Key Takeaways

- Tax bill doesn't make the cut in House spending plan

- Cost to extend TCJA provisions is a WOW

- Crypto tax plans on hold

- Partnerships audits doubled

- Retirement strategies

- Firm joins Eide Bailly, Welcome!

Johnson's big test - John Bresnahan, Andrew Desiderio and Jake Sherman, Punchbowl News ($). This article is about the state-of-play for funding the Federal government. Current funding ends on Friday, November 17th.

[T]he House will seek to extend government funding until Jan. 19 for four spending bills: Agriculture, Energy and Water, Military Construction-VA and Transportation-HUD.

Funding for the rest of the federal government — the eight remaining bills — will be extended until Feb. 2.

What’s notable is what has been left out of this package: money for Israel, Ukraine, Taiwan and any extension of FISA surveillance authority.

Another thing to note is that the bill is missing tax provisions, like R&D expensing, expanding the 163(j)-interest deduction and upping Bonus Depreciation to 100%. The bill’s text is here.

If Congress can address these spending issues before Thanksgiving, then lawmakers will have time to pass additional pieces of legislation well before Christmas, which could include tax measures.

From the article:

[T]here will still be a year-end and first-quarter 2024 legislative crunch.

No tax provisions in Senate's spending bill as well:

Senate stopgap plan might extend to January, jettison war funds – Paul Krawzak, Roll Call:

The Senate’s CR vehicle won’t contain an extension of Federal Aviation Administration spending and revenue collection authority, since it’s not a tax bill and thus would be subject to a potential “blue slip” in the House. The FAA’s current authorization runs out Dec. 31, so lawmakers would still need to pass another extension if they can’t agree to a multiyear reauthorization.

Congress needs to address the FAA before December 31st or flying will become an interesting experience.

Bottom line: We're in wait-and-see mode on whether Congress will move a tax bill this year.

Speaking of taxes and Congress, the individual tax provisions in the 2017 tax reform bill expire at the end of 2025. Next year, 2024, the House Ways and Means Committee is expected to review these provisions to determine which should be extended, modified, or allowed to expire. The cost for extending all of these provisions is mind-blowing. So 2024 could be an interesting year for tax law.

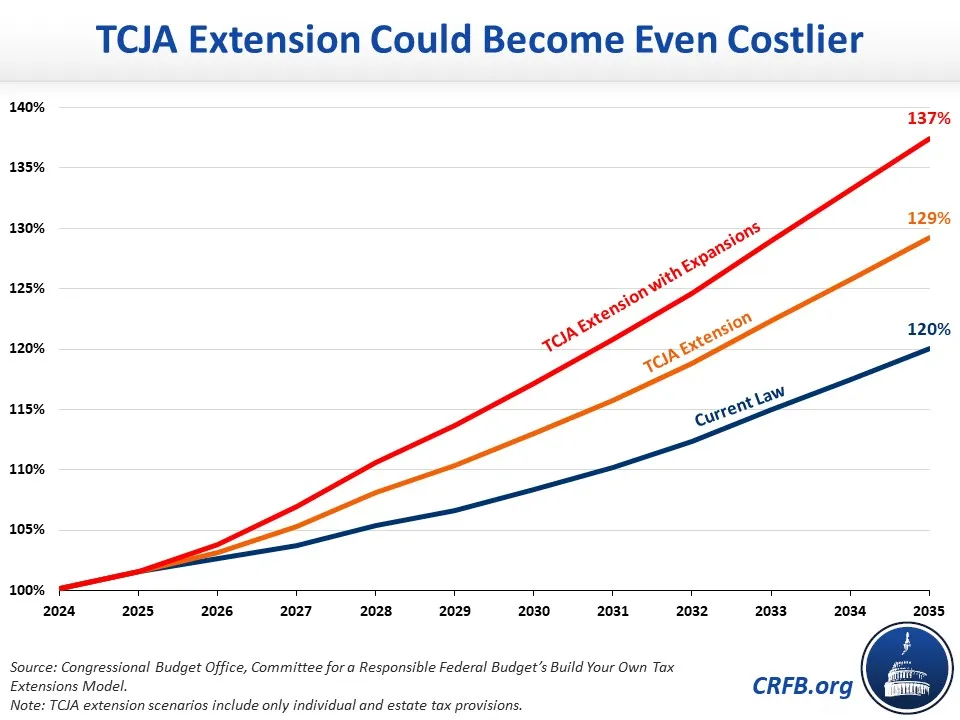

TCJA Expansions Could Balloon Cost of Extensions – Committee for a Responsible Federal Budget:

Extending various income and estate tax provisions of the Tax Cuts and Jobs Act (TCJA) expiring after 2025 would cost $3.4 trillion through 2035. Rather than beginning to discuss how to limit and offset these costs, however, many politicians in both parties are focused on expanding parts of the TCJA. We estimate an expanded TCJA could cost up to $6.4 trillionto extend through 2035.

Potential costs to extending the tax reform provisions:

Crypto Tax Changes on Hold as Lawmakers Seek Regulatory Clarity - Samantha Handler, Bloomberg ($). “Congress is a long way from passing legislation on ways to tax digital assets, as lawmakers zero in on regulating the industry first amid a crowded congressional agenda.”

IRS Doubles Exams for Partnerships in 2023, Still Misses Goal - Erin Slowey, Bloomberg ($):

IRS exams of partnership returns started in fiscal year 2023 jumped by 112% from the previous year, though still fell short of expectations, according to the agency’s annual financial report released Thursday.

The Internal Revenue Service started exams for 6,709 partnership returns in 2023, compared to 3,155 in 2022. But because of delayed phases of training and more time given to trainees, the IRS said it missed its goal of starting exams for 8,852 partnerships returns for the fiscal year.

IRS Releases Long-Awaited Guidance on Charitable Giving Tool - Michael Rapoport, Bloomberg ($):

Individuals who put money into donor-advised funds now have more direction from the IRS, after years of waiting.

The proposed rules (RIN 1545-BI33), released Monday, relate to excise taxes on taxable distributions made by a sponsoring organization from a donor-advised fund, and on the agreement of certain fund managers to the making of such distributions.

The document is here.

New IRS 401(k), IRA contribution limits a win if you need catching up – Erica Lamberg, Fox Business:

The IRS recently announced that the amount individuals can contribute to their 401(k) plans in 2024 has increased and catch-up contributions are getting a minor tweak.

"Tax-advantaged retirement accounts allow investors’ assets to grow without the tax friction experienced in typical brokerage accounts. It’s much like a track race," Jonathan Lee, senior portfolio manager, U.S. Bank Wealth Management, told FOX Business. "In this example, your contribution is the runner. Taxes on capital gains and dividends are hurdles to finishing the race (reaching the retirement savings goal) within a desired time frame. Tax-advantaged accounts eliminate those hurdles in saving for retirement."

We can help:

Protect the assets of your plans and meet challenges head on – Eide Bailly:

Offering competitive benefits, including a retirement plan, is important. It’s also critical to maintain plan compliance with current regulations. Our experienced employee benefit plan auditors can help identify compliance issues before the Department of Labor or the IRS.

You can expect quality service at reasonable fees with Eide Bailly. We build strong relationships with our clients, dedicating time and attention to ensuring a successful audit experience. We belong to the American Institute of Certified Public Accountants’ (AICPA) Employee Benefit Plan EBP Audit Quality Center (EBPAQC) and are one of the top 10 audit firms nationally for employee benefit plan audits. Our experienced professionals have audited over 1,400 retirement plans, resulting in increased insight and expertise to your audit experience.

Trial Should Decide IRS Donor Reporting Rule, Judge Rules – Anna Scott Farrell, Law360 Tax Authority ($):

A think tank's challenge to major-donor reporting requirements for nonprofits is headed to trial after an Ohio federal judge on Thursday rejected the federal government's bids to toss the case, saying questions about the disclosure requirement's constitutionality remain unanswered.

The Buckeye Institute, which brought the challenge in December, raised First Amendment questions during briefing and undercut claims by the Internal Revenue Service that the disclosure requirement is an important part of the agency's enforcement efforts, U.S. District Judge Michael H. Watson said in an order.

IRS Criminal Malta Summonses Raise Tax Defense Lawyer Hackles – Nathan Richman, Tax Notes ($). “Tax litigators are raising questions about whether the IRS Criminal Investigation division should be at the forefront of an investigation into Maltese pension arrangements that the IRS wants to make listed transactions.”

Liability Exposure For Unpaid Payroll Taxes May Surprise You – Douglas Charnas, Law360 Tax Authority ($):

The U.S. Court of Appeals for the Ninth Circuit's Aug. 11 decision in Richard W. York v. U.S. emphasizes the potential personal liability exposure that so-called responsible persons may have for payroll taxes under the Trust Fund Recovery Penalty, or TFRP, provisions of Internal Revenue Code Section 6672.

You may be a responsible person and not know it. Moreover, the failure of other personnel in a company to pay over to the IRS withheld employment taxes can result in personal liability for you, even if you are unaware of such failure.

We can help:

10 Common Payroll Mistakes to Avoid (and what they’ll cost you) – Eide Bailly:

Key Takeaways

- There is much more to payroll than simply ensuring your employees are paid correctly.

- Proper documentation and withholding practices are essential to the overall financial well-being of your organization.

- Many organizations outsource payroll to avoid costly mistakes.

Challenge to IRS EO Disclosure Rule Moves Forward – Fred Stokeld, Tax Notes ($). “A lawsuit challenging the constitutionality of an IRS disclosure requirement for tax-exempt charitable organizations will proceed after a district court denied summary judgment in the case.”

IRS Defends Inventory Tax on $6.5 Million in Partnership Gains - John Woolley, Bloomberg ($):

Proceeds from a foreigner’s $6.5 million sale of her interest in the US partnership that makes “5-hour Energy” drinks should be subject to US taxes to the extent that they are attributable to the partnership’s inventory held for sale, the IRS told the D.C. Circuit.

Whether her gain is sourced in or outside of the US for federal income tax purposes should be governed by source rules for inventory property under IRC Section 865(b), and not by those for personal property under Section 865(a), the IRS said. That’s because to do otherwise would permit her to transform US-sourced income into foreign-source income “simply by passing it through a partnership,” the government said.

Foreign Currency Regs Hope to Soften Compliance Burdens – Andrew Velarde, Tax Notes:

Aimed at reducing compliance burdens, new regs on currency gains or losses for qualified business units (QBUs) provide detailed rules on a pair of elections and contain numerous provisions reflecting concern over the use of losses.

The newly proposed regs (REG-132422-17) retain the basic approach of the 2016 final regs (T.D. 9794), which had been criticized for their complexity, but make changes aimed at simplification and provide additional guidance on determining section 987 gain or loss and section 987 taxable income or loss. The new rules allow for an election to treat all items of a QBU as marked items, an election to recognize a QBU’s foreign currency gain or loss annually, and a transition rule.

Once the new rules are finalized, they will apply to tax years beginning after December 31, 2024, but taxpayers may also apply the final version of the proposed regs, and parts of the final regs that are not changed by the proposed regs, for tax years ending after the date the proposed regs are published as final.

Additional coverage of this topic is in Friday’s Roundup, which is here (scroll down).

Treasury pushing to extend pause on digital services taxes – Brian Faler, Politico ($). “The Biden administration is quietly pushing to extend a moratorium on digital services taxes likely to expire at the end of this year.”

From the “Score One for the Home Team” file:

Eide Bailly Acquires Arizona Firm – INSIDE Public Accounting:

IPA 100 firm Eide Bailly (FY23 net revenue of $616.5 million) is merging in Secore & Niedzialek PC of Phoenix. The deal will add ten staff members from the accounting and tax planning firm to the Eide Bailly team, as well as partners Ted Niedzialek and Earl Secore.

We have seen incredible growth in the Phoenix and Scottsdale markets recently – this combination will further build Eide Bailly’s brand and market depth in a thriving region.” says Eide Bailly CEO and MP Jeremy Hauk. “[Secore & Niedzialek’s] extensive track record and deep industry expertise make them the perfect complement to Eide Bailly.”

It’s World Kindness Day! Pick on your siblings tomorrow.

Make a habit of sustained success.