Key Takeaways

- R&D plus CTC

- Heavy lift in 2025

- IRA and Obamacare

- Donating v. fraud

- Taiwan tax bill advances

- Taxing the rich

- Tip your servers!

R&D Should Be in Parity With Child Credit, Wyden Says – Doug Sword, Tax Notes ($):

Senate Finance Committee Chair Ron Wyden said a tax extender agreement should first settle the relationship between the two main components — expanding the child tax credit and restoring full research and development expensing.

“We’re going to have to have parity and my first choice would be to have parity between the child tax credit and research and development and then on top of that take some steps in terms of low- and moderate-income housing,” the Oregon Democrat told reporters November 30.

Wyden’s comment is not random. It happened right after 150 House Republicans urged House Speaker Mike Johnson (R-La.) to pass legislation allowing for R&D expensing and other tax relief – but their ask did not include modifications to the Child Tax Credit.

Capitol Hill Recap: Lawmakers Call for Passing Year-End Tax Bill – Jay Heflin, Eide Bailly:

Scores of House Republicans signed and sent a letter this week to Speaker Mike Johnson (R-La.) imploring him to pass by year-end legislation on the Big Three (R&D expensing, expanding 163(j)-interest deduction, and upping Bonus Depreciation to 100%).

We write to urge you to support legislative action in any upcoming package by the end of the year to support three important, pro-growth tax changes. Specifically, we support extending: immediate R&D expensing, full capital expensing, and a pro-growth interest deductibility rule… Failing to act quickly will jeopardize hundreds of thousands of American jobs.

If tax legislation passes Congress that includes R&D expensing then modifications to the Child Tax Credit will also likely be included, according to tax-writing lawmakers and their staff. That being said, how large the Child Tax Credit becomes may not be satisfactory to some members in Congress - which begs the question of whether these lawmakers will support the tax package.

There is the current tax debate regarding R&D and CTC. Then there will be the tax debate in 2025 that could dominate discussions on Capitol Hill for that year.

The Short Form: Parts of the TCJA Are Expiring Soon—Here’s What That Means for You – Noah Peterson, Tax Foundation:

Unless Congress acts, Americans are in for a tax hike in 2026.

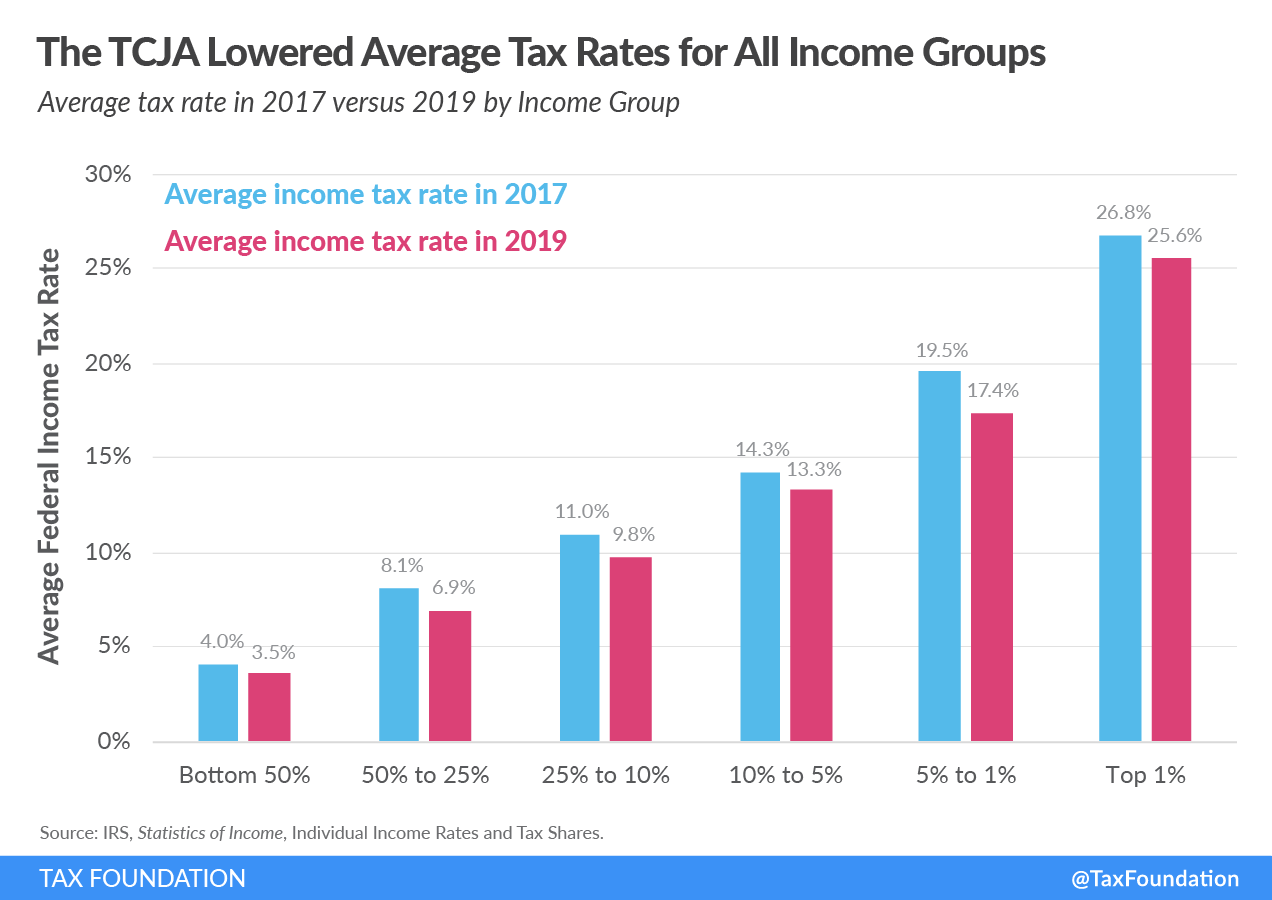

Why? In addition to business tax cuts and changes to the international tax system, the 2017 Tax Cuts and Jobs Act (TCJA) overhauled the individual income tax code, cutting taxes for all income groups on average. But these cuts are set to expire after the end of 2025, sticking most of us with a larger tax bill.

Somewhat related:

Unpacking Long-Awaited Clean Energy Tax Credit Guidance - Casey August, Andreas Andrews and Kathryn Seen, Law360 Tax Authority (commentary). “This guidance is also largely consistent with market expectations, except that the proposed regulations seemingly endorse the position that the apprenticeship portion of the PWA requirements need not be met after the energy project is placed in service.”

The guidance is here.

IRS Issues More Guidance for Manufacturers of Clean Vehicles – Erin Slowey, Bloomberg ($). “The IRS and Treasury Department released two sets of guidance on the excluded entity restriction for the clean vehicle tax credit from the Democrats’ tax-and-climate law.”

The documents are here and here.

Need help?

Energy Incentive Program – Eide Bailly:

Energy efficiencies, renewables, and decarbonization can translate into significant cashflow and funding savings.

A trusted advisor can help you benefit from energy efficiency and renewable credits and deductions, including Energy Efficiency Deduction (Section 179D), Residential Home Credit (Section 45L), and Clean Energy Investment Tax Credit (Section 48).

IRA Credits Creating ‘Battery Belt’ in U.S., Says Yellen – Alexander Rifaat, Tax Notes ($):

Treasury Secretary Janet Yellen has used a trip to North Carolina to argue that the energy tax credits enacted as part of the Inflation Reduction Act are spurring a new geographical manufacturing hub in the United States.

In a speech November 30 at a plant operated by lithium producer Livent Corp. in Bessemer City, Yellen argued not only that the implementation of the subsidies has led to an increasing number of clean energy production facilities, but also that those facilities are flourishing in areas traditionally reliant on conventional energy production.

Biden administration rolls out rules for foreign entities in electric car tax credit eligibility – Zack Budryk, The Hill:

The Biden administration has issued rules for determining which so-called foreign entities of concern are not eligible for electric vehicle tax credits under the Inflation Reduction Act (IRA).

The definition used by the Treasury Department will determine who is eligible for a $6 billion battery manufacturing and grant program under the Bipartisan Infrastructure Law, as well as the IRA’s $7,500 tax credit for the purchase of electric vehicles. Beginning in 2025, eligibility will be restricted if the battery contains either components or critical minerals from a foreign entity of concern (FEOC) under the language of the IRA.

Here’s the thing, these tax incentives may be on the chopping block. Lawmakers are expected to extend many of the 2017 tax reform measures that expire in 2025. This will be an expensive endeavor.

To offset the cost of this undertaking the energy tax incentives could be repealed or modified, according to tax staffers. A big determination in their fate will be the outcome of the 2024 elections. One party wants to keep them. The other party does not. We could have a redux of the Obamacare fights.

IRS Must Stay Fully Staffed in a Shutdown to Avoid Taxpayer Harm – Charles Rettig, Bloomberg ($) (commentary):

During a shutdown, the IRS and every other federal agency must comply with the requirements of the Antideficiency Act, which bars agencies from spending funds during a lapse in appropriations and prohibits them from employing personnel, unless specifically authorized by the OMB.

Considering that the IRS generates at least 95% of the gross revenue that funds our country, the agency—and funding sufficient to properly maintain its vital operations—is of utmost importance.

Rettig didn't write this because he was bored. The odds of a Federal government partial shutdown within the first two months of 2024 are higher than normal because of the spending arrangement lawmakers approved.

Individual’s Social Security Benefits Are Taxable, Tax Court Says – Tax Notes ($). “The Tax Court, in a summary opinion, held that Social Security benefits an individual received are includable in his income, rejecting his argument that the payments he received were a “survivor benefit” and finding that the Social Security Administration did not designate the payments as supplemental security income, which would not have been taxed.”

IRS Court Win Paves Way for Higher Taxes on Hedge-Fund Managers – Richard Rubin and Peter Rudegeair, Wall Street Journal ($):

The Internal Revenue Service scored a significant win over the hedge-fund and asset-management industries this week in a case that could bring higher taxes for many fund managers.

The U.S. Tax Court’s ruling could require managers to pay self-employment taxes of more than 3% on much of their income. If the opinion survives additional legal battles and is applied broadly, it would close off a popular technique that lets them exclude millions of dollars in income from self-employment taxes and related levies that others must pay.

Feds Ordered To Clarify IRS Leaker's Worker Status – Anna Scott Farrell, Law360 Tax Authority ($):

The federal government must produce its contracts with consulting firm Booz Allen clarifying the employment status of an IRS contractor who admitted leaking to the media the tax data of thousands of wealthy people, a Florida federal judge ordered in a billionaire's privacy suit against the tax agency.

The government must also produce details related to its arrangement with the firm, including whether Booz Allen evaluated contractor Charles Littlejohn's work and whether the Internal Revenue Service communicated directly with Littlejohn about his job duties, according to Wednesday's administrative order in hedge-fund founder Ken Griffin's case against the IRS.

Accountants, IRS and DOJ hunt for fraud – Michael Cohn, Accounting Today. “The IRS issued an advisory on Giving Tuesday calling attention to Charity Fraud Awareness Week. It noted that charitable organizations lose 5% of their revenue each year to fraud, according to the Fraud Advisory Panel, a U.K.-based organization that leads the effort in organizing Charity Fraud Awareness Week, which runs from Nov. 27-Dec. 1.”

The advisory is here.

Need help protecting against fraudsters?

Helping you maximize your resources so you can focus on your mission – Eide Bailly:

As a nonprofit organization, your mission is your passion, and you work endlessly to achieve it. But governance, compliance, financial, and operational issues can dominate your time and resources. Our professionals know the ins and outs of the industry and can help you with these challenges so you can focus on serving your community.

How to Donate to Charity, Get a Tax Break and Have Income for Life – Laura Saunders, Wall Street Journal ($). “With year-end pitches from charities rolling in, older Americans have a new option in 2023: donating funds from an IRA via a charitable gift annuity. Seniors should consider all the angles before jumping in.”

House Tax Panel Clears Taiwan Tax Relief Bill – Dylan Moroses, Law360 Tax Authority ($):

The House Ways and Means Committee unanimously approved legislation Thursday that would provide certain tax treaty-like benefits for Taiwanese businesses after bipartisan leaders of the panel reached agreement to proceed on the measure with Senate lawmakers…

A chairman's amendment to H.R. 5988 combined legislative language from proposals passed by the Senate Foreign Relations and Finance committees earlier this year to provide double-taxation relief and other treaty-like benefits for Taiwanese businesses.

EU Nearing Full Implementation of Global Minimum Tax Next Year - Stephen Gardner, Bloomberg ($). “European Union countries are largely on track to start applying Pillar Two of the global tax deal next year, but the finalization of Pillar One remains uncertain, an EU official said at a European Tax Adviser Federation seminar Wednesday.”

From the “Tax the Rich” file:

Senate Dems Seek Mark-To-Market Tax On Gains By Wealthy – Asha Glover, Law360 Tax Authority ($). “High-income and high-net-worth taxpayers would be required to pay a mark-to-market tax on the unrealized gains of their tradeable assets on an annual basis under a bill introduced Thursday by Senate Finance Committee Chairman Ron Wyden and co-sponsored by 15 Democratic senators.”

Mark-to-Market Bill Would End ‘Buy, Borrow, Die,’ Senator Says – Doug Sword and Chandra Wallace, Tax Notes ($):

Wyden insists that his billionaires tax could withstand a constitutional challenge, noting that its mark-to-market requirement is enshrined in sections 475, 877A, 1256, and 1296.

“I think there’s no question it’s constitutional,” Wyden said. “I don’t see how the Court can strike down sections of the federal tax code that we are using as our model that have been on the books a long, long time.”

The Republican-controlled House is unlikely to pass this bill, and the current Congress ends in December of 2024. In other words, this piece of legislation is not going anywhere for a while.

Respect! It’s National Bartender Day! I used to sling drinks. It’s harder than it looks. Tip ‘em well!

Make a habit of sustained success.