IRS managers defend automated penalty notices - Michael Cohn, Accounting Today:

A group representing managers at the Internal Revenue Service is pushing back against demands from lawmakers in Congress and tax and accounting professionals who want the agency to stop sending automated tax notices to taxpayers while it remains backlogged during the pandemic.

Really.

We understand the mailroom backlogs are an area of concern for Congress and taxpayers. In the short term, Congress can ease the burden by passing robust appropriations to allow for the hiring, onboarding and training of new employees. While the IRS is operating under a continuing resolution, these hiring and training objectives are very difficult to accomplish, if possible even at all. In the long term, dedicated multiyear funding for technology modernization would allow the IRS to improve electronic systems and take significant burdens off paper processing.”

The IRS managers are responding to complaints by taxpayers and tax pros about the IRS sending assessments and notices while responses to previous notices sit unopened in IRS mail bins. Their plan seems to be to continue beating taxpayers until funding improves.

IRS phone service was inadequate prior to the pandemic and spiraled from there, with calls reaching an all-time high and level of service (LOS) falling to an all-time low. Inadequate phone service disadvantages taxpayers, harms tax compliance, and causes frustration and exasperation. I have concerns this upcoming filing season may be just as difficult.

...

One sign of the extent to which these delays have seeped into the tax culture is the cottage industry that has sprung up to assist tax practitioners in getting through to the IRS. Some practitioners hire companies that use automated technology to continually dial IRS phone lines until they finally get through on behalf of their customers. One firm charges up to $1,000 per month for this service. A troubling aspect of this entrepreneurialism is that it has the effect of further straining IRS phone lines and making it even more difficult for the average taxpayer to reach the IRS. It’s a bad look for the IRS and unfair to taxpayers when some can essentially pay to cut to the front of the line and receive services that should be equally available to all.

"NTA" is the National Taxpayer Advocate, an independent arm of the IRS charged with protecting taxpayers in dealing with the agency.

No More Automatic Method Changes for Post-TCJA Research Costs - Nathan Richman, Tax Notes ($):

Rev. Proc. 2022-14, 2022-7 IRB 1, released January 31, is the first update to the list of automatic tax accounting method changes since 2019. IRS officials have noted that the pandemic placed efforts to update the list on the back burner.

The list of automatic method changes is where taxpayers wanting to change the timing of income inclusion and deductions for a variety of tax items look for how to make their changes without having to ask the IRS for permission ahead of time. The IRS has maintained the list with mostly annual updates since it was assembled in 2015.

Automatic method changes are the taxpayer's friend when mistakes are made. Accounting method changes allowed by the IRS permit taxpayers to fix mistakes without changing prior year returns while preventing IRS examiners from assessing taxes as a result of the errors. If correcting the error increases taxable income, the taxpayers usually can spread the make-up income over four years. If the taxpayer benefits from the correction, the benefit comes all in one year.

Automatic changes are best because they don't require the user fee the IRS charges for other method changes, and because their deadline is the return filing deadline, rather than the end of the year for which you want to make the change

Schedule K-2 and K-3 Will Be Required to Be Provided Unless Partnership Knows It Will Not Be Needed Even if Partnership Has No Foreign Activities or Partners - Ed Zollars, Current Federal Tax Developments:

The IRS made modifications to the instructions for new partnership Schedules K-2 and K-3 (Form 1065)[1] that will require partnerships to either have all partners certify that certain information will not be necessary to complete some international tax related items on their return (including the Foreign Tax Credit) or complete the relevant portions of Schedule K-2 and K-3 and provide them to all partners that they are not aware will not need the information.

...

Not all of the changes will cause increased reporting—in fact, some changes result in less work than would have been needed under the original instructions. But the changes made to the reporting of information that could impact a foreign tax credit calculation will create significant additional paperwork for many partnerships and S corporations.

Don't expect partnership return preparation to get less expensive as a result.

Manchin Casts Further Doubt on Build Back Better by Insisting Committee Action on the Bill - Jay Heflin, Eide Bailly:

The reason why this could potentially kill the bill is because the Senate is evenly divided politically (50 Democrats and 50 Republicans). Passage from committees require a majority of support, which means GOP votes and no Republican is expected to back passage of the reconciliation bill.

The Senate has a power sharing agreement for bills that are voted on in the chamber. However, that agreement does not extend to the committees in certain circumstances. This means that a bill can pass out of a committee with just Democratic support if it goes straight to the Senate floor. But legislation still requires a majority of support if it is passed from one committee and goes to another committee.

House and Senate Reconciliation Bills Differ on 24 Tax Provisions - Doug Sword, Tax Notes ($):

The biggest difference between the House bill and the Senate draft is that the Senate pared the biggest pay-for in the package — the 15 percent minimum book tax — mostly by excluding gains from defined benefit pension plans in calculating financial profits. The Senate version of the minimum book tax would bring in $21.3 billion (7 percent) less over 10 years than the House version, according to the December 20 JCT estimate.

The biggest collection of changes, though, occurred in the energy section, which Senate Finance Committee Chair Ron Wyden, D-Ore., had revamped with an eye toward gaining Manchin’s support. The House-passed version includes $300 billion in energy-related tax incentives, while the Senate version bumped that to $325 billion.

"...so it’s not only Sen. Joe Manchin III, D-W.Va., who will need to be appeased as Democrats relaunch efforts to move their cornerstone legislative package."

Still waiting on BBB, but the states are moving - Bernie Becker, Politico. "But at some point, Democrats are going to have to speed the process along on President Joe Biden’s Build Back Better agenda — or perhaps more to the point, get to figuring out what parts of that measure are salvageable."

Timberland Parent Co. Can't Shake $505M Tax Bill - Dylan Moroses, Law360 Tax Authority ($):

The parent of Timberland Co. failed to properly recognize the tax implications of the footwear company's merger with another apparel maker and owes $504.7 million in taxes as a result, the U.S. Tax Court said Monday.

The parent company, TBL Licensing LLC, failed to recognize the gains it made by acquiring intangible property held by Timberland in the form of ordinary income, and the Internal Revenue Service properly raised the company's income by more than $1.45 billion, according to the Tax Court's opinion.

Under Internal Revenue Code 367(d), transfers of intangible property by U.S. people or businesses to a foreign corporation don't qualify for nonrecognition as a taxable event.

Ownership Transparency Rules May Bring Growing Pains - Natalie Olivo, Law360 Tax Authority ($):

According to the regulations, reporting obligations apply to any domestic company "that is created by the filing of a document with a secretary of state or similar office of a jurisdiction" and any foreign company that's registered to do business in the U.S.

The rules include exemptions for companies with more than 20 full-time employees and more than $5 million in gross receipts or sales. Businesses in heavily regulated industries — banks and securities brokers, for example — are also exempted.

Ultimately, about 25 million existing companies are expected to fall under the regulations, with 3 million new ones formed each year, according to FinCEN.

The $5 million / 20 employee thing will ensure that the compliance costs will fall most heavily on the businesses least likely to be aware of the reporting requirement. It will also surprise larger businesses with start-up or inactive subsidiaries.

MTC's Partnership Project Is Its Largest Effort, Panel Says - Maria Koklanaris, Law360 Tax Authority ($). "The amount of information to be analyzed, the complexity of the topic, even for the technical state tax world, and the lack of uniformity among state treatment of partnership taxation has created a tall order for the MTC, the panelists said at the American Bar Association tax section's midyear meeting, held online."

Minnesota DOR Completes Returns Affected by UI, PPP Changes - Minnesota Department of Revenue, via Tax Notes. "The Minnesota Department of Revenue announced today that the processing of nearly 540,000 tax returns impacted by changes made only to the treatment of Unemployment Insurance (UI) compensation and/or Paycheck Protection Program (PPP) loan forgiveness is complete. The department sent out over $300 million in the form of refunds or a reduction in taxes owed to taxpayers whose returns were impacted."

IRS issues 2021 Filing Season frequently asked questions, information to help taxpayers preparing their 2021 returns - IRS. "Recipients of advance Child Tax Credit payments will need to compare the amount of payments received during 2021 with the amount of the Child Tax Credit that can be claimed on their 2021 tax return."

Competing with China, Tax Relief, New Taxes, And Pope Francis Praises Taxes - Renu Zaretsky, Daily Deduction. "In tomorrow’s budget address, Gov. J.B. Pritzker will announce a $1 billion tax relief package designed to mitigate the impact of inflation. It would suspend the 1 percent grocery tax for a year, delay the automatic inflation-adjusted increase in the motor fuels tax, and provide a 5 percent property tax rebate to qualifying owners."

Pass-Through Entity (PTE) Tax - Minnesota Department of Revenue.

Qualified entities may elect to pay PTE tax if owners who collectively control more than 50% of the entity decide to do so, and the entity meets all other election requirements. Once made, the election is binding on all owners.

PTE tax is calculated by multiplying the entity’s Minnesota source income by the highest Minnesota individual income tax rate, which is currently 9.85%.

The PTE tax election is available for an entity’s tax years beginning after December 31, 2020.

This bill enables Minnesota owners of partnerships and S corporations to bypass the $10,000 cap on deductions for state and local taxes arising from income from these entities.

Tax Haven U.A.E. to Introduce Levy on Corporate Profits - Rory Jones, Wall Street Journal ($). "Individuals will remain exempt from income tax, capital-gains tax on real estate and other investments, and other earnings, the ministry said. The state will only tax profits above 375,000 U.A.E. dirhams, equivalent to around $102,000, to help support small businesses and startups. In addition, the new rate won’t apply to companies involved in resource extraction, such as state-owned oil firms."

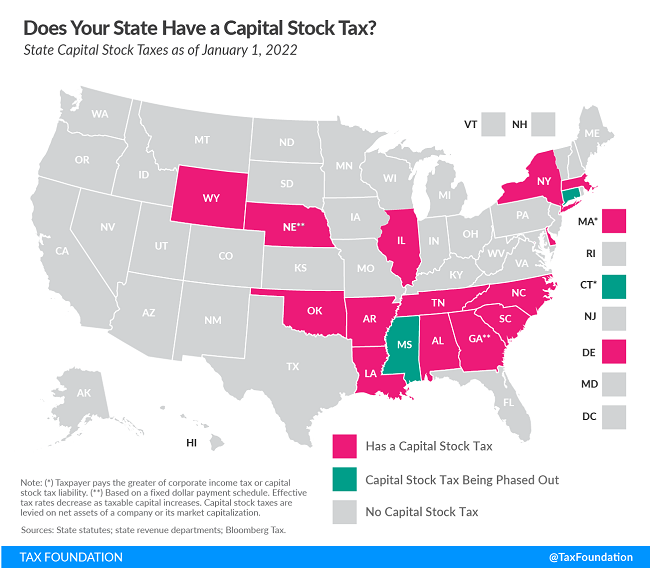

Does Your State Levy a Capital Stock Tax? - Janelle Cammenga, Tax Policy Blog. "Sixteen states levy capital stock taxes (often called franchise taxes, though some states use that term for different types of taxes as well). Capital stock taxes are not always limited to C corporations, either; different states have different laws regarding the types of businesses that fall under a capital stock tax. However, regardless of which entities are subject to the tax, the incentive is clear—capital stock taxes disincentivize capital accumulation in a state."

Be sure to report cryptocurrency activity on your tax return - Kay Bell, Don't Mess With Taxes. "You must answer with the correct yes or no checkbox whether, 'At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?' The checkbox yes or no"

Lower Reporting Thresholds Apply to Third Party Network Payments Beginning in 2022 - Parker Tax Pro Library. "Beginning with 2022, taxpayers that use Paypal, Venmo, and other third-party networks to receive payments for goods and services will receive a Form 1099-K, Payment Card and Third Party Network Transactions, if the aggregate amount of the 2022 payments for the year exceeds $600, regardless of the number of transactions."

Syndicated Conservation Easements (and Other Tax Schemes) Beware - Cory Halliburton, Freeman Law. "In sum, any investor or promoter involved in a syndicated conservation easement should take caution and evaluate whether the deductions represented, taken or pursued are appropriate and defendable under I.R.C. section 170 and corresponding Treasury Regulations because the IRS is seeking to engage hundreds of attorneys to review these transactions to show otherwise."

Charlie Sheen Income Tax Woes - Things Are Looking Better - Peter Reilly, Forbes. "Based on the public record we don't know how much the IRS is trying to get from Charlie Sheen. It is reasonable to infer that it is considerably more than the $3.1 million offer in compromise that CPA and United States Tax Court Practitioner Steven Jager negotiated for Mr. Sheen." Also: "I picked up the story from a brief mention in Eide Bailly Tax News & Views." As someone once said, "winning!"

Does the Mafia hire good accountants? - Tyler Cowen, Marginal Revolution, quoting a new paper by Pietro A. Bianchi, Jere R. Francis, Antonio Marra, and Nicola Pecchiari:

We investigate if organized crime groups (OCG) are able to hire good accountants. We use data about criminal records to identify Italian accountants with connections to OCG. While the work accountants do for the OCG ecosystem is not observable, we can determine if OCG hire “good” accountants by assessing the overall quality of their work as external monitors of legal businesses. We find that firms serviced by accountants with OCG connections have higher quality audited financial statements compared to a control group of firms serviced by accountants with no OCG connections.

But when the Mafia terminates an accountant, it can be all too literal.

I will decorate my tummy from the inside. Today is Decorating with Candy Day!

Make a habit of sustained success.