Key Takeaways

- Tax filing deadline fast approaching

- Per Diem rates announced

- Regs released

- Wage base increase for Social Security

- Candidate for top IRS attorney vows to restore trust in agency

- The morass that is Congress

- Dec. 5 = Big Tax Day

- The gaping Tax Gap

The Last Day to File Taxes in 2023 Is Looming Large. Here's What to Do If You Still Haven’t Filed – Jessica Walrack, U.S. News and World Report:

The last day to file taxes in 2023 is quickly approaching for Americans who requested extensions for their 2022 federal income tax returns.

If you're one of the many who haven't filed yet, here's what you need to know...

While a tax extension typically gives you until Oct. 15 to file a return, the date falls on a Sunday in 2023 so taxes are due by the following Monday, Oct. 16. You can file electronically up until the deadline or can mail in your return, so long as the parcel is postmarked by the Oct. 16 deadline.”

Eide Bailly can help. Info is here.

IRS Announces 2023-2024 Per Diem Rates For Taxpayers Who Travel For Business - Kelly Phillips Erb, Forbes:

The IRS has released its annual update of special per diem rates for taxpayers to use in substantiating business expenses while traveling away from home. The new numbers are effective as of October 1, 2023, and are to be used for per diem allowances paid to any employee on or after October 1, 2023, for travel away from home. The new rates include those for the transportation industry, the rate for the incidental expenses, and the rates and list of high-cost localities for purposes of the high-low substantiation method.

The IRS allows the use of per diem (that’s Latin meaning "for each day” - remember, lawyers love Latin) rates to make reimbursements easier for employers and employees. Per diem rates are a fixed amount paid to employees to compensate for lodging, meals, and incidental expenses incurred when traveling on business rather than calculating the actual expenses.

The IRS document is here.

Final Regs Provide Guidance on Supporting Organizations – Tax Notes ($):

The IRS has issued final regulations (T.D. 9981) that provide guidance on the prohibition on making certain gifts or contributions to Type I and Type III supporting organizations by persons who control a supported organization and on other requirements for Type III supporting organizations.

The document is here.

Proposed Regs Would Modernize Rules on Property Seizures by Levy – Tax Notes ($):

The IRS has issued proposed regulations (REG-127391-16) regarding the modernization of regulations on the sale of taxpayer property the IRS seizes by levy to allow the agency to maximize sale proceeds for the benefit of the taxpayer and the public fisc. Comments and public hearing requests are due by December 15.

The document is here (Tax Notes sub required).

Social Security wage base, COLA set for 2024 - Bryan Strickland, The Tax Adviser:

Individual taxable earnings of up to $168,600 annually will be subject to Social Security tax in 2024, the Social Security Administration (SSA) announced Thursday.

The amount, an increase from $160,200 in 2023, is the wage base limit that applies to earnings subject to the 6.2% OASDI tax (old age, survivors, and disability insurance). At or above the wage base limit, the employee and the employer each will pay $10,453 in tax, an increase of $521 for each party in 2024.

The announcement is here.

IRS Chief Counsel Pick Vows Accountability in Backdating Case - Chris Cioffi, Bloomberg ($):

IRS top attorney pick Marjorie Rollinson vowed in written answers to senators’ questions to restore trust in the agency, following a case where the agency admitted to backdating a form.

Lawmakers’ questions at Rollinson’s hearing Sept. 28 were echoed in their written questions to her after the hearing, pushing her for more clarity on agency accountability. They wanted answers on the backdating matter in which the IRS agreed to settle a US Tax Court conservation easement case, giving up a $15.2 million penalty.

Speaking of the IRS cracking down on unlawful shenanigans:

Former IRS contractor pleads guilty to leaking Trump tax records – Daniel Barnes and Dareh Gregorian, CNBC:

A former IRS contractor admitted in federal court Thursday that he stole tax records belonging to Donald Trump and thousands of other wealthy people in 2019 and 2020 before he leaked them to the media.

Charles Littlejohn, 38, pleaded guilty to one count of disclosure of tax return and return information at a brief hearing in Washington. The felony charge carries a five-year maximum sentence, but Littlejohn is expected to face eight to 14 months in prison, according to prosecutors’ estimate of the sentencing guidelines.

IRS Spends Close to $2 Billion in Tax-and-Climate Law Funds - Erin Slowey, Bloomberg ($):

The tax-and-climate law, passed last year, gave the IRS nearly $80 billion for enforcement, customer service, and technology improvements, though about a quarter of those funds are slated to be pulled back under a deal between the White House and former House Speaker Kevin McCarthy (R-Calif.) earlier this year.

The IRS used about 2.5% of its $78 billion by June 30, the largest portion of the spending going to employee compensation, according to the TIGTA report.

The report is here.

Steve Scalise drops out of Speaker’s race – Emily Brooks, Mychael Schnell and Regina Zilbermints, The Hill:

House Majority Leader Steve Scalise (R-La.) on Thursday dropped out of the race for Speaker, just one day after he won the Republican nomination for the role.

Scalise narrowly prevailed in a secret ballot internal GOP election on Wednesday, but it was clear almost immediately that he would struggle to get the 217 votes needed on the House floor.

There is currently no clear choice for who will become the next House Speaker. Barring a radical rule change, the House cannot pass legislation until a Speaker is confirmed.

The longer this process takes to install a new Speaker the less chance there is for Congress passing tax legislation by year-end - and before this mess began the odds for passing a tax bill by January were slim. This situation isn't helping.

Supreme Court to Hear Foreign Earnings Tax Case in December - Samantha Handler, Bloomberg ($):

Supreme Court Justices will hear oral arguments in a pivotal tax case on foreign earnings on Dec. 5, according to the high court’s docket.

Charles and Kathleen Moore have challenged the mandatory repatriation tax, also called the transition tax, enacted in the 2017 tax law, arguing that it’s an unconstitutional charge on unrepatriated foreign earnings from 1987 to 2017. Lawmakers, the Joint Committee on Taxation, and tax professionals have warned that the case, Moore v. US, could upend large parts of the tax code.

From the "Does Anyone Pay Their Fair Share" file:

Gap between US income taxes owed and paid is set to keep growing, IRS says – Wyatte Grantham-Philips, ABC News:

The amount of tax money owed but not paid to the IRS is set to keep growing, according to projections published by the federal tax collection agency on Thursday.

For tax years 2021 and 2020, the latest to receive such IRS estimates, the projected gross “tax gap” soared to $688 billion and $601 billion, respectively. That marks a significant jump compared to years past — with gross tax gap projections standing at $550 billion for 2017-2019 and $496 billion for 2014-2016.

One of the IRS's biggest challenges is making sure that people actually pay their taxes. While agency data shows that the vast majority of Americans pay their taxes voluntarily and on time, hundreds of billions of dollars in unpaid taxes pile up each year — and tax gap estimates keep getting bigger.

Related:

Americans Failed to Pay a Record $688 Billion in Taxes. The IRS Says That Will Change – Ashlea Ebeling, Wall Street Journal:

The report comes as the IRS is ramping up audits on high-income taxpayers and fighting to keep funding it got in the Inflation Reduction Act to improve taxpayer service and increase enforcement. A recent bipartisan deal ratcheted back that funding.

“The additional staff and hiring at senior levels is really a critical aspect of being able to expand our coverage,” said Melanie Krause, IRS chief data and analytics officer.

A bigger Tax Gap means less revenue to pay federal bills, which means more bonds are issued to cover all the bases:

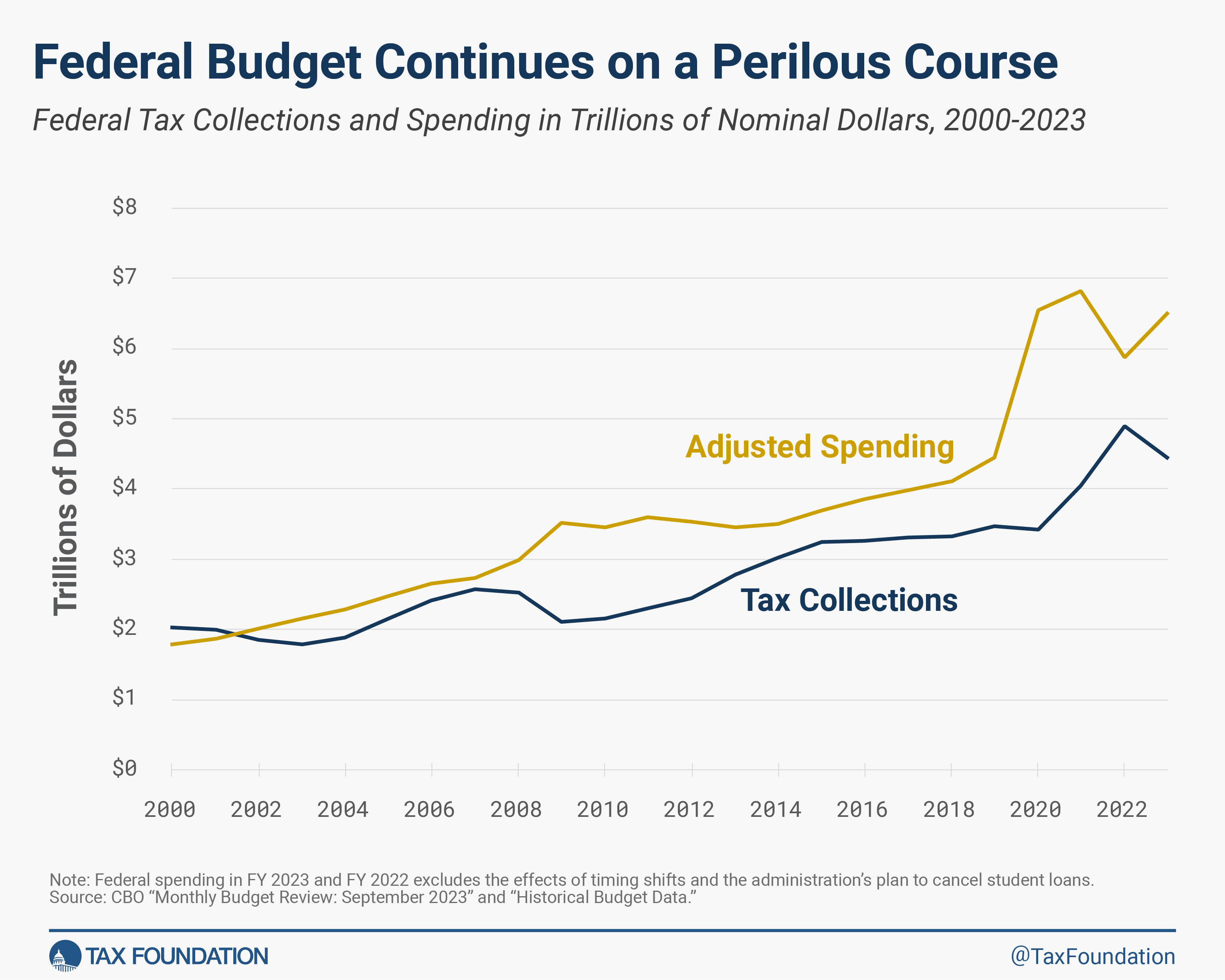

Federal Deficit Grew to $2 Trillion in FY 2023 – William McBride, Tax Foundation:

It’s Friday the 13th! Don't be scared. Be very scared!

Possible reasons why this day is sooo scary:

Friday the 13th Is Coming Up. Try Not to Be Spooked – Isabella Kwai, New York Times:

The No. 13 has long been linked to ill fortune in mythology and religion. In one Norse tale, a dinner party of 12 gods derails when Loki, the god of mischief, shows up uninvited. The number also represents betrayal at the biblical Last Supper that Jesus shares with his disciples, with Judas Iscariot joining as the 13th guest.

Executions and sentencings were also sometimes carried out on Fridays in North America, making the day known as “Hangman’s Friday.”

Whom amongst us would not be scared after reading this?

Make a habit of sustained success.