Key Takeaways

- Does new Multistate Tax Commission online activity guidance gut PL 86-272.

- The guidance "confuses taxpayers" when applied in audits.

- The complexity of state tax on partnerships and S corporations.

- "Mixed" transactions.

- Digital taxes and business inputs.

- The vexations of market-based sourcing.

- Taxation in the Inca Empire.

Welcome to this edition of our state and local tax roundup. Remember Eide Bailly for your state and local tax planning, compliance, and incentive needs.

This week saw the 30th Annual Paul J. Hartman State and Local Tax Forum, which is Lollapalooza for state tax policy. It's the focus of this week's SALT roundup.

We'll start with a quick recap recent developments relating to Public Law 86-272, which is a key limit on the ability of states to apply income taxes to out-of-state businesses, to set the stage for some of the items below.

PL 86-272 is a law passed by Congress in 1959 to protect businesses from paying income taxes in states where they only sell goods, but do not have any other activities. As long as out-of-state limit their in-state business to a narrow range of activities directly related to sales, PL 86-272 prohibits states from taxing the out of state business.

In 2021, the Multistate Tax Commission (MTC), an organization of state tax agencies, issued guidance on how it believes PL 86-272 applies to online activities. The MTC said that many online activities go beyond the "solicitation of sales for approval outside the state" and therefore open the businesses to taxation in-state. Many tax practitioners view the guidance as overly aggressive, but states are beginning to apply it.

MTC Online Biz Tax Update Defeats P.L. 86-272, Panel Says - Maria Koklanaris, Law360 Tax Authority ($):

The Multistate Tax Commission's updated statement on a federal law that insulates businesses from state taxes on net income when the soliciting of tangible personal property orders is their only connection to a state would effectively gut the law, tax practitioners said on a panel Wednesday.

The law is P.L. 86-272 , formally known as the Interstate Income Act. The MTC adopted an updated statement in 2021 that outlines when an out-of-state business' internet activities exceed P.L. 86-272 protections against state income tax. The MTC's guidance lists which online activities, such as post-sale assistance to customers and inviting viewers to fill out an online application for a nonsales job, it considers to fall outside the law's protections. Such connections to a state, if they are connections at all, are so tenuous as to render the law meaningless, the panelists said. They were speaking at a tax conference hosted by the Paul J. Hartman State and Local Tax Forum, held in Nashville, Tennessee, and online.

Gutting P.L. 86-272 is what the MTC guidance is all about.

Related: Eide Bailly State & Local Tax Services.

Panel: 'On Audit' Adoptions of MTC's P.L. 86-272 Guidance Confuse Taxpayers - Christopher Jardine, Tax Notes ($)

The MTC's guidance on P.L. 86-272, issued in 1986, has been revised several times. The latest revision was published in 2021 after the U.S. Supreme Court’s 2018 decision in South Dakota v. Wayfair Inc. It provides a general rule that customer interaction through a business’s website or app constitutes the business engaging in a business activity in that customer’s state, and the business could lose P.L. 86-272 protections if that activity exceeds the statute's thresholds, according to the panelists.

“All of us interact with technology every single day. If you think about 1959, you didn’t interact with the type of technology we have today. . . . We’re interacting with technology and getting a remote audience right now in this very room. This happens all the time. So the P.L. 86-272 guidance lights that piece of paper on fire,” Anderson said.

States' Taxation Of Pass-Through Stakes Brings Complexity - Maria Koklanaris, Law360 Tax Authority ($):

A growing body of case law focused on whether states can tax a nonresident owner of a partnership or limited liability company that sells their ownership interest in that business has produced inconsistent results and has raised key unanswered questions, tax professionals said Tuesday.

The tax professionals were speaking about the concept of investee apportionment, a term that has become commonplace only within the last two years. Tax agencies use investee apportionment to levy state taxes on out-of-state investors who may or may not have activities in the state. But the investors have realized a gain from the sale of an in-state business, and the tax agencies — and sometimes the courts — say that is enough for nexus. Under what circumstances nexus is OK is not always clear, the tax professionals said. They were speaking at a tax conference hosted by the Paul J. Hartman State and Local Tax Forum, held in Nashville, Tennessee, and online.

"Nexus" happens when a taxpayer has sufficient involvement in a jurisdiction to be subject to tax there.

Panelists Discuss Challenges of True Object Test for Mixed Transactions - Cameron Browne, Tax Notes ($):

During an October 23 panel at the Paul J. Hartman State and Local Tax Forum in Nashville, Tennessee, speakers discussed the true object test for mixed transactions of taxable and nontaxable components. Panelists noted that cases challenging mixed transactions have been on the rise in recent years as states try to find additional revenue sources. Some states determine the taxability of these mixed transactions through the true object test to characterize the entire transaction as either taxable or nontaxable, panelists said.

...

The panel focused on the Arizona Court of Appeals' January 31 decision in ADP LLC v. Arizona Department of Revenue, which upheld a lower court decision that ADP LLC's rental of software to Maricopa County was subject to the state's transaction privilege tax (TPT) under the rental classification. The TPT applies to the sale, lease, or rental of tangible personal property.

States Could Tax Digital And Exempt Biz Inputs, Official Says - Maria Koklanaris, Law360 Tax Authority ($):

Gil Brewer, senior assistant director for tax policy at the Washington Department of Revenue and chair of the MTC work group, said that if states want to provide an exemption for business purchases, or business inputs, they can consider statutes to impose taxes on digital products. But there is a "window of opportunity" to do that, he said, and it is closing. Brewer spoke Monday on a panel at a tax conference hosted by the Paul J. Hartman State and Local Tax Forum, held in Nashville, Tennessee, and online.

Elaborating on his point, Brewer said a broad-based tax on digital products and an exemption for business inputs could be adopted together statutorily. But once states begin to tax digital products and also tax business purchases, it becomes harder to do so, he said. Brewer raised the issue because the taxation of business inputs has emerged as a major theme of the work group he chairs. Representatives of business interests, such as the Council on State Taxation, have appeared frequently at the work group's meetings to lobby for exempting business inputs from any digital taxation recommendations the work group might make.

Sales taxes on business inputs is widely considered bad tax policy because it results in the same item being taxed multiple times as it goes through the economic chain to the consumer.

Digital Services Are the Future of Sales Tax Debate, Panelists Say - Cameron Browne, Tax Notes ($). "As the nature of services moves from physical to digital, there's likely to be more litigation over whether digital services are subject to sales and use tax, according to panelists."

Expanded Local Taxes Pose Challenges to Businesses, Panel Says - Cameron Browne, Tax Notes ($). "Noting that the types of localities that can collect taxes vary widely from cities and municipalities to county and school boards, the panel discussed the administration issues that could arise based on the organization of the local government and the resources it has to audit and inform taxpayers. Some smaller and more rural districts have less sophistication and provide less guidance on newer forms of taxation to taxpayers, which could result in uncertainty for taxpayers and a need to consult with local authorities to find out if they're subject to tax. Local taxation becomes even more complicated with businesses that operate in multiple smaller localities across the nation. Panelists said some businesses file zero-dollar tax returns with localities they do not operate in but that are in states they do operate in to prevent potential tax liabilities."

Market-Based Sourcing Continues To Be Vexing, Panelists Say - Maria Koklanaris, Law360 Tax Authority ($):

Only 11 states with a corporate income tax have not yet moved to market-based sourcing, which sources receipts to where a business' customer is, but even basic concepts such as definition of the market remain a struggle, panelists said Wednesday.

...

Mitchell Newmark, tax partner at Blank Rome LLP, said some states switched to market sourcing because the older method, cost of performance, was deemed too complex. With that, states and businesses haggled over where the service was performed to determine which state the receipts should be sourced to. But with all the intricacies and inconsistencies in market-based sourcing, one set of complexities has been traded for another, he said.

Moore and Quinn Are Supreme Court Cases to Watch, Panelists Say - Andrea Muse, Tax Notes ($). "Bruce Fort, senior counsel with the Multistate Tax Commission, said that the petitioners in Quinn v. State of Washington argued in their August 21 cert petition that if Washington’s tax on capital gains is an excise tax, then the state is taxing a transaction occurring on the New York Stock Exchange, which it does not have jurisdiction to do."

State-by-State Roundup

California

Michigan

Mich. Legislators OK Shift In Personal Property Tax Sourcing - Michael Nunes, Law360 Tax Authority ($). "Michigan would keep assessing personal property at its ordinary business location without regard to whether an employee uses it at an alternate location as part of a bill unanimously passed Wednesday by the state Senate and headed to Democratic Gov. Gretchen Whitmer."

Link: H.B. 4926

New York

Hochul Approves NYC Tax Break for Affordable-Housing Renovations - Danielle Muoio Dunn, Bloomberg. "The bill, S.4709A, offers eligible property owners a property tax abatement for 70% of the 'certified reasonable cost of the eligible construction,' capped at 8.3% per year for no more than 20 years. The City Council must authorize the program for it to move forward."

North Dakota

North Dakota Senators Quash Income Tax Relief Bill - Emily Hollingsworth, Tax Notes ($). "H.B. 1549 would have effectively eliminated income tax for single filers with income of $60,000 or less and for joint filers with income of $100,000 or less, and would have increased the exemption threshold for estates and trusts."

Wisconsin

Wis. Will Update IRC References In State Tax Laws - Michael Nunes, Law360 Tax Authority ($). "Democratic Gov. Tony Evers on Wednesday enacted A.B. 406, which will update the state's tax laws to reflect changes to individual income, franchise and corporate income tax that federal legislation adopted in 2021 and 2022."

Tax Policy Corner

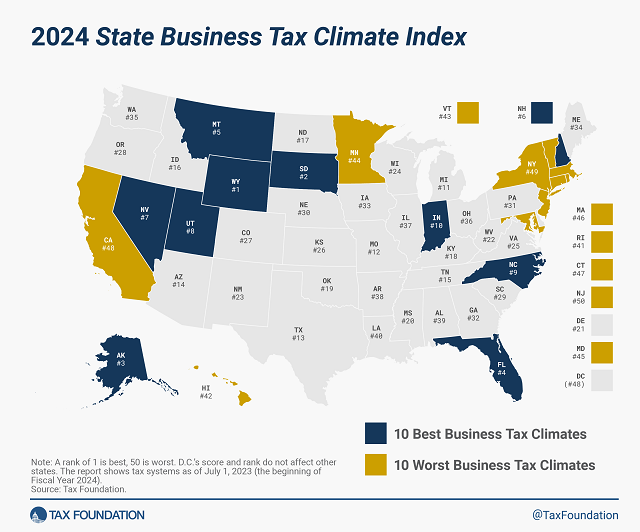

The State Business Tax Climate Index Is Your Guide to Economic “Wins Above Replacement” - Jared Walczak, Tax Policy Blog. "This week we published our annual State Business Tax Climate Index, which measures tax structure. It’s an extremely valuable diagnostic tool, enabling readers to compare states’ tax structures across more than 120 variables. Unlike most studies of state taxes, it is focused on the how more than the how much, in recognition of the fact that there are better and worse ways to raise revenue. Inevitably, though, the publication of the Index raises some questions, like: if Wyoming and South Dakota lead in the rankings, why aren’t more companies heading for the Black Hills?"

Taxes aren't everything. They are a thing.

Permanence And Other Elusive Notions: SALT In Review - David Brunori, Law360 Tax Authority ($). "There are few more pernicious policy proposals than worldwide combined reporting. Its advocates demonstrate little understanding of how economics works in the real world."

Tax History Corner

Do you often wonder how taxes were levied in the Incan Empire? Of course you do. From Worldhistory.org:

As there was no currency in the Inca world taxes were paid in kind - usually foodstuffs (especially maize, potatoes, and dried meat), precious metals, wool, cotton, textiles, exotic feathers, dyes, and spondylus shell - but also in labourers who could be shifted about the empire to be used where they were most needed.

"Labourers who could be shifted about the empire to be used where they were most needed." Definitely an incentive to find more spondylus shells.

Make a habit of sustained success.