Holiday notice. Eide Bailly offices are closed for the Independence Day holiday Fricay, July 2, and Monday, July 5, and Tax News & Views will also take those days off. Come back for fresh news next Tuesday!

IRS Provides How-To on Farming Loss Election - Kristen Parillo, Tax Notes ($). The CARES Act allowed farmers to carry back net operating losses generated in 2018, 2019, and 2020 for five years, instead of the usual two-year farm carryback period. This didn't help farmers who had elected to carry forward losses already, and who therefore could not use the five-year carryback period. This was fixed by P.L. 116-260, which also allowed taxpayers to keep their old two-year carryback if they didn't want to use the five-year rule.

New IRS guidance cleans up some loose ends. From the article:

Rev. Proc. 2021-14 explains how taxpayers can make an affirmative election to disregard CARES Act amendments. It provides that a taxpayer is treated as having made a deemed election if it filed one or more original or amended federal income tax returns, or applications for tentative refund, before December 27, 2020, that applied the TCJA rules on the farming loss portion of an NOL.

The revenue procedure also prescribes when and how taxpayers can revoke an election to waive the two-year carryback period for the farming loss portion of an NOL incurred in tax year 2018 or 2019.

Rev. Proc. 2021-14 provides affirmative elections that taxpayers can make on extended 2020 returns. Taxpayers who filed 2020 returns disregarding the CARES Act five-year carryback are considered to have made a "deemed" election to bypass the CARES Act five-year rule and don't need to do anything else. The procedure also allows farmers who filed two-year claims that were rejected rules for re-applying.

Related: IRS simplifies CARES Act net operating loss refund claims.

Taxpayer Advocate Report Reveals an IRS Overwhelmed in 2021 - Jonathan Curry, Tax Notes:

By some metrics, the IRS performed about as well as it has in past years, the report notes. The IRS processed 136 million individual income tax returns and issued 96 million refunds by the end of the 2021 tax return filing season, roughly the same as it had during the most recent ordinary filing season in 2019, according to the report.

But the manual processing backlog of 35 million returns — more than three times the total in 2020 and almost five times as many as in 2019 — and other metrics show how the pandemic strained the IRS’s ability to perform many of its functions.

Also: "[Taxpayer Advocate Erin] Collins observed that all most taxpayers can do is wait for the backlog to clear..."

Related: IRS chief: Agency is 'current' on mail as start of filing season approaches.

Millions Await Tax Refunds as IRS Struggles to Clear Backlog - Richard Rubin, Wall Street Journal ($). "IRS Commissioner Charles Rettig has said that employees are working as quickly as possible using mandatory overtime to process the returns. He told the Senate Finance Committee on June 8 that the IRS had processed returns received in 2020 and was effectively caught up on backlogged opening of mail."

IRS ended filing season with 35M unprocessed tax returns - Celine Castronuovo, The Hill. "The report, conducted by the National Taxpayer Advocate's office at the IRS, found that while most taxpayers were able to successfully file their returns and receive refunds, a record high number of Americans did not, with unprocessed tax returns more than four times greater than the number recorded at the end of the 2019 pre-pandemic filing season."

35,300,000 - Russ Fox, Taxable Talk. "And if you called the IRS general phone line for individuals, you had a 3% chance of getting through!"

Democrats search for sweet spot on ‘SALT’ deduction - Lindsey McPherson, Roll Call. "A compromise short of full repeal appears to be the direction Democrats are headed, lawmakers and aides say. They may lose two House Democrats — New York’s Tom Suozzi and New Jersey’s Josh Gottheimer — who have taken a hard line. But more limited SALT relief is seen as satisfying enough lawmakers to avoid sinking the broader bill."

IRS Extends Relief for COVID-19 Donations of Paid Time Off - Caitlin Mullaney, Tax Notes ($). "Notice 2021-42, 2021-29 IRB 1, released June 30, extends the treatment of cash payments made to section 170(c) charitable organizations in exchange for vacation, sick, or personal leave that employees donate under employer-sponsored donation programs as long as the payments are intended to help pandemic victims after December 31, 2020, and before January 1, 2022."

Missouri Governor Signs Wayfair Bill - Lauren Loricchio, Tax Notes ($). "Missouri's governor has signed a bill requiring remote sellers and marketplace facilitators to collect and remit tax on sales into the state, becoming the last state with a sales tax to enact legislation responding to Wayfair."

Related: States Respond to SCOTUS Wayfair Decision.

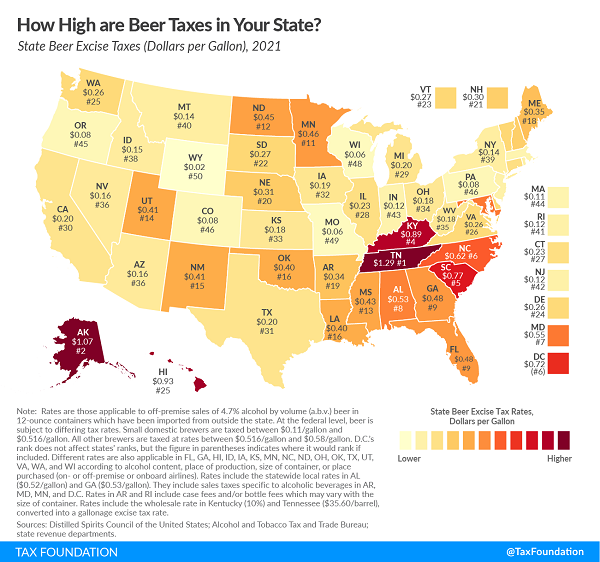

How High Are Beer Taxes in Your State? - Janelle Commenga, Tax Policy Blog. "The United States collects an excise tax on beer at the federal level (ranging from $0.11 to $0.58 per gallon based on production, location, and quantity), but all 50 states and the District of Columbia also collect their own taxes on fermented malt beverages. While general sales taxes are tacked on after the price of goods is subtotaled, most states go straight to the retailer for beer excise taxes, collecting according to the quantity of beer sold (usually expressed as a rate of dollars per gallon)."

Fake tax promises, other phony ploys are part of the 2021 IRS Dirty Dozen - Kay Bell, Don't Mess With Taxes. "Despite recent studies that show young people are just as (or more) susceptible to scams, con artists still find older folks are prime fraud targets. So are immigrants who aren't proficient in English."

IRS Couples Schedules K-2, K-3 Instructions With Penalty Relief - Kelley Taylor, Tax Notes ($). K-2 and K-3 are new forms for 2021 to report international tax information to partners. From the article:

In Notice 2021-39, the IRS acknowledges that some partnerships may face compliance challenges with the adoption of the new schedules K-2 and K-3.

As a result, partnerships that are required to file partnership returns won’t be subject to specific penalties for incorrect or incomplete reporting on schedules K-2 and K-3 for tax years beginning in 2021.

...

To be eligible for the penalty relief, the filer must establish — to the satisfaction of the IRS — that it made a good-faith effort to comply with the filing requirements.

Until now, partnerships have reported much international information to partners in footnotes, with no standard format available. The new format should make it easier for partners to fill out international forms.

Thinking Out Loud About the Advanced Child Tax Credit- Part I - Nina Olson, Procedurally Taxing. "Some child welfare and anti-poverty advocates are promoting the concept of a monthly payment that would bear many characteristics of traditional social benefits programs, notably the concept of “presumptive” eligibility. While this concept appears superficially attractive, I have a lot of concerns about how this approach would fit with fundamental principles of taxation. If it is adopted as currently proposed, I believe it would ultimately lead to the CTC being removed from the tax code entirely because it would become unworkable and severely impair taxpayer rights and a fair tax system."

Nina Olson retired in 2019 as IRS Taxpayer Advocate.

Construction Companies with PPP Loans Are Likely to See the Loan Forgiveness Process Eased - Mark Friedlich, Wolters Kluwer Tax & Accounting. "The elimination of this certification requirement will ease the concerns of construction (and other) companies who had taken these PPP loans in anticipation of loan forgiveness without the necessity for additional documentation."

What is reasonable compensation for employees of an I.R.C. § 501(c)(3)? (Part 1) - John B. Reyna, Freeman Law. "The I.R.C. provides three types of tax to be imposed as intermediate sanctions when an excess benefit transaction occurs. Two of the taxes apply to disqualified persons who receive a benefit because of the excess benefit transaction. The third tax can apply to an organization manager."

Former Owner of Florida Produce Business Pleads Guilty to Tax Evasion - U.S. Department of Justice. The taxpayer "filed a false 2014 corporate tax return for Fleischmann’s with the IRS that overstated total business expenditures by falsely reporting the $896,951 in gambling expenditures as cost of goods sold."

Oh! Today is Canada Day, the national day of our northern neighbor. With COVID border restrictions still in place, you may want to pivot to International Chicken Wing Day, also celebrated today.

Make a habit of sustained success.