2023 State Business Tax Climate Index - Janelle Fritts and Jared Walczak, Tax Policy Blog:

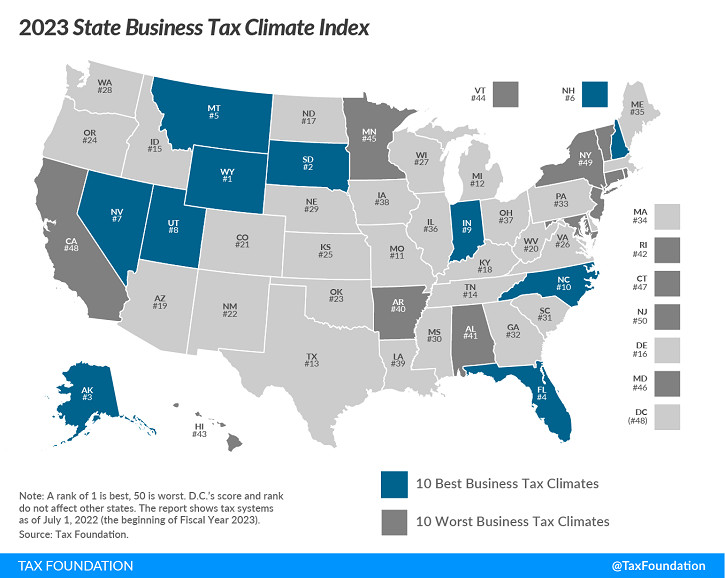

The absence of a major tax is a common factor among many of the top 10 states. Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax. Nevada, South Dakota, and Wyoming have no corporate or individual income tax (though Nevada imposes gross receipts taxes); Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire and Montana have no sales tax.

This does not mean, however, that a state cannot rank in the top 10 while still levying all the major taxes. Indiana and Utah, for example, levy all the major tax types but do so with low rates on broad bases.

...

The states in the bottom 10 tend to have a number of afflictions in common: complex, nonneutral taxes with comparatively high rates.

The Tax Foundation's rankings have their critics. These sometimes amount to unhappiness that the index doesn't measure something other than what it attempts to measure - "the Index is designed to show how well states structure their tax systems and provides a road map for improvement."

Tax structure matters. A gross receipts tax on businesses is less business friendly than a net income tax, for example, because it taxes non-profitable businesses.

Taxes aren't everything in public policy, but they are certainly a thing.

The Tax Foundation’s 2023 State Business Tax Climate Index: Bring Me the Usual Suspects (Again)! - Russ Fox, Taxable Talk. "While California bureaucrats would argue that the high and complex tax and regulatory system in the Golden State doesn’t matter, reality is what it is: It truly does matter."

IRS Focuses on ‘Day 1 Issues’ With Corporate AMT, Buyback Tax - Chandra Wallace, Tax Notes ($):

The corporate AMT and the stock buyback excise tax were “kind of sleepers,” Karen Gilbreath Sowell of EY said, adding that “nobody in the tax world was paying attention to this stuff, and all of a sudden we’ve got” them, and they’re scheduled to go into effect on January 1, 2023, just over two months away.

Both taxes, enacted August 16 as part of the Inflation Reduction Act (P.L. 117-169), escaped significant participation in the legislative process by the tax bar, Sowell noted. “It’s also a good example of why we need to pay attention to proposals before they become law, because it’s much harder to get things corrected” now, given how much Treasury and the IRS have on their plates, she said.

Corp. Minimum Tax Guidance A High Priority, IRS Official Says - Theresa Schliep, Law360 Tax Authority ($):

Guidance on the new corporate alternative minimum tax and its application to split-offs and other transactions is a top priority for the Internal Revenue Service, and the agency is working on identifying the most urgent areas to address, an IRS official said Tuesday.

The IRS and U.S. Department of the Treasury are working to tease out the top "day one" issues to include in guidance on the new 15% corporate alternative minimum tax that will go into effect next year, according to William Burhop, senior technician reviewer, Branch Five, in the IRS' Office of Associate Chief Counsel, Corporate. That includes the tax implications of book gains from split-off transactions.

Companies Seek Guidance on New U.S. Minimum Tax as Launch Date Nears - Jennifer Williams-Alvarez, Wall Street Journal. "Tax executives and lawyers said companies need additional clarifications from the government soon, as they are in the process of tax planning for 2023. The IRS is working to give priority to 'day one issues' that companies need guidance on as quickly as possible, William Burhop, a senior technician reviewer at the agency, said at a conference Tuesday, without spelling out what those issues are. The Treasury Department doesn’t have updates to share on the timing of any guidance, a spokeswoman said."

Want a big tax break for a Porsche? Better move fast - Lynnley Browning, Accounting Today:

One of the more lucrative benefits of the 2017 tax-code overhaul will be pared back come 2023, leaving barely two months for business owners to lock in its full value. Financial advisors say that affluent clients who haven't yet used the incentive have a tight window to significantly reduce their federal income tax bills for this year.

The temporary benefit, known as bonus depreciation, allows taxpayers to take a full deduction immediately on an asset that's used for business and has a "usable life" of 20 years or less rather than writing off, or depreciating, its cost in chunks over a longer period of time.

Related: Cost Segregation: The Right Asset Classification Produces Huge Tax Savings.

Number of AMT Payers Estimated to Skyrocket After TCJA Expires - Doug Sword, Tax Notes ($):

After the Tax Cuts and Jobs Act went into effect, the number of taxpayers paying the AMT plummeted from 5.2 million in 2017 to 200,000 in 2018 as the law raised AMT exemptions by 34 percent, bumped up the 28 percent tax bracket’s threshold, and at least quadrupled the exemption phaseout threshold. The TCJA also repealed some of the most-used preferences of AMT payers, or in the case of the state and local tax deduction, limited the preference.

...

In a new estimate released October 25, however, the TPC forecast that the number of taxpayers paying the AMT will be 7.6 million in 2026 — 900,000 more than the earlier forecast.

Some in Congress have pushed for a restoration of the deduction for state and local taxes. If they succeed, AMT will soak up most of the benefit.

The next chapter of America’s post-Roe, pro-weed, tax-the-rich movement is coming - Liz Crampton and Marissa Martinez, Politico. "The 'tax the rich' progressive movement is facing a major test with proposals in three states. Revenue gathered from hikes on high-income earners in Colorado, Massachusetts and California would go toward providing kids with universal free school meals, boosting education and transportation spending and fund electric vehicle infrastructure."

IRS warning millions of low earners they're missing out on Covid-era payments - Brian Faler, Politico. "People can potentially get five-figure payments if they haven’t claimed last year’s expanded child credit, worth as much as $3,600 per child; stimulus payments of $1,400 per person; an expanded child and dependent care credit of up to $8,000; as well as a boosted Earned Income Tax Credit."

Lawmakers, advocates eye year-end bills for housing credit - Caitlin Reilly, Roll Call. "Despite bipartisan support for the low-income housing tax credit, or LIHTC, its expansion in a year-end bill may come down to cost and negotiations around bigger partisan priorities, including the child tax credit, and research and development incentives."

Tax changes mean brighter future for retirement savings - Pinar Cebi Wilber, The Hill. "Last week the Internal Revenue Service (IRS) announced new limits on various tax advantaged saving vehicles, such as IRAs and 401(k) contributions, for 2023. As expected, rising inflation increased these limits significantly. For example, the annual 401(k) contribution limit will increase to $22,500, from $20,500, while the annual IRA contribution will increase from $6,500 to $7,500."

401(k) And IRA Contribution Limits Will Jump In 2023, IRS Says - Janet Novack, Forbes. "The Internal Revenue Service announced today that young workers will be allowed to contribute up to $22,500 pretax to a 401(k) or similar retirement savings plan in 2023, a $2,000 jump from the current $20,500 limit. Those 50 or older will be permitted to sock away up to $30,000, a $3,000 boost, which includes a $7,500 “catch-up” contribution, up from a $6,500 catch-up in 2022."

Popular tax deductions, credits, and exclusions get better in 2023 due to inflation hikes - Kay Bell, Don't Mess With Taxes. "In 2023, the QBI threshold will increase to $364,200 for married couples filing joint returns, and to $182,100 for married individuals filing separate returns, single taxpayers, and heads of households who operate pass-through businesses."

Inflation Adjusted Amounts Issued by IRS for 2023 - Ed Zollars, Currrent Federal Tax Developments. "For taxable years beginning in 2023, the Maximum Zero Rate Amount under § 1(h)(1)(B)(i) is $89,250 in the case of a joint return or surviving spouse ($44,625 in the case of a married individual filing a separate return), $59,750 in the case of an individual who is a head of household (§ 2(b)), $44,625 in the case of any other individual (other than an estate or trust), and $3,000 in the case of an estate or trust."

Will Rescheduling Cannabis Help State-Legal Dispensaries With Their Taxes? Probably Not Any Time Soon - Amber Gray-Fenner, Forbes. "In a cannabis business, however so many expenses are disallowed under § 280E that the business’ profit is much larger on their tax return than it is in fact."

What happens to a loan against a qualified retirement plan when the plan or employment is terminated? - Cory Halliburton, Freeman Law. "Basically, a plan participant can avoid paying taxes on the plan loan offset amount by timely rolling that amount over to another qualified retirement plan listed in 26 U.S.C. § 72(p)(4)(A)(I)-(III))."

A Tax Rule of Substance - Alex Parker, Things of Caesar. "When I first learned about the economic substance doctrine, something about it seemed almost downright un-American to me. You mean you can outsmart the tax laws fair and square, and yet somehow the government still wins?"

Cannabis Taxes on the Ballot: Voters Approve, Legislatures Change - Richard Auxier, TaxVox. "Since 2012, voters have approved state ballot measures legalizing recreational cannabis 13 times and rejected them only four."

Ottumwa Man and Woman Charged for Filing Hundreds of False Tax Returns and Fraudulently Obtaining Unemployment Insurance Benefits Payments - US Department of Justice (Defendant names omitted).

As alleged in the indictment, Defendant Father, age 47, and his daughter, age 20, conspired to defraud the Internal Revenue Service (IRS) by preparing and filing hundreds of fraudulent tax returns. Defendants provided tax-preparation services out of their family’s home in Ottumwa. Their customers primarily were immigrants who had little or no ability to read, write, or speak English.

The indictment also alleges that Defendants would prepare their customers’ tax returns in exchange for a cash fee. Defendants acted as “ghost preparers,” meaning that they did not sign their clients’ tax returns when they prepared and filed them. Without their customers’ knowledge or approval, Defendants often included on their customers’ federal tax returns, schedules, and forms, fraudulent items, such as false claims for residential energy credits, business-expense deductions, or moving-expense deductions. The effect of Defendants including fraudulent items on the tax documents was to increase the refunds their clients received and increase Defendants’s customer base.

In addition, it is alleged that Defendants engaged in wire fraud by directing that portions of their customers’ fraudulent refunds be deposited into financial institution accounts accessible to Defendants. By doing so, Defendants attempted to obtain from the IRS over $140,000 in fraudulent refunds.

The IRS warns against using "Ghost preparers." If the allegations here are true, this is a good illustration of their point.

This also illustrates the limits of efforts to further regulate tax preparers. By limiting the number of legal preparers via paperwork and fee requirements, harsher regulation will push more taxpayers to black market preparers, with unhappy consequences.

Sure, and in two weeks you'll just take them out to the curb. But for now, celebrate National Pumpkin Day!

Make a habit of sustained success.