Key Takeaways

- IRS "zaps" $1 billion in penalties for 2020, 2021.

- Automated collections resume.

- "...there are so many taxpayers that will find themselves in a hole or be surprised by liens and levies in the coming months."

- IRS estimates 5 million returns affected.

- Relief is automatic.

- Senator questions tax collection policy for elder fraud victims.

- New Jersey corporate tax changes.

- Chile-US tax treaty takes effect.

- Pennsylvania fixes grantor trust taxation.

- EU-Ukraine tax policy scorecard.

- Buying a Benz is legal, stealing to fund one is not.

- Cathode Ray Tube and Dot Your I's day.

IRS Zaps Nearly $1 Billion in Penalties for Taxpayers - Ashlea Ebeling, Wall Street Journal:

Americans who owe back taxes will be given an incentive to pay up after the Internal Revenue Service said Tuesday it would waive nearly $1 billion in late-payment penalties.

Roughly 4.6 million individual taxpayers who owe for tax years 2020 and 2021 will be eligible for the penalty relief. The IRS is extending the olive branch because it stopped sending out many collection letters during the pandemic. It hoped the letter halt would help struggling taxpayers and reduce its backlog.

Ben Peeler, Leader of Eide Bailly’s Tax Controversy team, comments: “The penalty relief will be extremely helpful, but most notable will be the soft collection letters. More importantly, automated collection will resume. It is stunning that it has been held off for so long as there are so many taxpayers that will find themselves in a hole or be surprised by liens and levies in the coming months. Somehow this needs to be broadcast openly.”

Margarita Stone, a member of the Eide Bailly Tax Controversy team, adds: "In regard to the penalties – this is exciting news – For 2020, the IRS has now included the automatic removal of the failure to pay penalties, in addition to the removal of the failure to file penalties (for Taxpayers that filed their return prior to September 2022). For 2021, the IRS will automatically abate the failure to pay penalties, should Taxpayers have the failure to file penalty, this can still be removed by reviewing a Taxpayers compliance history or via reasonable cause."

IRS to Wipe Clean $1 Billion in Penalties as Collection Resumes - Jonathan Curry, Tax Notes ($):

The IRS announced December 19 that it will apply roughly $1 billion in automatic penalty relief to about 4.7 million taxpayers and businesses whose tax year 2020 and 2021 tax returns were affected by pandemic disruptions in notifications. Although the agency had paused much of its automated collection activity, failure-to-pay penalties continued to accrue over the past 22 months. More specific parameters of the relief were provided in Notice 2024-7, 2024-2 IRB 1, which was accompanied by a fact sheet to help taxpayers better understand the situation.

That’s the good news for the taxpayers. The bad news is they still need to pay the outstanding tax liability the IRS seemingly forgot.

IRS to Resume Collection Notices Following Pandemic Pause - Erin Slowey, Bloomberg ($):

Taxpayers who owe less than $100,000 will automatically get their failure-to-pay penalties waived. For taxpayers who already paid their penalties, the IRS will issue a refund or credit the payment toward another liability. Refunds will be begin to be processed this week, Werfel said.

“A clock will be running on the failure-to-pay penalty, and the penalty will resume accruing again on April 1, 2024,” he said.

To help taxpayers as the normal processes resume, the IRS will be issuing a special reminder letter starting next month. The letter will alert the taxpayer of their liability, easy ways to pay and the amount of penalty relief, if applied. The IRS urges taxpayers who are unable to pay their full balance due to visit IRS.gov/payments to make arrangements to resolve their bill.

The IRS is also taking steps to waive the failure-to-pay penalties for eligible taxpayers affected by this situation for tax years 2020 and 2021. The IRS estimates 5 million tax returns -- filed by 4.7 million individuals, businesses, trusts, estates and tax-exempt organizations -- are eligible for the penalty relief. This represents $1 billion in savings to taxpayers, or about $206 per return.

As a first step, the IRS has adjusted eligible individual accounts and will follow with adjustments to business accounts in late December to early January, and then trusts, estates and tax-exempt organizations in late February to early March 2024. Nearly 70 percent of the individual taxpayers receiving penalty relief have income under $100,000 per year.

The IRS is releasing Notice 2024-7, which explains how the agency is providing failure-to-pay penalty relief to eligible taxpayers affected by the COVID-19 pandemic to help them meet their federal tax obligations.

"As the IRS has been preparing to return to normal collection mailings, we have been concerned about taxpayers who haven't heard from us in a while suddenly getting a larger tax bill. The IRS should be looking out for taxpayers, and this penalty relief is a common-sense approach to help people in this situation," said IRS Commissioner Danny Werfel. "We are taking other steps to help taxpayers with past-due bills, and we have options to help people struggling to pay."

This penalty relief is automatic. Eligible taxpayers don't need to take any action to get it. Eligible taxpayers who already paid their full balance will benefit from the relief, too; if a taxpayer already paid failure-to-pay penalties related to their 2020 and 2021 tax years, the IRS will issue a refund or credit the payment toward another outstanding tax liability.

Additional coverage

Holiday bonus: IRS cancels $1 billion in taxpayer penalties - Julie Zauzmer Weil, Washington Post.

IRS to waive $1B of penalties for overdue pandemic-era taxes - Benjamin Guggenheim, Politico.

IRS To Provide $1 Billion In Penalty Relief To 4.7 Million Taxpayers - Kelly Phillips Erb, Forbes.

Related: Eide Bailly IRS Dispute Resolution & Collections Services.

Casey Asks IRS to Quantify Effect of Casualty Deduction Rollback - Cady Stanton, Tax Notes ($):

Senate Finance Committee member Robert P. Casey Jr., D-Pa., is pressing the IRS to quantify the impact of the Tax Cuts and Jobs Act’s limitation on personal casualty loss deductions on victims of fraud and scams.

Casey, who chairs the Senate Special Committee on Aging, asked IRS Commissioner Daniel Werfel in a December 19 letter to provide data on the number of taxpayers who have contacted the IRS about receiving large federal tax bills after being scammed; to explain whether the IRS has been documenting the impact of the deduction suspension on taxpayers; and to provide a breakdown on use of the deduction following passage of the TCJA.

...

The letter also cites a December 14 Washington Post article reporting the stories of older adults who owed large amounts of federal taxes in addition to the money lost to scammers as a result of the rollback of the deduction in the TCJA, as well as experiences of specific older Americans as reported by Forbes and CBS News.

US-Chile Tax Treaty Enters Into Force After Decade Plus of Delay - Chris Cioffi, Bloomberg ($). "A tax treaty allows businesses to avoid being taxed twice on the same income and creates a framework for resolving tax disputes between companies and governments while offering lower withholding rates. Chile joins Mexico and Venezuela on the list of Latin American countries that have a tax pact with the US."

Related: Eide Bailly International Tax Services.

Pa. Aligns With Federal Law For Taxation Of Grantor Trusts - Zak Kostro, Law360 Tax Authority ($):

Pennsylvania will align with federal tax law by allowing income received by a resident or nonresident trust from in-state sources to be taxable to the grantor of the trust under a bill signed by Gov. Josh Shapiro.

S.B. 815, which Shapiro, a Democrat, signed Thursday, will allow the grantor of a resident or nonresident trust to be taxable on the trust's income, to the extent the grantor is treated as the trust's owner under sections 671 through 679 of the Internal Revenue Code, according to a fiscal note. The bill stipulates that such income may be taxable to the grantor regardless of whether the income is distributed or distributable to the beneficiaries of the trust or accumulated.

Manchin seeks EV tax credit do-over - Kay Bell, Don't Mess With Taxes. "That means that right now only 11 electric cars from four automakers (Tesla, General Motors, Ford Motor, and Volkswagen) qualify for the full $7,500 credit. And now a U.S. Senator who helped write the EV provisions, which some argue already are creating chaos for consumers, wants to revisit the tax break regulations."

2023 and 2024 Tax Planning Ideas for Individual Taxpayers - Thomas Gorczynski, Tom Talks Taxes. "Capital loss harvesting can have many benefits for investors. It can offset either short-term or long-term capital gains, which can be taxed anywhere from a 0% rate to a 40.8% rate (including the net investment income tax). It can also reduce a taxpayer’s AGI, leading to downstream tax benefits. Capital loss harvesting must be done before the close of the tax year, and capital losses will not offset qualified dividends taxed at long-term capital gain rates."

What you need to know about RMDs under SECURE 2.0 - National Association of Tax Professionals: "Q: Must taxpayers who are over 72 and still working take an RMD from a 401(k) or a SEP IRA? A: If the plan allows postponement and they aren’t a 5% owner, taxpayers don’t have to start taking RMDs from the 401(k) until they retire. Check with the plan sponsor. SEP IRA account owners who have reached the age to start taking RMDs must take RMDs even if they are still working."

$700,000 Settlement Payment from Apartment Complex Was Not Excludable from Income - Parker Tax Pro Library. "The Tax Court held that two taxpayers, a formerly married couple who lived together in an apartment, could not exclude from gross income a $700,000 settlement payment received by one of the taxpayers from the owner of the apartment building as a payment made on account of personal physical injuries or sickness under Code Sec. 104(a)(2) because the payment was intended to compensate the taxpayers primarily for moving out of the apartment building."

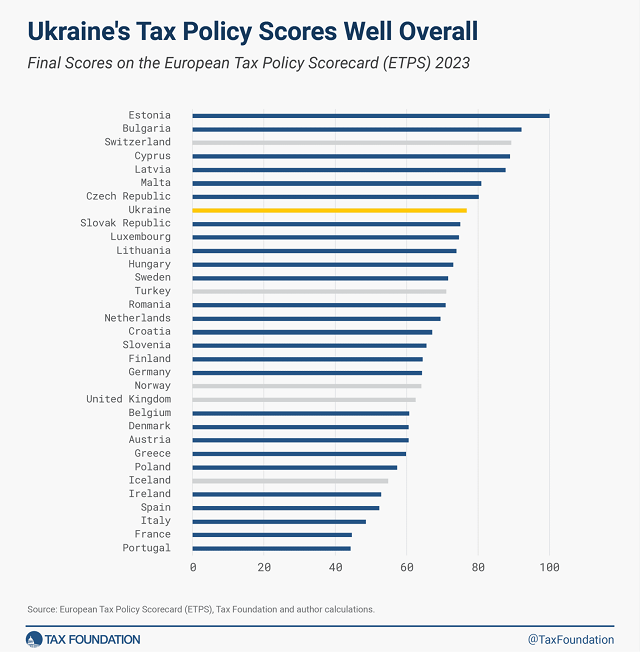

European Tax Policy Scorecard: How Competitive is Ukraine’s Tax System Relative to EU Member States? - Sean Bray, Scott Hodge, and Alex Mengden, Tax Policy Blog. "Aside from wartime tax policy measures, Ukraine’s current tax code is fairly conventional by EU standards and its rates are in line with other EU nations. The personal income tax rate is 18 percent, the corporate rate is 18 percent, and the value-added tax (VAT) rate is 20 percent. The social contribution rate is 22 percent with an additional 1.5 percent military surcharge."

Small Move for NBA, NHL Teams Could Be Monumental Loss for Washington Region - John Buhl, TaxVox:

Place-based tax breaks and public subsidies are always controversial with economists but popular with politicians, who, notwithstanding the evidence, view them as bringing jobs to their communities. But both agree that if you have high local unemployment, vacant office buildings, and unused infrastructure, securing a large private-sector investment is a worthy goal.

Alexandria suffers from none of these problems.

Why cutting IRS funding is not a conservative move - Brian Riedl, Washington Post:

My fellow fiscal conservatives must grasp the inescapable truth that in the long-term, federal taxes are headed upward. Annual budget deficits now exceed $2 trillion and will surpass $3 trillion within a decade, due overwhelmingly to soaring Social Security and Medicare shortfalls that neither party is willing to touch, and to rising interest rates on the federal debt. Even the most aggressive GOP cuts to discretionary spending would merely trim the projected deficit a decade from now from $3.3 trillion to $3.0 trillion.

So unless lawmakers are willing to finally address Social Security and Medicare, the only remaining debate is over whose taxes will rise and by how much. Simply enforcing existing tax laws is the lowest-hanging fruit — and protecting millionaires from IRS audits (sacrificing trillions of dollars in potential tax revenue over the long term) is a luxury that middle-class taxpayers can no longer afford.

Woman sentenced to 31 months in prison for stealing stimulus payments and purchasing Mercedes-Benz and jewelry - IRS (Defendant name omitted):

Defendant pleaded guilty on September 21, 2023. In her plea agreement, Defendant admitted that she collected personal information from homeless and low-income individuals as well as detainees at local detention facilities. She admitted she used the information to apply for Economic Impact Payments, commonly referred to as "stimulus checks," and directed payments to bank accounts she controlled. Defendant also admitted to using the information to apply for benefit payments from California's Employment Development Department (EDD), and to receiving at least 40 EDD debit cards in the names of others. Defendant used the EDD debit cards to withdraw cash from ATMs and to pay for jewelry, furniture, and a Mercedes-Benz G-Glass 550 SUV that the IRS seized.

As best I can tell, it's still legal to buy a Benz and bling. It's the theft that is the problem.

Contain your excitement. It's both Cathode-Ray Tube Day and Dot Your I's Day. I won't bother to explain these tubes to our younger readers, other than to note that they are not the series of tubes that constitutes the Internet.

Make a habit of sustained success.