checks to debit funds from Client A's account... Defendant accessed or utilized legitimate checks drawn on Client A's account in order to prepare fraudulent counter checks. Defendant cashed 21 counter checks totaling $73,924 that were supposedly for "roofing," "market/garden work," "light fixtures/cleaning," "extras plumbing," "misc. work," "renovations," and "maintenance." Defendant cashed the other 79 counter checks totaling approximately $275,632 payable to another individual that were supposedly for "house," "maintenance," and for "happy birthday."

The "Happy Birthday" is an interesting touch. Somehow it's not surprising that the defendant didn't think to pick up the birthday present on her 1040.

On your toes! It's Ballet Day!

Make a habit of sustained success.