IRS Says Tax Compliance Rising, but Hundreds of Billions Still Go Uncollected - Richard Rubin, Wall Street Journal.

In tax years 2014 through 2016, Americans paid 85% of their taxes on time, up from the agency’s 83.7% estimate for tax years 2011 through 2013, the IRS said Friday. That compliance rate climbed to 87% after IRS enforcement and late payments were included, from 85.9% in the prior estimate. The IRS projects that those higher percentages were consistent for tax years 2017 through 2019.

...

Measuring tax dodging is difficult, because it requires the IRS to see what it can’t normally see. For this research, the agency uses special intensive audits to look for noncompliance and then extrapolate. The IRS said its estimates don’t fully include several potential sources of tax dodging, including corporate maneuvers, cryptocurrency, offshore entities and illegal activities.

Tax Gap Has Grown to Nearly $500 Billion, IRS Says - Lauren Loricchio, Tax Notes ($):

Estimates from some IRS and Treasury officials have been much higher.

[IRS Commissioner] Rettig told the Senate Finance Committee during an April 2021 hearing that “it would not be outlandish to believe that the actual tax gap could approach, and possibly exceed, $1 trillion per year.”

Annual Tax Gap Hit Nearly $500 Billion, IRS Projects - Kat Lucero, Law360 Tax Authority ($). "In a release announcing the new estimates, the IRS warned that the estimates do not account for all noncompliance transactions, including those involving offshore and illegal activities, because the agency lacks data. The IRS said the agency faces some challenges in sketching a better picture of the annual tax gap, which is the difference between how much U.S. taxpayers owe in taxes and the amount that has been paid on time."

Biden to replace IRS commissioner as Democrats seek to retool tax agency - Jacob Bogage, Washington Post:

The Biden administration will replace Internal Revenue Service Commissioner Charles Rettig at the conclusion of his term in November, Treasury Secretary Janet L. Yellen announced Friday.

Douglas O’Donnell, a deputy commissioner and longtime IRS official, will lead the agency on an interim basis beginning Nov. 12.

Yellen Names Acting IRS Commissioner Ahead Of Rettig's Exit - Asha Glover, Law360 Ta Authority ($):

O'Donnell is temporarily inheriting an agency that is tasked with implementing changes made under the recently enacted Inflation Reduction Act. The law includes a 15% alternative minimum tax on adjusted financial statement income for corporations with profits over $1 billion, as well as renewable energy tax credits and incentives.

President Joe Biden will have to nominate Rettig's permanent replacement, but he has yet to do so. Former President Donald Trump nominated Rettig to replace acting commissioner David Kautter in February 2018, about four months after former IRS Commissioner John Koskinen's term expired.

Treasury’s Pick for Acting IRS Commissioner Widely Lauded - Jonathan Curry, Tax Notes ($):

As a 36-year veteran of the IRS, O’Donnell knows the agency well, and therefore he’s a “good choice as a caretaker,” said Jeffery S. Trinca of Van Scoyoc Associates. O’Donnell is well positioned to know what kind of hiring and training the IRS needs to undertake, and he’s undoubtedly familiar with the risks posed by the upcoming filing season, he added.

O’Donnell has worn various hats over his long career with the agency — including serving as commissioner of the Large Business and International Division for six years — and will be stepping into his new position at a critical time. The IRS is simultaneously recovering from the setbacks of the COVID-19 pandemic — a seemingly insurmountable backlog of unprocessed tax returns and mail and taxpayer services stretched to their limit — and laying the groundwork for how it will undergo an agencywide transformation using the nearly $80 billion in extra funding it received as part of the Inflation Reduction Act (P.L. 117-169).

Career IRS employee will be acting commissioner after Rettig leaves - Kay Bell, Don't Mess With Taxes. "Former IRS commissioners Fred Goldberg, Charles Rossotti, Mark Everson, and John Koskinen, who served under both Democratic and Republican administrations, along with former National Taxpayer Advocate Nina Olson issued a statement this month calling for quick action on Rettig's replacement."

Interim IRS Chief Named - Jay Heflin, Eide Bailly. "It is not clear if O’Donnell will be Rettig’s permanent replacement. The role for a permanent IRS Commissioner must by confirmed by Congress. Lawmakers are expected to return to Capitol Hill on November 14 and possibly stay in session until mid-December. A confirmation process could occur during this time period, but it is not clear if it will happen."

Compliance Sweeps to Target Taxpayers With High Balances Due - Wesley Elmore, Tax Notes ($):

Darren Guillot, deputy commissioner of collections, said October 27 that the revenue officer compliance sweep of taxpayers with high balances due will begin “in the coming few months.” He compared the sweep to the IRS’s past initiative to bring high-income delinquent filers into compliance.

...

The IRS is making headway on its paper return backlog and still expects to be caught up by the end of the year, Guillot said. But because it’s not caught up yet, the agency hasn’t resumed sending out the automated collection notices that were suspended during the COVID-19 pandemic.

Coalition gears up for lame-duck push to shield online sellers - Laura Weiss, The Hill. "Online platforms, ranging from marketplaces like eBay to payment apps like Venmo and gig working sites like Uber, previously had to send tax reporting forms to users and the IRS only if sellers made at least $20,000 in at least 200 separate transactions. But a last-minute offset attached to Democrats’ 2021 pandemic relief package cut the threshold to $600 in aggregate earnings, which the Joint Committee on Taxation estimated would capture $8.4 billion more in tax revenue over a decade."

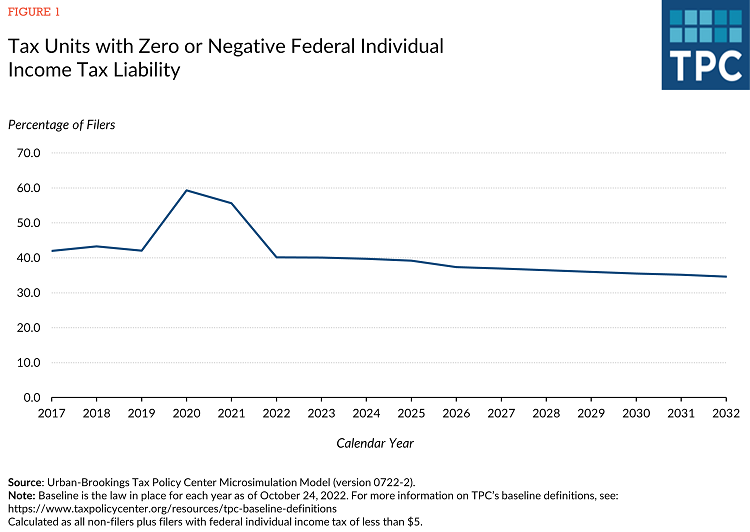

TPC: The Number Of Those Who Don’t Pay Federal Income Tax Drops To Pre-Pandemic Levels - Howard Gleckman, TaxVox. "After dramatically rising during the worst of the pandemic, the number of households who pay no federal income tax has fallen sharply. It will remain relatively steady in absolute numbers and as a share of tax filers as long as the job market remains relatively healthy and until the individual tax provisions of the 2017 Tax Cuts and Jobs Act (TCJA) expire at the end of 2025."

IRS Waives RMD Penalty for Certain Inherited Retirement Accounts - Melissa White, Eide Bailly. "The notice says penalties on such missed RMDs will not be imposed until 2023 at the earliest. If a beneficiary already paid the penalty for a missed 2021 RMD, the beneficiary can request a refund from the IRS."

Poor Return Preparation Voids Deduction For African Art - Peter Reilly, Forbes. "The opinion illustrates Reilly's Fourth Law of Tax planning - Execution isn't everything, but it's a lot - with a shoutout to the Seventh Law - Read the instruction."

IRS Publishes Draft of 2022 Form 1065 K-2 and K-3 Instructions With Revised Exemptions from Filing - Ed Zollars, Current Federal Tax Developments. "If a partnership receives notification from only some of the partners that they are eligible for the Form 1116 exemption, the partnership need not complete the Schedule K-3 for those exempt partners but must complete the Schedules K-2 and K-3 with respect to the other partners to the extent that the partnership does not qualify for the domestic filing exception."

If You Used IRS Direct Pay on October 20th Check Your Bank Records - Russ Fox, Taxable Talk. "I love IRS Direct Pay. It’s a simple method to make payments to the IRS for most (but not all) taxes individuals might have. And it works…well, it works most of the time."

Cracking Down on Tax Return Preparation 'Freebies' - Nana Ama Sarfo, Tax Notes Opinions. "Tax return preparation service Liberty Tax is being sued by the District of Columbia for allegedly cheating customers by luring them with a cash bonus program, while secretly increasing their preparation charges. The lawsuit feeds into a long-running debate over whether there should be better federal regulation of the tax return preparation industry."

Treat(y) Yourself - Alex Parker, Things of Caesar:

As you may have heard, the global minimum tax agreement announced by President Joe Biden last year, as part of the Organization for Economic Cooperation and Development’s Two-Pillar Solution, is in trouble.

...

However, there’s a sleeper issue which could potentially threaten the project’s long-term viability from the inside, undermining countries’ abilities to rely on the legislation carrying it out. National laws usually rule supreme–but not necessarily against treaties. More and more experts are starting to question the OECD’s insistence that this project can be carried out without changing the intricate network of bilateral tax treaties which have been the backbone and arteries of the global tax system for a century.

Trump Organization faces criminal tax fraud trial over perks - Michael Sisak, AP via Washington Post:

For years, as Donald Trump was soaring from reality TV star to the White House, his real estate empire was bankrolling big perks for some of his most trusted senior executives, including apartments and luxury cars.

The case alleges that the Trump organization paid personal expenses of CFO Allen Weisselberg without including them on his W-2. Mr. Weisselberg has pleaded guilty to taking $1.7 million in untaxed compensation.Now Trump’s company, the Trump Organization, is on trial this week for criminal tax fraud — on the hook for what prosecutors say was a 15-year scheme by top officials to hide the plums and avoid paying taxes.

Dallas attorney charged in $1 billion tax shelter scheme - IRS (Defendant name omitted):

According to the indictment, Defendant allegedly created multiple shell companies – including shell "services" companies and shell "investments" companies – to create a circular flow of funds to help clients avoid paying taxes.

These shell companies purported to provide services to the clients' businesses or to serve as family investment vehicles, but actually had no legitimate purpose other than to move money. Defendant and others allegedly created sham operating agreements, sham service agreements, phony invoices, and false private annuity agreements designed to give the companies the appearance of legitimacy and conceal the scheme from the IRS.

Scary.

Boo! Of course today is Halloween. It's also Magic Day! But remember, there is no magic trick to make taxes disappear.

Make a habit of sustained success.