Biden Scales Back Corp. Minimum Tax Proposal In New Plan - Alex Parker, Law360 Tax Authority. "But while Biden's campaign proposal would have applied to all companies earning more than $100 million per year in income, the plan released by Treasury would only apply to businesses earning more than $2 billion. According to the department, this would cover about 180 U.S. corporations, of which about 45 would pay more under the book tax based on their current statements."

Biden Softens Tax Plan Aimed at Profitable Companies That Pay Little - Richard Rubin and Kate Davidson, Wall Street Journal ($). "The administration also wants to impose a 21% minimum tax on U.S. companies’ foreign income and get other countries to do the same. To prod other nations to adopt such taxes, the new plan includes tough limits on deductions for foreign-headquartered companies from countries that don’t adopt them."

Biden’s ‘Book’ Profits Tax Risks Distorting Corporate Financials - Allyson Versprille and Nicola M. White, Bloomberg Tax ($). "President Joe Biden’s plan to tax the profits corporations report to investors will likely distort financial reporting incentives, provide shareholders will less transparency, and raise difficult implementation questions."

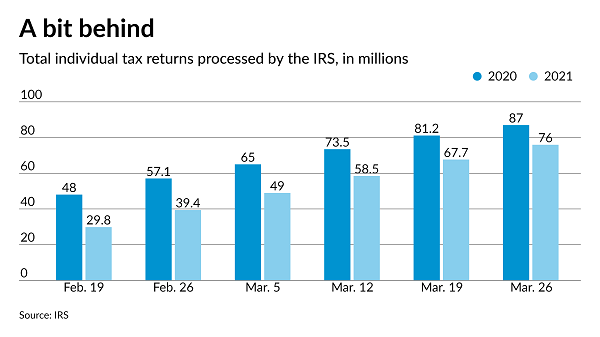

A midseason update from the IRS - Roger Russell, Accounting Today:

The extension of the filing deadline to May 17, 2021, automatically extends the time to make 2020 contributions to IRAs and Roth IRAs, health savings accounts, Archer medical savings accounts and Coverdell education savings accounts. But it does not extend the April 15, 2021, deadline for estimated tax payments, [National Conference of CPA Practitioners tax chair Stephen] Mankowski noted...

“It’s not only the rich that have to do estimates. Over the last five years there have been a lot more self-employed persons. They’re required to file quarterly estimates, and are not in any sense wealthy. They’re just doing what they have to do to get by.”

Chart by Accounting Today.

Can a Taxpayer Apply an Extension Payment in 2021 That Results in an Overpayment to the First Quarter Estimated Tax Payment for 2021? - Ed Zollars, Current Federal Tax Developments:

We could get lucky—the IRS might announce that overpayments resulting from payments made with extensions filed on May 17, 2021 will count against first quarter estimates, though given the IRS’s reason for not extending the estimate date I wouldn’t count on it. As well, and maybe more likely, the IRS might just not challenge the issue when 2021 returns are filed. But right now it appears far from sure that taxpayers who rely on such overpayments will not end up with notices asking for underpayment penalties on 2021 returns.

Normally the "penalty" for being a month late with an estimated tax payment - interest at a 3% annual rate for one month - makes spending any professional time to avoid it not worth it. That doesn't make the IRS Commissioner's purposeful mismatch of the estimated tax date and filing date any less unwise.

NY Legislature OKs $4.3B Tax Hikes On Biz And Wealthy - James Nani, Law360 Tax Authority. "The bill would also increase the current top state personal income tax rate of 8.82% to 9.65% until 2027. Two brackets would be created at a rate of 10.3% for those with income between $5 million and $25 million and 10.9% for those earning more than $25 million, according to a release by the Senate Democrats."

New York Budget Would Increase Taxes on Wealthy, Expects SALT Cap Repeal - Carolina Vargas, Tax Notes ($). "New York's fiscal 2022 budget agreement includes income tax increases on the wealthy, but Gov. Andrew Cuomo (D) has assured taxpayers that there will be a "net reduction in taxes” once the federal government repeals the state and local tax deduction cap."

Arizona DOR Explains How to Claim Charity Donation Credits - Arizona Department of Revenue via Tax Notes. "Arizona provides two separate tax credits for individuals who make contributions to charitable organizations: one for donations to Qualifying Charitable Organizations (QCO) and the second for donations to Qualifying Foster Care Charitable Organizations (QFCO)."

Updated Guidance on Lost Revenue and Expanding Allowable Costs for Higher Education Institutions - Kristin Diggs, Eide Bailly:

On March 19, 2021, the Department of Education provided additional guidance associated with the Coronavirus Response and Relief Supplemental Appropriations Act, 2021 (CRRSAA). This update not only provided information for calculating lost revenue, but it also reversed a previous stance held by the Department to only allow costs incurred on or after December 27, 2020, to be reimbursed under CRRSAA. Under CRRSAA, grantees will now have the ability to charge costs back to March 13, 2020, the date of declaration of the national emergency.

Impact of Initial Exclusion from EIP of U.S. Citizens Filing Jointly with Non-Citizen Spouses - Lauren Zenk and Lauren Heron, Procedurally Taxing. "Initially excluded from these [stimulus] payments were most taxpayers without a Social Security Number (SSN), which the government argued included U.S. citizens with a SSN who elected to file jointly with their non-citizen spouse."

Household help could mean more tax work for employers - Kay Bell, Don't Mess With Taxes. "If you are indeed the boss of your household worker, then get ready for those aforementioned added tax duties." With a much-appreciated nod to Eide Bailly Tax News & Views!

Shuttered Venue Operators Grant - Are you ready? - Larry Evans, Eide Bailly. Venue operator grant applications open April 8.

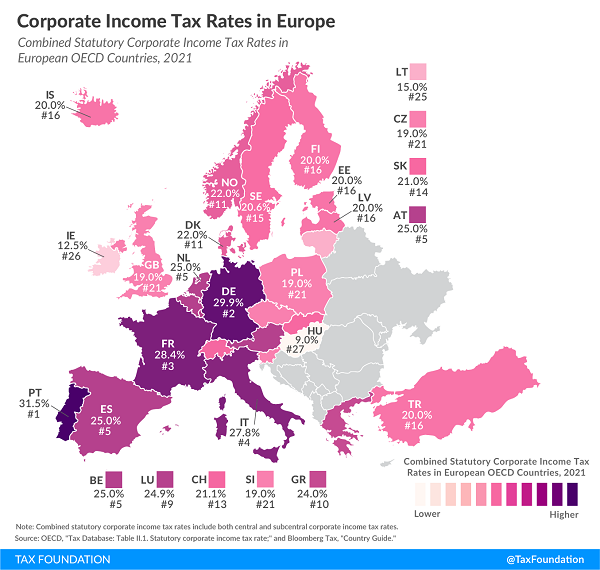

Corporate Income Tax Rates in Europe - Elke Asen, Tax Policy Blog. "European OECD countries—like most regions around the world—have experienced a decline in corporate income tax rates over the last decades. In 2000, the average corporate tax rate was 31.6 percent and has decreased consistently to its current level of 21.7 percent."

The current U.S. corporate rate is 21%; President Biden proposes a 28% rate.

Treasury Report Poses Reasons to Enact Tax Portion of Biden Infrastructure Plan - Jay Heflin, Eide Bailly. "These programs would be in effect for eight years and they would be paid for over 15 years by the tax portion of the plan, which is called The Made in America Tax Plan and largely calls for tax increases on U.S. multinational corporations."

Build Back a Better Revenue Base with Environmental Taxes - Thornton Matheson, TaxVox. "An effective solution is taxing fossil fuels at their full social cost--which includes not only carbon emissions but also local air pollution--and offsetting the burden on lower-income households with other policy measures. For example, the cost of a carbon tax could be rebated to low-income households through an expansion of the earned income tax credit."

Interview: Stranger Than Fiction: Lessons From Odd Tax Facts of Yore - David Stewart, Stephanie Soong Johnston, Joel Slemrod and Michael Keen, Tax Notes Opinions:

I have one from Argentina around 1900, which still makes me giggle childishly. Around then, Argentina had a tax on bachelors, which wasn't uncommon at the time. But there was some lovable romantic worried about what to do about men who make proposals but are turned down.

Well, clearly what we need to do is give them a tax exemption. They should be able to, if their marriage offer is refused, get the rejected woman to sign a tax exemption certificate for them. We have pictures of men all around Argentina saying, "Well, if you won't marry me, at least will you give me a tax break?"

And of course, as all of us would expect, one of the consequences was there emerged a small professional class of women who, for a small sum of money, would in fact guarantee to reject your offer of marriage.

Consolation for those of us who get rejected for free.

Appreciate! Today is National All is Ours Day. "National All is Ours Day is devoted to appreciating all the things of beauty around us. One way it is observed is by reflecting on the great things in life that are open for everyone to enjoy." If you're hungry, it's also National Empanada Day.

Make a habit of sustained success.