Key Takeaways

- Treasury to make "Hoffman CRATs" a listed transaction?

- IRS warns of fake charity scams.

- Leaker plea focuses Congress on IRS data issues.

- Worldwide reporting fails again, but still interests states.

- Early 2024 Section 174 rules rumored.

- Canada tests compliance with foreign-owned vacant housing tax.

- Japan Prime Minister plans income tax cuts

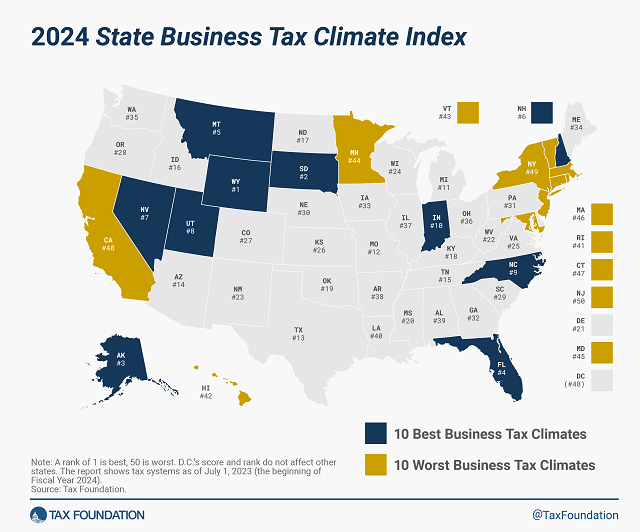

- 2024 Business climate index: high marks for SD, WYO.

- Salon owners find employee tip reporting FICA to be expensive.

- Recycled tax evasion

- Bologna fete.

Treasury and IRS Appear to Set Sights on ‘Hoffman’ CRATs - Jonathan Curry, Tax Notes ($):

The IRS and Treasury aren’t being explicit about it, but a particular transaction involving the use of charitable remainder annuity trusts seems to be squarely what the government has in mind as it prepares to identify a new listed transaction.

...

Neither Hughes nor the guidance plan named it directly, but it seems plausible the agency has the “Hoffman strategy” in mind, according to Mitchell Gans of Hofstra University School of Law. Promoters of that transaction argue that capital gains on income derived from the sale of property can be eliminated by selling the property through a CRAT.

The Justice Department filed a complaint in February 2022 in the case of United States v. Eickhoff, No. 2:22-cv-04027 (W.D. Mo. 2022), involving Hoffman Associates LLC, claiming that dozens of the company’s clients had engaged in the “abusive tax scheme” that led to the underreporting of $40 million in taxable income.

"Hoffman" transactions were advertised in farm publications as a way for farmers to sell their crops tax-free through a, to put it kindly, heterodox reading of the rules for charitable remainder annuity trusts. The Tax Court has upheld the orthodox view twice so far, and the promoters of the "strategy" have been barred from promoting it further.

Beware of fake charities; check before donating - IRS:

Fake charity promoters may use emails, fake websites, or alter or "spoof" their caller ID to make it look like a real charity is calling to solicit donations. Criminals often target seniors and groups with limited English proficiency.

Here are some tips to protect against fake charity scams:

- Verify first. Scammers frequently use names that sound like well-known charities to confuse people. Potential donors should ask the fundraiser for the charity's exact name, website and mailing address so they can independently confirm the information. Use TEOS to verify if an organization is a legitimate tax-exempt charity.

- Don't give in to pressure. Scammers often pressure people into making an immediate payment. In contrast, legitimate charities are happy to get a donation at any time. Donors should not feel rushed.

- Don't give more than needed. Scammers are on the hunt for both money and personal information. Taxpayers should treat personal information like cash and not hand it out to just anyone.

- Be wary about how a donation is requested. Never work with charities that ask for donations by giving numbers from a gift card or by wiring money. That's a scam. It's safest to pay by credit card or check — and only after verifying the charity is real.

Taxpayers who give money or goods to a charity can claim a deduction if they itemize deductions, but these donations only count if they go to a qualified tax-exempt organization recognized by the IRS.

Congress Boosts Pressure on IRS After Tax Leaker Guilty Plea - Chris Cioffi and Caleb Harshberger, Bloomberg ($):

House Oversight Committee lawmakers hear testimony Tuesday from IRS and Government Accountability Office officials for the first time since the contractor was charged, and Senate appropriators requested a new government watchdog probe this summer.

The Oversight hearing includes testimony from IRS Commissioner Danny Werfel and is slated to include discussion of the tens of billions in modernization funding provided last year and the agency’s policies on enforcement, customer service, and protection of taxpayer data. Republicans already tried to claw back that money this Congress several times.

Interest In Worldwide Reporting Persists Despite Setbacks - Paul Williams, Law360 Tax Authority ($). "New Hampshire legislators are primed to shelve the idea of imposing worldwide combined reporting in the coming months, as a commission studying the topic is slated to release a report advocating for keeping the state's current water's edge method that accounts for activity only of domestic entities. That decision comes on the heels of Minnesota lawmakers pulling their own worldwide combined reporting initiative in May, which was one of the few such proposals to gain significant traction since a dozen states that employed the method repealed it decades ago."

Related: Eide Bailly State & Local Tax Services

IRS Sees Issuing Rules for Amortizing R&D Costs Early in 2024 - Michael Rapoport, Bloomberg ($). "The proposed rules will address what kinds of costs will and won’t be amortized, and they will cement interim guidance the IRS issued in a September notice on issues such as contractors’ deduction of costs, software development, and abandoned property, among others."

Canada to Verify Compliance of Foreign-Owned Housing Vacancy Tax - James Munson, Bloomberg ($):

Canada is launching a pilot program Nov. 1 to test how much property owners are abiding by a new 1% tax on foreign-owned vacant housing, an official said Monday.

...

Prime Minister Justin Trudeau passed a law enacting the Underused Housing Tax in June 2022 as a way to curb the impact of foreign ownership on residential property prices. The tax took effect beginning Jan. 1, 2022.

Japan’s Prime Minister Kishida plans an income tax cut for households and corporate tax breaks - Mari Yamaguchi, AP via The Hill. "Japan’s Prime Minister Fumio Kishida said Monday he is preparing to take bold economic measures, including an income tax cut for households hit by inflation and tax breaks for companies to promote investment, in what’s seen as a move to lift his dwindling public support."

The State Business Tax Climate Index Is Your Guide to Economic “Wins Above Replacement” - Jared Walczak, Tax Policy Blog. "This week we published our annual State Business Tax Climate Index, which measures tax structure. It’s an extremely valuable diagnostic tool, enabling readers to compare states’ tax structures across more than 120 variables. Unlike most studies of state taxes, it is focused on the how more than the how much, in recognition of the fact that there are better and worse ways to raise revenue. Inevitably, though, the publication of the Index raises some questions, like: if Wyoming and South Dakota lead in the rankings, why aren’t more companies heading for the Black Hills?"

Taxes aren't everything. They are a thing.

IRS allows businesses to withdraw improper ERC claims - Kay Bell, Don't Mess With Taxes. "The IRS is also working on guidance to help employers that were misled into claiming the ERC and have already received the payment. More details will be available this fall."

IRS announces withdrawal process for employee retention credit claims; special initiative aimed at helping businesses concerned about an ineligible claim amid aggressive marketing, scams - National Association of Tax Professionals. "The new withdrawal process follows the Sept. 14 announcement of an immediate moratorium on processing new ERC claims. The moratorium, which will last until at least the end of this year, follows a flood of ineligible ERC claims. Payouts for claims submitted before Sept. 14 will continue during the moratorium period but at a slower pace due to more detailed compliance reviews. With stricter compliance reviews in place, existing ERC claims will go from a standard processing goal of 90 days to 180 days – and much longer if the claim faces further review or audit. The IRS may also seek additional documentation from the taxpayer to ensure the claim is legitimate."

Actor Failed to Properly Roll Over Non-Traditional Investment Held in IRA Account - Ed Zollars, Current Federal Tax Developments. "The estate of actor James Caan contended that he had accurately rolled over the entire balance of an IRA from UBS to Merrill Lynch. The IRS largely concurred with this stance, save for the transfer of an interest in a non-publicly traded hedge fund. This asset encountered numerous challenges during its transfer from UBS to Merrill Lynch. Ultimately, the hedge fund interest was liquidated, and the proceeds were transferred to Merrill Lynch—nearly a year after UBS reported the fund’s distribution to Mr. Caan."

Cash Value of Life Insurance Policy Was Taxable Under Split-Dollar Insurance Rules - Parker Tax Pro Library. "A district court held that a taxpayer who put in place a life insurance policy product referred to as a restricted property trust (RPT) was not entitled to a refund of taxes assessed as a result of the IRS's determination that the split-dollar insurance rules in Reg. Sec. 1.61-22 applied to the RPT."

IRS Recovers $122M From Wealthy Taxpayers In New Crackdown - Ronald Marini, The Tax Times. "The back taxes were collected from 100 high-income individuals the agency targeted in its effort to ramp up enforcement against people with more than $1 million in income who haven't filed taxes and those who have failed to pay more than $250,000 in tax debt, the IRS said in a statement."

Taxing Tips: Untangling The Hairy Situation Between Beauty Salons, Restaurants And The IRS. - Kelly Phillips Erb, Forbes:

The holidays are coming and Paige Garland, co-owner of Rachel’s Salon and Day Spa in downtown Memphis, is bracing for a tax hit. Along with springing for more of the salon’s $72 event up-dos and $94 highlights, customers will also be giving more-generous-than-usual tips to their favorite stylists. As a matter of salon policy, those holiday tips will be rung up separately on Rachel’s payment processing system with 100% going to the employee and all of it properly reported as income to the Internal Revenue Service on the stylists’ W-2 forms.

The problem for Garland is this: for every $100 in tips an employee collects, Rachel’s owes the IRS $7.65 as the employer’s share of Social Security and Medicare payroll taxes—even though not a penny of that $100 tip goes to the salon, and even though under reporting of tips is widespread in the industry.

2023 State Elections Feature Key Tax Questions - Richard Auxier, TaxVox. "In short, TABOR (The Taxpayer’s Bill of Rights) currently limits what Colorado can collect and then sends excess revenue to residents via rebate checks. If approved, Proposition HH would direct some of those excess TABOR funds to local governments, allowing for property tax relief but also lowering future rebate checks."

The US Is Doing a Terrible Job Collecting Taxes - Karl Smith, Bloomberg via Washington Post. "When the rules for pass-through entities were created, the thinking was that they would mostly small businesses who couldn’t afford to comply with the same complex tax filing rules designed for big corporations. Times have changed. Back in 1980, pass-through entities represented just over 20% of business income; by 2015, that figure had ballooned to more than 60%. Global manufacturing giants and Wall Street hedge funds are structured as pass-through entities, in large part because such entities enjoy easier reporting requirements and lower tax rates than corporations."

Inland Empire man sentenced to two years in prison for purposely underreporting plastics recycling business income to IRS - IRS (Defendant name omitted):

Defendant, of Fontana, was sentenced on Monday by United States District Judge Dale S. Fischer, who also ordered him to pay $276,549 in restitution to the IRS.

Defendant pleaded guilty on May 8 to one count of subscribing to a false tax return and one count of willfully failing to file a tax return. Judge Fischer ordered Defendant to surrender to the Federal Bureau of Prisons by November 20.

Defendant willfully filed false tax returns for the tax years 2010 to 2014, then willfully failed to file tax returns during the tax years 2015 to 2017. Specifically, he willfully underreported his gross receipts for... his plastics recycling company, then did not file tax returns at all. The total tax loss to the United States Treasury was $169,974.

Every year that you play the audit lottery, you have another chance to "win."

Well, Congress is in session. It's National Bologna Day!

Make a habit of sustained success.