Key Takeaways

- SALT cap pledge helps elect new speaker. A meaningless promise?

- Crypto 1099 tsunami: “Our technology, the way it is today, will not support the data and the volume.”

- New corporate minimum tax guidance to address partnership questions.

- MTC guidance "would effectively gut" protections for out-of-state businesses.

- Clarence Thomas and cancellation of debt.

- Year-end tax moves.

- Charitable scams.

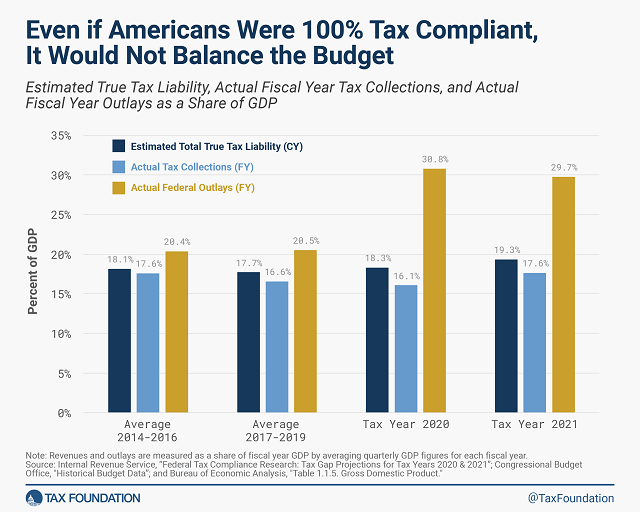

- Closing the tax gap - a lot of money, but well short of the deficit.

- University tax exemptions and free speech.

- Mule day, pumpkin day.

New House Speaker Pledges SALT Cap Relief - Kim Dixon, Bloomberg ($):

Tax policy may have helped bring Rep. Mike Johnson (R-La.)—who secured the speaker slot on Wednesday after weeks of intraparty wrangling—over the finish line, after the previously little-known lawmaker vowed to keep the state and local tax deduction in mind in any year-end tax bill.

Rep. Andrew Garbarino (R-N.Y.) said he was reassured by Johnson, who was propelled at least in part by former President Donald Trump’s backing, after a positive discussion of Long Island-oriented issues, including relief from the $10,000 SALT cap.

New House Speaker Made Commitment to Raise SALT Cap - Cady Stanton and Doug Sword, Tax Notes ($):

Johnson had conversations with members of the SALT Caucus the evening of October 24 and the morning of October 25, in which he promised any major tax package would include a raise in the SALT cap, according to caucus member Anthony D’Esposito, R-N.Y.

...

Those conversations will include how to square the half-dozen proposals for relief, [ranging?] from raising the cap to $100,000 to relieving the so-called marriage penalty from the cap to repealing the cap altogether, according to D’Esposito.

The cap on personal itemized deductions for state and local taxes is currently set at $10,000 for both single and joint returns. The cap raises a lot of revenue and it hits high earners the hardest, so changes may be difficult to advance. Or impossible. From the Tax Notes article:

But the promise to attach a provision to a bill that isn’t going anywhere is no promise at all, and senior taxwriters in the House and Senate doubt that major tax legislation can get anywhere in this Congress.

IRS Prepping for at Least 8 Billion Crypto Information Returns - Jonathan Curry, Tax Notes ($):

“Our estimate right now is that we will ingest — don’t fall off your chairs — 8 billion” information returns, and that’s just the in-development Form 1099-DA, Julie Foerster, IRS director of digital assets, said during the Council for Electronic Revenue Communication Advancement meeting October 25.

That avalanche of information returns — which Foerster said alone would be about double what the IRS currently receives for every other Form 1099 combined — threatens to overwhelm the agency.

“Our technology, the way it is today, will not support the data and the volume,” Foerster continued. That’s where the Inflation Reduction Act funding comes in, which is giving the IRS the wherewithal to update the underlying technology so it can be ready when the information reporting rules go live, she said.

But if you matched those returns manually, just think of how many jobs you could create...

Treasury Details Upcoming New Guidance on Book Minimum Tax - Danielle Muoio Dunn, Bloomberg ($). "The corporate alternative minimum tax, or CAMT, created under the Inflation Reduction Act, imposes a 15% minimum tax on the adjusted financial statement income of large corporations for tax years beginning after Dec. 31, 2022. The tax generally applies to corporations with average annual financial statement income exceeding $1 billion."

Proposed Regs for Corporate AMT Will Address Partnership Shares - Chandra Wallace, Tax Notes ($). "Among the issues for taxpayers with partnership investments is determining how much partnership income to include in adjusted financial statement income. A taxpayer subject to the corporate AMT includes only its distributive share of the partnership’s adjusted financial statement income, Haradon explained."

MTC Online Biz Tax Update Defeats P.L. 86-272, Panel Says - Maria Koklanaris, Law360 Tax Authority ($):

The Multistate Tax Commission's updated statement on a federal law that insulates businesses from state taxes on net income when the soliciting of tangible personal property orders is their only connection to a state would effectively gut the law, tax practitioners said on a panel Wednesday.

The law is P.L. 86-272 , formally known as the Interstate Income Act. The MTC adopted an updated statement in 2021 that outlines when an out-of-state business' internet activities exceed P.L. 86-272 protections against state income tax. The MTC's guidance lists which online activities, such as post-sale assistance to customers and inviting viewers to fill out an online application for a nonsales job, it considers to fall outside the law's protections. Such connections to a state, if they are connections at all, are so tenuous as to render the law meaningless, the panelists said. They were speaking at a tax conference hosted by the Paul J. Hartman State and Local Tax Forum, held in Nashville, Tennessee, and online.

Gutting P.L. 86-272 is what the MTC guidance is all about.

Related: Eide Bailly State & Local Tax Services.

Clarence Thomas’s RV loan was forgiven, Senate committee report says - Robert Barnes and Ann E. Marimow, Washington Post:

Senate Finance Committee Chair Ron Wyden (D-Ore.) called Wednesday on Supreme Court Justice Clarence Thomas to tell the committee whether he declared more than a quarter-million dollars of loan forgiveness on his tax filings.

Wyden released a report by the committee’s Democratic staff that details a loan that Thomas received from a friend, Anthony Welters, to buy a luxury Prevost Marathon motor coach in 1999. The report said Thomas made some interest payments on the $267,230 loan, but that it was declared settled by Welters in 2008 without Thomas repaying a substantial portion — or perhaps any — of the principal.

Cancellation of debt is typically taxable income. It can also be a gift under some circumstances, but it would be unusual for a non-family loan forgiveness to qualify as a gift. Details of the loan remain uncertain, and Justice Thomas's tax returns are not public.

Sell Your Loser Stocks—and Other Year-End Tax Moves to Consider - Tom Herman, Wall Street Journal. "A few things to keep in mind, though. When making these year-end moves, “remember to focus first on investing fundamentals rather than taxes,” says Roger Young, a certified financial planner and thought leadership director in the individual-investors division at T. Rowe Price."

Global disasters mean even more charitable scams - Kay Bell, Don't Mess With Taxes. "Fake charity promoters may use emails, fake websites, or alter or 'spoof' caller ID to make it look like a real charity is calling to solicit donations. Criminals often target seniors and groups with limited English proficiency."

Real Estate Investor Couldn't Rely on CPA to Excuse Accuracy-Related Penalties - Parker Tax Pro Library. "The Tax Court held that a taxpayer who improperly claimed depreciation deductions for the value of commercial by applying a seven-year depreciation period rather than a 39-year period and claimed the same home mortgage interest deduction twice on a tax return did not qualify for the reasonable cause and good faith exception to accuracy-related penalties in Code Sec. 6664(c)(1). The taxpayer asserted that he relied in good faith on his CPA who prepared his return but the court found no evidence that the CPA told the taxpayer that the 7-year depreciation schedule applied to commercial buildings or that the mortgage deduction could be claimed twice."

IRS Announces Withdrawal Process for Employee Retention Credit Claims - Cody Edwards and Charles Telk, Iowa Tax Cafe. "Unfortunately, the withdraw process does not allow for a withdrawal of refunds received that have been cashed or deposited. However, the IRS has indicated there may be a program for this scenario forthcoming. "

IRS Recommends Tools to Prevent and Report Tax Refund Fraud - Carrie Brandon Elliot, Tax Notes Opinions. "Taxpayers should report emails and texts claiming to be from the IRS to phishing@irs.gov. The report should include the caller ID (email or phone number), date, time and time zone, and the phone number that received the message. Communications forwarded to the IRS should include all email headers and should not be scanned images because scanning removes valuable information."

IRS Report Shows Closing the Tax Gap Would Not Close the Deficit - Scott Hodge, Tax Policy Blog. "The tax gap is based on the IRS’s benchmark estimate of how much the government would collect if taxpayers were 100 percent compliant, what they call the “Estimated Total True Tax Liability.” This, of course, is an ideal that has never been achieved in any tax system in history. Markets and people are remarkably adept at altering their behavior to minimize their tax burden. Compared to the rest of the world, the United States does not have a unique problem with tax evasion, and contrary to what headlines imply, is actually below average compared to tax gaps across the developed world."

Questioning The Tax-Exemption Of Universities Over Their Mideast Views Is Dangerous - Howard Gleckman, TaxVox:

Smith and his fellow lawmakers could do a real public service by thoroughly reviewing the tax-exempt status of all colleges and universities, especially their non-academic businesses such as sports and real estate development.

But selectively targeting schools because you don’t like their institutional views, or even because they don’t sufficiently police student comments you find offensive, is troubling.

Gasoline Excise Tax Outdated - What will come from recent House hearing on this? - Annette Nellen, 21st Century Taxation. "The federal gasoline excise tax that helps fund road construction and maintenance has been 18 cents per gallon since 1993! The tax is not tied to the price of gasoline or adjusted for inflation. It requires an act of Congress to increase the tax."

Sacramento area tax preparer convicted of presenting false tax returns - IRS (Defendant name omitted, emphasis added):

According to evidence presented at trial, Defendant was a paid tax preparer who was registered with the IRS. In 2014 and 2015, Defendant prepared and submitted federal income tax returns for Sacramento-based clients, relating to tax years 2013 and 2014. These tax returns requested tax refunds to which the clients were not entitled. Defendant deliberately manipulated the reported income on each tax return by either inflating it or fabricating it altogether, in order to qualify her clients for the maximum refundable tax credits available. Based on these falsehoods, each return that Defendant submitted sought thousands of dollars in tax refunds from the IRS. At times, the refunds requested were almost half of the annual income claimed. Defendant would then take a substantial portion of any tax refunds that issued as compensation for preparing her clients' Form 1040s.

The biggest refund may turn out to be a bad deal. The IRS won't be keen on letter her clients keep their extra cash.

Treat your mule to a nice pumpkin pie. It's both National Pumpkin Day and National Mule Day.

Make a habit of sustained success.