Key Takeaways

- Multistate Tax Commission ponders nexus for partners.

- Courts wrestle with state and local streaming service taxes.

- CA, NY, MA and AZ climb on IRS direct file bandwagon.

- State tax issues can blow up M&A deals.

- California extends 2022 deadlines for taxpayers in most counties to Nov. 16.

- Iowa rules for farmer gain exclusion finalized.

- Appeals court nixes East St. Louis streaming tax bid.

- Business groups seek Supreme Court review of WA gains tax.

- The Pharaohs were hands-on tax collectors.

Welcome to this edition of our state and local tax roundup. Remember Eide Bailly for your state and local tax planning, compliance, and incentive needs.

MTC Group Floats Extending Partnership Nexus To Partners - Paul Williams, Law360 Tax Authority ($):

States like to find ways to tax non-residents, who cast no votes in state elections. California was thwarted in a 2017 case attempting to collect an $800 minimum annual tax from an Iowa corporation with a .2% interest in a California partnership. Partnership investors should consider possible state tax considerations.

Courts Wrestle With Whether Streaming Should Be Taxed - Maria Koklanaris, Law360 Tax Authority ($):

Across the nation, a similar story is playing out again and again. The patterns of facts are different in various jurisdictions, but the concept is the same. Cities in states including Arkansas, California, Georgia, Illinois, Louisiana, Missouri, Nevada, New Jersey, Ohio, Tennessee and Texas have sued the streaming services, arguing that the companies, similar to cable and telecommunications companies, use public facilities to bring their products to their customers. Thus, the cities argue, the companies owe a franchise fee, typically 5% of the gross revenue earned in any given locality.

The companies strongly disagree, arguing that their products are delivered over the internet, not via public rights of way. As in Indiana, some courts have allowed the cities' litigation to go forward. But even when they have, the services of late have had a string of victories.

See the Illinois section below for a federal appeals court opinion blocking an East St. Louis bid to impose franchise taxes on streamers.

Four States Team With IRS for 2024 Direct-File Effort - Jonathan Curry, Tax Notes ($). "A select group of taxpayers from California, New York, Massachusetts, and Arizona will be invited to file their federal income tax returns for free directly with the IRS. Although state income tax return filing won’t be directly integrated into the IRS’s tool, those taxpayers will be referred to a state-level tool for them to file their state income tax returns once their federal returns are completed, the agency said in an October 17 release."

State and Local Tax Rules Can Disrupt M&A Deals, Tax Pros Warn - Caleb Harshberger, Bloomberg ($). "Disparate state and local tax rules can blow up mergers and acquisitions or even lead to unexpected tax bills after deals close, tax pros warned Thursday during a virtual conference hosted by the American Bar Association’s tax section."

State-By-State Roundup

Arkansas

Ark. AG OKs New Ballot Bid For Feminine Hygiene Tax Break - Jaqueline McCool, Law360 Tax Authority ($). "In an opinion issued Tuesday, Arkansas Attorney General Tim Griffin said he was approving the popular name and ballot title for the proposed initiated act exempting feminine hygiene products from state sales and use tax."

California

California Extends Due Date For California State Tax Returns - Kelly Phillips Erb, Forbes. "Earlier today, the IRS announced that various tax filing and payment deadlines for most taxpayers in California were being further postponed to Nov. 16, 2023... Now, the California Franchise Tax Board confirmed that most Californians have until November 16, 2023, to file and pay their tax year 2022 state taxes to avoid penalties."

Attorneys Test Avoidance Strategies On LA Tax - Chuck Slothower, Law360 Tax Authority ($). "Beginning April 1, the city levied a 4% tax on real estate transfers between $5 million and $10 million. The rate grows to 5.5% for transfers valued at $10 million or more. While popularly known as the 'mansion tax,' Measure ULA applies to both commercial and residential real estate."

Calif. To Provide 5-Year Sales Tax Break For Breast Pumps - Zak Kostro, Law360 Tax Authority ($). "A.B. 1203, which Newsom, a Democrat, signed Friday, will provide a sales and use tax exemption for breast pumps, breast pump collection and storage supplies, breast pump kits and breast pump pads starting April 1, according to an analysis by the state Assembly. The exemption sunsets April 1, 2029, according to the analysis."

Iowa

Iowa Tax Dept. OKs Regs To Implement Farm Gains Deduction - Zak Kostro, Law360 Tax Authority ($):

The regulations implement deductions enacted by legislation that Republican Gov. Kim Reynolds signed last year, H.F. 2317, according to a notice the state Department of Revenue published Wednesday. The legislation provided a capital gain deduction for taxpayers who have held real property used in a farming business, and materially participated in such a business, for 10 years, according to a statement summarizing the regulations.

The regulations also implement an election for eligible individuals to deduct capital gains from the sale of real property used in a farming business or to deduct income from a farm tenancy agreement covering real property, according to the statement.

Illinois

Netflix Doesn’t Owe Illinois’s Local Franchise Fees, Seventh Circuit Says - Cameron Browne, Tax Notes ($):

Netflix Inc., Disney Platform Distribution Inc., and other streaming companies are not subject to Illinois’s statutory provisions that require cable companies to pay local franchise fees to the state municipalities, according to the Seventh Circuit.

In an October 13 decision in City of East St. Louis v. Netflix Inc., the Seventh Circuit affirmed a federal district court’s dismissal of East St. Louis’s proposed class action against streaming companies.

Illinois Grants Relief to Taxpayers Affected by Israel-Hamas War -Michael Bologna, Bloomberg ($). "Gov. J.B. Pritzker (D) said Tuesday that Illinois taxpayers affected by the conflict would have until Oct. 7, 2024 to file their returns or make payments for income, withholding, sales, specialty, and excise taxes. The governor said the Illinois Department of Revenue would waive penalties and interest for returns and payments due between Oct. 7, 2023 and Oct. 7, 2024."

Pritzker Says He’d Veto Any Chicago Financial Transaction Tax - Shruti Date Singh and Isis Almeida, Bloomberg ($). "Pritzker’s comments follow months of speculation over how Chicago Mayor Brandon Johnson plans to raise revenue to tackle the city’s embattled finances. They also represent the billionaire governor’s strongest words of opposition to the levy, after he expressed dissent to the proposal following Johnson’s election."

Indiana

Indiana DOR Releases Guidance on SALT Cap Workaround - Emily Hollingsworth, Tax Notes ($). "According to the bulletin, entities treated as S corporations and partnerships for federal income tax purposes — including limited liability companies treated as partnerships for federal tax purposes — are eligible to make the election. The PTET is equal to the flat individual income tax rate of 3.23 percent for tax year 2022 and 3.15 percent for tax year 2023."

Link: Information Bulletin No. 72B.

Kansas

Kan. Governor Seeks One-Time Rebates Funded By Surplus - Jaqueline McCool, Law360 Tax Authority ($). "In a news release Monday, Gov. Laura Kelly's office said she planned to use some of the state's budget surplus for "smart tax cuts." Kelly is proposing a tax rebate of $450 for individual filers and $900 for joint filers. The release said Kelly previously had proposed the rebates, but the Legislature had failed to move forward with the proposal."

Massachusetts

Massachusetts DOR Publishes Guidance on Millionaire Surtax - Emily Hollingsworth, Tax Notes ($). "The 4 percent surtax was approved by voters in 2022 and took effect beginning in tax year 2023. The tax applies to individual income taxpayers, including trusts and estates. The guidance notes that the $1 million threshold will be increased annually for inflation."

Massachusetts Adopts Single-Sales-Factor Apportionment; Manufacturing Classification Becomes Less Controversial - Stephen Kranz, Richard Call, and David Jasphy, Inside Salt. "On October 4, 2023, Massachusetts Governor Maura Healey signed House Bill 4104 into law. The most significant change it introduces is the adoption of single-sales-factor apportionment (SSF) for all corporate taxpayers, not just manufacturers and mutual fund service corporations. Massachusetts joins more than 30 other states that have adopted either mandatory or elective SSF. The law applies to tax years beginning on or after January 1, 2025."

Ohio

Ohio Voters to Again Consider Taxing, Legalizing Adult-Use Cannabis - Emily Hollingsworth, Tax Notes ($). "Issue 2 would impose a 10 percent tax on sales of adult-use marijuana in dispensaries, in addition to the 5.75 percent sales tax rate. Revenue from the tax would go to the adult use tax fund, which the measure would establish.:"

Oklahoma

Okla. Supreme Court To Hear Gov.'s Veto Dispute In December - Crystal Owens, Law360 Tax Authority ($). "The case has drawn the attention — and at times the ire — of Oklahoma's Native American communities who say the governor has no lawful grounds to 'hold the lock and key' to tribal-state relations and has yet to show how the legislative action had any adverse effect or encroached on his execution function."

Washington

Biz Groups Urge Justices To Hear Wash. Capital Gains Case - Maria Koklanaris, Law360 Tax Authority ($).

In two amicus briefs filed Monday, the groups asked the U.S. justices to review the March decision by the Washington Supreme Court, which held that the state's tax on capital gains, the only one in the nation in a state without an income tax, is permissible under both the state and U.S. constitutions. Before the opinion from the Washington justices, groups opposing the tax argued that a capital gains tax is an income tax, and so Washington's tax is therefore subject to uniformity requirements and not permissible under state law.

Now, however, the groups are arguing that the tax is not levied on the income of Washington state residents but rather on out-of-state transactions. This is unconstitutional, they told the U.S. justices.

Wisconsin

Wisconsin Senate Advances Income Tax Cut Bill - Paul Jones, Tax Notes ($):

The income tax cut provision was amended into special session bill S.B. 1 October 17, and the Senate approved the bill the same day on a 21-11 vote. The main tax cut would reduce the rate for the state’s second-highest income tax bracket — which applies to income between $27,630 and $304,170 for single filers and $36,840 and $405,550 for joint filers — from 5.3 percent to 4.4 percent. That would effectively combine the bracket with the one below it, which is also taxed at 4.4 percent, leaving the state with three brackets instead of four. The proposal is the same as one included in a different bill that the State Assembly passed in mid-September.

However, Gov. Tony Evers (D) has already said he will veto the GOP-backed cut. He notably vetoed cuts to the state’s top two tax brackets in July while signing cuts to the two lower brackets. The Republican majority doesn’t have the numbers to override a veto by Evers.

Wis. Lawmakers OK Updated IRC References For State Taxes - Zak Kostro, Law360 Tax Authority ($). "A.B. 406 passed the state Senate by a 32-0 vote Tuesday after the Assembly approved the measure 97-0, according to a summary on the state Legislature's website. The bill would update references to the IRC in state law governing individual income, corporate income and franchise taxes to conform to most federal tax provisions adopted through federal legislation in 2021 and 2022, according to a bill memo."

Tax Policy Corner

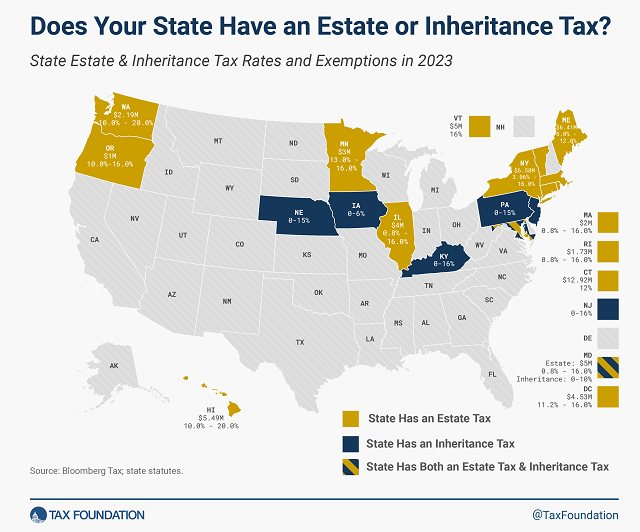

Does Your State Have an Estate or Inheritance Tax? - Andrey Yushkov, Tax Foundation. "Estate taxes are paid by a decedent’s estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. Inheritance taxes are remitted by the recipient of a bequest and are thus based on the amount distributed to each beneficiary."

Related: Eide Bailly Wealth Transition Services

SALT Cap's Fate Unclear Until After 2024 Election, Panelists Say - Christopher Jardine, Tax Notes ($):

“You have to wait until after the 2024 election. I don’t think you have an answer until we find out who is going to be controlling Congress at the time,” according to Steven Wlodychak, a retired principal at EY.

...

“The SALT limitation alone probably paid for all the international tax reform that came out by the 2017 act — you look at it and it’s almost equal — and if you’re going to unwind the SALT deduction but not change international, where is that money going to come from?” Wlodychak said. He said it's interesting that the deduction limit is scheduled to expire in 2025, so any changes do not affect the election.

Tax History Corner

Those pyramids didn't pay for themselves. Back in the days of the pharaohs, tax collection wasn't delegated down the bureaucracy, according to this article:

As early as the reign of Hor-Aha (c. 3100-3050 BCE), institutionalized during the Second Dynasty (c. 2890 - c. 2670 BCE), and continuing through the time of the Old Kingdom of Egypt (c. 2613-2181 BCE), an annual event was instituted known as the Shemsu Hor (Following of Horus), better known as the Egyptian Cattle Count, during which the king and his retinue would travel the land, assess the value of farmers' crops, and collect a certain amount in taxes.

That might not go very well nowadays.

Make a habit of sustained success.