It's April 15. Does it matter? The federal Form 1040 filing deadline was moved to May 17 this year. So does today mean anything?

For some taxpayers, it means a lot. Some things remain due today:

- Gift tax returns are due today on paper Form 709, unless you extend with paper Form 8892.

- Calendar-year Trust and estate income tax returns are due today on Form 1041, unless extended with Form 8736.

- Calendar-year C corporation returns are due today on Form 1120, unless extended on Form 7004.

- Estimated taxes are due for Trusts and Calendar-year C corporations today.

Finally, first quarter individual estimated tax payments are inexplicably due today. The IRS has stubbornly refused to match the 1040 deadline and the estimated tax deadline, even though most taxpayers base their estimates on the tax shown on the prior year return.

How should you file? If you can file electronically, you should. The IRS is still months behind in filing paper returns, and that can lead IRS computers to think you are a non-filer until they find your filing at the bottom of a mail bin.

If you must file on paper, document your filing. Certified Mail, Return Receipt Requested, is the standard. Yes, it costs $3.60, but it can more than pay for itself if the IRS asserts a late filing penalty. If you really are a last-minute filer and you get to the post office after it closes, you can use an authorized private delivery service. Be sure you use the right delivery option; for example, UPS Next Day Air qualifies, but UPS Ground does not. Save your shipping documents.

How should you pay? Consider one of the IRS electronic payment options. You can pay individual estiated tax payments on the IRS direct pay website. This is recommended. Otherwise, you put yourself at the mercy of the postal service and the IRS mailroom. Other options are also available.

IRS clarifies application of 2020 overpayments to Q1 estimated payments - Michael Cohn, Accounting Today. "IRS Commissioner Charles Rettig faced some tough questions about the matter during a Senate Finance Committee hearing Tuesday about the tax season, but he continued to insist that no extension would be provided on quarterly estimated payments. Lawmakers have introduced legislation that could allow for a delay, but with the April 15 deadline just a day away, accountants are filing the quarterly estimated payments, even while questions have lingered about what to do in some instances, such as overpayments of 2020 taxes."

When Are Taxes Due? May 17 Is Tax Deadline Day for 2020 Taxes - Laura Saunders, Wall Street Journal ($). "Last year, the pandemic prompted the agency to postpone the April 15 deadline to July 15 for a range of tax filings, but this year’s relief is narrower."

Form 4868 Filed After April 15 and On or Before May 17, 2021 Will Not Extend the Time to File a Gift Tax Return - Ed Zollars, Current Federal Tax Developments. "However, if a taxpayer files the Form 4868 after April 15, 2021 but on or before May 17, 2021 it will only serve to extend the time to file the income tax return. There would be no extension of time granted to file the gift tax return."

Congressman Brady, former tax-writing chief, announces retirement, setting up race to replace him - Jay Heflin, Eide Bailly. "Committee Republicans Devin Nunes (Calif.), Vern Buchanan (Fla.), Adrian Smith (Neb.) and possibly Jason Smith (Mo.) and Tom Rice (S.C.) could vie to replace Brady."

The Republicans racing to replace Brady on Ways and Means - Olivia Beavers, Politico. "Rep. Devin Nunes (R-Calif.) is widely seen as the front-runner. He is the most senior Republican after Brady, a close ally to GOP leader Kevin McCarthy (R-Calif.) and a prolific fundraiser. And he is said to be very interested in the job. But, that would also mean he would have to relinquish his top role on the House Intelligence Committee, where he was able to make his mark as a loyal ally to then-President Donald Trump, particularly during the Russia probes."

Free File can help those who don't usually file taxes get COVID payments and more - Kay Bell, Don't Mess With Taxes:

Advantages of filing a tax return: Your return filing also could reveal that in addition to qualifying for an EIP, you are eligible for other tax breaks.

Potential tax benefits include payments from the prior EIPs. If you didn't get the two disbursed last year, you can claim the amounts as the Recover Rebate Tax Credit on your 2020 return.

You also might be eligible for the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC).

House Dems Consider Raising SALT Cap to Appease New York Reps - Jad Chamseddine, Tax Notes ($). "Kildee said he expects the issue to be addressed, even if the solution is not full repeal. Some Democrats, like Rep. Lauren Underwood of Illinois, have proposed increasing the cap to $15,000 to spare middle-income taxpayers from increased taxes while preventing millionaires from benefiting."

Private Tax Collection Up 50 Percent in Fiscal 2020 - William Hoffman, Tax Notes ($). "The four private contractors cumulatively collected $321.2 million in past-due tax debt during fiscal 2020, despite obstacles posed by the COVID-19 pandemic, noted Kristin Walter in an April 14 statement from the Partnership for Tax Compliance. That compares with fiscal 2019 revenue of $213 million."

What to do About Sales Tax if you Close Your Business - Jennifer Dunn, TaxJar. "Pay ALL Sales Tax Collected to the State. This is arguably the most important step to closing your business when it comes to sales tax."

Officer compensation and IRA early withdrawal tax - National Association of Tax Professionals Blog. "Given the uncertainty surrounding the pandemic and economic hardships faced by many, we are highlighting two recent court cases many practitioners can relate to and can serve as a cautionary tale of what NOT to do."

Sometimes bad examples are the best examples.

Tax Pros Fear Erosion Of Independence At IRS Appeals Office - Joshua Rosenberg, Law360 Tax Authority. "Resource constraints at the IRS Independent Office of Appeals and a poorly received pilot program has some practitioners concerned that the celebrated independence of the office could become compromised, which could drive more cases to the courts."

Delivering Tax Benefits to People Who Are Experiencing Homelessness - Elaine Maag, Peace Gwam, and Sonia Torres Rodríguez, TaxVox. "The IRS should consider expanding its use of prepaid low- or no-fee debit cards to deliver tax refunds and the CTC advance payments."

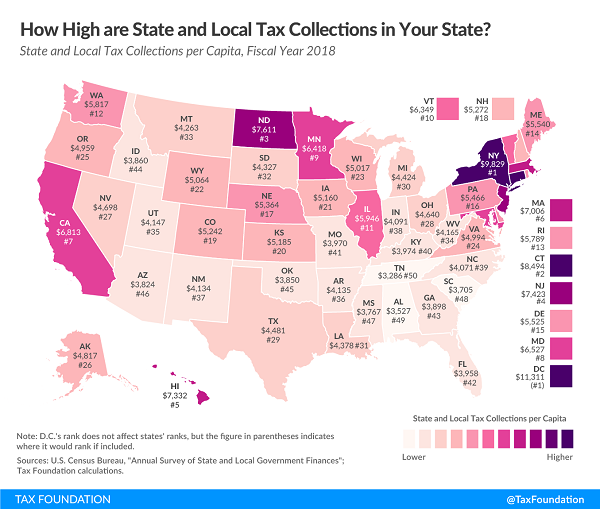

How High Are State and Local Tax Collections in Your State? - Janelle Cammenga, Tax Policy Blog. "Tax collections of $11,311 per capita in the District of Columbia surpass those in any state. The five states with the highest tax collections per capita are New York ($9,829), Connecticut ($8,494), North Dakota ($7,611), New Jersey ($7,423), and Hawaii ($7,332)."

North Dakota? These are per-capita numbers, and while the northern plains may be light on people, they are heavy on fracking rigs.

Ew, David: The Tax Lessons You Can Learn From ‘Schitt’s Creek’ - Kelly Phillips Erb, Bloomberg Tax ($):

It’s your responsibility to make sure that your taxes are filed and paid. Johnny Rose parlayed a $2,000 investment in a video rental business into a fortune. While at the helm, he entrusted his business manager, Eli, with the company’s finances. As tax agents seize the Rose family’s assets, Johnny learns the difficult truth: Eli had been embezzling money from the company instead of paying taxes. Johnny is told, “He took everything.” Johnny, who likened Eli to family, responded, “He was our business manager, he was supposed to pay taxes.” Only he didn’t. Eli ended up in the Cayman Islands (they think) while the Roses ended up in a motel in Schitt’s Creek.

It’s an important lesson. Even if you hire a tax professional, it’s important to keep close tabs on your finances and ensure that your tax returns are timely filed and that the taxes are paid. Remember, when you sign your tax return, you are confirming that “I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.” In other words, you are responsible for what is reported on your tax return.

If you run a business, it's wise to go online and check your account on the federal Electronic Federal Tax Payment System (EFTPS.gov). Trust your payroll clerk or service to remit your employment taxes, but verify.

What to celebrate? Since today isn't 1040 deadline day this year, you may be looking for something to celebrate. Pickings are slim today: National High Five Day and National Laundry Day may not be enough to get your office to close. But today is the anniversary of Jackie Robinson's Major League debut, and that's worth a high-five.

Make a habit of sustained success.